Derivatives markets slow down BTC

The current trading range is in the area of $49500 - $51500 and the attempt to break the channel put in place by the bearish has not produced significant results, in fact at the moment BTC has been rejected and is quoted at $47,000.

Despite the working week, markets liquidity will remain relatively low. In light of the analysis on derivatives and on-chain activity, we have two aspects to consider.

The First element of consideration relates to Whales. Although the number of BTC present on the Exchange is at an all-time low since Friday there have been significant deposits on Binance (we are talking about 60000 BTC, even if about half of the amount has been an internal shuffling between cold wallets).

This information has to be dropped in the context of the low liquidity market of the next few days, which will undoubtedly be influenced by whales with sudden spikes in volatility in every direction.

In this regard, the price compression underway is favoring a "squeeze" of volatility.

The second consideration relates to the leverage ratio on crypto derivatives platforms. We have already seen in the past how the abuse of leverage by retail traders, often anticipates a countermove. The leverage ratio is on the highs with the funding rate moderately positive, and speculators are mostly bullish.

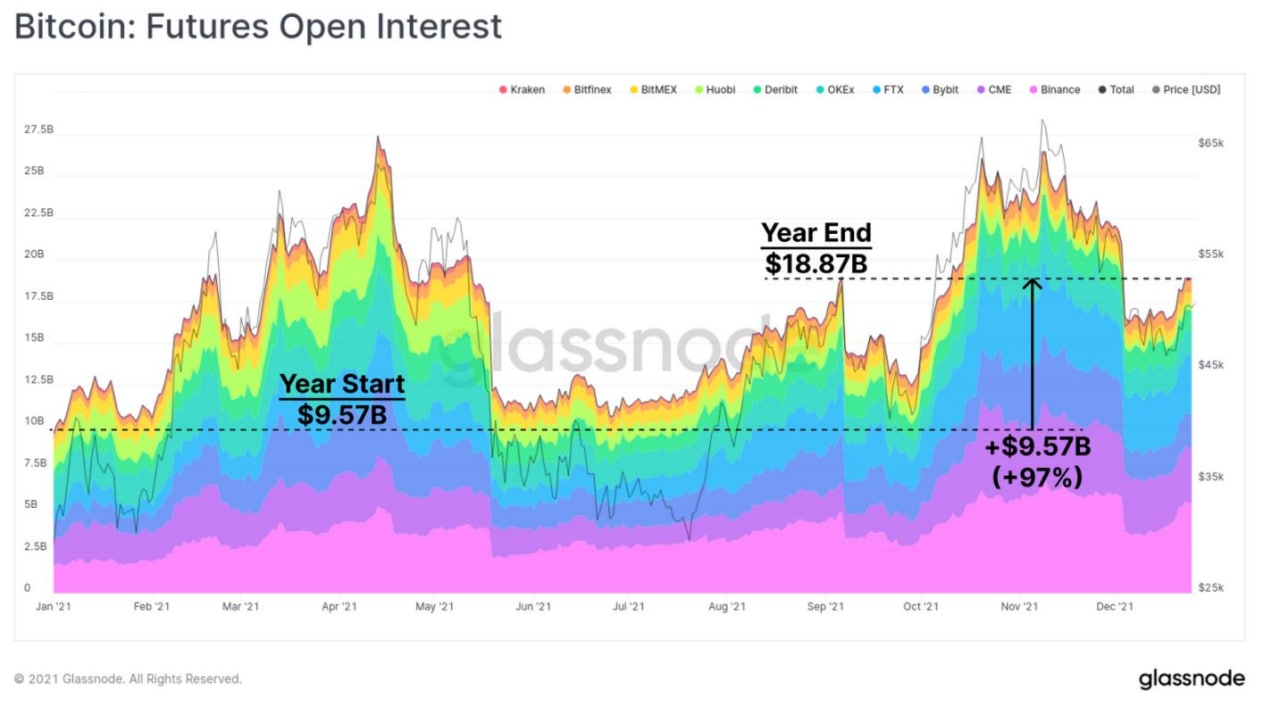

Interesting in this sense is the graph proposed by Glassnode in which it can be seen that this year there has been a doubling of positions in this market (from 9.57 billion to 18.87).

The chart also shows that in this week alone there has been an increase of 2.5 billion open positions, mainly on Binance.

Of course, even if the number of open positions in this period does not reach historical highs, nevertheless it is high enough to cause mass-selling phenomena or upward squeeze at certain price levels. Not the best picture for an impending uptrend resumption.

Conclusion

As long as BTC stays below 53k this sluggishness in price action development will persist.

There is a similarity between this price action and that of June and July 2021, which wears out weak hands, as well as liquidating the various margin traders and compacting the ground. This summer BTC took about 9 weeks to complete this process, for now, 3 weeks have passed since the minimum of the first week of December.

Pay close attention to false breakouts, i.e. a temporary breakout of a level followed by an abrupt move in the opposite direction. These are very common dynamics during volatility squeeze setups.

So, barring any major developments in the spot market, derivative transactions are still dominant and will help keep prices within a channel of very tight and volatile lows and highs, with no specific trend.

Thanks for reading

Posted Using LeoFinance Beta

Congratulations @cryptomaster5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 3750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Dear @cryptomaster5,

The current HiveBuzz proposal will expire in a few days.

Do you mind supporting our proposal for 2022 so our team can continue its work next year?

You can do it on Peakd, ecency, Hive.blog or using HiveSigner.

https://peakd.com/me/proposals/199

Thank you. We wish you a Happy New Year!