Are we close to a new bursting of the financial markets bubble?

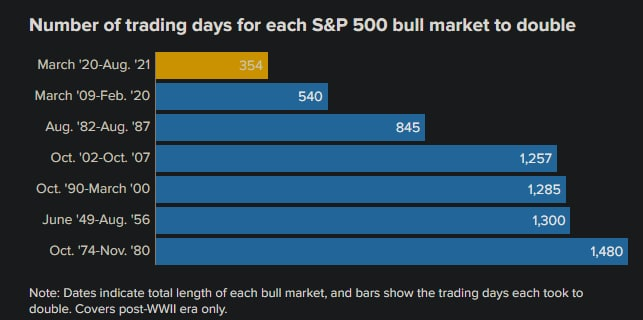

The S&P500 in a year and a half has doubled its value, an excessively rapid and unhealthy growth, as it was not driven by an effective recovery of the real economy but by abnormal injections of liquidity by central banks.

The doubling of the value of the S&P500 in the course of its history, has required from 3 to 4 years, as we can see from the graph.

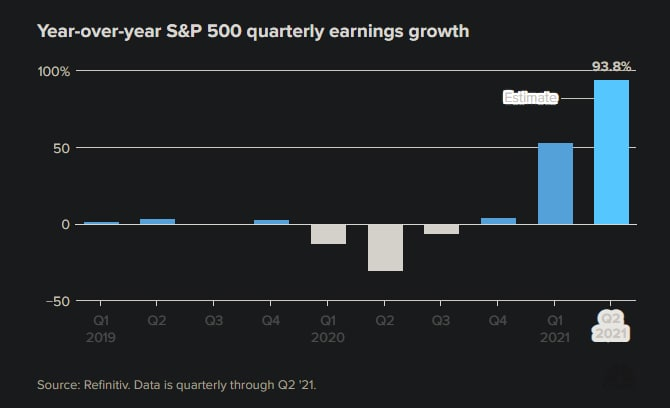

At the moment the market is discounting the important growth of corporate profits:

in the first part of the year (Q1) we have already seen earnings growth of 52.8%, which was remarkable, forecasts for the second quarter (Q2 whose data are due out soon) are for 93.8% growth. These are statistics based on the years 2020 and 2021, in my opinion they are completely useless and misleading, because 2019 levels have not been exceeded, which in my view are the true benchmark for a fair comparison, but serve the "positivist" narrative.

Earnings trends are important to watch because the bursting of a bubble in financial markets usually occurs when assets have very high valuations compared to the profits they generate.

Basically, if the price of securities is rising but is not followed by the growth of their earnings, then a so-called "bubble" is being created.

When securities grow in value, usually investors also expect a growth in earnings, if this growth is disregarded, the investor gets angry (disappointed by lower results compared to growth expectations) and sells the securities that did not satisfy him, leading to the bursting of the bubble.

If, on the other hand, the price of the securities is rising and is followed (with similar if not equal speed) by earnings growth then the valuation of the securities is healthy and sustainable by the market.

Final note.

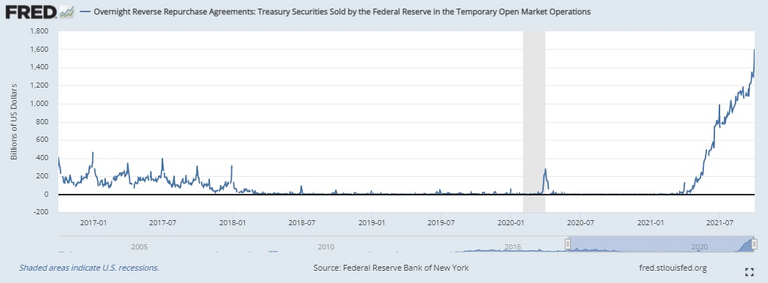

On Thursday evening, there was a new record that has to do with banks: they have in fact deposited $1,605 billion in the form of repos (repurchase agreements) at the Fed. A signal that they are keeping very liquid for fear of strong shocks. Not only the Chinese ones, between energy crisis and default announced by Evergrande, but also the internal problems of the Democrats, partly related to the ceiling on government spending and the fear that the U.S. will default on its debt.

In this sense on Thursday the president, Joe Biden, signed interim funding of nine weeks that avoids the government blackout, but only in the short term. The bill was rushed through both chambers of Congress and aims to keep funding levels for government departments and agencies flat until December 3. Had it not been passed, some areas of the U.S. government would not be able to work today.

The measure, however, does not include a provision called for by Democrats to suspend the nation's debt limit, after Republicans in the Senate blocked the bill Monday. Treasury Secretary Janet Yellen has said that if the House fails to raise the debt limit by Oct. 18, the government may not be able to pay its bills, posing a significant risk to the U.S. economy.

Meanwhile, ninety-two institutional entities placed $1.605 billion in repos at the Fed on Thursday, which allows financial groups to deposit cash with the central bank. The previous record, recorded the day before, was $1,416 billion. Thursday night's jump was the largest increase on a daily basis since last June, Bloomberg calculated.

Two weeks of high volatility in the U.S. and non-U.S. markets certainly lie ahead, and excessive fears could trigger the long-awaited correction.

So keep your eyes open, even these overly violent BTC pumping looks too good to be physiological!

Thanks for reading.

Posted Using LeoFinance Beta