What Could Have Triggered The Bitcoin - Traditional Markets Decoupling and "How Sustainable" Shall Be

The correlation between bitcoin and traditional markets has been more than obvious in many cases, especially during important events of the world like the March 2020 crash when the pandemic has been ignited almost everywhere in the world(except Sweden), despite it being an asset of its kind.

Bitcoin has simply followed the herd(traditional markets) for most of the time.

Bitcoin has been designed to be a form of "digital cash", according to its inventor, but so far it hasn't proved to be working that good for this matter. Very few are using it as cash and you can't even do that on a large scale, with just 4 transactions per second and the fees Bitcoin has.

Mastercard and Visa are processing hundreds of thousands of transactions per second, thus kicking the ass of Bitcoin in that regard. The lightning network might be a game changer, though, but still, BTC is seen more as an asset and a store of value, by some, than it is as digital cash.

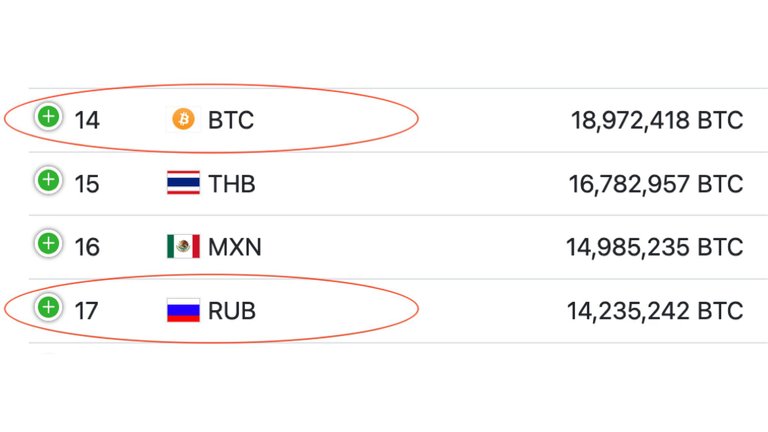

The so called digital cash has decided to decouple lately from the traditional markets, when it comes to dollar valuation, and BTC has even managed to overpass the Russian Ruble in becoming the 14th currency in the world.

Alessio Rastani has had a quite interesting take regarding stocks and Bitcoin in one of his latest videos by saying that most often "sentiment follows charts and not vice versa". I'm not a fan of TA, you probably know that by now, but the man has a point.

If you look at the chart of BTC, especially at the time frame following its $69,000 top, you shall see that it has been printing higher highs and higher lows which is a bullish signal for any type of asset. So, is it BTC's price following sentiment or is it the sentiment following the chart and implicitly its price?

Hard to answer that one, but I can see why the decoupling from the traditional markets occurred. Bitcoin has proved lately, in the middle of this world wide so called crisis created by the Russia Ukraine war, that it has a quite important use case during such times, thus making it more valuable than any stock.

Donations have been made through BTC's network towards Ukraine from all across the world, the citizens of the affected countries have turned towards BTC as a safe haven from their falling currencies, same as it happened in any countries and governments are somehow confirming its value as well.

Worth mentioning is also the fact that Bitcoin makes you a bank, available for transactions 24/7, when your regular bank might get closed when you least expect it or run out of cash at any time .

I have honestly no clue if the current decoupling is going to last for long, although I don't see any reason why it wouldn't, especially when looking at inflation affecting almost every country in the world and when uncertainty has become "so thick". Gold is doing pretty good as well, so we can't call for a flippening for it as a store of value, but Bitcoin makes much more sense than gold does, in the era we're living.

What's your take, by the way?

Thanks for attention,

Adrian

Posted Using LeoFinance Beta

https://twitter.com/AdrianPapava/status/1499024337545879552

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Looking at the volume on Binance the craze seems to be slowly dying down. It could easily be an overreaction to the Ukraine news and just pure speculation by crypto traders from Russia.

If the rally was to continue we would need to see many more high-volume days for it to be sustainable. Not having high hopes for this pump personally.

Posted Using LeoFinance Beta

Anything is possible...

Posted Using LeoFinance Beta

BTC recovers from downturns faster and more than other assets.

It also has extraordinary spikes, usually after a halving.

That’s why it’s been the best performing asset class every year except 2018 when Facebook and Google banned crypto ads.

I hope/believe this last decoupling shall be an extended one.

Posted Using LeoFinance Beta

I wonder how much gold the refugees from Ukraine can bring across the border?

Posted Using LeoFinance Beta

Their own jewelries probably...

Posted Using LeoFinance Beta

It was rhetorical question.

For crypto you need to bring just laptop or smartphone. Or even less. Your keys are sufficient enough.

Hmmm... For crypto, it's easier and smarter. No stress!

Posted Using LeoFinance Beta

I must say Bitcoin is not my favourite coin, but it is the leader of the pack, due to it being the first one. And will be for a while. But I am assuming that some investors saw the latest dive of Bitcoin as a true last buying opportunity. And I only see it going higher from here. And in its trail others will follow, like Hive, like Polygon, ... The sentiment has indeed changed, so it could be a wild ride in the next month!

Posted Using LeoFinance Beta

I'm betting on that too.

Posted Using LeoFinance Beta

Bitcoin, they can it the Mother of all Coins. Hopefully, Hive goes above $3 soon.

Posted Using LeoFinance Beta

Crypto is showing nowadays only a fraction of its power to the world.

I hope crypto will help us become sovereign once again, cuz the future doesn't seem so bright with what these leaders are planning during the WEF.

Posted Using LeoFinance Beta

Crypto such as BTC are way better as money but I think one of the biggest issues that most people have is that they prefer fiat. So I think they would much rather get things like stable coins over things like BTC. The volatility from crypto isn't exactly the greatest for places like businesses.

Posted Using LeoFinance Beta

Btc has been in bullish trend since yesterday but it doesn't mean,it will not sell again.

Posted Using LeoFinance Beta

I prefer having bitcoin than having my local currency. Most people here says why get the coin when it would drop in value later and I start weeping but what they don't see it, every single time our currency devaluate and yet it has never come back up not even once.

Then why shouldn't I own a crypto that can make me a millionaire.

Posted Using LeoFinance Beta