Ethereum, Eip-3554, the Difficulty Bomb.

Proposition 3554 does not include a feature, but it postpones the Difficulty Bomb that was supposed to go off in August, putting it off until December.

The Difficulty Bomb is a feature developed in 2015 to incentivize miners to switch to Ethereum 2.0.

With the Difficulty Bomb, the computational power required to resolve a block increases exponentially, and for the same amount of power, there would therefore be a slowdown in the network: today Ethereum, through miners, resolves a new block every 13 seconds on average. With the Bomb, the time would reach 20 seconds, an increase of about 50%.

All these changes will be applied to make as smooth and painless as possible the transition, for users, developers and miners, to Eth 2.0, the new generation of Ethereum network that should see the light at the end of 2022.

The development of this new network is parallel to Ethereum, and so the current changes on ETH 1.0 will be irrelevant once the new network is up and running.

It might still seem like a long way off for this update, but that's exactly why it's important to anticipate it and capitalize on the opportunity.

Due to the increase in difficulty, there will be a large shift towards staking nodes on ETH 2.0 and this will cause a major decrease in commission costs (GAS) which will attract additional DAPPS users and programmers.

Also, the increase in GAS on the ETH 1.0 Layer, will increase the value of existing Ethereums. To understand, it will be an effect similar to the increase of interest rates by central banks, that as you know increasing them leads to an increase in the value of money and a lowering of inflation.

Interest rates are the cost of FIAT currency, GAS is the cost of coin Ether.

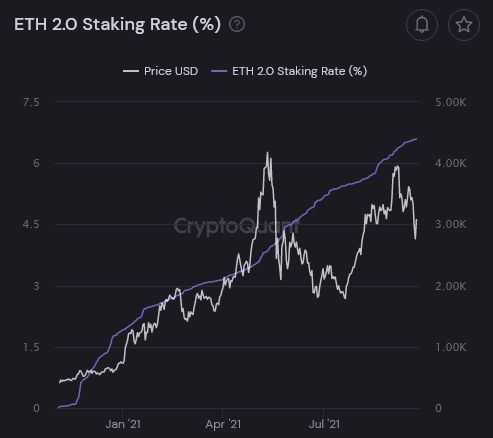

Interest in ETH 2.0 rises steadily and decisively, regardless of price changes.

This is a very positive sign for the sentiment of ETH holders who have great confidence in this project.

So far we have arrived at around 8 million Ethereum stakes in the 2.0 blockchain. To date, compared to the total supply of about 117,600,000 ETH, are in staking 6.7%, at this rate by the end of 2021 should have touched about 10% staked, in a totally voluntary.

All this is remarkable, as all the coins in stakes cannot be sold until ETH 2.0 will not pass to the Mainnet, thus replacing, permanently, ETH 1.0.

Thanks for reading

Posted Using LeoFinance Beta