High Risk No Reward

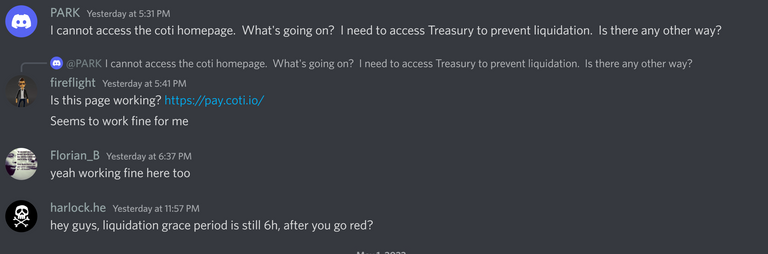

Why if you invest in a project you stay up to date with any new notifications. Liquidation safety times were changed on 30th March from a 6 hours grace period to 1 hour. Obviously many were unaware as there was carnage last night as the amateurs/gamblers were cleaned out.

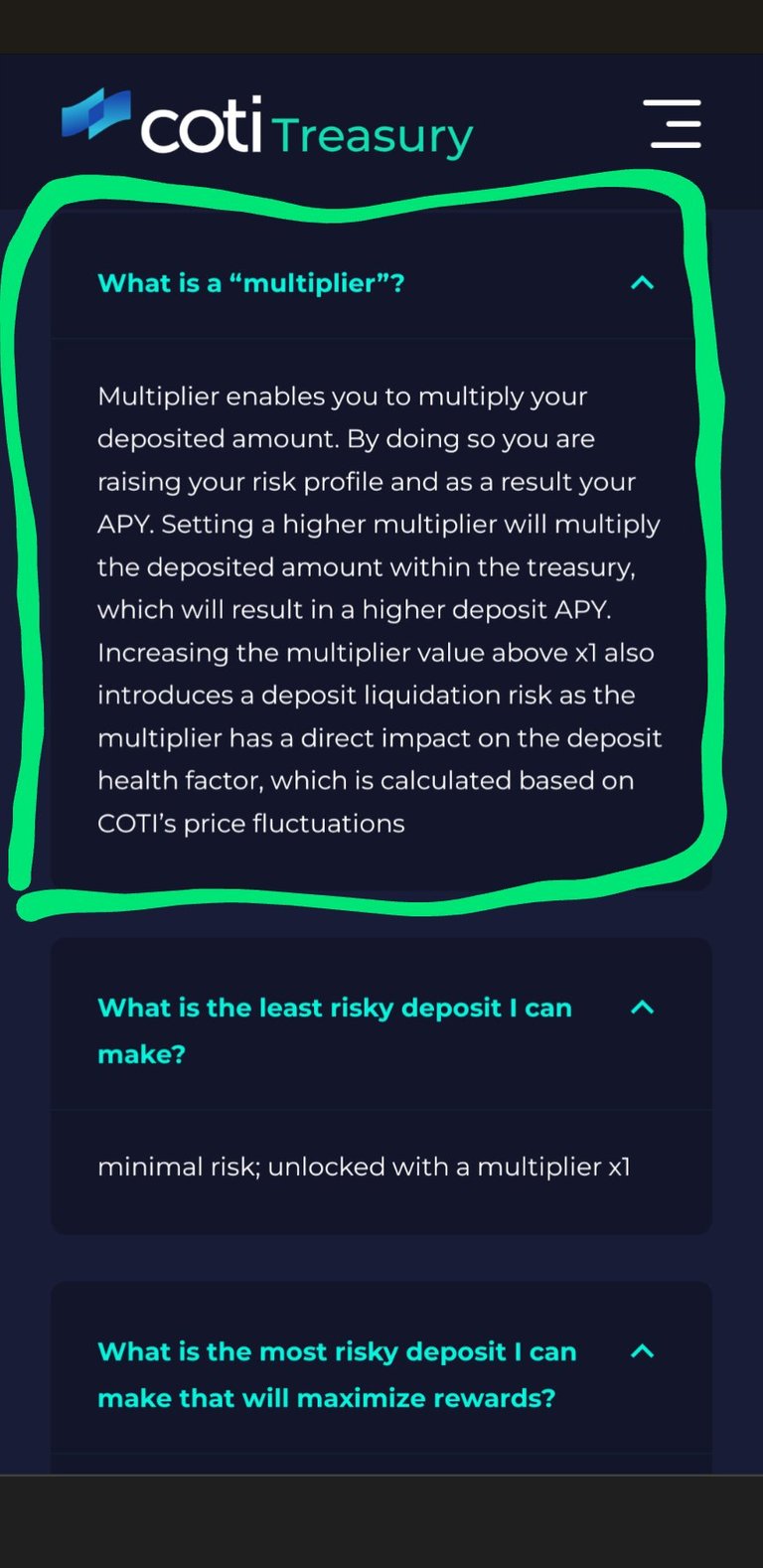

The COTI Treasury is a new type of staking where there are 4 levels of reward with each level representing a higher risk attached to the stake. Most of my staking up until last week was placed in Level 1 which is risk free and no danger of liquidation. If you are thinking long term and able to make 12% or 24% each month what is there not to like. These APR's are still high as there is still price action on top of this that can turn what is invested into a small fortune.

Millions were liquidated last night when in fact it became an opportunity to stake more and not to lose your investment.

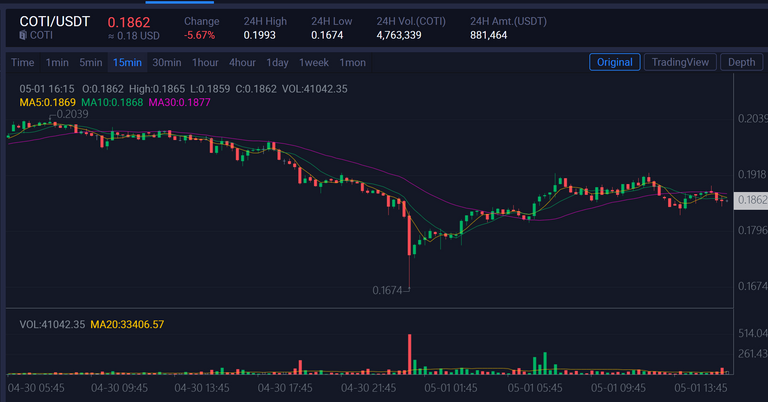

Yesterdays price action where COTI went down as low as 16.74 triggered millions in liquidation which actually benefitted those who weren't at risk. The APR rose in Level 1 from 11.62% to 11.89% which is fantastic news as this is how the treasury works. The liquidated COTI comes back to the treasury and is shared amongst the other stakers.

Panic in discord as this is why you are earning double the APR of everyone else and need to pay attention. @belemo asked about this on my last COTI Treasury post as there is a big risk. You have 1 hour to add stake when your stake turns red meaning you are about to be liquidated. How can people invest in something not knowing how everything works? This is why I took weeks holding back to ensure I knew all the rules.

Sounds harsh, but you sow what you reap and you cannot always win when you are trying to maximize your returns. The Level 4 APR is currently sitting at 47.56%, but what good is that if the price drops down and you lose it all. There are definitely benefits of playing it safe as today I scored an extra .27% and .54% on my stake holdings.

I do think if you are smart and take the more cautious approach when the price drops you use that to add to your stake which also reduces your liquidation price at the same time resetting your risk levels.

I would feel sick knowing I had thrown my stake away by being liquidated as this is just pure greed and carelessness. There is no need as the APR is very decent and generous at the lower levels are still very high. These levels will rise once the project is earning from the services COTI provides so one just has to have a little patience and not about earning all at once.

Posted Using LeoFinance Beta