There is a bomb in the Nasdaq set to go off in March

We currently observe a disconnect between the performance of the Nasdaq as a whole and that of most of the stocks that make up the index.

This is due to the fact that stocks with larger market capitalizations (think Apple, Microsoft, and Amazon) receive a higher weighting within the index.

Thus, the way these mega-cap stocks perform has a much greater impact on Nasdaq than other stocks with smaller capitalization.

To understand this on an intuitive level, just compare these two charts:

The first chart shows that the index as a whole, net of the recent ups and downs we've seen in recent days, is down no more than 5.6%.

The second chart, on the other hand, shows that if we remove the influence of the largest-capitalization stocks from the Nasdaq, it turns out that nearly two-thirds of the stocks represented are already largely in a bearish trend.

Many of these stocks are already down 30%-50% or more because investors have already "priced them in" in view of the possible interest rate hikes that the Federal Reserve has hypothesized for this year.

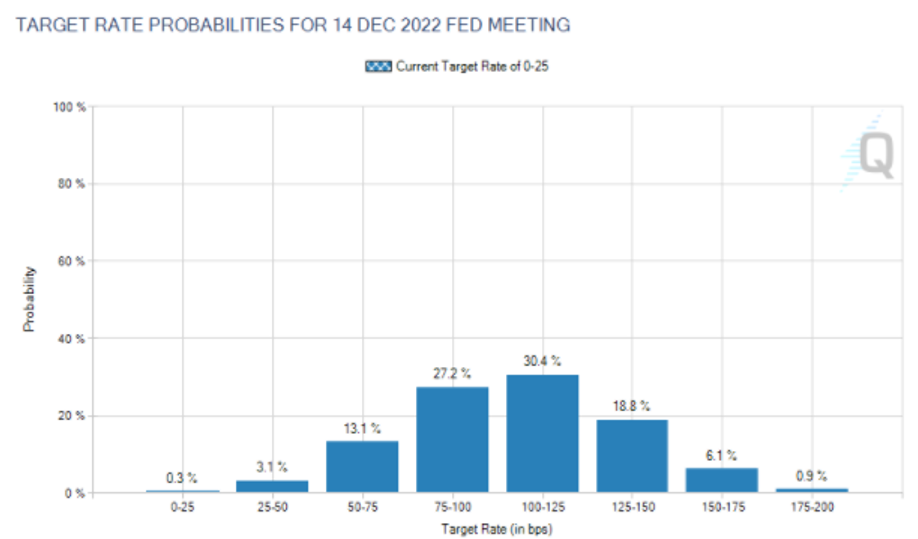

The chart below shows the interest rate hike expectations that investors assume after the Fed's last meeting in December 2022:

In practice, the most likely increase would be in the range of 1.00% - 1.25%; implying rate increases of four quarters of a point from the current rate of 0% - 0.25%.

Because of this strong investor bias towards rate hikes, the Nasdaq is already in a de facto advanced bear market, even if its most popular stocks don't show it.

This fact immediately caught my attention; because typically, when there is a hidden trend in the markets, there is also a good opportunity for gains on the horizon.

The history of previous rate hikes made by the Fed shows us that these already heavily discounted stocks then have a strong appreciation once rates start to be tweaked upward by the central bank.

For example, in 2016, Square suffered two corrections of over 30%, Shopify fell over 15% on four separate occasions, Netflix fell 30%, Amazon had two slumps of over 15%, and Salesforce fell over 20% three times.

Subsequently though, at the end of the Fed's rate hike cycle, these stocks have had increases of between 50% and 150%.

It is therefore very likely that also this time the beginning of the actual rate increase by the Fed (probably in March) will be the turning point from which the rallies in the Nasdaq stocks that have today the biggest declines could start.

This time then we have to consider an aspect that makes the current moment very different from the years in which the previous rate increases took place.

The unprecedented liquidity that has been injected by the Fed due to the pandemic has brought the debt-money system to the extreme limits of its capacity.

This fact, as we have amply demonstrated in one of our articles, means that rate hikes are now more expensive than ever for the federal budget.

As a result, the odds are very high that, when all is said and done, The Fed will be able to make far fewer rate hikes than everyone expects.

In that case, the "surprise" effect would further load the upward momentum for these bonds...

Thanks for reading.

Posted Using LeoFinance Beta