More on the possible year-end stock and crypto market rally

In this article I will go deeper with more data that hints at a possible rise in the stock markets, probably by the end of the year, but let's go in order.

On Thursday, the stock markets recovered their losses after the news that Democrats and Republicans reached an agreement to raise the national debt ceiling before the current ceiling expires.

The agreement was a foregone conclusion, because neither party would ever want to be responsible for the default of the United States.

The U.S. stock market, like the cryptos, is also showing signs of exhausting the summer sideways bearish phase that lasted until September. Let's see it in two graphs....

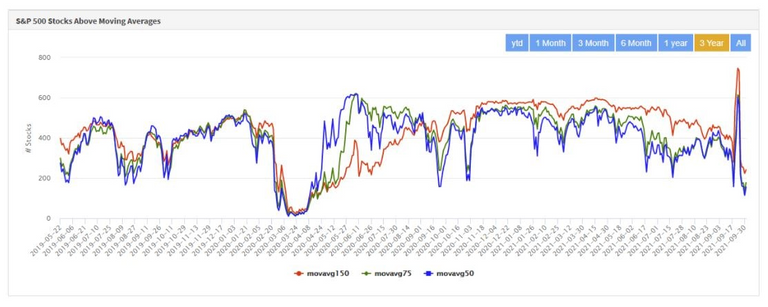

Here it is shown the number of stocks that are below or above their moving averages (each curve of different color corresponds to a moving average).

As you can see, the curves are at the minimums, a sign that the number of securities below the moving averages is at the maximums.

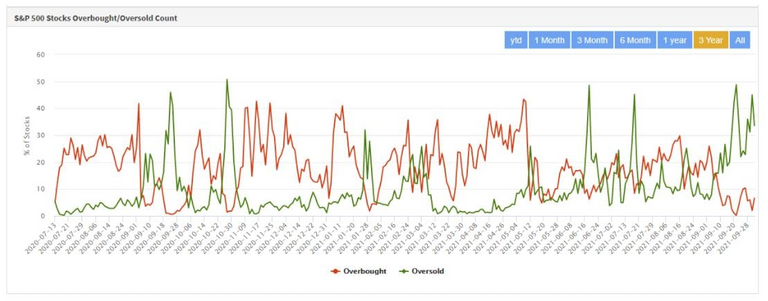

Here instead you can see that the number of securities that are oversold according to different indicators, such as RSI, MACD etc, is quite high (green line), compared to the number of securities that are overbought (red line).

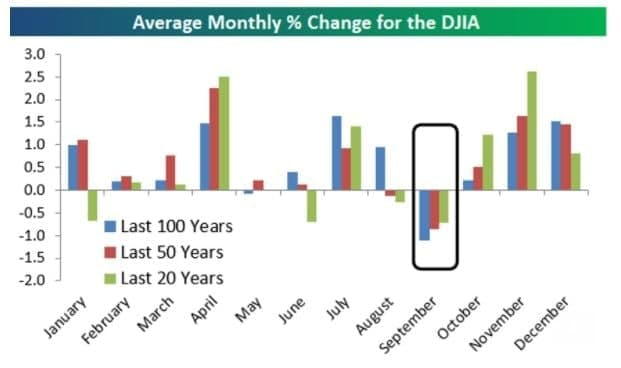

The chart regarding the seasonality of the stock exchanges also applies to cryptocurrencies.

Investor "sentiment" is down

A survey by Allianz Life shows that 54% of U.S. investors are concerned that a major market crash is on the horizon. And more than two-thirds of them said they want to protect their money from losses by keeping some of it out of the market.

CNN's Fear & Greed index also shows that "extreme fear" is the sentiment driving the market right now:

In September, the net percentage of fund managers who are convinced that the global economy will improve over the next 12 months fell to 13%, which is the lowest since April 2020.

Similarly, expectations that profits will increase fell to a net 12%, a 29 percentage point drop making it the worst figure since May 2020.

As a result, these managers have slightly increased their cash positions.

This data suggests a situation incompatible with a possible market crash because, as we know, the "tops" of bullish cycles tend to form when investors are extremely confident, bullish and "greedy," while the "bottoms" are reached when investors are hopeless.

According to Jason Goepfert, founder of SentimentTrader, this year the markets have had only sporadic episodes of "exuberance" that have mistakenly suggested possible bullish tops.

In reality, all these phenomena have not affected the mass of investors.

For example, the false exuberance in January with the GameStop "case" was triggered by a relatively small percentage of traders who were not followed by the entire investor base, both retail and professional.

In the spring, the boom in SPACs (the new indirect forms of IPOs) did not cause a mobilization of investors towards tech stocks. So much so that tech and biotech stocks are in a bearish trend that continues from May to the present.

According to Goepfert, fear, not exuberance, is the prevailing sentiment over the past five months.

This is also evidenced by a survey by Morgan Stanley's E-Trade Financial, which found that the percentage of investors with $1 million or more who sold positions in the second quarter more than doubled, from 7% to 16%.

And millionaire investors who say they are bearish is up 6 percentage points, from 36% to 42%.

Market reality and media fantasies

Next, let's look at this analogy between what happened in the S&P500 in September 2020 and September 2021:

In 2020, the S&P made three moves:

1 it fell 9.6%,

2 then rose again at the end of the month,

3 then was hit by another 7.5% loss in October.

We then see that in September of this year, the biggest decline in the S&P (from the highs of the month) was about 5.3%. That decline has now diminished to just 2.5%, relative to the highs of the month.

To repeat the September 2020 pattern, we should therefore expect further temporary weakness of no more than 5% in October, before the uptrend resumes.

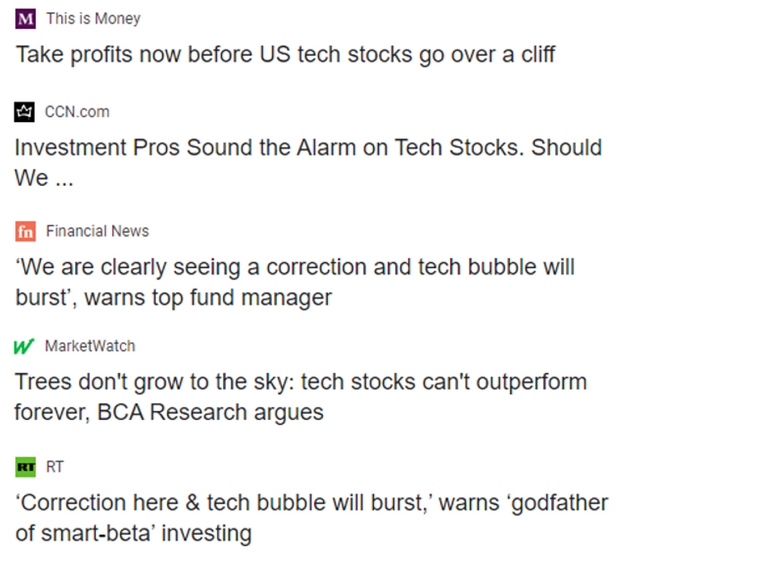

It is interesting to note that in 2020, during the September declines (which as we know are seasonal and have existed since the stock market was born), the media advised investors to sell and stay cash waiting for some catastrophe:

Anyone who sold last year, thanks to the predictions of these "experts", lost 33% of gains made in the following three months by, for example, Etf QQQ (the Etf that tracks technology stocks) and will probably also miss the next rally in this sector in the coming months.

In conclusion I'll give a summary of the reasons why I'm bullish on year-end....

The six reasons for the possible year-end rally

Here are some reasons why, in my opinion, we are not at all on the eve of a bear market, but rather at the end of a medium-term downtrend and therefore at the beginning of an uptrend (medium or long term, I am not able to say):

we are in the midst of a long correction that has lasted 5 months and we are approaching the point where sentiment, already too unbalanced towards "fear", will begin to shift back towards confidence;

not all investors are "all in," as evidenced by the data we cited on recent sales and the growing cash positions taken by fund managers;

corporate earnings releases begin in a couple of weeks, which will likely bring back some optimism;

despite recent squabbles, Democrats and Republicans will find a way to pass another multi-billion dollar piece of legislation that will pour even more money into the markets, further inflating prices;

"transient" inflation continues to erode those cash dollars that investors, as mentioned in point 2, now keep out of the market. You can't meet your financial goals when a large chunk of your net worth depreciates by 5% a year because you didn't invest it;

despite all the media hype, raising rates remains a temporary phenomenon because it clashes with economic fundamentals. It is not enough to repeat every day that rates will rise to make them really rise in a structural way.

On this last point I would like to point out that yesterday the American labor data came out and they were very bad (I mentioned this data in my first articles, referring to the number of applications for benefits, which increased in September).

What is bad for the real economy is not necessarily bad for the financial markets, this is because it will influence the decisions on raising interest rates, which the FED has said it will review in December, putting its hands forward, saying that all the talk of returning to normal from the mad stamping is "linked" to a "possible" simultaneous improvement of the real economy. If this does not happen, and in this sense this data is positive for the markets, the accommodative monetary policy will continue.

What do you think? Feel free to give me your feedback in the comments.

Thanks for reading.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @cryptomaster5.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more