Weekly markets overview

This week's Glassnode charts indicate a turn toward a possible bull market phase.

Factors that point to this are:

- increase in trading activities

- increase in coins held by holders

- increase in leveraged investments in the derivatives market.

Let's look at these metrics one by one.

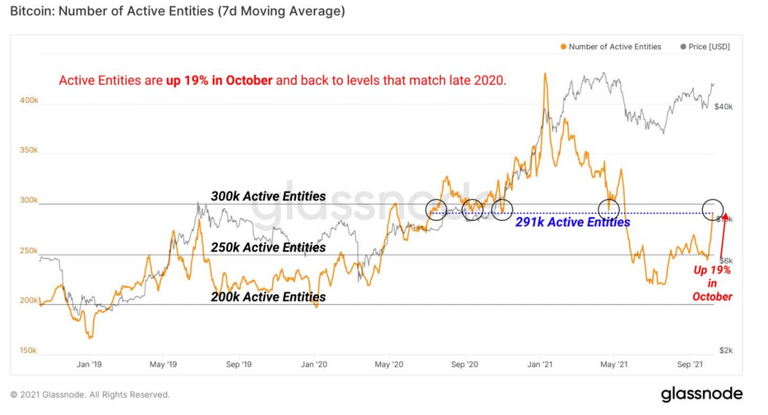

Trading activity (yellow line) is moving to levels close to those reached before the January-April 2021 bull market.

Note the sharp recovery indicated by the red arrow on the right, much stronger than the weak increase we had a few weeks ago (false start of bull market).

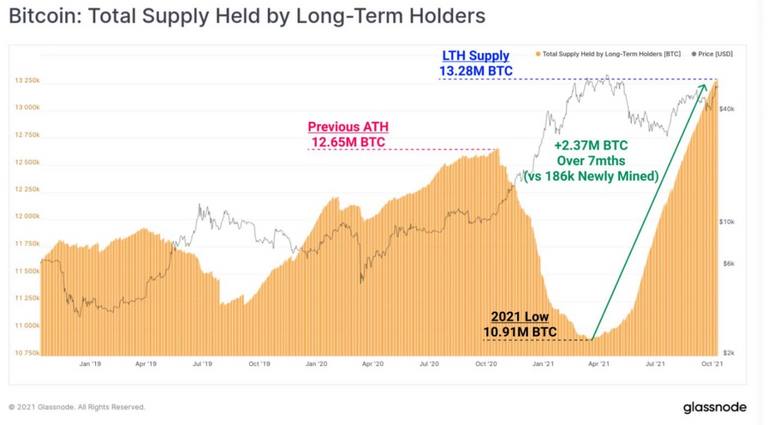

The amount of coin kept on deposit by the "holders" increases dramatically.

This fact, compared with the previous graph, shows a situation where the "demand" of coin is for the first time in strong increase (the previous graph), while the "supply" of coin continues to decrease (the holders subtract significant amounts of coin to the market ignoring the "temptation" to enter the market).

When demand increases and supply reduces, and all this happens in such a strong and evident way, the explosive effect on prices is inevitable.

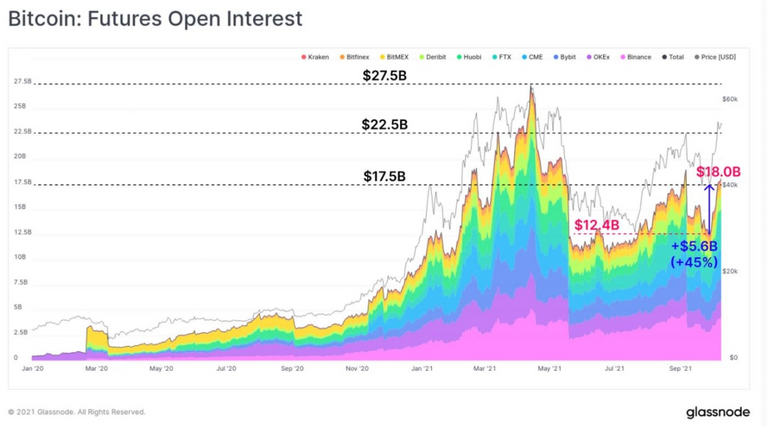

The newly bullish sentiment and constructive price action is starting to be reflected in futures as well, with a marked increase in new open positions.

The same is happening in options, as shown in a chart that for brevity we omit.

As said before, therefore, a bullish turn in the crypto market is often a good indicator of the fact that all the rest of the exchanges could soon turn towards a "risk-on" sentiment, that is, towards a new attitude to invest in non-conservative securities (moving for example from bonds to equities, or from these to derivatives), triggering a bullish phase whose duration is impossible to define at the moment.

Sooner or later this situation will be transmitted to the stock exchanges, as bitcoin and its companions are indicators of a risk-on or risk-off attitude of the markets in general.

Tomorrow will be a critical day for inflation sentiment: September consumer price data for Germany, USA and China will be published. Turbulence in the markets is expected.

Will the advocates of inflation-tapering be satisfied or disappointed?

Thanks for reading

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @cryptomaster5.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Congratulations @cryptomaster5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 700 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP