#FinancialGoals2021 Initiative | My plan to grow in 2021

Hello Leo World,

as I defined my main targets for this year in this post I would go deeper into them and share some other information to be able to participate into the challenge in this post by @theycallmedan as I could not edit the tags as suggested by @khaleelkazi.

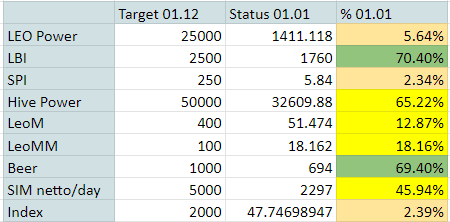

This is the plan presented till 1st of December 21, which is only related to the Hive ecosystem:

Of course my plan is broader and the financial goals are spread also outside the Hive universe and I will go now into those deeper.

1. Crypto

Crypto is one focus for my early retirement. My early retirement does not mean that I don't want to work anymore, it means that I'm not forced to work for a living. This is a major change and it is what fuels me daily. I want to have more time with my family and choosing to work whenever I want it is freedom.

I've accumulated crypto during the past years and will probably going to accumulate even further.

Now my main goal for 2021 is to put this crypto to work for me via pools for example. To use as little time as possible and have the maximum gains. I will keep growing ADA, BNB and some others that I did not present last time. I might sell some for a stable coin when I feel a stronger mark correction, just to buy back at a good price and also growing my stake. ADA and BNB have been very keen in terms for rewards to me lately also on the pool and I think I will keep this positions for sure in 2021.

Else, the same as most, watching of good airdrops as I've missed most of the good ones in 2020. Here is it free money that can be leveraged.

2. Real Estate

Next to crypto I love real estate. I own some units that bring a small return on a monthly basis. Real estate is not really passive as most people think or say as I have to deal with a lot of problems, from permits to tenants that are causing issues.

Most tenants are good, as I try to screen them wisely. I avoid drug addicts, even if they smoke weed as mostly this are a guarantee for trouble. I'm not selecting tenants by they are from and sometimes if they have a good job at a good firm I try to take people that others avoid like immigrants from Asia. In Europe people avoid them as usually there is a need for renovation after they move, but this I don't mind as I put the renovation mark-up in the rent and they don't bother me with every idiotic issue like a local. I had one that was clocking up his sink kitchen because he poured oil in and was calling me at 2 am to tell me that. Now I mostly gave the administration to external services to avoid such issues.

I want here to add 3 units this year, one in Munich as my first one, one in Romania and one somewhere on an island, either in Croatia, Italy, Spain or Greece. I want to work also on my retirement and a place where is warm in the winter is my target. All units shall be 110% financed as the interest rates in the EU are something between 0.1%-1.5%, taking in account inflation this is free money that I want to use for my advantage.

3. Stocks

Here I will continue my basic strategy from the past two years, which is, that if I buy a product from a company that I find the stock attractive and don't need that product really, I will buy the value of the product also in stocks.

For example if I drink 100 bottle of Coke at 1$ the next year, I will get stocks for 100$. With this strategy I tend to consume less as my cost are double with every purchase.

All the stocks are bought for holding and probably my son will inherit them, as well as the other assets we own.

4. Job

This year a job change is needed as this one is stressing me to much for not to much pay. Even if the market is very bad now for a change, I would give it a go to get a job with an increase pay and better perks. With perks I don't mean luxury company cars as I have it here, but like bonuses for targets, share of new won projects, more holidays, especially stuff that increases my pay and my free time.

5. Poker

I haven't played poker in the past 2-3 years as I was not needing it. I will probably restart playing and aim to go from 100$ bankroll to 10k$ till end of the year. This is manageable as I did it before. My poker staking with the current mentee is going very well and I think I will get two new ones next year to teach them, stake them and let a new income source be active.

6. Social Media

Except the usual chains, I'm not that active in old social media. Here I want to learn more about and start creating an income stream. Not alone, of course, but create a team that handles it. Maybe I shall start something with @uwelang and @detlev or a collaboration with @liuke96player as I like what he does.

Plan for achievement

Splitting every thing into smaller targets with daily/weekly tracking and daily/weekly/monthly planing.

If something needs adjustment than I will adjust it and if something is a dead end, then it shall be analysed and in the end removed if it is not fiable.

A NO at the right time saves a lot of things.

What are your plans? Let's discuss. Feel free to drop your link in here also so that I can check yours.

Thank you!

Posted Using LeoFinance Beta

Your current Rank (67) in the battle Arena of Holybread has granted you an Upvote of 30%

Good luck!

I'm mostly curious of your poker progress this year tbh so hopefully you will keep us updated.

Posted Using LeoFinance Beta

Thank you!

Will do, I played today some short games and it seems that people have changed a little the strategy. Made some 2$ profit, which is nothing, but I get a lot of data from this players!

Posted Using LeoFinance Beta

Earning money by playing Poker? This is not 2008 where you have American Fish swimming everywhere...

Posted Using LeoFinance Beta

I play on winamax, a French site and some crypto poker sites where crypto traders are not poker players :)

Posted Using LeoFinance Beta

I would love to read/watch some content on Crypto Poker Sites.

Posted Using LeoFinance Beta

Ok, will post some hands and some infos in another post. One thing, stay away from carbon poker as they are making life hard for withdrawals.

Posted Using LeoFinance Beta

Great insight and perspective for the investments. With you the best of luck to achieve them.

For the real estate I would recommend you to take a look at Tenerife as an option as the properties could be affordable enough and it has great potential.

Posted Using LeoFinance Beta

Thank you for the Tenerife hint. I was looking on Palma, Sardigna Cres and Brac, but Tenerife sounds good. This is planned for later in the year, when the prices will drop a little due to the crisis and the banks are still willing to throw away money at anyone who asks for it.

Posted Using LeoFinance Beta

LOVE this. #YoureAnInspirationForAll 💙

Can I give a special shoutout for #5? Reminds me of a book I read a few years ago written by a female ex professional poker playa! I think a lot can be learned from poker champions... that can be applied to cryptocurrencies, cuz impulsive emotional reactions are the danger!;)

I hope that all your financial goals come to life in 2021! xox

Thanks for the shout out! That book seems amazing! Yes at poker it is important to control the emotions and impulses. Whenever I notice that my game has turned (have a software that analyses the hands and how I play them) I stop playing.

Thanks for the wishes and I hope you will reach your dreams and targets also!

Posted Using LeoFinance Beta