vexPOLYCUB Yield is not Inflationary: More Reason to Trust the Platform - Explore How this Works

Hello LeoFinance ecosystem!

It's another day and an opportunity to unveil what's hidden in xPolyCub and vexPolyCub in order to determine which is more preferable to invest in.

For those that don't know, vexPolyCub, which stands for

Voting Escrow xPolyCub is no longer a news, it's now live and you can participate. For more information about vexPolyCub check here

What's vexPOLYCUB?

vexPolyCub is the newest PolyCUB project that allows you to lock xPolyCub for 2 years in exchange for rewards. The rewards ranges from a fixed 20% APY and an additional 66.77% APY for xPolyCUB stake. This means that vexPolyCub offers holders a whooping 86.77% APY for a 2 year period, which began yesterday. The clock is already ticking and the earlier the better.

The main purpose of this post is to excavate more information to encourage holders and potential holders of xPolyCub to invest in vexPolyCub.

Let's Talk about the non inflationary nature of vexPolyCub

It's very shocking to note that xPolycub yield is inflationary in nature. I know that one of the things potential investors are looking for is a platform that's deflationary, don't go far, vexPOLYCUB yield is not inflationary, making it more preferable to xPolycub yield.

How does it work?

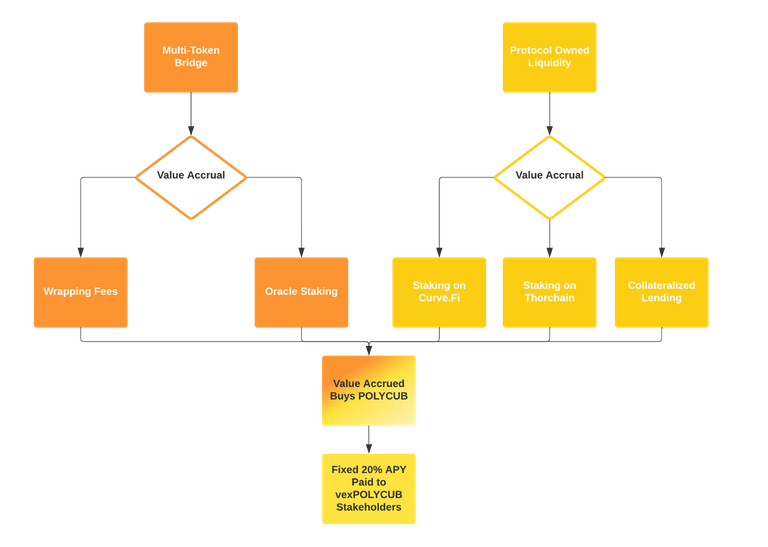

A % of that revenue is used to buyback POLYCUB and deposit it into the vexPOLYCUB Vault for all vexPOLYCUB stakers. The amount of that revenue that is used to buyback POLYCUB and deposit it in vexPOLYCUB is dependent on how much vexPOLYCUB is staked. For example, if $100,000 USD is staked in vexPOLYCUB, then $20,000 per year worth of POLYCUB will be bought regularly and deposited into the vault.Source

The buyback clause that inherent in the vexPolyCub platform is what makes it's yield not to be inflationary. This gives room to buy PolyCUB into the fixed 20% APY.

If we assume that a large % of xPOLYCUB moves to vexPOLYCUB, then we can also assume that the buybacks of POLYCUB to deposit the 20% fixed yield into vexPOLYCUB will be quite high. These buybacks happen through PoL autonomously and at randomized intervals throughout each month (to avoid front-running).Source

The more the migration of xPolyCub to vexPolyCub, the higher the deposit and a greater avenue for the buyback.

Please, I'm not yet an expert in vexPolyCub techniques, but you can visit here to see how it works.

Thank you!

Posted Using LeoFinance Beta

Congratulations @creativehive! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!