I'm trying to Learn How to Trade: January 2023

A post about documenting my trades for the month of January.

Objective: To have a monthly log of my progress in trading. I want to know my baseline and see where I’m heading. Trading has been for kicks and giggles hobby rather than a means to generate income for my living expenses. I want to learn how to do it, see if I could get good at it and how far I can go doing it.

Disclaimer: It was midway till I noticed that fees altered the end profit amount which was a noob mistake in hindsight but I just continued how I logged the results considering it’s not really meant to be a strict journal. I’m not an account/bookkeeper by profession so I am also open to entertain some numbers here maybe inaccurate. The whole point of the post is sharing some insights from my trades. I’ve been doing this for months and it’s only this year that I started to consider improving at the skill. Nothing here is meant as a financial advice.

I’d teach anyone how I do my trading but I’ll never frame my methods to be at a professional caliber. I took inspiration from a local stock trader that eventually started his own company teaching people how to trade, what started as a hobby led him to enrich himself and then it snowballed into teaching people how to make a living out of the markets. He eventually created something of value and it was inspiring enough to get me to try out the art.

I’ll freely share what I know without any paywalls from these posts and maybe give some aspiring traders out there to learn what not to do.

The Summary of January 2023

| Starting Capital | 1000$ |

|---|---|

| Total Trades | 73 |

| Win | 48 |

| Loss | 25 |

| Win Rate | 65.75% |

| Ave. Win Per Trade | 23.4147 |

| Ave. Loss Per Trade | -15.225 |

| Largest Win | 597.971 |

| Largest Loss | -36.8865 |

| Win Streak | 5 |

| Loss Streak | 4 |

| Net Profit | 743.259 |

| Net Gain | 74.25% |

Despite the positive results, there’s this inner drive to be competitive and self-improve. I know I could do better and the blunders on some trades stem from having FOMO and testing out systems from the spur of the moment. I tend to innovate what I learned just to see where it goes.

Inspired from an anime called Blue Lock where the protagonist tries to piece together formulas in the form of jigsaw puzzles to produce an outcome. I review my trades from countless screenshots to see which part works and don’t.

The win rate may have been considerably high but most of the largest earnings came from a combination of arbitrage and lucking out I happen to be online at the moments. These can just happen in seconds to minutes. The consists wins and small to moderate earnings came from spending a few hours watching the chart which was inefficient relative to the value of my time doing it.

I wouldn’t say spending a few hours to acquire a loss or small gain was wasted. It helped me gain some insights on what I was doing right and what could be improved. For this month, the success was being near indifferent to the amount of losses I have incurred. Winning trades don’t generate me a lot of dopamine kick, but losing trades tend to make me more focused. It’s not the loss of money that is a main concern but it’s the winning aspect. Trading, is a game for me there are quantifiable measures to determine if I won and achieved something for my time.

My best trade so far that took me a few days to wait it unfold. Although it's dated Feb 4, I had been buying up positions and averaging up at the late part of January which led to the final reap of rewards to this day. The black line was where I entered and orange when I exited. I missed out on selling above 0.522 levels for 14% missed opportunity but I'll take my 48% just fine.

Most of the wins came from trading AGIX. I didn't trade Hive due to the low volume but this token has a high pump frequency that it's hard to not keep under watch. I usually look for high volume tokens reaching more than 5 million as a screener. The bulk of my selection came from checking the chart if it looks like it's going to pop up, consolidate or whatever setup I require. There's not a lot to pick from as only small pool of tokens can reach high volumes on a daily basis and almost every popular token follows whatever BTC price is heading.

My worse trade was losing around -36$ for not cutting losses at 3% even if I knew I should have already cut early at 2%. It's during times I had this thin hope to wait and see if it reverses where my loses drag higher. But this was a mixed reception considering when I did get to follow my initial plans, the market turns 360 real quick and proceeds to go on track with what was the expected direction and I end up missing the boat with an added loss. It's a fun and frustrating experience lump into one activity.

Sitting for small gains isn’t worth the wait, but if viewed from the lens of skill building, this isn’t so bad. I find the waiting game exciting only when my order is filled and I’m in position to see what happens next.

So far, the system that has given me consistent wins is a combination of trailing and a bit of buying before break out during consolidation. The latter method is also my most common sources of losses so I tend to rely on it less. There were instances when I just knew it was going to pump and I should have taken the trade but was busy with work to commit. I just saw the token fly 50% up and sat there thinking, dang, I’m right but not profitable right.

I think the most remarkable part about this exercise is when I loss 20$ or gain 20$ both circumstances didn't budge me to stay out of the game. I went for 5 winning streaks and 4 losing streaks during revenge trading. I made all the common mistakes a new trader makes and this was the fun part about relearning a previous assumption where I thought I've figured it out.

I’m trading with pocket change compared to how much other traders are risking so I don’t think 74% is a big deal for a small account. It’s the systems to trade I want to develop here before I’m ready to handle a larger portfolio. All in all, this is just for kicks and giggles. I just want to know if I can and whether I can get good at it.

If you made it this far reading, thank you for your time.

Posted Using LeoFinance Beta

You are doing a lot better than I would.

I’ve given up trying to trade things. I just hold.

You may change your opinion about doing better, just had some streaks of losses for this month, just my luck :>

Always wanted to learn trading..

Maybe this year is my year😎

Congratulations @adamada! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

@adamada, one of your Hive friends wishes you a Happy Valentine's day and asked us to give you a new badge!

To find out who wanted you to receive this special gift, click here!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

He and his friends torture people and bullied on hive

This group also bullied me or downvoted me…so called group they are… they think they are smart but no they are losers and been stupid too

@freebornsociety @adamada @abh12345 @galenkp @whangster79 @gollumkp and the boss of this stupid group @livinguktaiwan she is the the main leader of that gang and at same time they all doing downvote to others for stole money.

My uncle used to be a secondary school teacher in Canada. Being a teacher is one of the better paid jobs in Canada (after all they get to take the summers off for vacationing), but its pension plan is the best. When he retired, under the guidance of his wife, he started investing in the stock market. As time progressed, he stopped trading and focused on buying dividend earning stocks. Instead of having the exhilaration of buying and selling, he bought and started getting the satisfaction from seeing dividend checks.

I have been involved in Cryptos since BTC was $100. I was enthusiastic with the technology and my uncle would just shake his head. His strategy was earning him so much money, all of his pension went to pay for the taxes he owed from his investment strategy. Fortunately the technology has evolved enough that there are now saving accounts, delegations and staking.

Last June, I gathered my resources and started earning $20 per month. However, I stuck with the plan and kept working at it. I grew up on a dairy farm. Beef farmers would get one huge paycheck once a year (or not large). Dairy farmers wake up early in the morning to milk their cows, and again in the late afternoon. I just realized. I am dairy farming again but now my cows are cryptocurrencies. I just check the price of two of my cryptos. One has just gained 3.1% in the last 24 hours and the other has lost 2.6%. I no longer make $20 per month. I make roughly $1.00 per hour. Each morning and evening I milk my cryptos (and reinvest them, I am building them for my retirement). I am actually accumulating them in a way that I will be able to buy a new cow. A different crypto that might even have a higher rate of return (all the eggs in one basket is a mistake philosophy). It's possible both my father and uncle might be smiling at me a little.

I am not suggesting that you change what you do, but maybe you might milk a cow for a little while instead of flipping it.

Congratulations on hoping into the tech and doing well despite the tough times. The only regret I have with crypto is not hustling on it sooner than 2017 when I got a chance to hop into it. I was skeptic and was learning more about traditional investing than venture into this unregulated territory. I do keep more than half of my crypto on staking and 1/3 is just play money, it's not much as most are kept on traditional assets. But it's just not a bright move to ignore this space given how abundant opportunities are there.

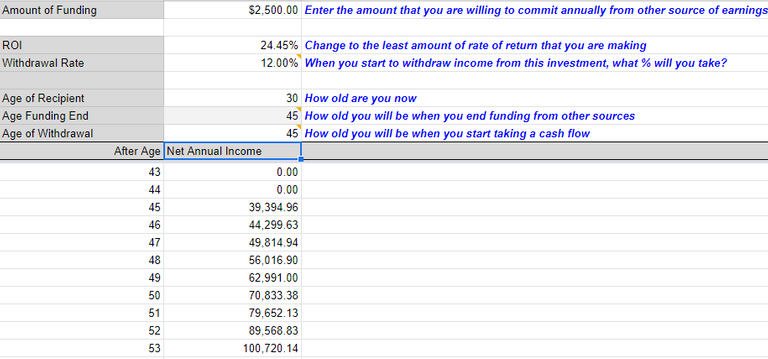

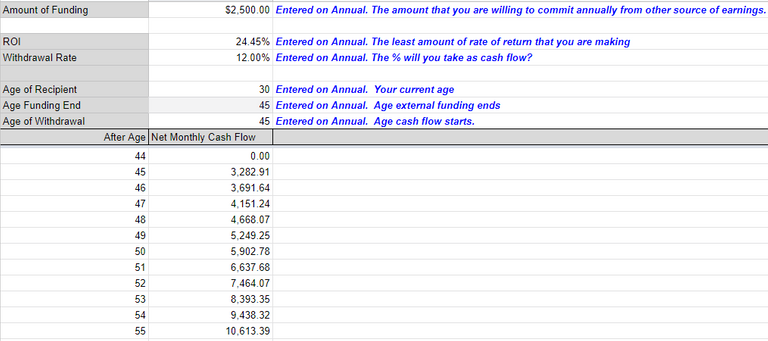

I have to remember to look at Hive more often - at least once per week. Have you posted what your end goal is? As I am approaching my last legs before retirement, I have set a monthly cash flow that I want. It includes estimates for living costs in some tropical paradise, travel, etc. I personally use a more complicated spreadsheet (multiple income streams), but I have included a link to a google sheet pictured below.

Annual Cash Flow

Monthly Cash Flow

Of course, these amounts change on a daily basis (depending on the APR) and the value of the coin against the currency. On my more advanced sheet, this is taken into account for multiple coins, but it means you must update the exchange rate daily as well.

Maybe in the future, I might create an App to automate this process, but I don't know if anyone aside from myself is interested in something like this.

Complicated spreadsheets and numbers about money are something I'm already interested in. I only have those for trading but not for computing retirement countdowns. You're on the right track and more organized than I am which is great.

I tried computing the projected income I need to maintain to keep my current lifestyle (not luxuries but comfortable) and I need 23x the amount to get by at 60 monthly at my country's current inflation rate which is more than twice than I initially projected pre pandemic. It's just nuts to think these scenarios are not far from reality and there are countless people out there not even doing spreadsheets to see where the economy is heading when they retire, just nuts.

I never entertained tropical paradise but a mountainous area in some province away from city where costs of living is the mental image I have working for me right now.

One of the advantages of computing using cryptocurrencies is that they are immune to your country's inflation rate. The danger is that the cryptocurrency you invest in may devalue; the upside is that anything you invest in now is probably undervalued.

I don't know how good this site is for predictions, but looking at BTC is very promising.

According to their prediction, BTC will have a price range of $16,587 to $79,207 by next year. This places it in the possibility of achieving a new high. Let's say you want to retire in 10 years; the possible range in price will be $276,642 - $795,565. That would put it at over ten times its current price in ten years.

Using that as a benchmark for your investments, attaining 23 times your current cash flow should be easily attainable in ten years.

I'd pick my country's inflation rate if it only took one law to repel any cryptocurrency used. The reality is that by a whim of the government, most people who are into crypto here would have a hard time accessing their funds and would just prefer fiat over risking it.

True to the first sentence. I'm not really into believing projections and relying too much on history since it's already in the past and it's information that other people can also access. Trading mindset just says don't get sold in the news because someone else has already in profit from you as soon as you received it. All this projections from a platform that has their best interest against retail traders or investors may not be the best indicator to rely on your future, but that's just me.

Learning from the hype from the last bull run where people say 100k BTC is happening, we know how it ended there so I'm just cautious with my money and take the present information as is as more important than a future or past.