Philippines: Crypto Slowly Becoming More Accessible Than Stocks

Coins.ph announced its partnership with Globe Telecoms on providing alternative reward incentives for Globe’s customers in the form of crypto of their choice. Now this piece of news happened a few months ago but somehow there’s not much buzz about it contrary to how I expected the news would fly post announcement. I was expecting a co-worker who frequently uses GCash app from Globe would ask about it.

If anyone else noticed a pattern on my posts, I’d often reference my co-workers being the closest thing I could gauge on public crypto perception. If an average person gets interested in stocks and crypto, then something is about to happen. And yet no spike in inquiries about how to hop into the trend happened.

It could just be the effects of the global bear market, inflation screwing our daily lives, or other mainstream media agenda preoccupied with something else because what’s more important than prying on a celebrity’s personal life? It’s not really a problem considering crypto adaption is still at its infancy stage within the country despite more Filipinos own crypto compared to investing in stocks.

1.6 million Filipinos investing in the Philippine stocks vs 7 million Filipinos estimated to be invested in cryptocurrency. This may mean I have a good chance meeting someone already interested in crypto than stocks over a cup of coffee.

The fact that Globe partnered with Coins.ph to provide those alternative rewards to its customer base signals it's serious about incorporating crypto into its future offers. It’s just my speculation but if Globe, the one that produced a successful mobile app for virtual money transfer decides to host its own cryptocurrency exchange services, then there’s nothing else stopping other companies to get into this venture.

Globe Telecom is one of the leading telecommunications company within the country that has entrenched its brand through decades of service. It’s always one of the staple brands that comes into mind when thinking about what network one subscribes for their phone or their preferred internet service provider. Their GCash app paved way to making investing opportunities accessible using an e-wallet. It’s no wonder this company is considered one of the blue chip stocks to choose from.

There are prerequisites before crypto can become mainstream here and one of those is having cryptorelated services get more partnership with established names and it needs to have a structured method of being taxed. Right now, users would have to be mindful about their crypto transactions because the tax scheme doesn’t specifically address gains from crypto.

Taxes will be a hot debate later on given how even an elementary school kid could potentially start earning some Hive just from their blogs without a Tax ID. I’m not even sure if the tax guidelines we got going now for our regular gross income will still apply to our crypto gains as stated from this article.

Globe already had its stock price soar during the height of pandemic due to the rise in use of GCash. Now if cryptocurrencies became part of its services in the future, there’s no doubt they’d be one of the leading providers people would trust in the future.

One advantage crypto has over traditional stocks is how less complicated it is to get started. With traditional stocks and banking, people can get intimidated with the financial terms that are inherently boring for most people. Play2Earn games promise fun on top of earning and people are more receptive to this form of marketing than get told "you put your money on some fund and wait for it to grow on its own but there are risks involved". And it's through the introduction of P2E games that get people more curious about other games and blockchains in the process.

Do your own research~

If you made it this far reading, thank you for your time.

Posted Using LeoFinance Beta

I’d take crypto rewards if I was in anything that offered them 😆 I avoid most things like the plague though.

Help me make a collection of you as an NFT, 10,000 shades of Ryiv exclusive on Hive.

Wat.

Stocks are here to stay, but a mix of crypto and stocks will be the norm soon.

^This tbh.

What is the meaning of tbh?

Just a short cut of "to be honest" implying I concur.

hayy globe.... infrastructure is crap. my sentiment.

Doesn't matter, you just need a good name promoting a name then everything follows into place when there's value in it.

may gusto ako isulat pero rant lang. pero yung statement mo.

True.~

Ahhh the terrors of banking. Being explained the terms and conditions is like a lecture 😅

Trading stocks here is still ridiculously slow, expensive and complicated.

Compared to (some) crypto which is just click and go.

Crypto is wayyyyyy more accessible than stocks.

Posted Using LeoFinance Beta

Wow globe. Never knew about it, or maybe I never bothered..? 😅

I rarely use gcash so maybe that's why?

Most Filipinos still think crypto is a scam. I don't know who started that but yeah, at least that's what people in my facebook feeds think.

I don't wanna argue with them because kapoy

But it would be good to see more people doing crypto

But tax? Naaaah it's so complicated!

Can't blame some of them, they are being scammed by their own peers.

I only knew about it 2 months after I started checking out what new features coins had.

True!

And some of them are not open minded!

I'd say tangible asset would still be safer and valuable, investing on real estate especially (landed) properties is still gold the rest are just extra, from my perspective.

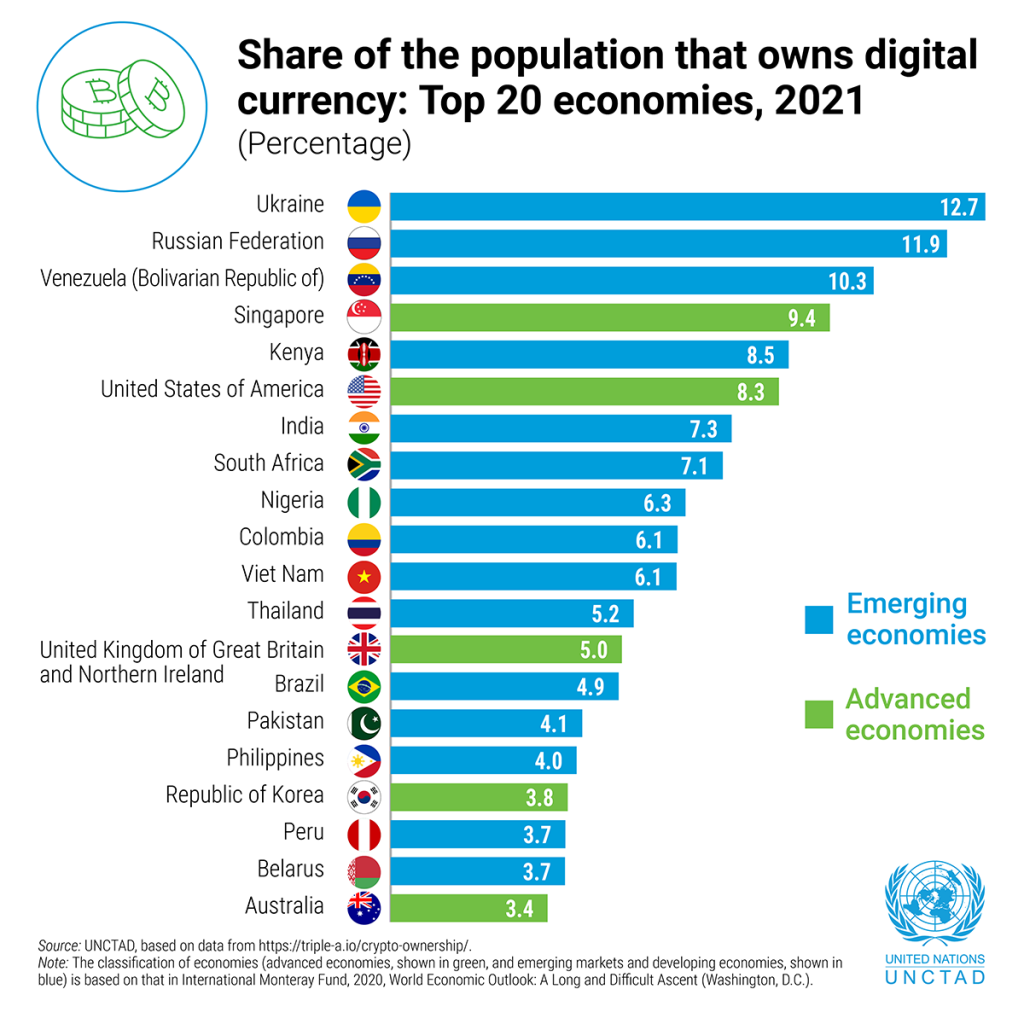

I just find it wild and bothering, seeing on the graph that the two countries at war are the top two of those holding most of the digital currency. i wonder how much the world wants to encourage war. 🤔🤷♂️

lost transition of focus of what should be..

depends on the land and what's being built on it. If it's just a piece of land without any income generating asset on top, it's just land that will appreciate at a slow pace, higher if it's near areas of development. I'm not really convinced of any asset that has no means of generating income on its own. Take for instance art or holding gold, they can appreciate or depreciate but not really helpful during inflationary periods compared to assets that are income generating.

this is very much true, like any other investment, needs to check and consider a lot of things with property investments, lame man's term would be always Location, Location, Location.

My top would be, Commercial Property and Agriculture Property

PS: We miss you adam uwu 😬😬😬

https://twitter.com/259651643/status/1582942449332518913

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Did you expect this development?

!discovery 31

Half of it, the news that made me optimistic was the central bank allowing more crypto related platforms operating which was a slow but positive progress on its own. This partnership from a big name in the country speeds things up.

This post was shared and voted inside the discord by the curators team of discovery-it

Join our community! hive-193212

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

Hi brother what happened why I get your downvote??

Dear @adamada,

May I ask you to review and support the new proposal (https://peakd.com/me/proposals/240) so I can continue to improve and maintain this service?

You can support the new proposal (#240) on Peakd, Ecency, Hive.blog or using HiveSigner.

Thank you!

Congratulations @adamada! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 55000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

America needs to catch up.. lol

Here I thought Philippines was behind, well we are on some parts but it's the US markets that currently dictates the bull run short term.