The Ever Shrinking Supply

There is a lot going on and more to come.

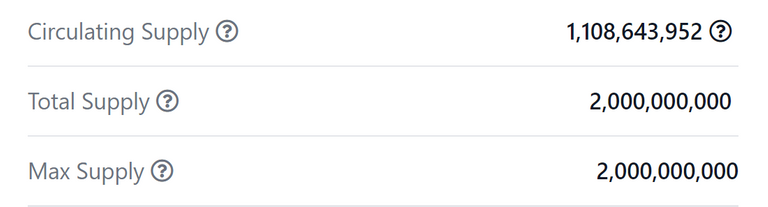

COTI over the last week updated their current supply stats which is always a constant reminder of how much is left. This was an increase of around 100 million tokens moving from just over 1 billion to 1.1 Billion. The number sounds a lot but not really considering the genuine use cases along with staking.

55% of the total max supply is in circulating supply leaving 891 356 408 million left. COTI being a stablecoin supplier for businesses and a payment service provider will only mean those businesses will have to lock up COTI in order to process the fees required for using the services. I do believe there are more surprises ahead and there is not just businesses lined up as they have been talking to various Governments.

We know of 3 big companies who are already on board and lunching their Enterprise tokens in the 4th Quarter which is literally around the corner. One of them has already been leaked as being a huge company so we have no clue on numbers required which will tie up even more COTI.

Over 40% is staked in the COTI Treasury which will rise as those involved are thinking long term as long as the APR remains decent. The ability to earn 10% or 15% via APR along with compounding is huge and expect to see the staking numbers only increasing over the next few years.

This staked number on the no risk APR is growing at over 128 000 (low estimate on level 1 staking average) every day which means there are less tokens hitting the exchanges reducing the overall liquid supply. I know I am buying from the exchanges and topping up my stake so I expect others are doing the same and this number will be closer to 50% of circulating supply staked before the end of this year.

A figure we don't know is how much COTI is sitting in wallets by those investors who cannot invest into the COTI Treasury due to regulations in their country. Many are staked earning APR in Binance and expect those numbers to be rather large as that is now offering 10% APR. We expect to see the likes of the USA and Canada being allowed into the treasury come Q4 this year.

Once everyone understands the use case for the COTI coin along with the use cases through the partnerships the liquidity will start to dry up. This will only result in the price rising out of need and will at some point have to buck the trend of what Bitcoin is or isn't doing. This is something we have yet to see play out as Bitcoin has always lead with the market following closely behind.

Posted Using LeoFinance Beta

I can tell you how much COTI I have sitting around that can't be invested because of regulations in my country :) Exciting stuff for sure. I am happy that I own some even if I can't do anything with it.