CTPSB growing at more than 20% APR

When you look at other tokens, 20% APR doesn't seem that extraordinary but when you consider that this APR is actually expressed in Hive, then it takes another dimension. So when you stake hive and curate with it, you get around 9.5% curation rewards if you don't let your voting power idle at 100%. If you own CTPSB tokens however, the value of your tokens is growing at a rate of around 20% per year in hive! When you compare these numbers then, CTPSB becomes more interesting. But how does the token manage to grow at this rate?

How does CTPSB grow?

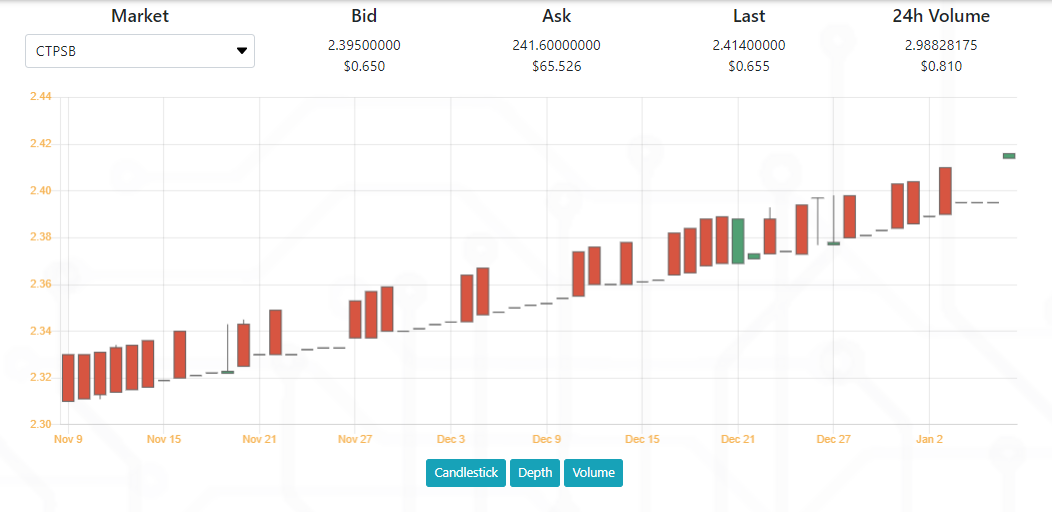

When you look at the chart evolution of CTPSB, the progression is almost linear. To evaluate the growth of the token, it's important to understand how the price of the token is fixed. There is a theoretical token value that is defined by the hive power on the @ctpsb account divided by the number of CTPSB tokens in circulation. So basically the token grows in parallel with the hive power off the underlying account. There is a market maker that reproduces this value on the market.

source: leodex.io

How come that the token grows so fast?

When you curate with your hive power, you earn curation rewards and also organic rewards for staking tokens. It's exactly the same for the @ctpsb account. But in addition to that, the account has additional income sources that allow him to grow faster:

Leverage thanks to delegations

The account grows faster than a normal account because people delegate hive power to @ctpsb. Let's say the account owns 20'000 Hive Power and 20'000 additional hive power is delegated to it. It means that the account gets curation rewards not from 20'000 but from 40'000 hive power. In this situation, the curation rewards would be 9.5% on 40'000 but since there are only 20'000 Hive Power that are divided by the CTPSB tokens in circulation, it actually means that the curation rewards are somewhere like 19% APR!

Author rewards

In addition to that, the account also grows thanks to 50% of the author rewards that are generated with the posts.

Organic burning

Finally, every week some CTPSB tokens are organically burnt. It's around 0.24 CTPSB every week that are burnt thanks to an automated mechanism.

With all these income sources, the CTPSB token grows at a rate of around 21% APR at the moment and it's doing that for more than a year already. This growth rate is the APR calcluated of the last two weeks and doesn't take into account compounding effects that are real.

The advantages of holding CTPSB

When you power up Hive and curate with it, you need to wait 13 weeks to power it down. With CTPSB you profit immediately and the APR is about double to what you would get for curating. If you need your hive, you can simply sell the CTPSB tokens on the market. No need to wait for a powerdown.

With CTPSB, the earnings that are generated are automatically added to the value of the token. This means also that this value is auto compounding without you having to do anything.

Finally when you buy CTPSB, you actually support the CTP community. The project supports the authors who stake CTP tokens and use the CTP tags on their posts. If you are a part of the community, it's possible that you also profit from CTPSB.

What are the disadvantages of CTPSB

There are also some disadvantages linked to the CTPSB. First of all, it's not always possible to sell all your tokens at once. The market maker has limited funds and can only buy so many CTPSB tokens at once. For bigger positions, it's possible that selling CTPSB can take longer.

There is also a difference between buy and sell price of CTPSB. This is to avoid too many movements and also to refinance the market maker. You might need to wait about two weeks to break even, when you buy at sell price and sell at buy price. CTPSB is therefore a rather long term investment.

Learn more about the CTP Swarm Booster:

Posted Using LeoFinance Beta

It's great to see the growth in CTPSB and I love how CTPSB supports the CTP community. I have seen a few people talk about over the counter transactions when it involves a lot of tokens. WOuldn't something like that work?

Posted Using LeoFinance Beta

There are some buffers in place that allow us to buy back tokens without powering down. If a big amount is required, then a power down becomes necessary. That is why, the amount of buy back orders needs to be limited. If necessary we could find a solution I believe :-)

This looks awesome Achim! One of the few predictable, ever-growing tokens on Hive-Engine. But, like most things on H-E, it's not for deep pockets.

You are right, it's rather the small pocket token that offers the advantages of a big wallet :-)

Which post does the CTPSB account vote on?

Top 40 CTP holders

Top 20 CTPSB holders

etc?

!CTP

We make a ranking every two months. And the top 50 of this ranking get support from ctpsb. For mor info, here is the link to the last ranking: https://peakd.com/hive-119826/@ctpsb/the-updated-ctpsb-ranking-november-2022