Daily CUB Report | Multi-Token Bridge Gains $100k in TVL This Week

Crypto markets are ripping higher and you know what that means... Record volumes on CUB DAO.

I'm tracking a lot of activities on the Cub Ecosystem. You see most of them in this report (see numbers and spreadsheets below).

There are plenty of other more experimental tracking metrics I have. I'm fine-tuning them and as you can tell if you're following along with these cubdaily reports, I am constantly adding new things and experimenting with others.

There's a lot happening behind the numbers at CUB. What I'm seeing is a ton of TVL growth for bHIVE and bHBD.

The arb bot that the DAO uses seems to be doing massive work both on-chain and off-chain as well. This is very hard to track but I've been able to gather some intel here and there.

According to the team, Arb Bot 2.0 is supposed to launch this month and I'm excited to see what this means for the CUB Protocol.

The team estimates that the efficiency of this new arb bot could 2x or even 3x+ the revenue generated each month by CUB DAO.... That literally means that we could see deflationary CUB this month.

It's all up to the team now. Let's see if the arb bot 2.0 reaches production and then also achieves the kind of numbers that the team has their eyes set on!

Follow along as I report daily on @cubdaily 🙏🏽

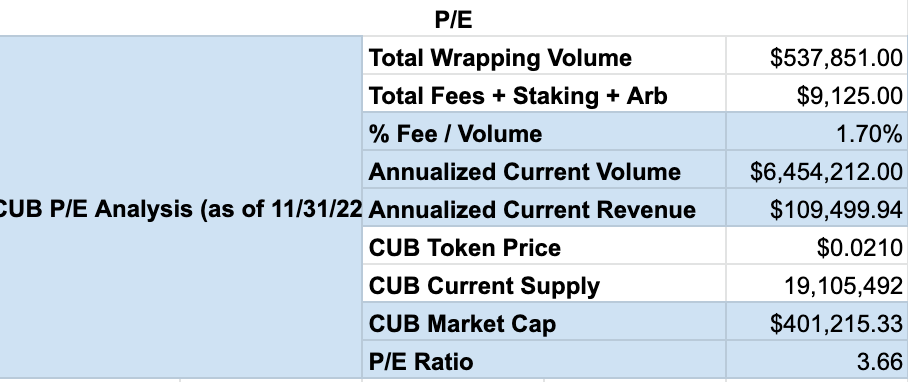

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

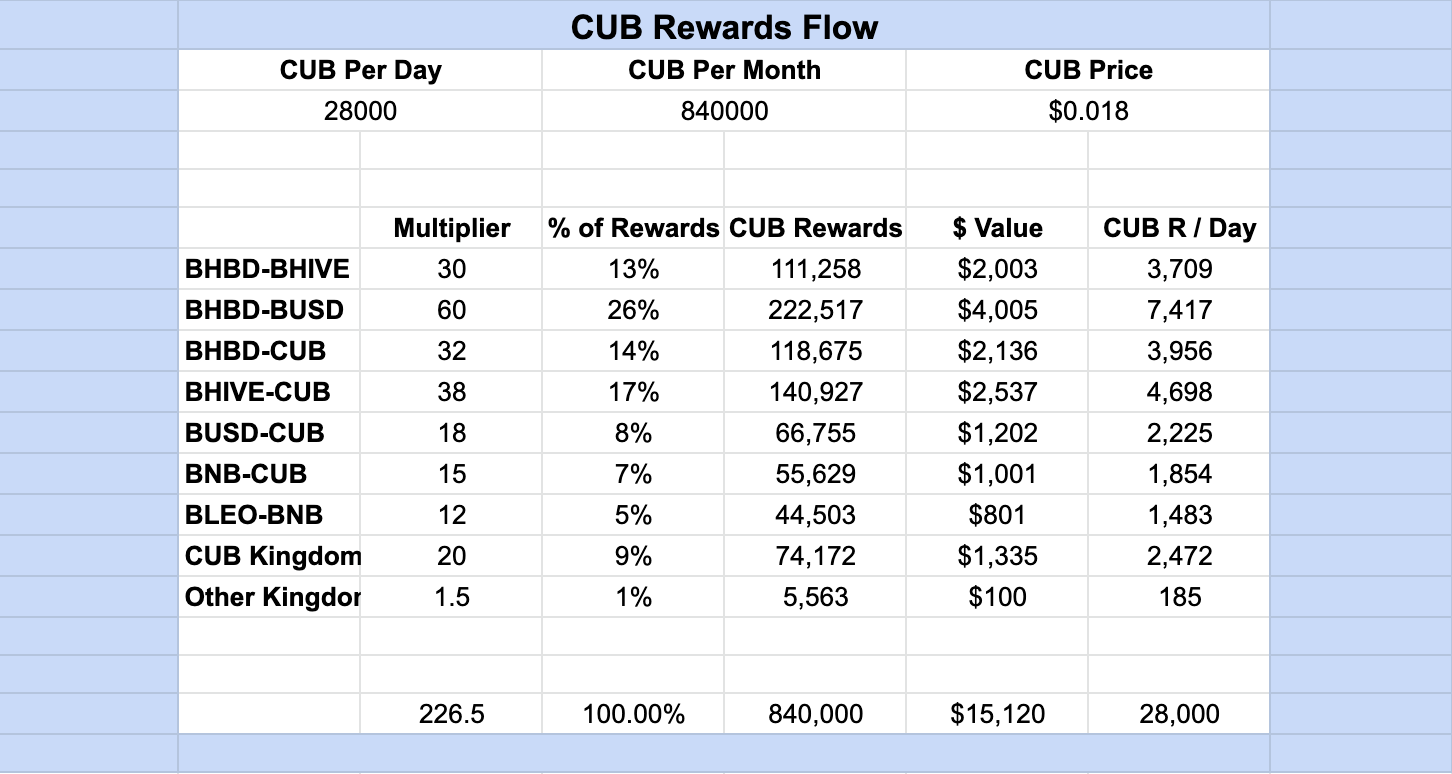

CUB Rewards Flow

*NEW

Here's another new section of my daily reports. This chart will be updated monthly. It accounts for the flow of CUB rewards.

"Over time, I'll start collecting data on how much each Liquidity Pool actually earns for the CUB Protocol (through wrapping revenue, arbitrage, etc.). Obviously, that's a lot of data to capture! This tells us something very important though: is the DAO effectively using its monthly funds (inflation) in paying LPs to build liquidity that ultimately generates revenue. Let's keep an eye on it and see how this progresses, maybe the team can even take this data and use it to migrate multipliers to more effectively build liquidity in the pools that are generating the most revenue."

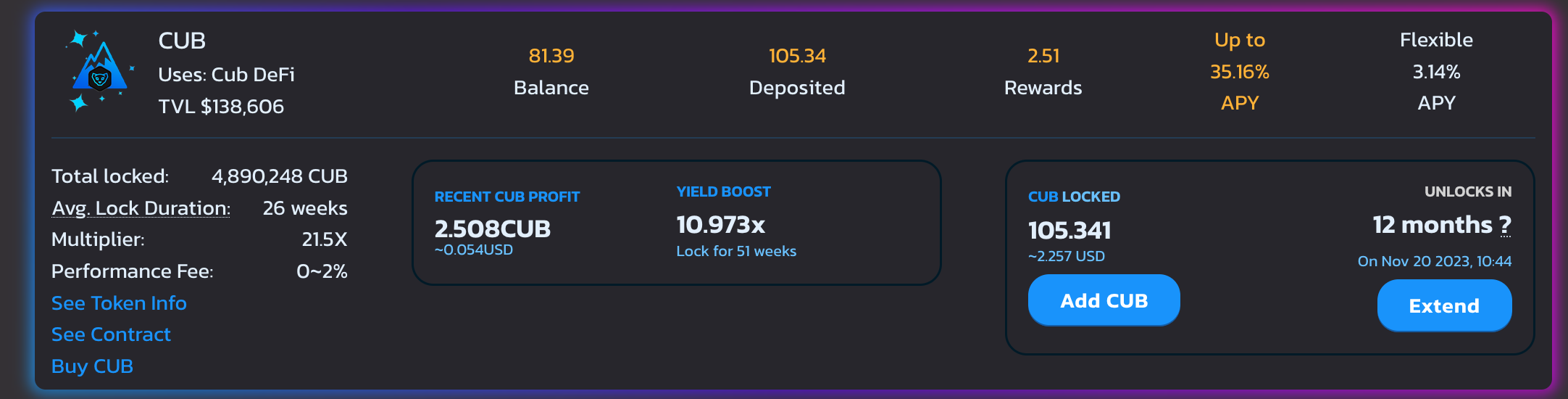

Locked CUB

A new section! The new CUB Kingdom is now live and we can track the amount of CUB locked and how long it is locked for.

- CUB Locked: 5,383,245

- Avg. Lock Duration: 32 Weeks

CUB Token

- Price: $0.02009

- Total CUB Supply: 20,020,153

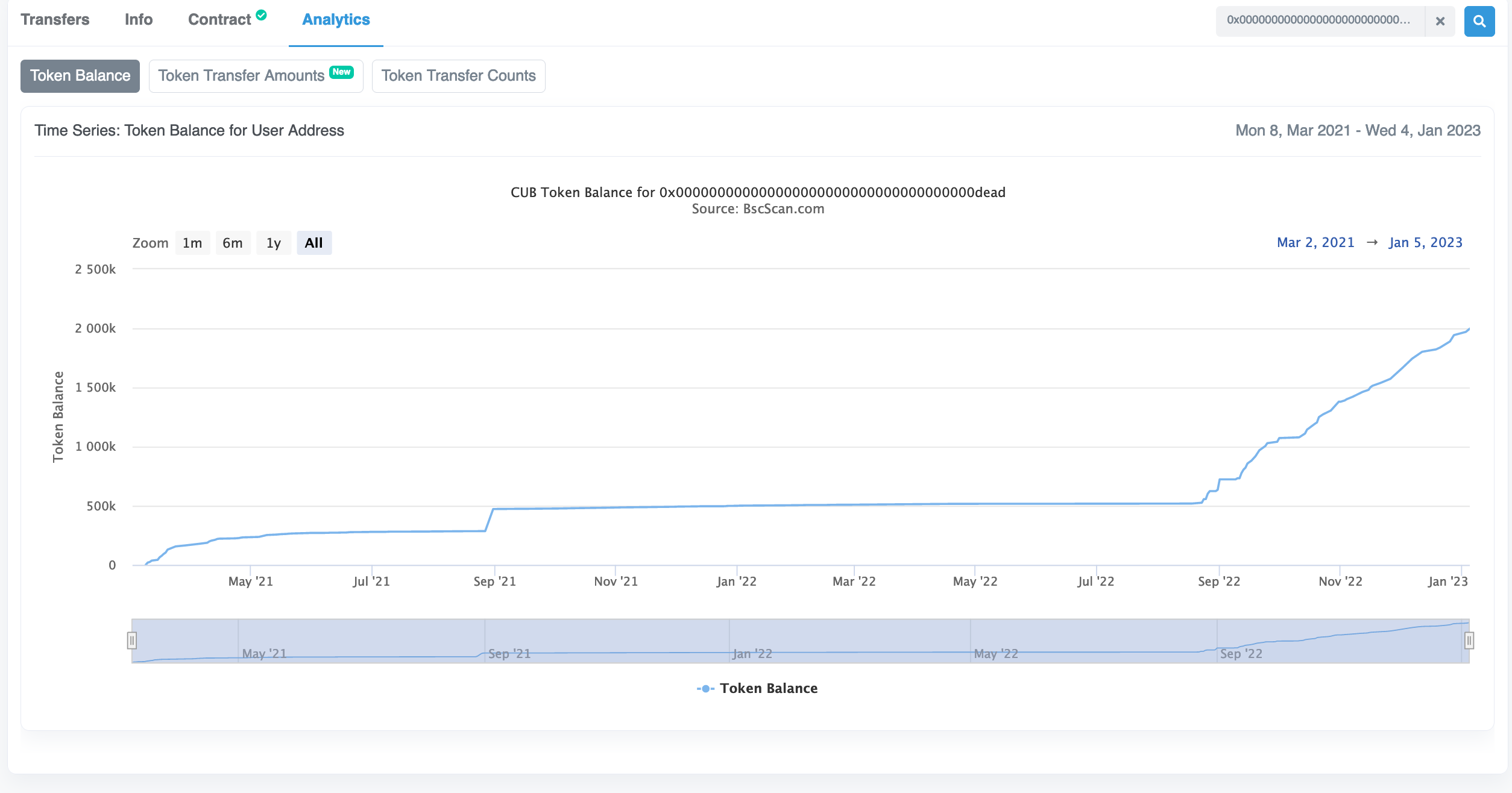

- Total CUB Burned: 1,996,886

- Total Market Cap: $400,280

- Total Value Locked: $1,334,182.71

Multi-Token Bridge Stats

- bHBD-bHIVE: $173k

- bHBD-BUSD: $293k

- bHBD-CUB: $130k

- bHIVE-CUB: $163k

- Total: $759k

Holy MTB growth Batman! This is up ~$100k since the last @cubdaily report!

CUB Burns

.png)

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: https://leofinance.io/@leofinance/cub-monthly-report-or-november-2022-50-of-cub-inflation-bought-and-burned-tvl-continues-to-grow-and-arb-bot-2-0

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.

Posted Using LeoFinance Beta

That is fantastic to read!

Posted Using LeoFinance Beta