Inflation falls more than expected.

Those who have been following the financial media these days will have been convinced that inflation has now reached unsustainable peaks. After all, September's consumer price index broke in with glowing numbers, showing a 5.4% increase year-over-year and 0.4% increase month-over-month, both above expectations.

News outlets slammed this data to the front page, publishing a plethora of articles about how inflation in the U.S. economy is hotter than ever.

However, you may have noticed that even after this news, the markets reacted the opposite of what might have been expected.

In fact, the stock market rallied:

Commodity stocks plummeted:

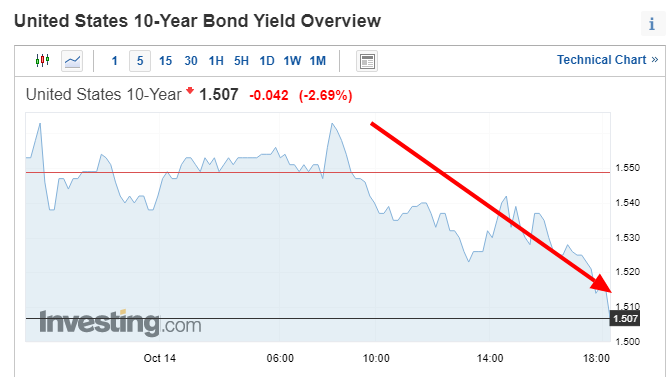

Along with US government bond yields:

What is this inconsistency due to?

No, it is not due to the fact that the markets had already "priced in" a rise in inflation, the intraday response was too decisive to be just that. The truth is that analysts and fund managers for once sifted through the numbers better than the media did, going to the data that really mattered.

While the media hastily read the charts, dwelling on the first figure that appeared in front of them, i.e. the simple CPI (i.e. the raw consumer price figure), the analysts went down a few lines and looked at the core CPI, or core inflation minus food and energy.

And here the numbers tell an entirely different story...

In fact, this index only increased by 0.2%, which is much less than expected. This means that in September, at least in the U.S., prices of used cars, clothing, transportation services and medical services decreased compared to August (source: U.S. BUREAU OF LABOR STATISTICS).

These are completely different numbers than in April, May, and June, when the U.S. core CPI increased from 0.7% to 0.9% each month, from July to September the monthly increase in CPI went back to being around 0.2% per month, which is what it was before the pandemic back in 2019.

This is a very accurate signal on one of the issues that analysts were most concerned about, namely the blockage of supply chains. There is now no doubt that these are gradually being restored. The data don't lie.

And that is wonderful news for the markets! It's also why tech stocks are regaining their strength.

During yesterday's trading on Wall Street, tech stocks and generally high-growth stocks returned to rally mode, while cyclical and value stocks, which are less sensitive to rates, stalled. I suspect this trend will persist and lead us to the long-awaited year-end rally.

After all, Covid-19 cases globally are declining and government restrictions are loosening, and if these trends persist into 2022, supply chain disruptions will be just a memory.

**Inflationary dynamics will not subside all in one day.

Gradually, production lines in China will reach 100% capacity in 2022. Supply shortages will ease. Global supply and demand dynamics will rebalance and inflation will fall, but markets prefer to price events well before they happen, so they'll make tech stocks soar much sooner.

Today, technology is the single most disruptive force - the biggest wealth-creating force - in the history of financial markets, **many people forgot about it in 2021!

I firmly believe that over the next 12-24 months, tech stocks will rise like they haven't since the dot-com boom.

Thanks for reading.

Posted Using LeoFinance Beta

This community needs a channel like yours to keep abreast of this data, a value that few people appreciate. Continue like this, you will get the recognition you deserve, thanks for the summarized information, simplifying so much data in a post like the one you have written is not an easy task, greetings friend!

Posted Using LeoFinance Beta

I'm so happy you liked my article, wonderful feedback. I always try to prefer quality to quantity, in the end this on Hive is almost an open personal diary, where I like to make reflections and exchange opinions. After all, no one has the truth. I'm trying to sponsor my posts to increase the audience and grow, even if I should take care of the engagement more.

I encourage you to follow that path and if you need any help, count on it. A little advice, in the discord groups they are very in favor of helping those who have just started or have been in this community for a short time, that way you can use some advice that also makes your channel grow and your visibility in Leofinance

Posted Using LeoFinance Beta

Definitely, I will try to sign up as soon as possible. Thanks.

I appreciate the analysis. It's anecdotal, of course, but I have seen many prices around me go up considerably. I've also seen wages increase. The unemployment numbers are crazy, especially because there are more job openings than there are people on unemployment, yet they remain there, nonetheless. The supply chain issue will not be solved by giving a speech at the Ports of Los Angeles...I think we're going to see some issues this holiday season. I'm already telling my children to make out their Christmas wish lists now. I believe there will be many shortages on the shelves this winter season, so I will do my shopping earlier than ever before. If I am wrong, I will be done early and will enjoy the holidays. If I am right, the same...I've also started to see many things on sites like Amazon not offer the 2 day shipping on many items I've been searching for lately...supply and demand is going to be a pain when many dollars are rushing after few goods this winter season. That means inflation unless the monetary supply is reduced...which we both know ain't gonna happen. House prices are still climbing, albeit not as white hot, but they're still going up. The fact that my house increased over 20% in value in one year is not sustainable. Inflation has definitely arrived...I'm just glad most of the items with the highest inflation rates did not affect me...for now...

Thank you. Yes the analysis is mainly about core inflation and I fully agree with you on the supply chain issues... we will probably only return to normal in 2022 (what the markets are anticipating is confidence in this return to normal).

As you say, I can see a surge in prices under Christmas, but this is a phenomenon linked to exogenous and temporary mechanisms, the risk is to enter a stasis similar to that of the early 70s.

As far as house prices are concerned, there are numerous factors that are pushing prices up, keep in mind that this is a phenomenon that we have been experiencing for a few years now (interrupted with COVID) and rests on the basis of the lows recorded with the crisis of 2008.

Thank you for contributing your thoughts.

Congratulations @cryptomaster5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 100 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP