This Time Is Really Different

It feels a lot like 2018, but it also feels different this time. Or I might be saying that just because we might not have yet reached the bottom of this crash in crypto markets. Cuz we can clearly call it a crash at this moment. That's no longer your average dip or correction...

The situation we are in for a few days reminds me of the May crash of 2021 and the one from March 2020 as well. Both have been steep as hell, it felt like there's no bottom and the outlook was grey as hell too.

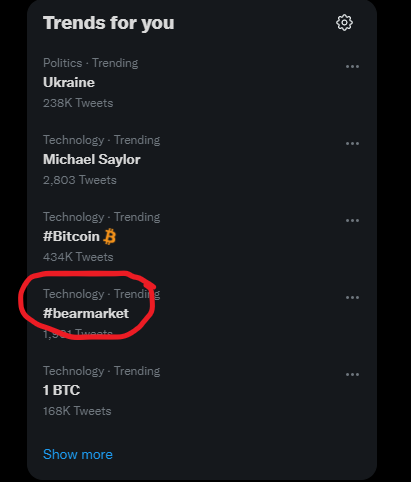

According to "the trends for you" board of twitter, #bearmarket seems to be currently a trend right now and it's happening because the majority thinks we've entered a bear market... and that might be true, I try to stay away from forecasting anything after so many failed predictions...

But you know what? The majority is often times wrong and the bear market narrative might be wrong as well right now, or at least the one related to the type of bear markets we used to have in crypto prior to the 2020 halving.

This time is different

I know, I know, you've heard this one so many times in the past, but it really might be different. Despite the clear head and shoulders pattern that the Bitcoin chart has formed, it's not doom and gloom yet and the right shoulder doesn't have to go down to hell.

The bottoming might be formed at $30,000 or a bit above $30,000 which would mean that on a higher time frame(macro) Bitcoin has actually created higher highs and higher lows for the past couple of years or so. $30,000 might be the new $3,000 and honestly at this point I really expect Bitcoin to dive as low as $30,000. $34,000 doesn't feels right without a flash crash.

I bet there's going to be insane buying pressure at that level, one of the reasons for that being the fact that 90% of the Bitcoin to ever be mined has already been mined and that we are two years away from the next halving which will slash the mining rewards to 3.125 BTC per mined block.

As @toofasteddie has pointed out today in a post, whales have been selling as well lately, no doubt about that, it's not just plebs that have dumped their coins, but whales have the habit of manipulating markets often times and they also probably don't want to miss the train on selling under $30,000, if we're gonna "flash crash" that low, knowing that Bitcoin is getting scarcer and harder to get over time.

It's churning time imo. I just talked at a bar with a friend of a friend, who surprisingly is into crypto as well, and after getting a bit into details he showed me his portfolio and was saying he's looking into adding more to his long term position these days.

This time is different

I know, you read that line already in this post and here's why I believe this time is different. Plebs like this guy who knows a thing or two about crypto, but not an expert, is not willing to throw money anymore into shitty projects and speculative bubbles like I was doing for example back in 2018.

He's actually looking for the ones having at least a roadmap, if not already a working project. Something that wasn't happening in 2018. The man has a bunch of close friends who made tons of money in crypto and are probably way more mature in this space than I am and prefers to "take advice from them" than from dudes like Trevon James, like some of us did back in 2017-2018.

This time is really different

Even if we are entering a bear market chances are it will be a short lived one. I now see this whole situation, after getting cool with it for a bit as a wealth transfer episode rather than your regular bear season. I might be wrong, but this time doesn't really look like 2018. What do you think?

Thanks for attention,

Adrian

Posted Using LeoFinance Beta

I bought again, BTC, no matter where we land, accumulation is a MUST if you believe in the technology and the values of the project. It can go deeper but I don't care.

That's also what makes this cycle different

Posted Using LeoFinance Beta

Anyone who compares this crash to 2018 is simply lashing out in fear.

To recap, this time ISNT different than any other bull market deflation we've had. We didn't get a mega-bubble, so we will not get a mega-deflation. Think back to summer 2019, deflating to $8k from $13k simply was not that big of a deal. We're already basically at the bottom. The head-and-shoulders pattern has pretty much already completed.

Posted Using LeoFinance Beta

that said it all.

Posted Using LeoFinance Beta

This is absolutely correct, this is just a normal deflation and I’m not even scared, buying the deep now should be our priority

Posted Using LeoFinance Beta

We are on bear market since December, just that crypto will get support soon and buy back again.

Posted Using LeoFinance Beta

When others fear, be bold!

Posted Using LeoFinance Beta

I think we should look at the bigger picture, just zoom out! We're still in the bull market! I think that instead of being fearful and panic selling, any smart person should focus on stacking his bag via the DCA strategy.

Posted Using LeoFinance Beta