Polycub: Exploring pHBD-USDC Liquidity Pair.

Drum roll please: Hive Backed Dollars is now live on polygon blockchain. This is truly a big deal for the Hive ecosystem as the bridge means Hive can now be traded on Polycub. By wrapping HBD as pHBD, it can now be paired with USDC to provide liquidity on Polycub. By adding pHBD as liquidity alongside USDC, there is an Annual Percentage Rate of above 60%.

With pHBD, the goal is to create Five Million plus liquidity paid for HBD.

This is one hell of a goal, but knowing Leo finance they always bring out the big guns and with the right amount of effort then it would be definitely be achieved.

Over the weekend, hive witnesses with a few varying votes, reached an agreement to raise interest rates from 12% to 20% APR. This has bullish move written all over it and why that is a welcome development, it also means that the demand of HBD is at an all time high but supply not so much. Prior to this bridge, there was no liquidity for HBD which made meeting the problem of supply difficult.

A few weeks ago, I began my polycub Defi journey and I remember asking why HBD stable coin can’t be added to the liquidity pool, but I just waved it off because what do I know. I later found out that the Leo finance team has had the resolution of this issue in the works so here we are, with one of the biggest news fir Hive ecosystem. Not only will this solve the issue of supply but it also means that HBD will now be opened up mass adoption by extension ; simply amazing. A vault has been created for pHBD and USDC to be added to liquidity. This is creating an ample opportunity for people to buy an enormous dollars worth of HBD.

In my journey of learning what DeFi is I came to understand the risks of investing, differences between staking and providing liquidity. I understood that staking has no risk but it’s APR is low, but providing liquidity has an impermanent loss risk involved. This means that if you stake two coins subjected to volatility in a liquidity pair, volatility affects the risk. This means that when volatility affects any part of the pair, the blockchain tries to reduce the coin quantity of the part of the pair gaining more value to balance the pair.

So the impermanent loss means that you might have a lesser coin quantity than you initially invested but the value will be regulated to stay same. Instead of risking it that way, why not provide liquidity to a pair of StableCoins? This way volatility doesn’t affect the impermanent loss.

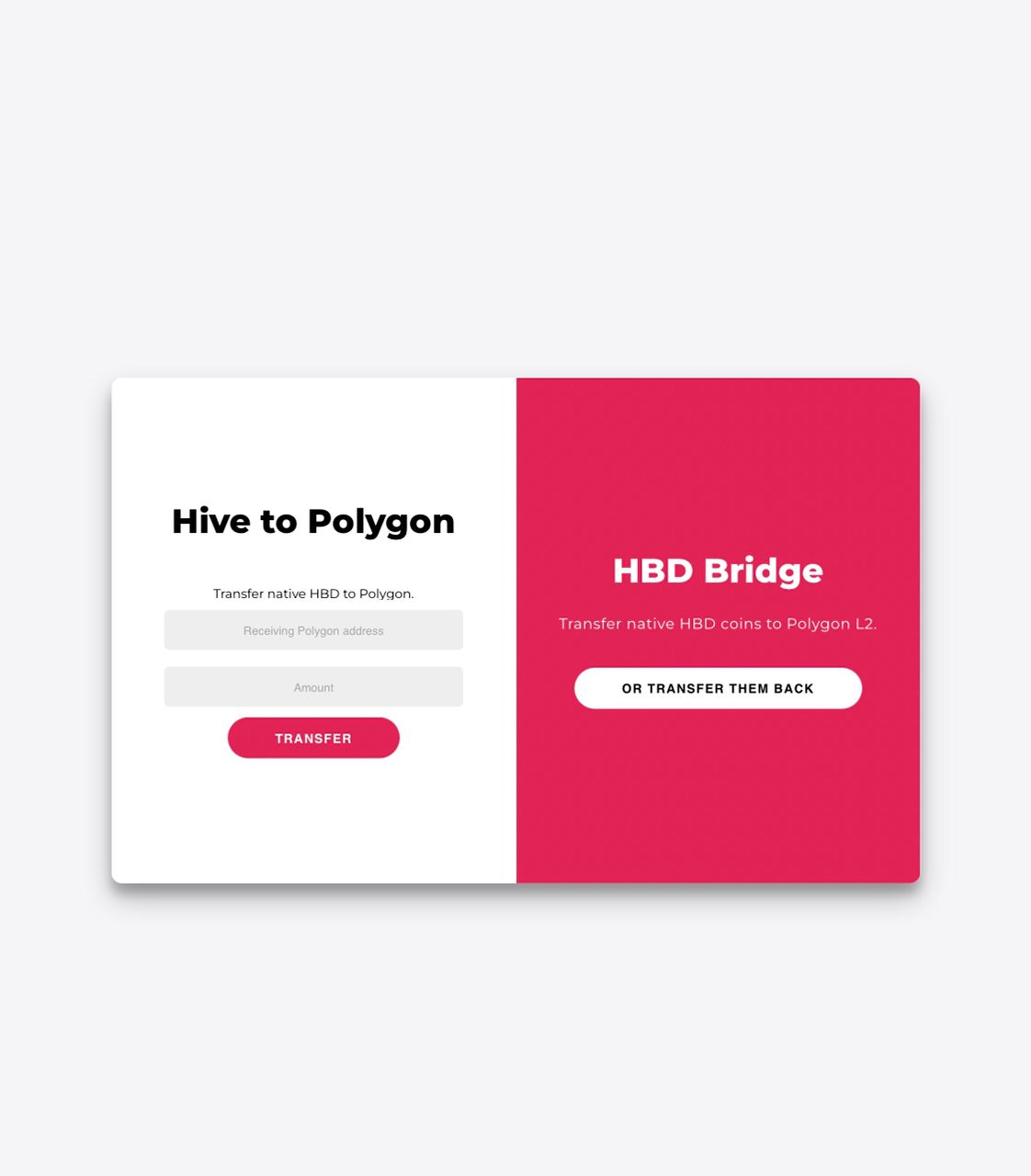

I’m not very conversant on how to bridge yet, so I will explain just what I understand by bridging HBD from the Hive blockchain to the polygon blockchain. HBD is the Stablecoin on Hive’s blockchain and to get pHBD to add in the pHBD-USDC liquidity pool you need to bridge HBD or rather wrap your HBD on the polygon blockchain to have pHBD.

WRAPPING HBD.

pHBD simply implies a wrapped version of HBD which would live on the polygon network and governed by Polycub.

So by adding your receiving polygon network address and the amount of HBD, confirming with Hivesigner then, wrapping is done.And in order to reverse it which is unwrapping, you’ll have to enter your receiving Hive username, amount of pHBD to be unwrapped then confirm with metamask.

I’m actually excited about this as a baby cub and cannot wait to run it myself.

Thank you for reading.

Posted Using LeoFinance Beta

Congratulations @atyourservice! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

Fantastic news and it is looking like it will be a success, further awesome work by the team!

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Nice write up. I must check this out. What is the apy paid in. Polycub, HBD or usdc?

Read how this all have started with Toruk

Posted Using LeoFinance Beta