The FED day: focus on the US economy

Today, the FED summit will draw its conclusions and in all likelihood the tapering will be announced. I chose to write this "special" post because the announcement that will be made will surely create a lot of volatility in the stock and cryptocurrency markets.

At this point, tapering seems certain, however we must keep an eye on recent macro data such as GDP and employment data.

GDP has disappointed expectations, marking a significant slowdown in Q3 and this is worrying because it increases the risk of stagflation.

This risk may now be realized and we are seeing it in the data.

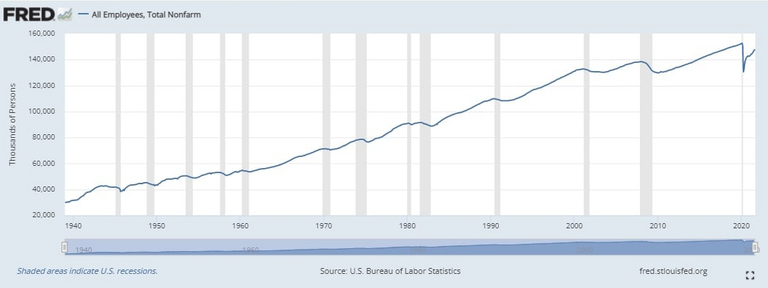

Employment data, although they have often disappointed expectations during the year, are moving towards the right side but more is needed, are we sure that starting tapering is the right move?

The economy is clear, it still needs the accommodative stimulus of central banks, although many of them have taken the path of raising rates (RBNZ - BoE soon to name a few)

The ECB and the FED have shown their rigidity on the initial plans but it seems that the FED has come to take the path so much rumored in recent months.

But let's return to the macroeconomic front.

In recent days we have already talked about GDP and today we would like to focus on employment data.

Employment data as Powell himself says is an important indicator to measure the health of the economy and is one of the main indicators on which the FED bases its strategy.

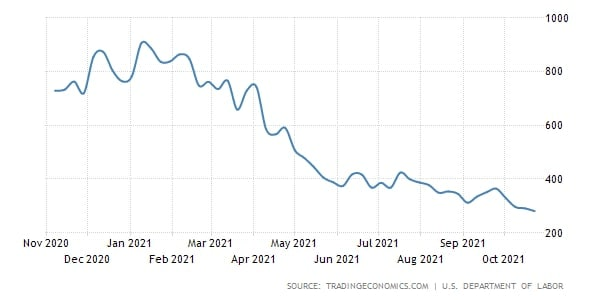

Just this Friday the employment data for October will come out and that will cause a lot of volatility in the markets, just because of the influence they have on monetary policy.

But the verdict will be held tonight for European time and the stock exchanges will be affected the next day.

Subsidy claims are steadily declining and that's certainly a good thing.

But as we said above, we are not there yet, are we sure that embarking on tapering now is the right move?

In the past few days we have been able to hear how Lagarde and Powell spoke again on inflation.

Their outlook remains the same, albeit with a longer time frame but arguing that inflation will ease as the economy continues to reopen and return to normal.

In fact, it is possible that with a return to a balance between supply and demand (although it will take time to recover) in the coming months, inflation will ease, however it must be pointed out that this is not the only factor.

Furthermore, if GDP figures continue to fall, and inflation, on the contrary, rises, bankers can forget about this prospect coming true.

Meanwhile.

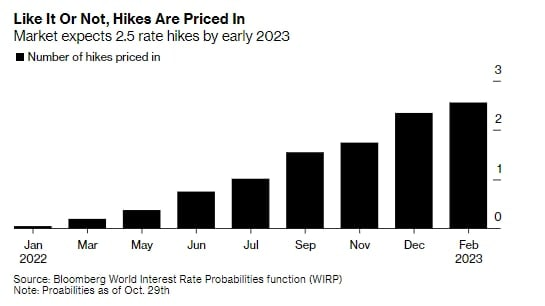

Fed officials have said that rate hikes won't be on the table until the bond-buying program ends, although investors expect a 2.5 increase by early 2023.

The committee is likely to say it has reached the threshold of "substantial further progress" on both inflation and employment, conditions for slowing bond buying.

Powell will likely highlight the fact that with the start of tapering, there will be no rush on the central bank's rate hike avoiding the "taper tantrum" of 2013, when Powell held the governor's post under Ben Bernake at the time, which caused turmoil in the markets.

The FOMC may also amend the statement to note that growth has slowed due to the delta variance and supply chain disruptions, making the third quarter the weakest for U.S. growth during the pandemic recovery.

Tapering, in my opinion by now, has been discounted by the markets.

As this date approached, the markets had no fears, on the contrary they broke new records.

Only with a greater awareness of the risks related to inflation will cause negative swings for the stock market, which has found and currently finds strong support in the FED.

Powell will have to be able to distinguish between tapering and raising rates as unrelated measures; i.e. the rate increase will not take place immediately just because there has been an easing in monetary policy.

Volatility during the press conference time is expected.

Thanks for reading

Posted Using LeoFinance Beta