BITCOIN: the great wave

In this post I will comment on some macroeconomic phenomena that are developing since March 2021 and that foreshadow the perfect wave, the great ride of the markets that we are waiting for, also highlighting the contradictions between the behavior of the FED in recent months, compared to the words of J. Powell.

The post will be a bit longer than normal so, for those who don't want to read the whole post and all the dynamics at work, can jump directly to the conclusions.

THE EVERGRANDE CASE

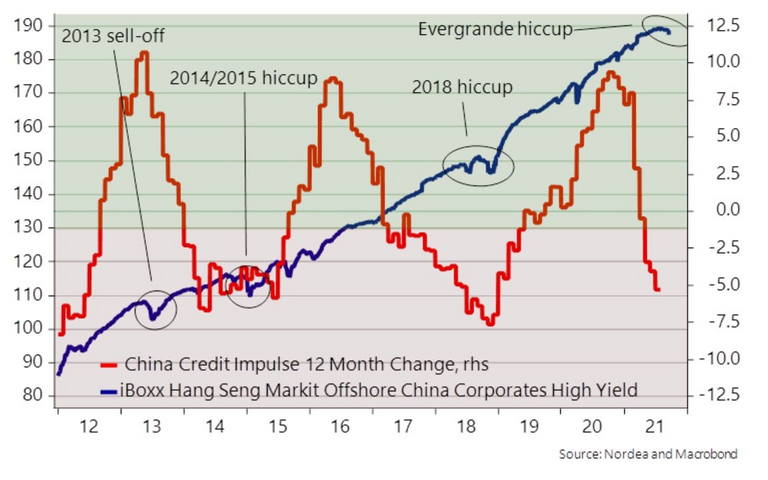

There are Evergande cases in China every 2-3 years on average. China's economy is very credit-based, so cyclically the government eases the throttle on corporate debt, creating critical situations.

The blue line shows that in the face of periodic major credit tightening, the Chinese high-yield bond market maintains its stability. This is due to the fact that the government then carries out "bailouts" of various kinds that put credit lines back on track.

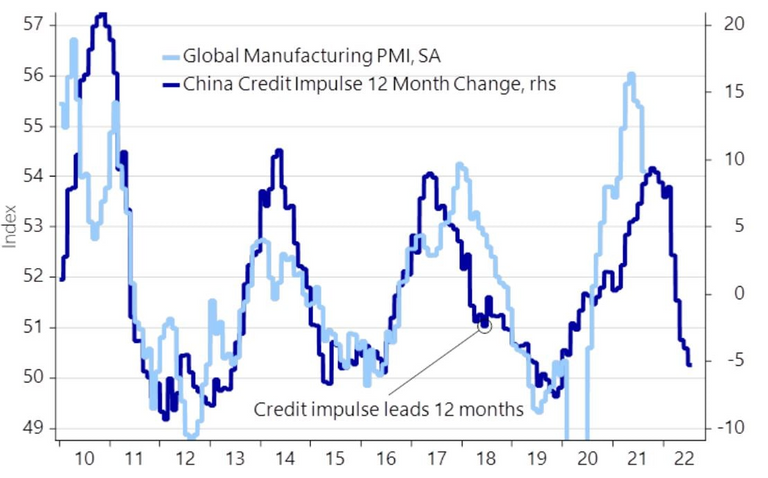

The current credit downsizing is actually a global phenomenon, not just a Chinese one, and is a prelude to a generalized recession (reduction in GDP).

The European "boom" narrative is also set to deflate soon.

This chart shows how the Chinese and German economies are correlated.

Usually, Chinese GDP trends are 3-4 months ahead of German GDP trends.

So the Chinese recession is an anticipation of the German and European recession.

This makes us understand why, despite Jerome Powell's words, the hypothesis of a structural recovery that would allow the tapering to be reduced seems distant.

October 2021: Likely liquidity crisis

Several factors that point to this type of crisis have been in place for some time. All you have to do is read them into the economic data:

the Chinese central bank recently lowered the reserve ratio requirement that commercial banks must hold against loans. This indicates economic weakness in China and liquidity problems in banks;

central banks in emerging countries are hoarding gold. According to Akash Doshi of Citigroup, such purchases could reach 1,000 tons. A figure that represents more than 20% of the gold produced each year by the mines;

foreign governments are reducing their holdings of US Treasury securities. The "conspiracy" media believe this indicates an aversion to the dollar. In reality it is just an indication that foreign banking systems are desperate for dollars and are selling Treasury securities to get them;

The eurodollar futures curve has inverted slightly, indicating a situation called backwardation (short maturity futures cost more than long maturity futures). This indicates that banks and large institutions expect lower rates on the dollar in the long term (a sign of recession) and higher rates in the short term (a sign of financial distress).

The Federal Reserve has made permanent its interventions in the repo market (with which it provides daily liquidity to banks that need it, which until now had been occasional, only when needed) by setting the repo rate at 0.05%. Also indicative is the fact that these interventions will also be available to foreign central banks that may need dollars.

November 2021: Recession

The liquidity crisis is only a collateral event that could occur as a foretaste of a much larger underlying phenomenon, i.e. a possible recession or slowdown of the global economy.

There is already abundant evidence of this phenomenon in the data as well.

In fact, while the media has been trying for months to convince us that the global economy is recovering along with inflation, the numbers tell us quite the opposite:

All of the points above from 1 to 3 indicating lack of liquidity (in dollars) in non-Western countries are also indirect evidence that the trade balance of these countries has weakened and is unable to secure dollar reserves. Indeed:

the latest U.S. export data are also weak, a reflection of the fact that the rest of the world is not buying U.S. products because the global economy is already in precarious shape;

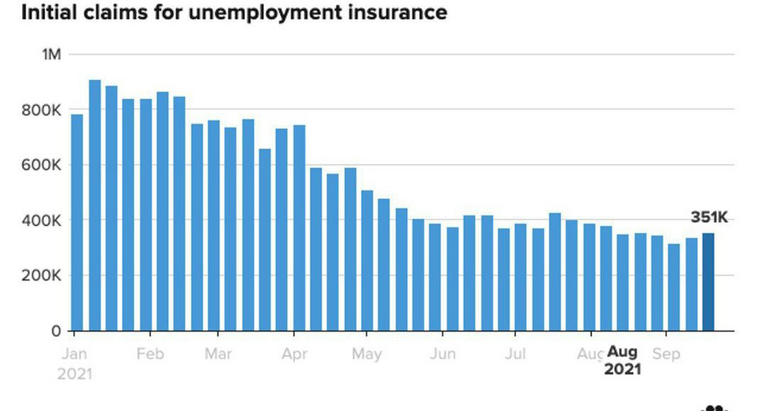

in America, personal income is down 30% year-over-year, while one by one government covid subsidies are running out (loans to businesses to protect staff are over. The rental eviction moratorium has been extended for 90 days, but sooner or later it will be lifted. And many states are already shutting down aid programs still officially in place at the federal level).

With government subsidies running out, private income stagnant, and exports declining, it is unclear what will drive U.S. GDP growth in the second half of 2021.

Not for nothing, yields to maturity on 10-year U.S. Treasury bonds have been falling sharply since last March. This is indicative of a flight to these bonds in the expectation of deflation and slower economic growth in the future.

Conclusion: but why November?

But why in November could the Fed decide to take countermeasures against this economic slowdown?

Because in November the economic data for the July-September quarter will be known.

In fact, let's do the math.

If the latest data published, influenced above all by the apparent economic recovery in April and May, indicated a GDP of 6.5%, in any case lower than expectations, then for the following quarter, the one in which we are now, in which the small economic miracle of the post-Covid reopening is already running out, the GDP will be well below 6.5%, expected to be 5.9% at the end of the year (annual basis). This discouraging figure will be released in November, along with other negative inflation and employment data.

At that point, the 2022 midterm elections will be less than a year away. The White House will panic and turn to Treasury for measures to weaken the U.S. dollar.

For that reason, and I'm writing this in bold here because it's pretty much the opposite of what the Fed said last night, I speculate that in November the Fed may be brought in for new monetary easing measures to make the dollar more competitive, measures that will drive down interest rates and boost stock markets. Year-end tapering, in my opinion, will not happen.

Summing up: two opposite phases of the same phenomenon

So summarizing: the economic slowdown, both in America and in the rest of the world, could lead to episodes of liquidity crisis already from the beginning of October. If these phenomena are strong enough to reach the media's radar, we could have increases in the dollar and gold.

After that, however, the main underlying phenomenon, i.e., the weakening of the global economy and in the U.S., will come to light in the data published in November and the Fed will be forced into new monetary easing measures. In that case, the effects will be opposite to the previous ones, i.e., there will be a reduction in rates and the price of gold (and an increase in the stock markets).

Having in mind this path that goes through two phases joined together, but with opposite effects, we will avoid confusing the short to medium term trends with the long term ones.

If, for example, we invest speculatively in gold, we must remember that any increase in prices will only be considered short to medium term.

At the same time, eventual corrections, even deep ones, of the stock exchanges, can be exploited to open positions in view of a subsequent bullish phase, even quite strong, because pushed by the "surprise" of a Fed in monetary easing after the media for six months had convinced us that there would instead be a "tapering".

BITCOIN: the perfect wave

Analyzing the cryptocurrency situation, I refer to the on-chain data provided by Glassnode, specifically the percentage of BTC supply that has been idle for at least a year is starting to form a low at 54.2%, compared to the 2017 peak. This indicates that a larger relative proportion of BTC remains in cold storage. (citing Glassnode).

In the past, after the sale of older coins, the accumulation of BTC would begin, leading to a contraction of supply and increased demand relative to available BTC, leading to higher prices, this has been visible since the 2017 rally, and within this logic is also included the April 2021 ATH.

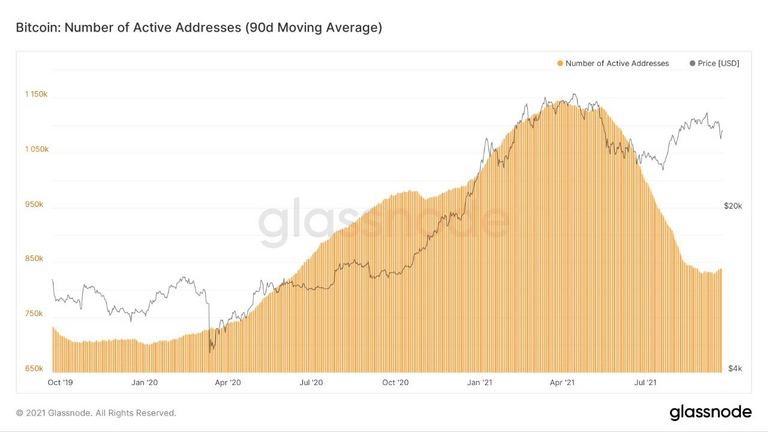

The graph above shows the number of unique addresses that were active in the network as a sender or receiver (so movements to and from exchanges are not counted).

Only addresses that were active in successful transactions are counted.

As interest in this market increases or decreases, the transactions that are made also vary.

Typically, during periods when the number of active addresses exceeds the average activity over the past 3/6 months (by at least a 30% increase), the price of Bitcoin is most likely overvalued.

It can be a good indicator of overvaluation of Bitcoin's price, the greater the deviation of the number of active addresses from its average, the greater the overvaluation of its price.

The same will apply in a negative sense, in case of undervaluation.

Right now, the number of active addresses is back to June 2020 levels, when Bitcoin's price hovered around $10,000.

CONCLUSION

We come to the conclusion. In my opinion, this period represents a real opportunity before a new bull market trigger. The macroeconomic dynamics illustrated above lead us to believe that the accommodative monetary policy of central banks is not yet over, which would lead to a rally in the stock market and an appreciation of commodities and safe-haven goods. The recovery is still not as structural as the politicians tell us! This is belied by the behavior of central banks, economists who do not have to sell talk!

If we add to this that the period October - December is statistically a period of appreciation of BTC, it comes to think soon could be realized a new ATH: the big wave to ride!

Thanks for reading.

CREDITS

Surfing in Morocco by BEN SELWAY is licensed free to use under the Unsplash license.

Posted Using LeoFinance Beta

Congratulations @cryptomaster5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 30 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: