Digging Deeper Into COTI's Tokenomics

I do believe the more you understand about your investment the more successful you will be and more importantly the more you will enjoy it. Having fun as well as being successful is a real bonus. The knowledge you have gained allows you to make informed decisions increasing the probability of success. When the information is freely available we would be foolish not to take the time to learn as much as possible.

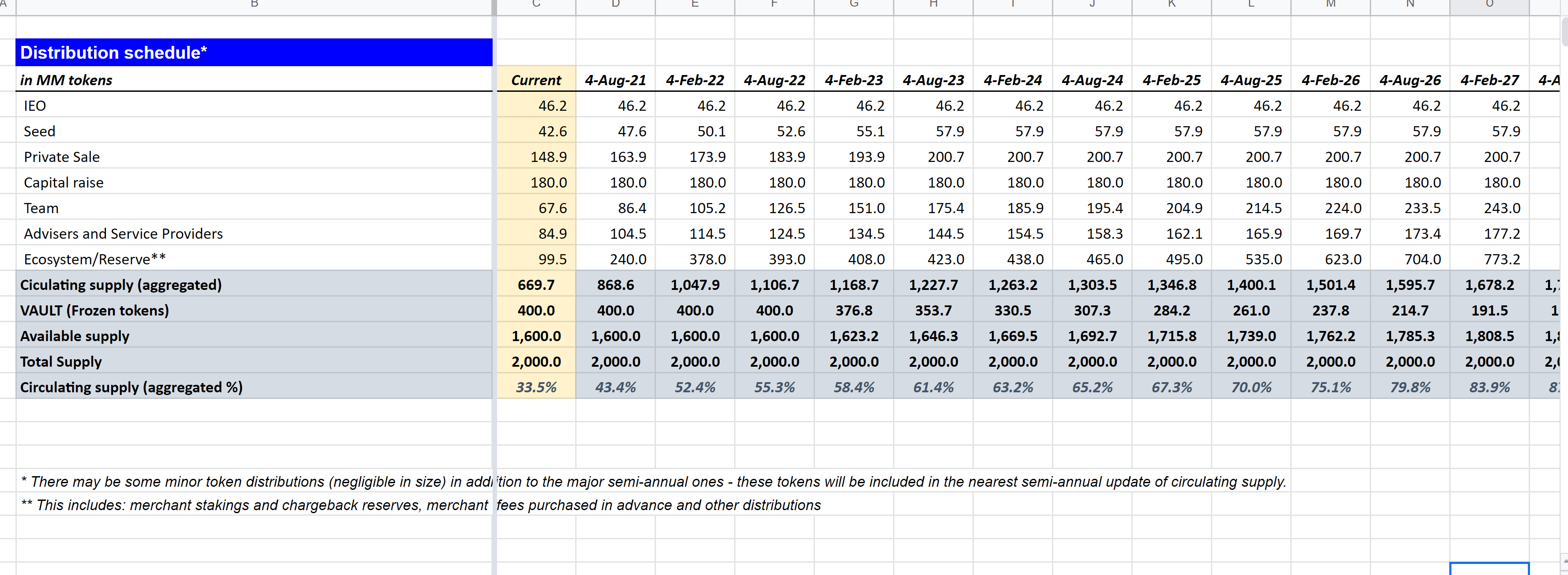

Being invested in COTI I decided I needed to know more about the tokenomics as the maximum supply is 2 billion with a current supply of 1.106 billion supply. There are two dates per year that COTI are added on a decreasing supply being 4th February and the 4th August. The last issue will be the 4th February 2032 when the last batch of 25.8 million COTI are added. That is 9 years away which is not that long considering how quickly things move in Crypto.

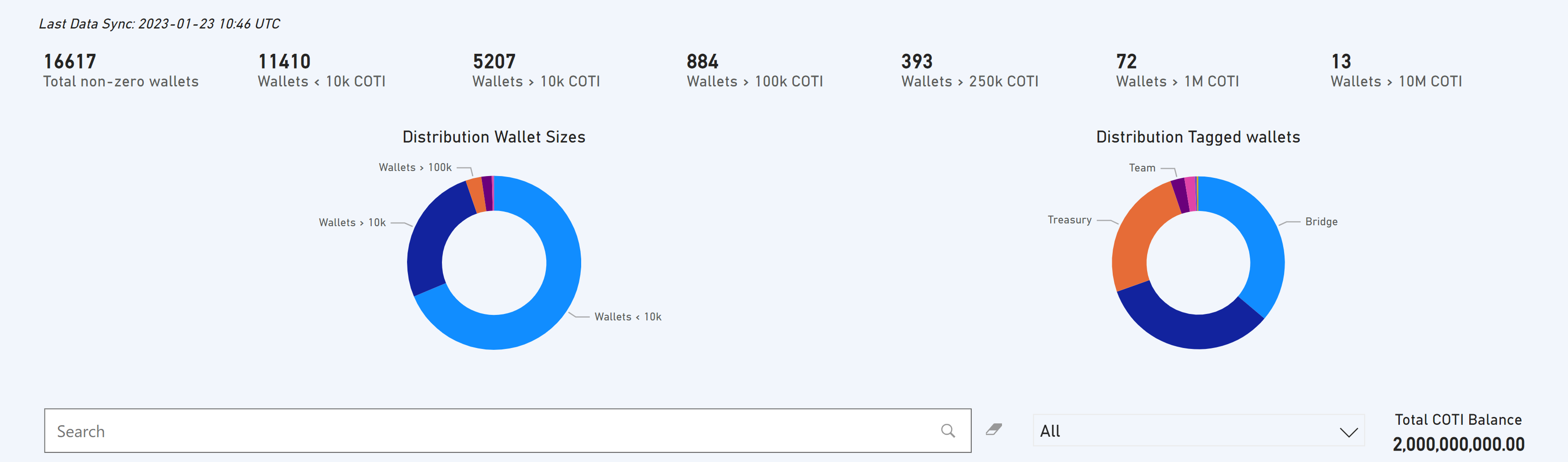

Knowing the extra details like where you stand amongst other investors with regard to your stake is a confidence booster more than anything else. My goal was to get to 100K COTI as soon as possible and still is the goal for this year. I am currently just over half way but the drop in the current APR (7.01%) is not aiding matters. This should increase over the next 6 weeks as the fees from DJED start to filter through. I think everyone's aim is to try and get as high as possible and a top 10% stake holder if possible.

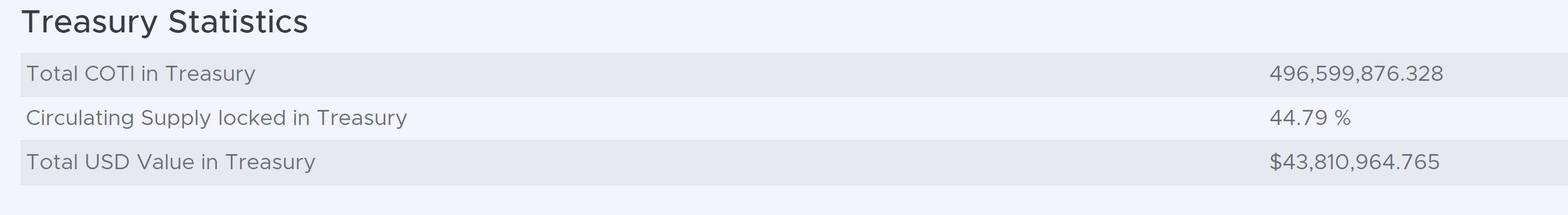

The Treasury which was only launched last year in February has seen a steady growth as the TVL is increasing monthly.

Just shy of 45% of all circulating COTI staked is a decent reflection considering a large number including the US investors have been excluded for now. I would expect to see that number above 70% once they are allowed to join in.

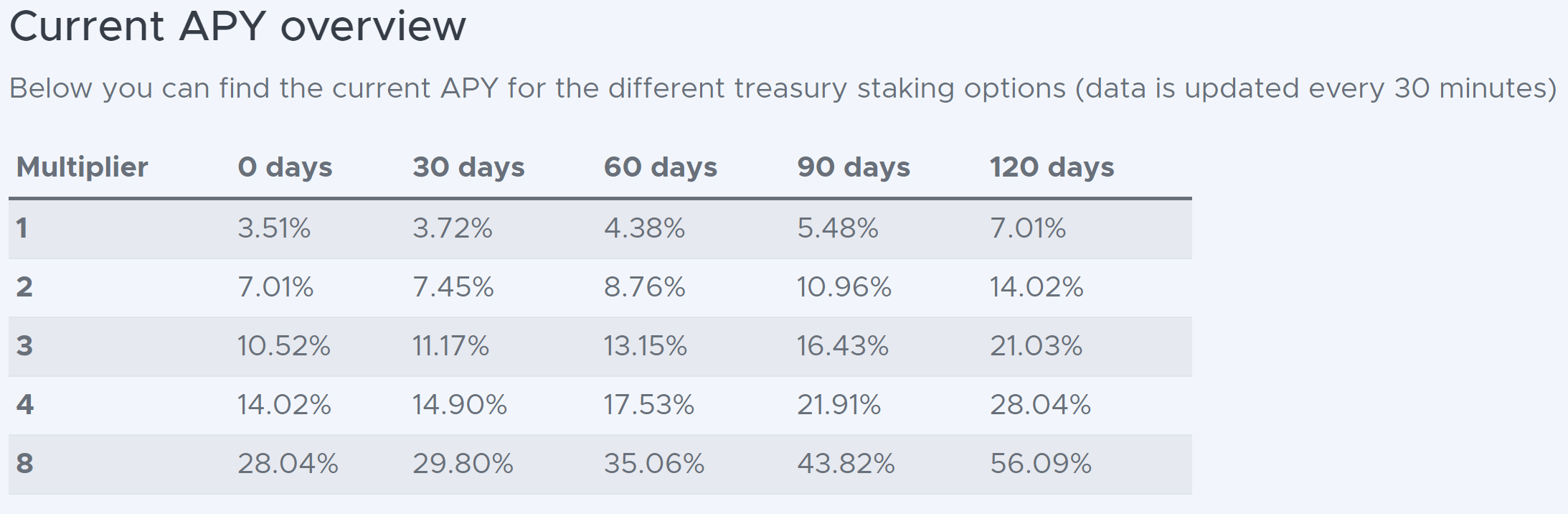

For those of you that aren't aware there are 5 levels of staking available with level 1 having zero risk of liquidation. I am not into risk so I have chosen this level even though it offers a lower APR.

At the current price $0,08821076 these are the liquidation levels.

Level 2 0,04410538

Level 3 0,05880717333333333

Level 4 0,06615807

Level 8 0,077184415

I do think my strategy has to change soon in order to benefit from more APR and need to open a new investment into a higher level. The 0.588 liquidation price on Level 2 would double my current APR. Knowing if we are going to go up or down over the next few days is the key as the lower the entry point the lower the risk of liquidation as those prices are adjusted down as well. I would love to see a 5 c COTI again but something tells me that is wishful thinking and that boat has already sailed. One can always add more stake when the price drops reducing the liquidation price that way, but you need to have liquid ready. The Level 8 is tempting, but is seriously high risk and is not tempting enough.

having the stats to back up your investment thoughts does assist in making the right decisions. My aim of holding 100K plus knowing the APR will increase and expect a 10-15% APR within the next 2 months on Level 1. The GCOTI is being airdropped next month which will boost the APR depending on how much you are given which for those in the longer time frames of 120 days or longer will receive more. I am hoping that some users will offer theirs for sale and there may be options to buy some from them as they will pay off long term.

Long term I do see a liquidity shortage as more and more COTI is making it's way to the Treasury and this will only be good for inflating the price due to demand. With an ever increasing APR around the corner this should become even more popular over the next 12 months. I have found this a fun project to be involved with growing as more and more developments are being run out.

Posted Using LeoFinance Beta

Wow, that top level is pretty tight. I'd definitely be worried about getting liquidated at that point. Seems like level 1 and 2 are the safer places to be. Maybe just take a portion of your funds and move them to level 2. That way you don't loose everything if things turn south.

Great information about COTI tokenomics and getting more information like this makes me wanna invest more in it. I feel that the hype is building again in crypto and with unexpected market movements, who knows... maybe will see the bulls running sooner rather than later. Everything and anything is possible!

Posted Using LeoFinance Beta

Glad this helps as knowing and understanding a project is key to unlocking the potential. This could spark a serious run on the price not only now but in 4 -5 weeks time when the team have to buy millions of Coti from the exchanges to pay the fees.

Posted Using LeoFinance Beta