(May 2 - May 7) Bitcoin Weekly Update

May for bitcoin began with a decline. At the time of writing, the BTC/USDt pair has fallen 5.88% since Monday to $36,204. The weekly low is fixed at $35,258. Increased volatility in the market was observed on Wednesday after the meeting of the US Federal Reserve and the press conference of J. Powell.

As a result of the two-day meeting, the US regulator raised the range of rates by 50 bp to 0.75% - 1.00% per annum. At a press conference, he made it clear that a 50 bp rate increase would also be discussed at the next meetings. Thus, the head of the Fed reduced market expectations for a rate hike in June by 75 bp.

The dollar index reacted with a fall. The S&P500 and Nasdaq jumped 3%. Following them, Bitcoin rose by 6.68% to $40,023. On Thursday, May 5, optimism quickly vanished. The stock market crashed. The tech sector fell the hardest. The dollar index hit a high. Bitcoin fell 11% to $35,258 including Friday trading.

Investors fear that against the backdrop of rising energy prices, inflation will unwind. As a result, the Central Bank may accelerate the process of tightening the VCT by aggressively raising rates. For oil, many forecast around $200. According to my estimates, the level of $148-150 is visible, there is no higher level.

Sellers were able to break through the daily trend line at $37,600. The fall accelerated to another trend line originating from the 20 Jul 2021 low of $29278. The 24 Feb 2022 low of $34322 held. American stock indices are trying to rebound. Together with them, you restore the crypt.

American indices may go even lower on the back of QE curtailment and rate hikes. Another thing that worries me is the rise in US bond yields. The bonds are being dumped. It became known that in March-April, China dumped bonds worth $150 billion. According to the latest TIC report, China owned US debt in the amount of $1.054 trillion in February of this year against $1.100 in March 2021. After the States and Europe froze Russia's gold reserves, many Central Banks began to reduce the share of the dollar and treasuries in their reserves. And the growth of yields is the future of raising rates and strengthening the dollar.

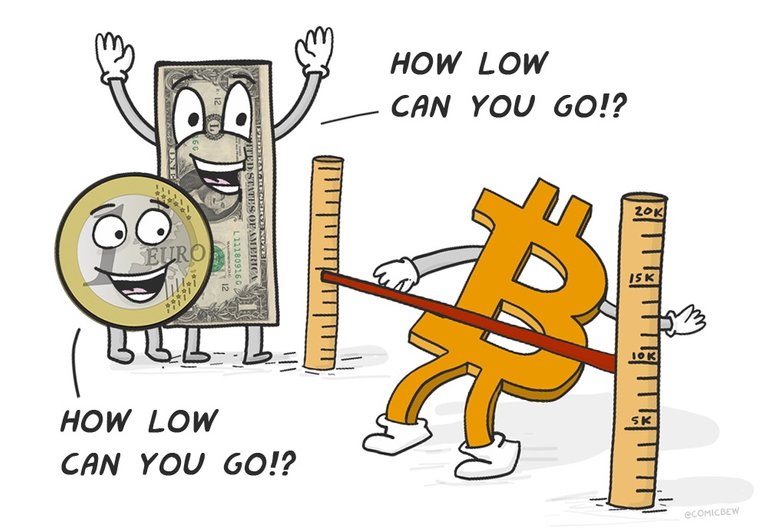

Conditions for the cryptocurrency market remain bearish. Levels below 30 thousand loomed on the horizon. Buyers need to close the week above 41,500. Only in this case, we can talk about a correction to 46 thousand. Now news for the US stock market is deciding on the market. So, together with the crypto, we are doing an analysis of the S&P500 and Nasdaq.

Posted Using LeoFinance Beta

https://twitter.com/PuxlikParadise/status/1522751826843643906

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Love the downtrend The lower we go the more fiat I swap into BTC

Posted Using LeoFinance Beta

That's the way it should be my friend! Way to go! Congratulations, and wish you all the best, smart DCA entries, and some !PIZZA.

- EvM

Posted Using LeoFinance Beta

Until things stabilize, we probably won't see much of an upturn if any.

Posted Using LeoFinance Beta

It is normal my friend. No thing can forever rise, or forever fall. Remember BTC has a finite supply, that alone will put it very higher in fiat valuation than actual prices. Patience is key. In the meantime let's accumulate more, and more.

Best regards, and some !PIZZA,

- EvM

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

elyelma tipped rcaine (x1)

@elyelma(3/5) tipped @whywhy (x1)

Join us in Discord!

I am being squashed by the bears on a personal level. But it's all good!! I am building stronger foundations because I am entering at a better price :)

Posted Using LeoFinance Beta