Stader Labs — Simplifying Staking & Unleashing Staking Derivatives

Crypto world is not a straight road. It’s a maze that can get confusing for the best of us. It’s dynamic where things move at the speed of light only natural for most people to stay clear than get their hands burnt. The world of staking, delegating, nodes, validators is not an easy space to wrap your head around. The overdose of information for an average user widens this space further.

Let me give an example, Let’s suppose I want to invest 1000 USD through one of the fixed interest bonds. The process is simple where I deposit it in an account for a certain duration of time expecting yield at a certain interest rate. Let me use the same analogy to explain staking. Staking is essentially committing your crypto for rewards (mostly more crypto). The concept of staking was born out of blockchains with the Proof of Staking consensus model where crypto assets are pledged to maintain the network. Every blockchain needs Validators and these Validators are chosen from the staking participants. The more crypto assets pledged, the more are the chances of the participant to be a Validator. Proof of Staking is energy efficient unlike Proof of Work. This was a short sum-up of the process to help you come onboard.

Existing Problems

Staking presents myriad opportunities to all value chain participants but the process of delegating your crypto assets to a Validator is not easy. Staking is complex and esoteric with limited information available regarding the nodes and the Validator performance. It is not easy for most delegators to understand the performance metrics of the Validators and the underlying risks of staking. The performance of the Validator directly affects your staked cryptos as any slashing will result in slashing of your crypto assets staked with the Validator. The process of tracking, monitoring, and re-delegating the assets requires a serious effort that is time-consuming and tedious.

This process becomes more complex and demanding when staking across multiple chains. This limits delegators to a single chain or choose a single Validator than spread it across multiple Validators. The voting power stays vested with a select few Validators while smaller Validators suffer due to limited visibility. The network only becomes a smaller replica of the true decentralization that it set out to be.

An added problem is the liquidity of the staked assets. For example, Bonded LUNA has an unbonding period of 21 days. Similarly, most of the staked assets have a time period of anywhere between 20 to 30 days before the stakers get their assets. This means no access to any of the DeFi related opportunities due to lack of liquidity.

All these hurdles need to be addressed before delegators can fully reap the associated benefits. The aforementioned process of making passive income needs to be simplified and Stader Labs intends to do that by creating an end-to-end stake management platform for delegators.

Solution — Stader Labs

Stader Labs — a platform designed to alleviate the existing issues and bottlenecks across the value chain of staking (Delegators, Networks, and Node operators). Sid Doddipalli and Amit Gajjala, two active stakers founded Stader Labs on the principle of simplifying staking while offering risk-adjusted returns.The vision of the platform in the words of Amit is “One billion delegators” so that Staking-as-a-Service (SaaS) becomes a principal feature of PoS networks and a vehicle for onboarding more users to the crypto market.

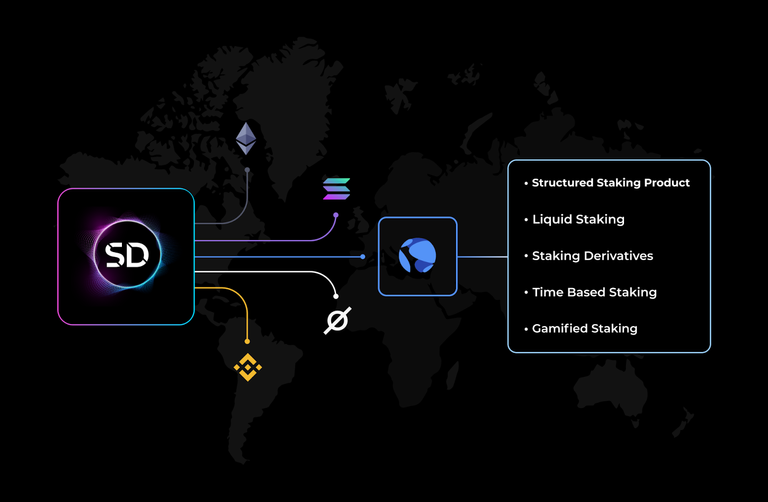

Driven by a strategy that focuses on delegators first, Stader Labs is designed to offer a convenient and safe way to maximize user returns on staking. By deploying curated vaults of Validators within a specific network’s Validator ecosystem, it assures maximized yields. With all of these offerings bundled into one platform, Stader Labs essentially empowers delegators and provides them with end-to-end stake management. In the long run, they strive to become a platform for DAOs and developers to build custom staking solutions. Moreover, Stader aims to extend its offering to the creation of multiple structured products on top of staking, aggregating all types of staking products- becoming the default distribution layer for staking across retail and business user segments for various blockchains.

Mission, Aim & Working

The mission of Stader Labs is to bring sustainable staking yields from digital assets by simplifying staking while offering the best risk-adjusted returns to delegators. It wants to build a one-stop, one-click, dynamic decentralized stake management platform. It aims to achieve that by being the distribution layer of staking while building protocols and products that enhance the security, decentralization, liquidity, and governance of the major DPoS blockchain networks like Ethereum, Terra, Polygon, and Solana. It intends to simplify staking through these stake management products.

- For L1 chains through:

Create Validator Indices by curating Validators based on performance and history.

Continuous monitoring of Validators’ statuses, APYs, and risks.

Auto allocation and management of users’ stake via a single platform.

Maximize yields from vault strategies as add-on features.

Notification Services through Telegram/email.

- For multi-chain assets, Stader Labs will leverage IBC and create multi-asset staking ETFs by:

Creating an ETF with a market-cap-weighted basket of L1 chains. The ETF price appreciates as the price of the underlying asset increases and as staking rewards get added.

Balancer pool mechanism will be used to maintain proportions of underlying assets.

Offer a staking derivatives platform through Synthetic tokens by Issuing sdToken (synth) for staked assets

Stader Labs will be a one-stop platform for stakers for all DeFi needs by creating multiple structured products on top of staking and aggregating all types of staking products thus becoming the default distribution layer for staking across retail and business user segments for various blockchains.

Yield farming on staking rewards

Lending/ borrowing pools

Futures and Options

Gamified Staking

My two cents

Proof-of-Stake (PoS) consensus has become the most preferred validation model and it’s no surprise to see all the major blockchains in the crypto ecosystem using this. It offers an opportunity for holders of networks’ native crypto tokens to contribute to consensus validation while earning yield in the process. Any solution that simplifies the staking process while removing the inherent flaws of subpar decentralization of network and concentration of voting power with a select few Validators is going to create a bright staking future, nothing short of magic.

Is Stader Labs going to create the magic? We can only wait to see if these features and products would live up to show the light.

Thanks to Stader Labs and Brian Curran for inspiration and content for this article.

I need your love and support. Please give it a like or follow or subscribe so that I can keep writing what I love.

Socials

Twitter Youtube Odysee Publish0x Read.cash Substack Medium Loop Medium Torum Presearch Noisecash

Crypto Taps Pipeflare, GlobalHive, GetZen for some free crypto

Exchange on SwapSpace

For price updates, check Coinmarketcap or download the app on Apple/ Google

Join CoinMarketCap for Airdrops, Diamonds, Learn&Earn

On Telegram, Telegram(EN), Twitter, Reddit, Instagram, Facebook

Create your crypto Watchlist or track your Portfolio on Coinmarketcap

(Please note - This article might also show under my alter ego - Cyek)