Crypto market analysis

After updating the local high at $44,400, in the night the main cryptocurrency fell to test the holding of the support area at $42K, where it is currently trading.

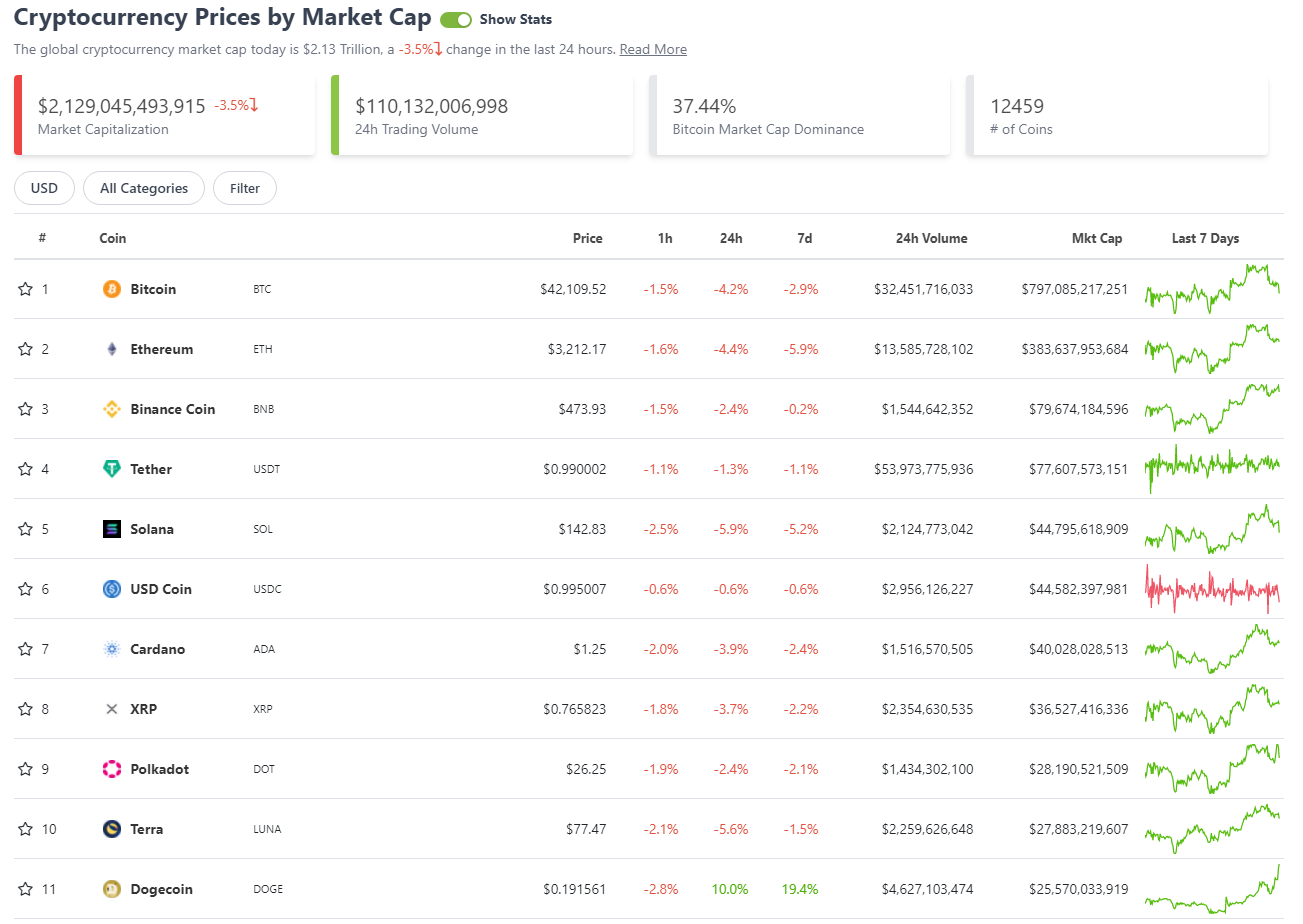

Market capitalization at $2029 billion.

BTC dominance index 39.7%.

Fear/Fearlessness Index 21 points.

Stock markets discounted a violent pullback yesterday, with the NASDAQ down 2.51% and the S&P 500 down 1.42%.

The sales have mostly hit the technology companies: Tesla has fallen by 6.75%, Microsoft by 4.23%.

Such a dynamic seems to be attributable to a profit taking triggered by the intervention in the US Senate by the Fed representative, who again stated that the central bank's priority is to fight inflation. Let me remind you that the US inflation rate recorded in December is 7% and the Fed's target is 2%.

Obviously, the technology sector will be the most affected by any tightening of monetary policy. And given the correlation between Nasdaq and the crypto market, at least in the short term this could trigger a further increase in volatility.

The dollar index has dropped below 95 points and a technical breakdown of the dollar index will undoubtedly be positive for the markets.

Moreover, I reiterate that, apart from the hysteria of the moment of intraday traders, the Fed will proceed to a change of monetary policy in a gradual way, without compromising the trend of stock markets.

Today the main market drivers will be the quarterly reports from the big US banks (JP Morgan and co.).

Bitcoin seems to have taken a break after the vigorous rebound of the past few days, penalized by the uncertain trend of the stock market.

Currently, the main cryptocurrency seems to have stabilized in the $42500 area, with the market capitalization still above $2 trillion and dominance below 40%.

Despite the high level of fear in the market, capital is not flowing out of altcoins.

From an intra-day perspective, a consolidation in the $42500-44100 range is very likely, with possible renewal of local highs.

However, if also today the stock should suffer heavy selling, we cannot exclude a breakdown of $42K and a return in the trading range $42,000-40,000.

We also consider that today there is a very important expiration of options on Bitcoin, with max pain price at $44,000. So this level can act as a "magnet".

Arriving at the weekend with Bitcoin above 43K, will be propaedeutic to a good increase in altcoins.

But in this context, it is better to evaluate with extreme caution any positioning on the alts. With the dominance of BTC on the lows, it can be a serious strategic mistake in the medium term.

If we analyze the on-chain scenario, the dynamics in 2021 were quite clear.

Long-term investors increased their respective positions in Bitcoin by 16%, while those of short-term investors decreased by 32%.

The usual transition of BTC from weak to strong hands.

To this must be added the attitude of individual states. Let's take India.

Since 2018, there has been talk of an impending cryptocurrency ban in India.

Of course, there has never been any serious attempt in this regard and instead it is yesterday's news that some companies in collaboration with the International Stock Exchange of India are about to launch an ETF on Bitcoin and Ether - source.

The ability to admit and correct one's mistakes is an important quality not only for a person, but also for a government.

Food for thought: cryptocurrencies are legal in countries like Switzerland, USA, Japan and Singapore, but banned in Syria, Egypt and Kyrgyzstan, for example.

Compare these countries and you will understand what direction the world will take in the coming years.

Thank you for reading

Posted Using LeoFinance Beta

Congratulations @cryptomaster5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!