120 Days In The Coti Treasury

Today one of my deposits is due for payout and haven't harvested any of the rewards yet due to wanting to see if fees apply when the lock up period expires. This was the first deposit and a small one so I could see how it all works and no cock ups wasting fees as that is profit after all.

The larger the deposit the more you pay as it is an overall percentage but adds up considerably when you have big numbers locked up. The catch 22 is we all know compounding your investment using APR is the quickest growth there is and why this was an experiment to see what the implications are first. I am hoping this will tell me what the right course of action is next as harvesting rewards regularly is what we do on CUBDEFI and this should be no different.

When you stake you have a choice of lock up periods from 0 to 120 days with an extended option. When you are thinking long term it is best to choose the longest possible stake so I have extended my main holding and will be moving all the other deposits over as they unlock. The fees are negligible it seems except for staking which take about 1 month to earn back. This adds up if you are having to restake every 120 days as you would be giving back 25% of your rewards over the course of 12 months which is not a smart move. This is why I have taken the tie to work out a strategy to maximise the earnings with no risk involved.

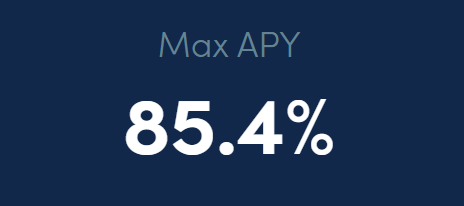

Today they have launched an 8 x multiplier so one would be earning 85.4% APR compared to the no risk 10.67% APR which I am currently earning. I am not a risk taker and this just seems madness in this volatile market as the bottom most likely has not hit yet. This is perfect if you knew what the bottom was as 8 x is big, but also a huge gamble. I expect many will be liquidated as they wont be able to resist this and expect the APR to rise over the coming months as volatility rewards the no risk takers with the liquidated coins.

Over the last 120 days I have worked out how best to use the COTI Treasury and will be moving new deposits into level 2 which is roughly 50% more than I am currently earning with no lock up period. The price needs to drop by 50% in order to be liquidated and the price is already fairly low so can it drop another 50%? The no lock up means I can move the stake with no penalty fees if the price drops avoiding the stake being liquidated. In Crypto we are always learning and that is not such a bad thing as one of these days we will be experts.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Good luck with that! I look forward to hearing what your fees are going to end up being. Hopefully they aren't too bad. 85% is pretty nuts for sure!

Posted Using LeoFinance Beta

Fees are same as staking unfortunately which chews up 25% of rewards in total for that 120 day period. This is why having an extended lock up is advisable over a short term period as you can harvest along the way. They mentioned tonight that there will be longer lock up periods coming with higher APR which is good news as the current 10.68% could easily become 12-15% which would be great. Then I would not hesitate to stick in level 1 no risk for 6 months or a year if available.

Posted Using LeoFinance Beta

Yeah, that would be pretty cool. Even the lower 12% range would be pretty lucrative.

I think exactly the same way as 12% is decent as what out there offers that with no risk?

Posted Using LeoFinance Beta