BITO ignites bitcoin

The market entry of BITO, the new Etf linked to bitcoin futures just approved by the SEC, is producing interesting phenomena in the derivatives market.

The exponential increase of applications for shares of the new etf (purchases for 1 billion dollars in just 2 days) is triggering an equally exponential increase of futures to hedge the shares of the etf.

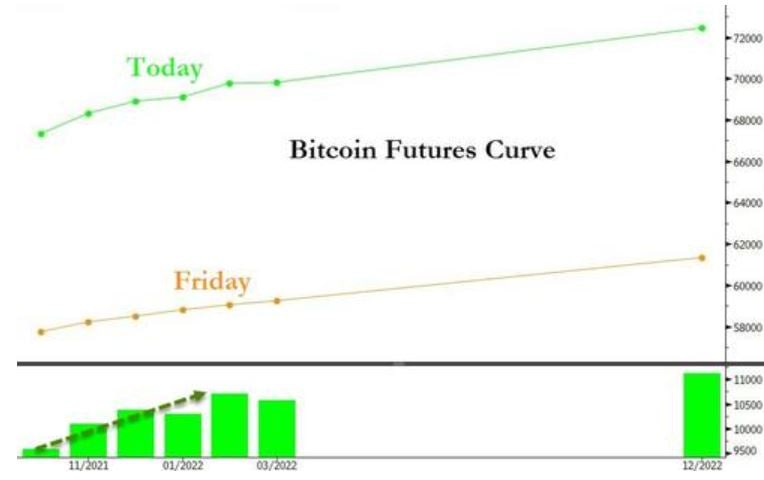

The demand for futures is so high that it is spilling over even into contracts with a shorter maturity (e.g. those of December, as shown in the last green rectangle on the right in the chart).

This phenomenon in practice creates a "mortgage" on the continuation of the price increase at least until that month.

The higher cost (premium) of a btc in the form of futures compared to a real btc is over $600.

Think of the gold market, where on the contrary it is the real gold that is traded at a higher price than the corresponding future.

The opposite situation in bitcoin indicates that at the moment futures quotes overstate (and thus distort upward) the real value of the underlying asset.

In gold, on the contrary, futures prices distort downwards.

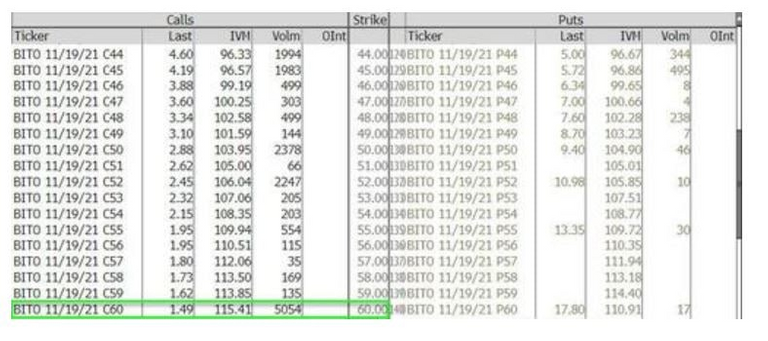

In the options market, there is a "gamma squeeze" on the options linked to the new etf.

Bottom line:

- Traders buy new contracts at higher and higher strike prices.

- Platforms buy bitcoin to cover the contracts sold, driving up the price of bitcoin.

- By increasing the price of btc, traders are pushed to buy more contracts, making the vicious circle repeat.

To be clear, a gamma squeeze also happened during the Gamestop stock rise in the famous January speculative attack.

The difference is that in the case of Gamestop the gamma squeeze was interrupted by the block of trading on the platforms. Here, instead, the game goes on to the bitter end....

This is the first time in bitcoin we have a speculative phenomenon of this magnitude on the corresponding derivatives.

In practice, it seems that this time the expected upward cycle of bitcoin will be dominated by the treacherous dynamics of futures and options, instead of the usually simple and linear dynamics of the crypto market.

We are therefore in uncharted territory.

Will this uptrend cycle replace the "normal" crypto market cycle altogether, or will it just be an advance and then be replaced by the latter?

Will the derivatives cycle lead to an upside glut such that it completely undermines the strengths of the traditional cycle? Or will it reinforce the "traditional" cycle by taking it to levels never reached in the past?

No one is able to make predictions now. We can only observe the developments and archive the data in order to use them as a basis to make predictions in possible future phenomena of the same type.

I would like to point out that yesterday was characterized by a flash crash on BINANCE US link, where BTC was traded at $ 8,200, while the other exchanges recorded a price drop but without causing major problems for those who operated on margin. Traders who had a cross position were liquidated and lost everything, while those who operated on the sidelines only lost what they had invested. What happened must represent a great lesson for all of us.

Thanks for reading

Posted Using LeoFinance Beta