The holiday week is over, it's time to get to work

At the beginning of the year, Bitcoin is losing more than 10%. The price has been declining for the sixth consecutive day. Several factors contributed to the weakening of cryptocurrencies. The triggers for the collapse of prices were the events in Kazakhstan and the published minutes of the FOMC December meeting.

At the end of the year, there was an outflow of money from institutions from crypto funds, associated, among other things, with the fact that at the end of the year funds like to rebalance portfolios to compile beautiful reports for clients.

Minutes of the December Fed meeting showed that due to a sharp rise in inflation, the first rate hike is expected in March.

Speculations about tightening monetary policy have deprived market participants of their appetite for risky assets, which negatively affected the American stock market and the dollar's competitors.

The tech stock selloff has been triggered by hedge funds. In early 2022, they are actively getting rid of software companies and chipmakers. Buying shares of airlines and companies in the industrial and energy sectors.

Bitcoin remains positively correlated with the Nasdaq index, so the fall in US indices has greatly weakened the position of cryptocurrency buyers.

- The riots in Kazakhstan removed all protection from the crypto market. The protests began on January 2 due to the rise in gas prices for cars from 60 to 120 tenge. Later, they escalated into riots with demands for the departure of the first president of Kazakhstan, Nursultan Nazarbayev, from politics, for new elections and the dissolution of parliament.

It seems, where does Kazakhstan have to do with it?

In the Republic of Kazakhstan, during the protests, the Internet was turned off, and about 18% of all world Bitcoin mining capacities are concentrated there. According to the University of Cambridge, Kazakhstan ranks second in the world in terms of bitcoin mining (18.1%) after the United States (35.4%), but ahead of Russia (11.2%). The country took the lead after the ban on cryptocurrency mining in China.

One of the largest providers, Kazakhtelecom, cut off internet access across the country, forcing miners to suspend their operations. The hashrate of the cryptocurrency network fell sharply by 12%.

As a result, the chain of events that caused the strait looks something like this:

Crypto sale by institutions at the end of 2020 to show beautiful reports to clients >>> The December protocol of the US Federal Reserve showed that the regulator is ready to start raising rates from March and reducing its balance by $ 9 trillion >>> speculation on tightening monetary policy hit stock market. The crypt remains positively correlated with the fund. Bucks are getting more expensive, everything else is getting cheaper. Appetite for risk has disappeared >>> Protests in Kazakhstan have removed all protection from the crypto market. The fall in prices intensified due to the drop in the hash rate after the power outage in the country >>> Long positions were triggered by liquidity on futures.

This week, Bitcoin has fallen in price against the US dollar by 12%, to $ 41,600. A series of events triggered a fall in the BTC / USDt pair and prevented buyers from regrouping to recover losses and further rally.

On Friday, January 7th, the price dropped to $ 41,000. The decline has slowed near the trendline that originates from the $ 10374 low (Oct 2). The rebound from the minimum of 41 thousand was 4.5%. This is not enough to reverse the bearish trend on the daily timeframe. Only when the weekly candlestick closes above 49 thousand, it is possible to build growth scenarios. After the breakdown of the trend line, three levels will appear on the horizon: 38190, 32250 and 26900 (the global trend line from the low of 3782).

The fear index is 18 points against 15 on Thursday. It is not difficult for sellers to create panic-sells in the market. At 16:30 Moscow time, an important report on the labor market for the US Federal Reserve and the dollar will be released. A strong labor market and job growth are needed to raise rates. Because of Omicron, he could be bad today. Weak data on the unemployment rate and jobs may delay the rate hike by 2Q, which will negatively affect the dollar.

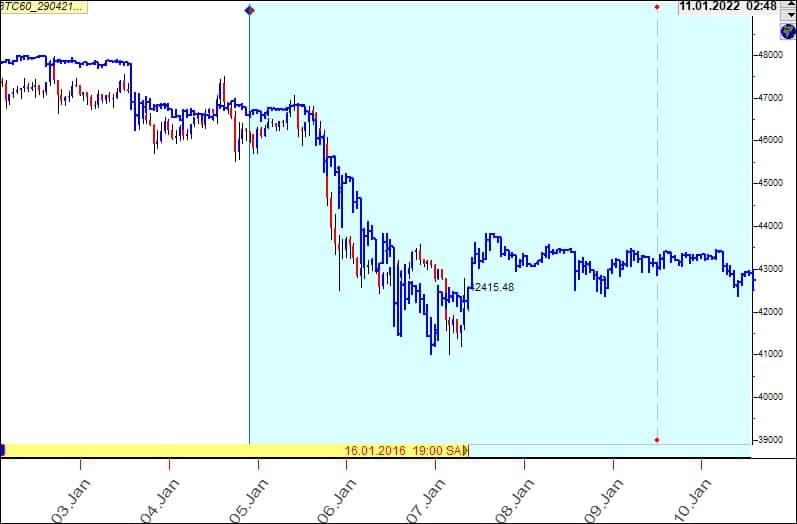

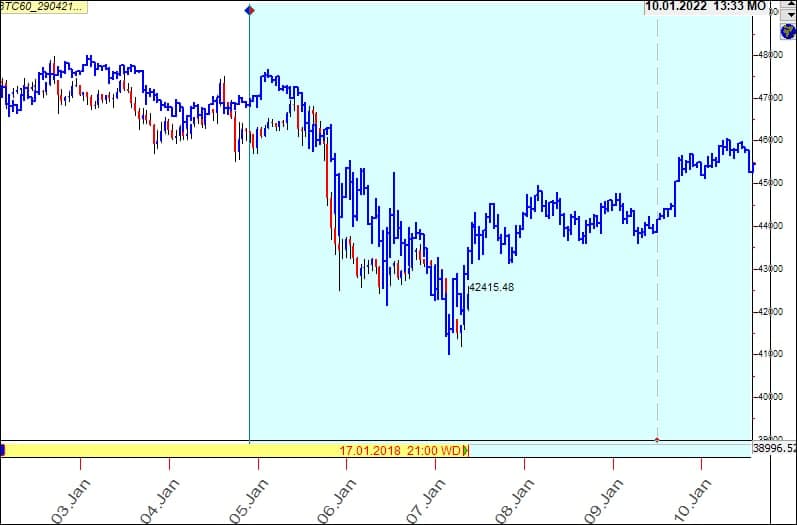

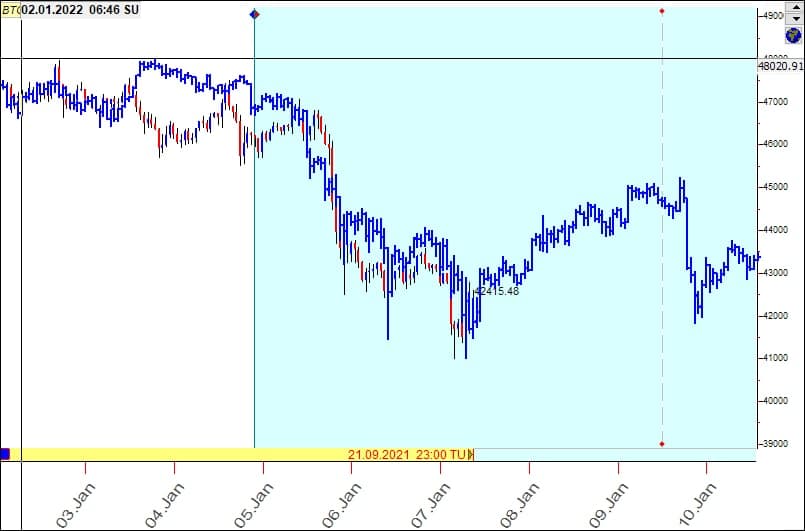

On the hourly timeframe, I found three patterns with high correlation from 01/16/2016, 01/17/2018, 09/21/2021 with a window of 168 hours (1 week). The sharper the rebound, the higher the likelihood of the trend line breaking out from the top of $ 69K.

Active sales began on January 4 at 46850. On January 5, after the publication of the minutes of the December meeting of the US Federal Reserve, sales increased against the background of the strengthening of the dollar and the growth of the yield on 10-year bonds. On January 6, the price swirled around the $ 43 thousand level. On January 7, the fall accelerated to $ 41,000.

It can be seen from the graph that sales prevail. In order for buyers to recover, they first need to gain a foothold above $ 44,000 (buy-in-the-fall zone).

Activity on the market began after the collapse on December 4 to 42 thousand. Some investors picked up the cue ball, others sold it on the rise. Resistances are at 47800 and 51150. If buyers' activity remains low, sellers will move to conquer the levels of 39750 and 34550. There are slightly different levels for TA.

Posted Using LeoFinance Beta