Finding A Tax Haven For Our Beloved Crypto

The other day in the COTI discord I asked a question about the rewards and the best way to deal with them by either harvesting them or waiting for the time period to unlock. Some smarty pants came back with an answer stating every claim would be a taxable event and not something even on my radar. I have to be honest as it will only cross my mind when the time is appropriate and that is not now. I currently have 2 choices to pay taxes into the UK or South Africa and the UK wins hands down. This will happen at some point if I haven't found a safe haven and this is the favored choice

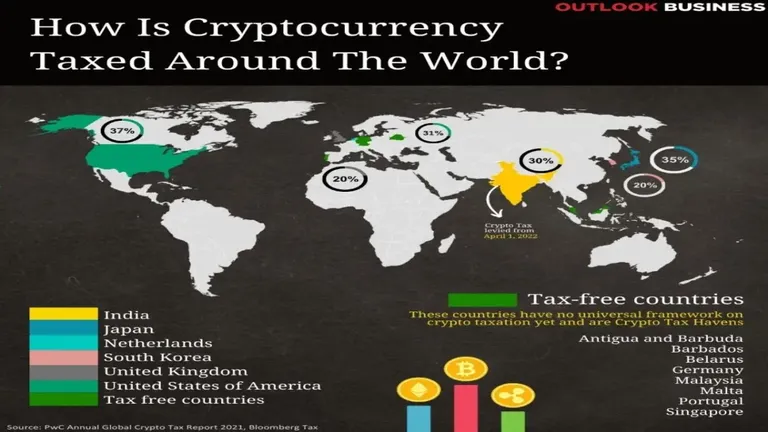

Countries maybe more lenient than others ,but you also have to be living therein order to qualify and this could be easier said than done. As our crypto bags increase in value this is something many are going to have to consider weighing up the pros and cons.

Finding a tax haven for our beloved crypto is easier said than done especially with a friendly face in Portugal looking to reverse their tax laws. I have no problem paying taxes, it is just the way the rules are laid out. I have never moved crypto into FIAT thank fully and don't intend to do so for some time. Does that mean what I am doing is illegal as possibly it is questionable as this makes no sense the way things are set up currently.

Pay the taxes on a fair basis where trades with a loss are also added to the equation as not everything is a winning trade. The governments cannot have everything their own way and need to also be realistic and fair at the same time. Being fair they will benefit far more by receiving more revenue from willing crypto tax payers.

Unfortunately or fortunately everything I have is a 100% gain as I have never used FIAT to grow my bags so it should be simple to work out what I owe if and when I eventually withdraw. Big if as I plan to use the crypto as a currency when that day arrives and stay away from FIAT.

The use of crypto cards is the obvious solution and then the next biggie is where as this crypto tends to start adding up quite quickly. Through staking our crypto is having babies every day meaning at some point down the line someone will want some babies back in the form of a tax payment.

The options out there are not exactly great as in places to live that is as the list is not huge. Obviously if you are mining or day trading then the taxation is going to be treated slightly different compared to investors who are stacking over a long period of time.

Places like Germany and Switzerland fall into this category, but then one has to take into account the cost of living. Belarus is another one that is up in the air and their 5 year policy of no taxation on crypto is expiring next year. Who knows if this will be renewed or a new tax law will be implemented.

Malaysia and Singapore are crypto tax havens with the exception of day trading and businesses who accept payment in crypto. El Salvador is totally tax free on crypto and is another one of those places you would possibly question ever living there. Holiday maybe but to live that is a different story entirely. Puerto Rico seems to be quite friendly as well and maybe needs further investigating but it is South America again and not a place I had ever considered.

Back to Europe we have Portugal which until they change their laws is still a beacon of hope. Who knows maybe it will be a small percentage and still an option when the laws change. Malta still seems reasonable if you compare what is on offer everywhere else. Maybe your bags are big enough to buy a property instead of paying taxes elsewhere and in some cases would make perfect financial sense. The UK has a crypto allowance of around 12K per annum which is tax free so neither here nor their really and wont really help if your bags are large.

I think like crypto this is all too early and growing your bags is the best answer for now at least. I am hoping not banking so "hopium" is the word on many other countries being less lenient in the future giving everyone more choices.

Posted Using LeoFinance Beta

That's what I'm doing. I bought COTI today.

Posted using LeoFinance Mobile

I feel like right now unless you have something you need to pull the money out for you are better off just leaving it in crypto until they get things sorted out. Either that or we have more options. It is anyone's guess how long that might take!

Posted Using LeoFinance Beta

The UK isn't actually a bad option. But for me Portugal is still OK - I've got NHR status for the next decade which means I pay 0 tax on wealth gains.

Maybe then I'll move back to the UK - as you say 0% on 12K and then it's 10% up to 35K (income and wealth combined though).

Posted Using LeoFinance Beta

The UK is my best option right now and why I am not exactly concerned as I can live with that if I have to. That is a genius move getting a 10 year exemption and make the most of it then.

Posted Using LeoFinance Beta

How can the government know all your transaction history regarding cryptocurrencies, so if I want to buy and sell products in cryptocurrency, i.e. do e-commerce, I have to pay taxes?

Hey Meno. Your quite right as I have no clue and why I am not exactly concerned. Apparently if it is a business then yes you are expected to declare the sales and pay taxes like it was FIAT. How they would know must be up to the individual I suppose.

Posted Using LeoFinance Beta

Fortunately in North African countries we don't have income tax for cryptocurrency so we use PayPal for transfers easily to our banks.

I hate this subject, but I thank you for bringing it up.

They make it too hard for people to comply. Someday this will be a big problem.

Posted Using LeoFinance Beta

I must admit it is not a nice subject and also think it may be a big problem one day. This is all rather confusing and not simple to wrap your head around. I am fortunate as I have a few choices and will choose the option that suits me best being the cheapest one.

Posted Using LeoFinance Beta

It sounds like a huge pain to think about taxes but I do like the idea of using crypto credit cards so nothing gets put on your fiat balance. If I remember correctly, taking out loans and using that could also be another way to avoid the taxes because taxes suck in the US.

Posted Using LeoFinance Beta