Introducing AqualisDAO: Revolutionizing Capital Efficiency in DeFi

To our dearest Aqualiens!

Over the past three months, our team have been working hard to create something new, something different and something just a little bit revolutionary: Aqualis, a fully decentralized global protocol and decentralized autonomous organization (DAO) with an extensive suite of features across multiple blockchains.

We believe Aqualis has the potential to not only challenge but exceed existing major DeFi protocols such as UniSwap, Aave, Curve and more.

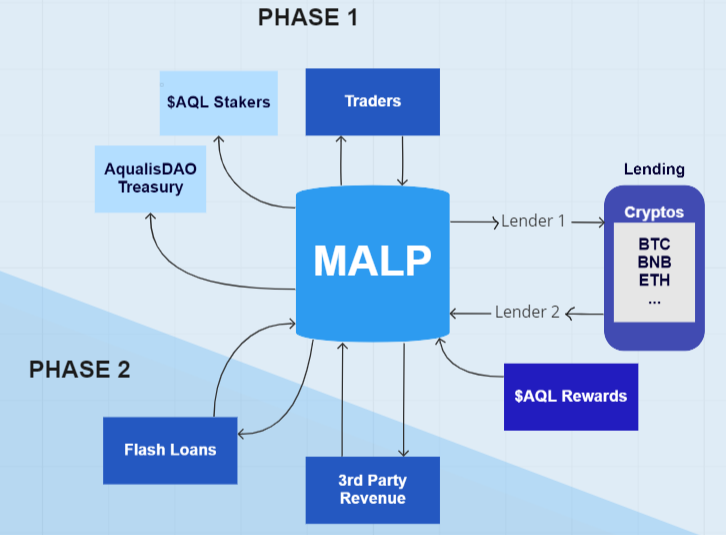

We plan to achieve this through our asset multi-utilization technique, which allows us to offer users zero price impact stable coin trades, one of the lowest trading and lending fees in DeFi and the highest utilization rate of funds in any project that exists in DeFi today.

In practice, what this means is when a user deposits stable coins into the MALP, they are not just earning trading fees, but also lending fees, AQL tokens and much more in our Phase 2 release. This means Aqualis can afford to offer the lowest fees in DeFi, while simultaneously providing high yields for depositors and thus a sustainable business model.

AQL Tokens, AQL Staking and Aqualis Power (AP)

Aqualis tokens (AQL) will serve as the governance token of the DAO, along with receiving a fee split from all fee bearing transactions on the protocol when it is staked into Aqualis Power (AP).

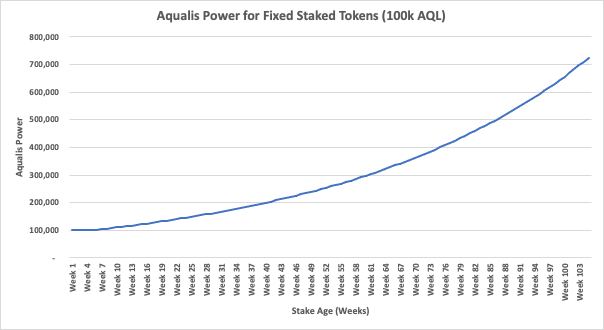

These tokens can be staked for any time between 5 to 105 weeks, receiving a 2% bonus for each additional week staked.

Users can withdraw Aqualis Power early at a fee of 1% plus 0.3% per week remaining (rounded up), the fee will be distributed the following way:

• 50% will be burned out of circulation forever

• 40% will be transferred to the AP Rewards Pool, which is redistributed to ongoing stakers

• 10% will go back to the protocol’s treasury, which is fully controlled by the community

The Aqualis DAO

The DAO will be used to make protocol changing decisions, from basic parameters such as fees to the strategic development of the protocol. Community members can create and vote on proposals related to changes, improvements, or anything they would like to see with the Aqualis ecosystem. Each user's voting weight is calculated by their Aqualis Power (AP), not total AQL staked, thus incentivizing users to stake for longer periods of time to make the most out of their AQL tokens.

Basic parameters may be fully controlled by the DAO in the future whereas proposals will need to pass an initial voting stage before being approved by the team for further development.

Upon approval, the team may also request a treasury grant to implement the feature if applicable.

Token Allocations

• Public sale tokens: 120,000,000

• Public sale price: $0.40

• Circulating supply at launch: 148,000,000

• Percentage of community owned tokens at launch: ~81%

• Maximum supply: 1,000,000,000

For more information on allocation and vesting schedules, visit our tokenomics page.

Tokenomics

We believe at the heart of Aqualis, is the AQL token. Therefore, we want AQL tokens to truly capture the value of the protocol at every possible opportunity, as the protocol grows, so should the value of AQ.

To achieve this, we have implemented multiple sources of burns. A portion of the following fees will be used to buyback and burn AQL tokens:

• Stablecoin trading fees

• Cross-chain swap fees (likely in phase 2)

• Lending interest fees

• Liquidation fees

• Staking early withdrawal fees

• And many more down the track…

Furthermore, a portion of some of the above fees will also be used to buy back AQL tokens which are transferred to the rewards pool which are redistributed to stakers based on their AP.

Is Burning only a Gimmick Used by Scams?

This has been a common question raised by early contributors, and a fair one considering the number of rug-pulls, scams, and just useless Ponzi coins out there. Well, the simple answer is yes and no. When the only utility of a project is fabricated scarcity through burning, then it’s by definition a Ponzi scheme since it requires new money fooled by the inflated scarcity to sustain the project’s existence.

However, the difference with Aqualis is we have a product and utility far beyond just burning. Through the ongoing existence of our project, we will generate fees for our services and revenue for the protocol, which partially goes back to buying back and burning AQL tokens. This creates a continuous and constant buy pressure for AQL tokens, along with giving passive income to AQL stakers.

As the protocol grows, so will the periodic buy backs and so will the passive income, thus simultaneously increasing demand and reducing supply, which will naturally lead to price appreciation.

Lastly, the reason Aqualis is in favour of burning over redistribution to stakers is that burning leads to a permanent reduction in supply, thus pricing in our past performance permanently, whereas redistributed tokens may be sold at any time, thus reducing the price back to where it would have been and having no permanent effect on price.

Risk Reminders

As with any DeFi investment, there are many risks involved, for an extensive list of risks and explanations, please visit our Risk Reminders page. Although we have endeavoured to compile a thorough list, we cannot guarantee there are not more.

Want to Learn More?

- Visit our website

- Read our whitepaper

- Join our Discord

- Follow our Twitter

Note: this article may become out of date over time but our whitepaper will constantly be updated

Posted Using LeoFinance Beta

They literally have attempeted my murder and are trying to kill me with V2K and RNM. Five years this has been happening to me, it started here, around people that are still here. Homeland security has done nothing at all, they are not here to protect us. Dont we pay them to stop shit like this? The NSA, CIA, FBI, Police and our Government has done nothing. Just like they did with the Havana Syndrome, nothing. Patriot Act my ass. The American government is completely incompetent. The NSA should be taken over by the military and contained Immediately for investigation. I bet we can get to the sources of V2K and RNM then. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism ..... https://ecency.com/gangstalking/@acousticpulses/electronic-terrorism-and-gaslighting--if-you-downvote-this-post-you-are-part-of-the-problem

Congratulations @aqualis.dao! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Welcome to Hive, @aqualis.dao.

You're already in the right place to build a strong membership team and may even raise funds to start up your project. LeoFinance community pages also offers you the facility to host a forum for the Aqualis participants.

Cheers!

Posted Using LeoFinance Beta