Splinterlands | Guide For Passive Investors!

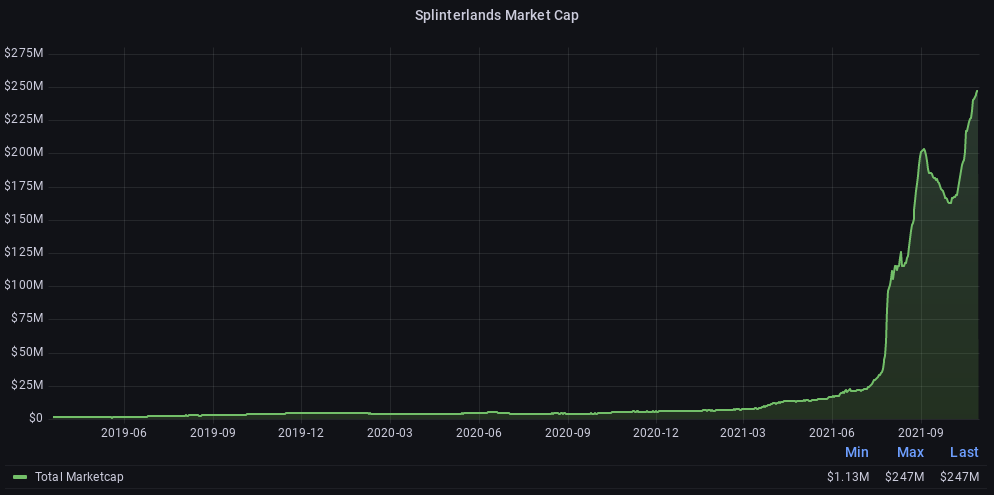

The beauty of Splinterlands assets as an investment is that they have an actual use case allowing those that own them to get a return on them. Each individual card also has a fixed supply so for as long as demand continues to grow they should become more scarce over time especially the older cards. Everything stands and falls with the team behind the game and they have shown over the last couple of years to be able to make the right calls when it comes down to the overall game economy. With the SPS Governance token, they will also get less and less direct power to potentially act against the players and investors in the game as proposals will be voted on by the community.

When looking to invest in Splinterlands without the intention to play the game, there are different assets to choose or spread the investment in. Right now most assets are trading at all-time high prices while at the same time the returns are also the highest they have ever been since all in-game assets count toward the SPS airdrop points with 270 more days for that to be distributed daily. Basically, those that want to get in are best to either do it as quickly as possible since each day that passes makes them miss out on airdrops and other passive returns, or wait for a time (which inevitably will come) where there is a massive dip and a lot of Fear, Uncertainty, and doubt around the game. I do believe that in both cases, a long-term mindset is the way to go. Personally, I'm comfortable holding most of the in-game assets I own taking some profit on the passive & active income they produce with the option to buy more in case I see something I believe is too cheap.

Different Splinterlands Assets

- Splinterlands Cards (NFTs)

- SPS Governance Token

- Dark Energy Crystals (DEC)

- Splintertalk Token (SPT)

- Card Packs

- Vouchers

- Land Plots

There are different Assets in Splinterlands that can be invested in with each of them having specific ways to earn passive returns from them without the need to put time into playing.

SPS Airdrop!!

Pretty much all Splinterlands Assets right now will earn Airdrop Points for the SPS Governance Token which offers major returns. These will go down over time as more assets get into circulation and the value the airdrop provides is likely calculated into the current market prices and it is possible for some of the prices to correct down when the airdrop is coming close to its end 270 days from now. For all I know with an increased adoption they can also continue to go up. Nothing is sure or guaranteed pretty much.

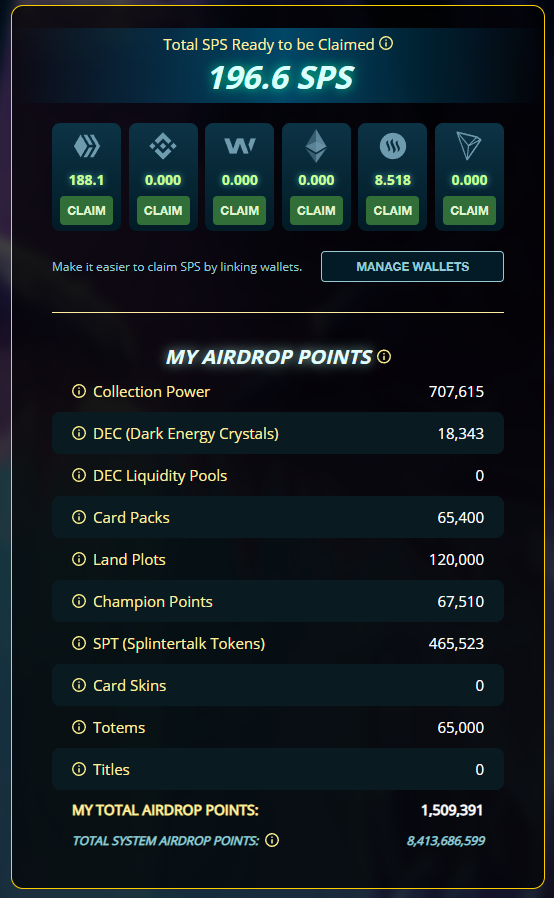

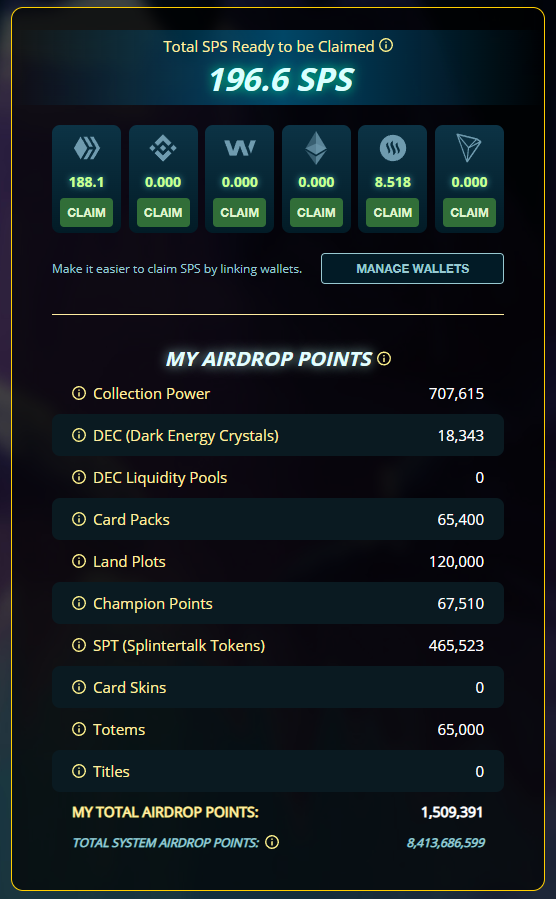

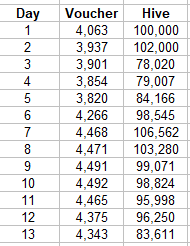

This is what I personally get from the SPS Airdrop Daily on my Main Account.

While a case can be made that old players are generously getting rewards for having diamond hands holding on to their in-game assets, it can also be said that those who are willing to invest in the game get generously rewarded.

1. Splinterlands Cards

There are right now 2 ways how Splinterlands Cards generate passive returns.

- Rental Income: Cards can be rented on the market (best use peakmonsters) depending on Supply, Demand and where we are in the season. With the demand there is right now for newer players to get enough Collection Power to get in higher leagues for more rewards, it is fairly easy to get Yearly returns on +20% to over +100% just from rentals. A general guideline is that the rental prices are linked to the collection power they hold (See Table) and how useful/rare they actually are.

Rental payments are being done in real time paid in DEC which has enough high liquidity trading pairs to turn them into other currencies and DEC can be used to buy more assets in the game.

For as far as what the best cards to buy are, it is somewhat of an art and playing the game certainly helps in order to make the right calls. I personally would rather buy cards that are currently not the most powerful ones as the meta will change in the future making some cards that are crazy powerful right now likely less effective and the other way around. Something that could help to make the right investments is to follow some of the Youtubers who are experts at Splinterlands (See Top 10 Splinterlands YouTubers You Should Follow !)

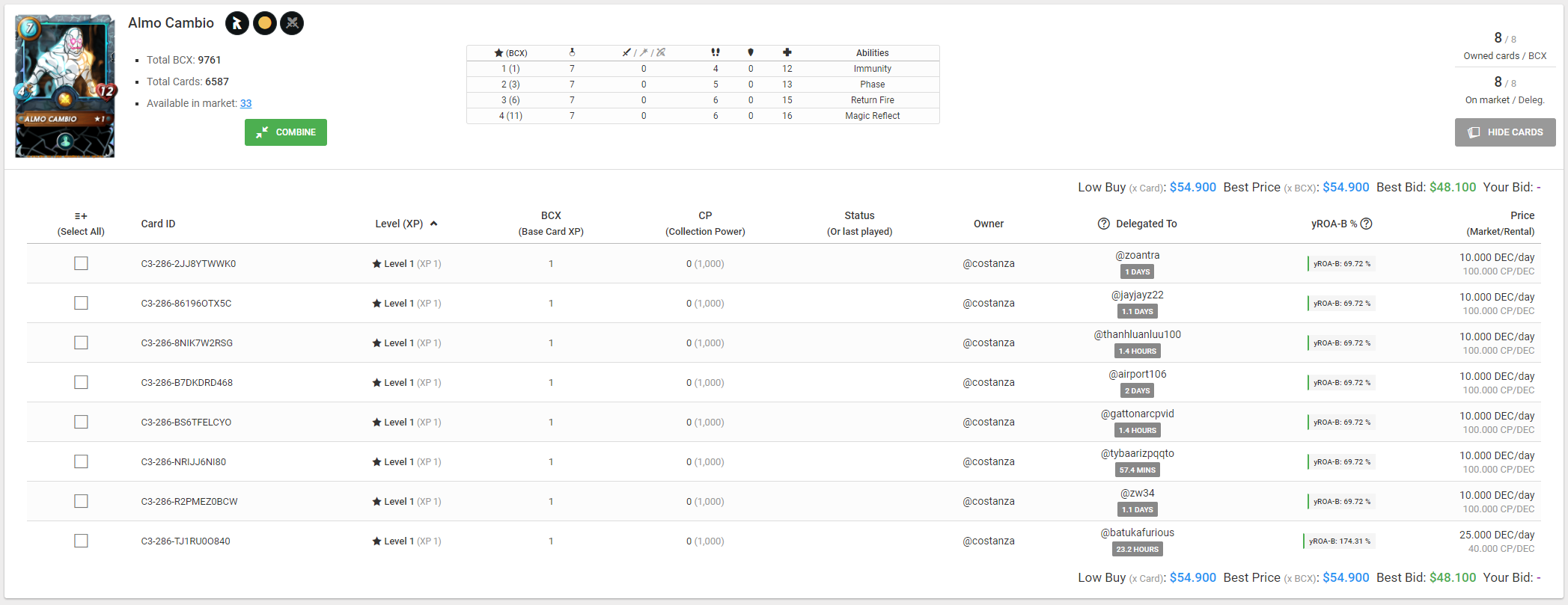

I made a post a couple of months ago about one of the cards that I was accumulating. See Splinterlands | Reasons I Bought 6 Legendary Almo Cambio Cards!

I never combine single cards that are an investment but will buy leveled-up cards on the market when they go for a major discount. The cards I bought 2 months ago now are earning a rental income and they also count toward the SPS airdrop for 6000 Collection Power also earning some SPS daily from the Airdrop. Right now single cards go for 55$ (compared to 30$ at which they were bought)

- SPS Airdrop from Card Collection

Each card has a collection power attached to it which gives 1 Airdrop point for 1 collection power. The older and rarer the card, the more collection power it tends to have attached to it which also reflects in the price most of the time. You can make the calculation of how much value each specific card gives in terms of collection power. The Received SPS Airdrop can be staked for more passive returns. (see below)

I do consider cards to be potentially a great buy if you manage to buy the right cards at the right price since they offer Passive returns from Rentals for a long time to come and they grow rarer as long as the game continues to grow. They pretty much offer 4 ways right now to earn with crazy compounding potential.

2. SPS Governance Token

Directly Buying the SPS Governance Token and Staking it is also a potential way to invest in Splinterlands getting some Passive Returns from it. Right now those that have SPS staked get double rewards. First from the SPS Staking rewards who go down as more SPS get staked. Right now it gives +54% APR which all basically comes from coins that are not yet in circulation so there could be quite some pressure on the price also because those holding assets are getting SPS Airdropped for their holdings daily. The Vouchers for the Staked SPS do provide some great passive earnings as the whales are pretty much willing to overpay for them.

13 days into the airdrop I started with 16k-20k SPS staked (all gotten from the Airdrop after initially taking some profit) and managed to get a total of 55 Vouchers (-> See Below) which were systematically sold in total for 1225.334 Hive (982$). The current airdrop still lasts 17 days and the voucher system will continue afterward at a double pace which will make the price of vouchers go down for sure.

SPS will continue to give benefits to players and ways to get passive earnings after the voucher airdrop but I'm not sure it's the best way to passively invest in the game. On the one hand, there is yet a lot of SPS to get in circulation (See Whitepaper) while on the other hand, the total marketcap of the total amount of SPS that ever will be in circulation (before potential burn mechanisms) is 1.5 Billion which is still a lot less compared to the 9 Billion valuation of Axie Infinity for coins they have in circulation (40 Billion counting all coins). SPS also can be used to buy the upcoming Chaos Legion Packs (which will be massively popular) with a 10% discount. Those coins will go to the team and they have all reasons to make sure SPS keeps or increases in value since that makes the game more attractive for players since SPS will be something that will be given as rewards.

Buying SPS is another way to potentially invest in Splinterlands in a passive way with the price still having some upside when comparing it to the Axie Market Cap. Some of the benefits SPS gives likely will just be for players which passive investors might miss out on.

3. Dark Energy Crystals

I personally see Dark Energy Crystals as a way to take some profit from the game. It is the currency that is being rewarded to players originally intended as a stable coin as the was a Peg where 1000 DEC could be used as 1$ of in-game purchases. Since the demand increased so much, the peg got broken and there is a system where more DEC is being printed when the price goes higher. One of the reasons DEC is trading so much above the Peg is because 1 DEC gives 1 Airdrop point so players are willing to hold on to it even at current prices. Since more DEC is being printed each day I wouldn't say it's a good way to passively invest in Splinterlands also because there likely will be a big dump once the airdrop is over. Right now, it can be used to do in-game purchases for the price it is trading at while the peg still counts in case the price would somehow go -90% back to 1$ for 1000 DEC. I do see the situation with DEC as somewhat of an issue and I never really hold more than I have to. Having Dark Energy Crystals locked in liquidity pools also doubles the airdrop points they give at the risk of potential impermanent loss.

4. Splintertalk Token (SPT)

SPT is the token that gets rewarded for Blogging on Splintertalk.io and it also counts toward the SPS airdrop. It is possible to get double passive returns from both the SPS airdrop and the curation rewards. It works with a similar system to Hive where those that have SPT stakes can dictate what content creators the newly minted SPT goes to earning 50% in curation rewards in return. I personally stacked up on SPT way before it was known that it would count for the SPS airdrop expecting it to get a use case which worked out quite well. 1 SPT counts for 0.25 Airdrop points which brings some good passive earnings the next 270 days and you can earn passive SPT by staking it and delegating it to @monster-curator who will do proper curation with it sharing 100% of the curation rewards. These passive earnings getting extra SPT are merely part of the inflation that you are getting offsetting the potential pressure on the price it causes.

I have 1.8 Million SPT delegated to @monster-curator which is giving me the following daily passive earnings:

With 1 SPT currently being sold for 0.008$ it comes at an averaged of 14.28$ passive earnings daily having 14.4k worth of SPS delegated which comes at a +36.2 APR not counting the SPS airdrop it also gives. 450k airdrop points roughly represents 59 SPS based on the current calculations. This is 30.56$ or +77% APR which brings to combined returns at an APR of over +100%. SPT also "only"' has a market cap of 800k which makes it have the potential to still go up.

I'm personally just holding on to the SPT I managed to accumulate so far and tend to take some profit on it when the price goes above 0.01$ for 1 SPT.

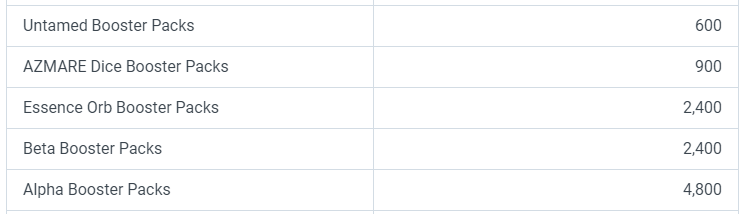

5. Card Packs

Card Packs also count toward Airdrop points which makes them an investment that for the next 270 days will give passive returns. Older card packs continue to get rarer over time and they have the potential to contain golden legendary cards which are worth a ton. Since people love to gamble, they should increase in value over time which is what they have done so far. Once the airdrop gets to an end there will likely be more selling pressure combined with less buying demand. The main time to see Card Packs as investments for me is near the time they are about to sell out as a quick profit flip since they tend to go for more in the 2nd hand market. I don't consider the Chaos Legion Packs as an investment as there is an incentive for players to buy packs to sell the cards in case what's in there is expected to be worth more on the market which again increases the pressure on the price of the cards as more get in circulation.

6. Vouchers

7. Land Plots

A single Land Plot currently gives 10k airdrop points generating a good amount of SPS daily. There are only 150k Land Plots in total and they will allow players to mint cards (Spells and Items) once the Land Expansion goes live most likely somewhere next year. So those that have land and the needed cards to put to work on them will be able to get some nice semi-passive returns from them. It will also be possible to rent out Land similar to cards for those that fully want passive returns from it. Right now a single plot goes for roughly 700$ while they went for 20$ during the initial sale. In fact, it are Land Plot claims which can contain a better or worse type of land plot. Since the plots themselves will earn passive SPS in the next 270 days with them likely becoming a big part of the game with the amount being limited in numbers, they might be worth it even at the current price.

Table Current Cost /Airdrop Point

| Splinterlands Asset | Price 1 Airdrop Point |

|---|---|

| Cards (Collection Power) | Variable |

| Dark energy Crystals | 0.011$ |

| SPT Token | 0.029$ |

| Untamed Packs | 0.123$ |

| Dice Packs | 0.028$ |

| Orb Packs | 0.063$ |

| Beta Pack | 0.066$ |

| Alpha Pack | 0.090$ |

| Land Plot | 0.068$ |

Dark Energy Crystals offers the best value for the SPS airdrop especially when it's being put inside a liquidity pool at the knowledge is it also most likely to drop in price once the Airdrop period is over.

Conclusion

Splinterlands offers plenty of ways for investors who are not looking to spend their time playing the game to get passive returns. Everything pretty much falls and stands with how popular the game remains and many of the value of the assets are directly linked to the price of SPS since they count toward airdrop points. It remains a question what will happen to some of the prices of the assets once the SPS airdrop comes to an end but in the meantime, there are 270 days left to get some excellent profit to offset an anticipated drop. I personally see cards as one of the better long-term passive investments in the game especially if you are able to get the ones that eventually will become very rare at a good price. I also like the fact that my investment in the game is spread between different assets owning a good card collection, SPT, Land, Packs, ... being well-diversified getting returns from all kinds of angles.IMPORTANT! It is important to know that having an investment in Splinterlands is highly speculative. There is a dynamic where rising prices attract more players which increases the demand making prices go up more bringing in more players and so on. This unfortunately also works the other way around in if prices drop, more players will likely leave increasing the selling pressure pushing prices down more making more players wanting to leave,...

For more Info Around the Splinterlands Game see...

|  |  |

|---|

|  |

|---|

|

|

|

Posted Using LeoFinance Beta

you have been manually curated by @skylinebuds on behalf of the 1up.zone curation team. Curating all original quality #play2earn content.

Thanks !!

This game has become in one of the most oustanding ways to invest your money, I look back and it is unbelievable how much splinterlans has grown, I am a bit sad cuz I sold out my plots in an early stage but as you posted there are many ways to get an interesting passive income, well done you rock!

Thanks, the growth indeed has been crazy and at some point it will likely all come back down a bit. Looking at it from a long term perspective I still very much like the value proposition with all the different ways it allows players to get some returns. I'm still holding on to the few land plots I have but might sell just a couple in case prices continue to go higher. It's just so hard to sell right now because of the airdrop which still has so many days left in it.

¡Enhorabuena!

✅ Has hecho un trabajo de calidad, por lo cual tu publicación ha sido valorada y ha recibido el apoyo de parte de CHESS BROTHERS ♔ 💪

♟ Te invitamos a usar nuestra etiqueta #chessbrothers y a que aprendas más sobre nosotros.

♟♟ También puedes contactarnos en nuestro servidor de Discord y promocionar allí tus publicaciones.

♟♟♟ Echa un vistazo a nuestra cuenta @chessbrotherspro para que te informes sobre el proceso de curación llevado a diario por nuestro equipo.

Cordialmente

El equipo de CHESS BROTHERS

Wow realy wow !❤

I have spent more the 15 minutes reading it, how much did it take you to write it !?

I also think the best two things to invest in are : buying and renting out the cards and buying dec ...both of them will increase your sps drop rate .....and at any time you would play the game you will have good cards .

It'a 3 by 1 plan 😎 .

I appreciate your work with all due and respect❤

It took some time but I enjoy the process of writing so I don't mind that much :-)

I also like cards the most and am even tempted to buy some more even though I'm already overinvested on Splinterlands assets in my crypto portfolio

What are the champion points !?

In the game they don't show you informations when you click ( ! )

So the game has always been more rewarding for lower level players / bots that had multiple accounts compared to the whales who played properly trying to reach as high as possible. (retaive is % return of what was invested). Players that have reached champions League now and in the past are getting champions points which before the airdrop had no real use case. As a way the reward those that heavily invested in the game they counted them toward the airdrop points. So if you reach champion you will earn them getting more of the SPS airdrop.

I hope that sets it straight

I will need more than two years I think if I want to reach the champions league.😂

Thanks for your explaination.❤

I have one land plot from the initial sale and am thinking of buying more, since it will only get me more sps the rest of the active year. good idea!

I remember waiting for the pre-sale to go live to see the site go down making me miss out on them being pissed about it. I luckily did put my earned and saved DEC inside the farming liquidity pool to get some Plots which I so far have held on to. There is too much uncertainty on them to actually make we willing now to buy more. I am still looking at specific cards though.

Good Luck!

This post explains everything I want to know and you break it in way that is helpful to those that are new to the game like me.

Thanks for sharing.

Posted Using LeoFinance Beta

Nice to see the article helped. good luck with your investments in the game!

Very good summary, i got some of my questions answered. Got so many lands that I cannot wait for the update to come, to rent some of them.

!LUV !PIZZA

<><

@costanza, you've been given LUV from @mightyrocklee.

Check the LUV in your H-E wallet. (5/10)

PIZZA Holders sent $PIZZA tips in this post's comments:

@mightyrocklee(5/10) tipped @costanza (x1)

Learn more at https://hive.pizza.

Thanks for sharing! - @ashikstd

Your analysis is incredibly thorough, as always. Bravo!

Thanks for showing me that I already am getting some DEC from the few cards I rented :)

As for the SPS and Vouchers. Currently, I am keeping SPS to get enough for a 100 Chaos Legion pack. I'll buy Vouchers needed on the market since I am receiving just 0.7 daily. I'll get additional SPS from the $CAKE pool which gives interest in SPS :)

!BEER

Nice guide to follow for passive income in splinterlands (from r1s2g3)

Your post has been manually curated by @monster-curator Team!

Get instant cashback for every cards purchase on MonsterMarket.io. MonsterMarket shares 60% of the revenue generated, no minimum spending is required. Join MonsterMarket Discord.

View or trade

BEER.Hey @costanza, here is a little bit of

BEERfrom @ervin-lemark for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Hi, thanks for the guide. New to the game and I tried to list one of my cards for rent -- it was not able to be listed for something like .02 (which I thought was DEC). Is there a guide on this here?