After Few Months Tether Started To Grow Again | A look at the top stablecoins | Aug 2022

The TerraUST fiasco has left a mark on the stablecoins industry. The crypto market cap felt further after the UST fiasco in May 2022. Before the implosion of the project the combine market cap of LUNA and UST was more then 40B.

In the traditional industry when a project from this size goes down its usually a cause for government intervention.

A lot of stablecoins saw decrease in their market cap after this and some small ones collapsed as well. When it comes to the top two USDT and USDC, Tether USDT has seen decrease while USDC has been growing. But in the last month this has been reversed and Tether started growing again!

With this said let’s see how the market cap of the top stablecoins looks in the last month.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks (or equivalent) there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- FRAX [FRAX]

- Terra-UST

There is a few more out there like TrueUSD [TUSD], Huobi USD [HUSD], etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from Jan – Aug 2022.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

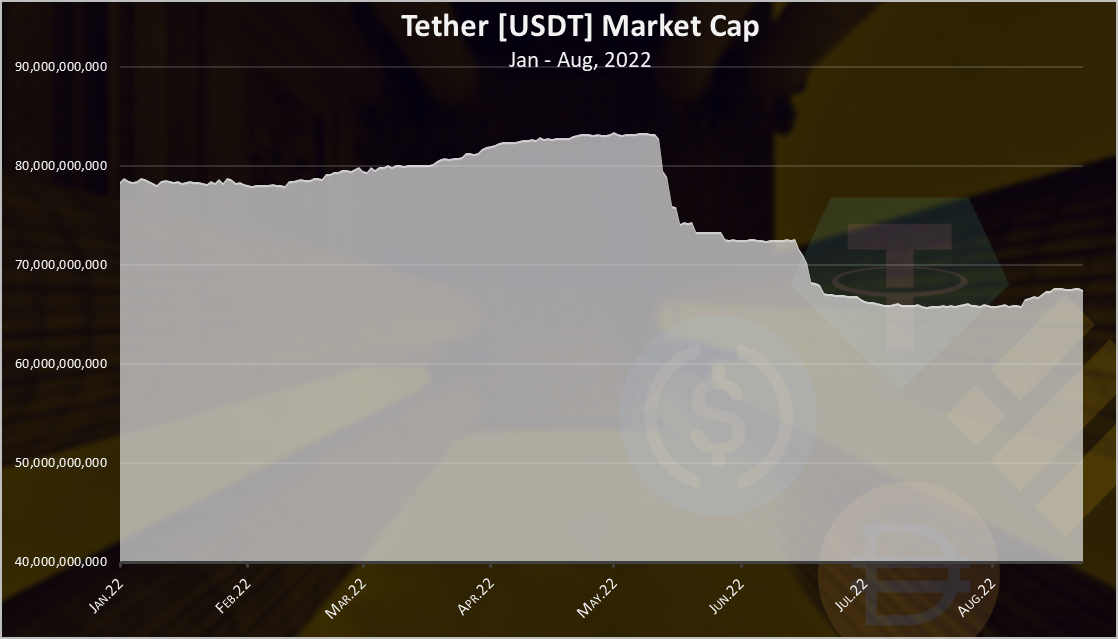

Here is the market cap for Tether in the last period.

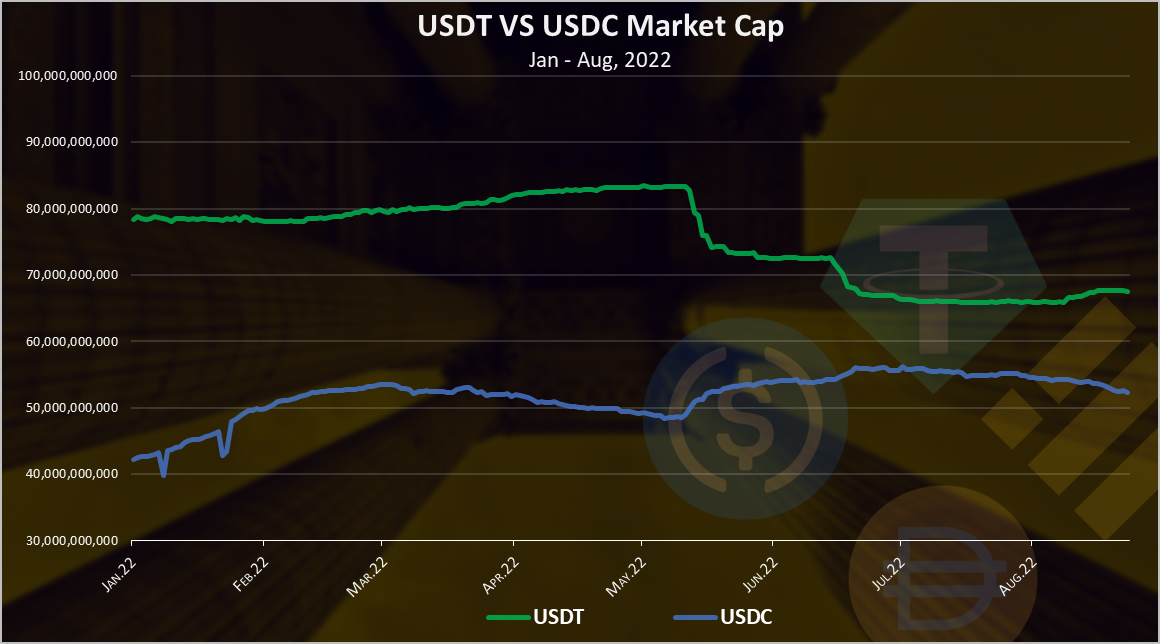

In the first months of 2022, up to May, Tether was growing slowly, going from 78B in January to 83B at its peak at the beginning of May.

Then UST happened and we can see the major drop in the Tether market cap. Just in a week Tether dropped for a full 10B in market cap. This was a real stress test for the token. A lot of users wanted out and were cashing billions. Tether provided all the exit liquidity users wanted in a very short period of time. Billions in the first days, and around 15 billion in less than a month. If this was to happen on any traditional bank, bankruptcy is almost certain.

There are a lot of audits and transparency reports for stablecoins, but the above is the ultimate test in real time from the market. Having in mind Tether was able to provide the needed exit liquidity proves that it is able to operate under the stressful conditions in the crypto market.

USD Coin [USDC]

USDC is a common project between Circle and Coinbase.

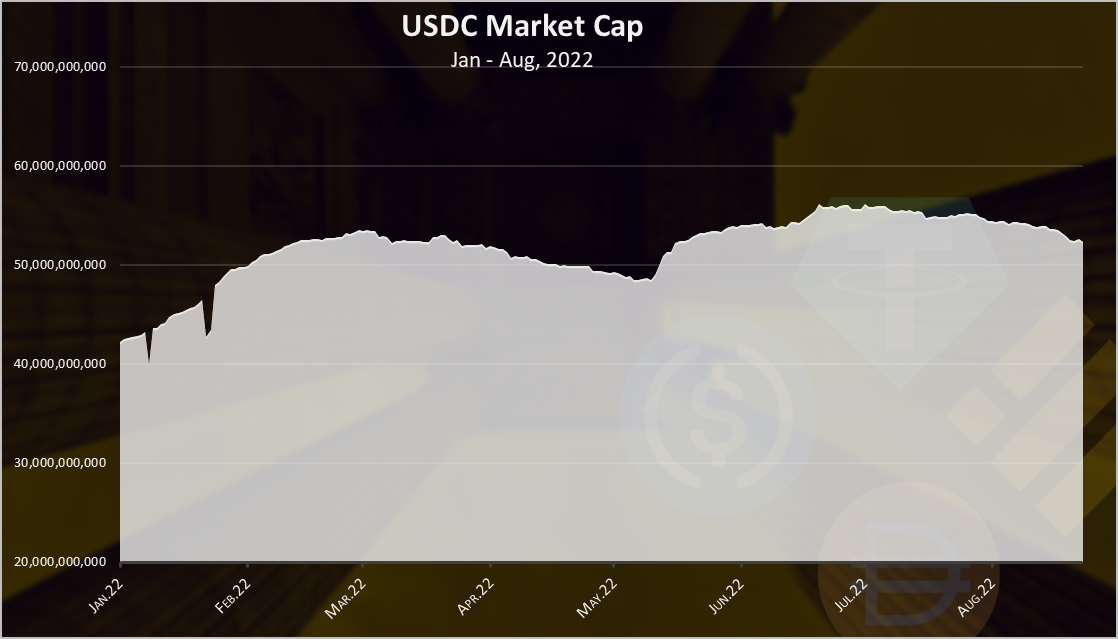

Here is the chart.

We can see the growth in the beginning of 2022 adding more than 10B in three months, but then in March the market cap of USDC started declining.

We can see a sharp increase in May 2022. At this time UST collapsed and a lot of capital entered USDC looking at it as a safe place to park their stablecoins. In the last month, the USDC market cap started do slowly decline again.

USDC stands at 52B now, down a bit from its peak of 56B.

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

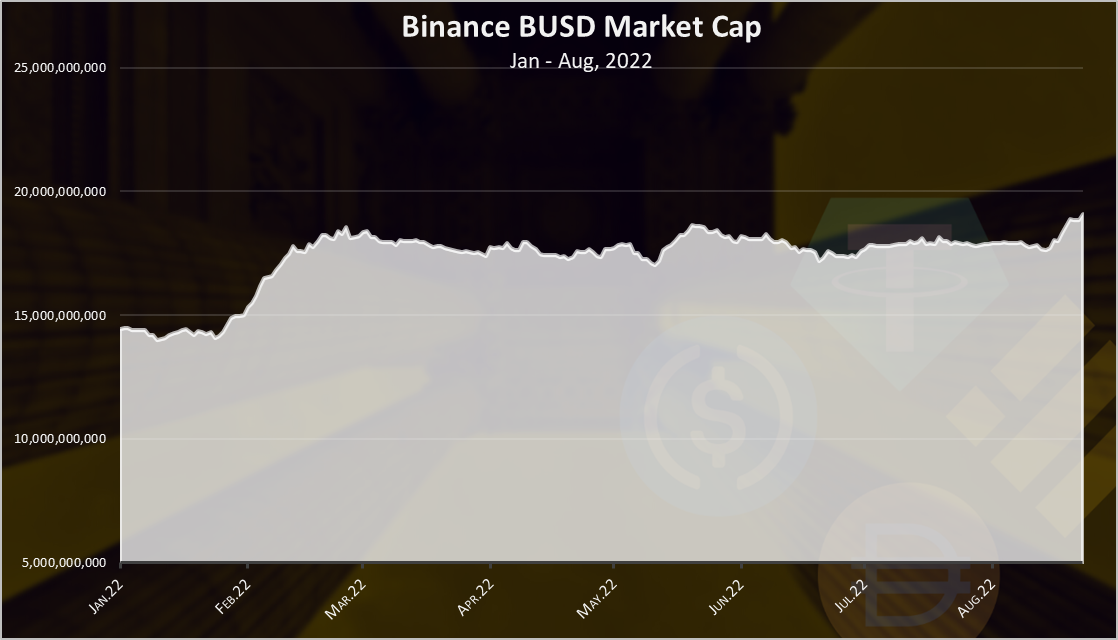

BUSD has been quite stable in 2022. An increase at the beginning of the year, then a small increase again in May 2022.

Interesting we have seen a recent increase in the market cap of BUSD. Almost 20B now.

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

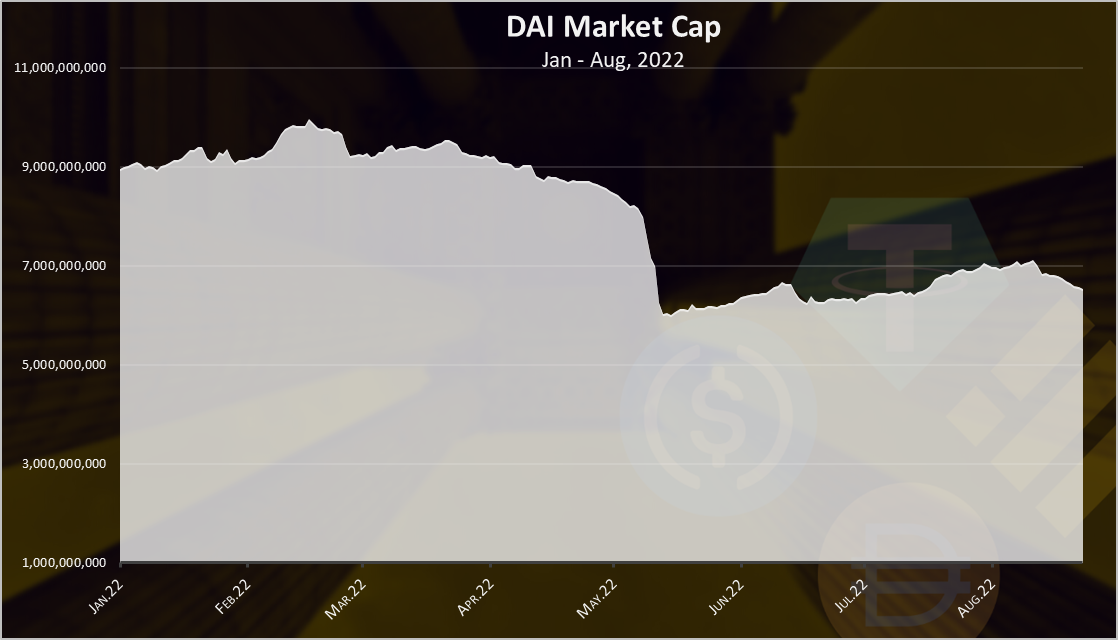

DAI as the number one crypto backed stablecoin has reduced its market cap in 2022. DAI works as overcollateralized stablecoin, where users put in 150% or more of other crypto assets to mint 1DAI. Since its backed by crypto asset, and the price of those has dropped it is logical for the overall market cap of DAI to drop as well.

We can see that during the UST fiasco in May 2022, the DAI market cap reduced as well, from , from 8B to 6B. The DAI market cap at the moment is 6.5B, while in the peak it reached almost 10B.

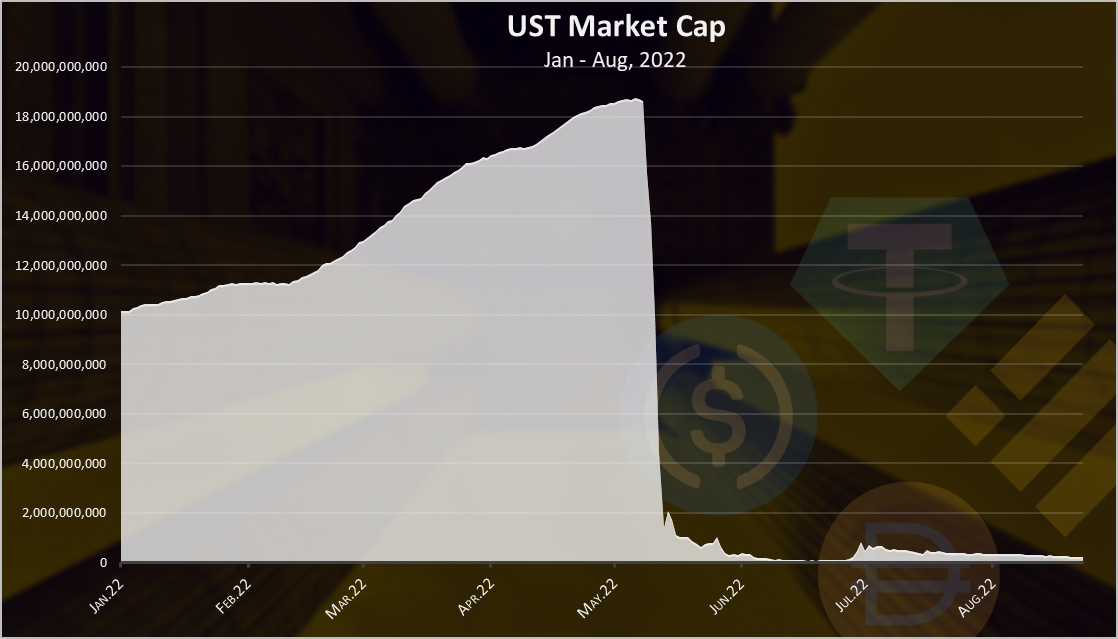

TerraUSD (UST)

The UST implosion is probably going in the history of the crypto books. UST is backed by LUNA, through instant conversions. But there is no limit how much of it can be printed, neither absolute nor relative to the market cap of the underlying asset LUNA.

Because of this there was an attempt, to put additional reserves in form of Bitcoin, but obviously this was not enough.

Here is the chart.

Starting from May 8th , the UST market cap started to decline in a free fall. At the peak the UST market cap was 18.2B. It went under 1B in less than a week time!

From the chart above we can see that there was more then 10B capital that wanted to exit UST. The few billions BTC that the team had obviously was not enough to provide the instant liquidity that the market needed. For a parallel we can notice the USDT market cap, that has 10B in reduction, that made the price of USDT to deppeg a bit, but USDT jumped in and provided all the liquidity that the market needed and restore the peg.

USDT VS USDC

If we compare the top two stablecoins in the year we get this.

This two are almost inversely corelated 😊.

We can see the drop in the market cap of USDT in May 2022, and the increase in the market cap of USDC. But in the last month USDT has started growing again, while USDC has dropped.

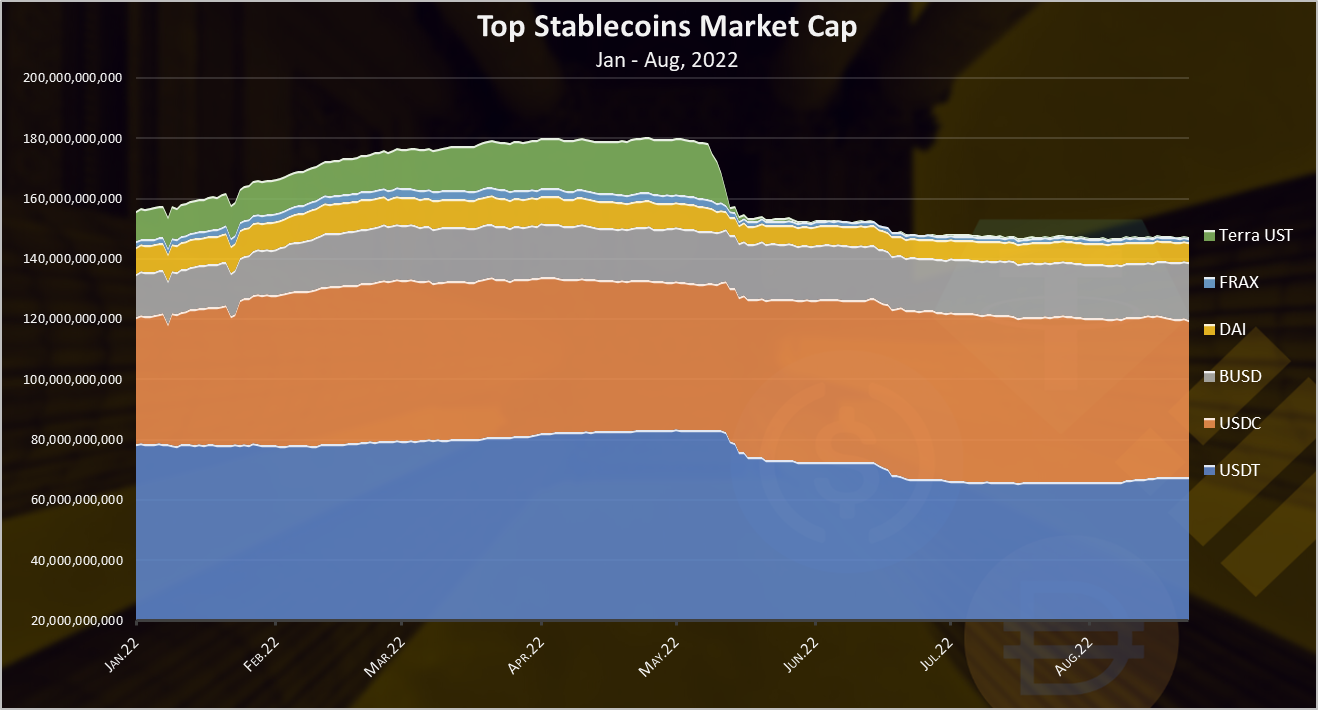

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

At the peak the market cap for the stablecoins was more than 180B. When TerraUST collapsed it lost almost 30B in a matter of week.

In the last months, the market cap of the stablecoins has been steady around the 150B mark. It hasn’t changed at all, although we can see some movements between the different stablecoins.

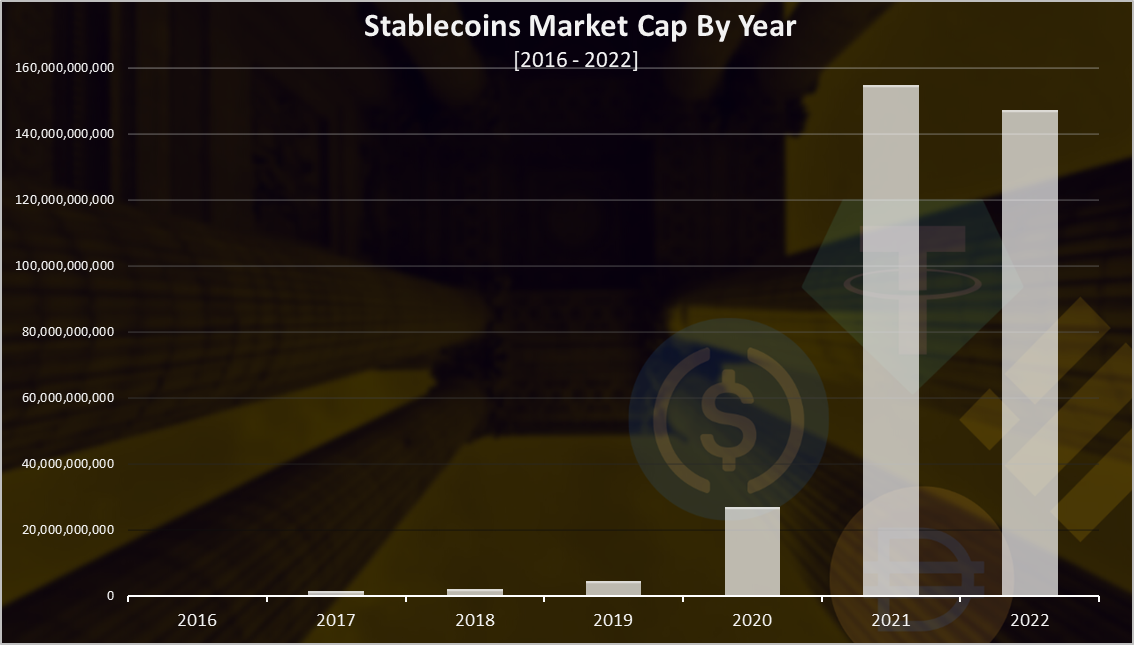

For context on a longer timeframe, on a yearly basis the market cap for stablecoins look like this.

After an explosive growth in 2021, the stablecoins market cap has started dropping in 2022. Will see how will the year end, but obviously the trend is down, alhough much not that much.

For example, the stablecoins market cap has reduced from 180B to 150B, or less than 20% drop. The top cryptos, BTC and ETH have both seen a drop more than 50%.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top, but USDC is closing in now. A 67B to 52B in market cap. BUSD is now on the third place, followed by DAI. FRAX is no.5.

Overall the stablecoins market cap seems to stabilize in the last month around the 150B mark. After a period of lowering its market cap USDT has now started growing again, while USDC has dropped a bit. These two act as opposites through all the 2022.

While we have seen a drop of the total market cap of the stablecoins for around 17%, this is still a much smaller drop compared to the drop in market cap for the top cryptos as BTC and ETH, that have more than 50% drop in both of the cases.

All the best

@dalz

Posted Using LeoFinance Beta

Nice analysis. Which do you prefer? I have mostly USDT at the moment.

I hold my stables diversified... I have some from all the top 4, plus HBD :)

Trying to reduce risk. I don't have a favorite one atm, but you gotta give respect to USDT for pulling out that liquidity during the May crisis.

Nice one Dalz. Do you plan any splinterland stats soon? Would be interested in your charts and thoughts of their DEC stable token model.

I do some SL stats once on every few months DEC included .. but yea the new situation would be interesting to look at ... maybe a short one soon :)

no pressure! keep up the great work!

Interesting how stable the overall stablecoin market cap is.

Yes, especially in the last months.

Should you not quote the source of those charts your presented... I think you should to validate the source from which you done your analysis.

Otherwise, it was a great read...interesting one!!

I liked what you mentioned about USt, that simpily minting without rules of minting limited to a portion of Luna's M.cap was a problem...

Anyway...

So, which is the safe Stablecoin to be in - USDT should have gained crediblity because it passed the test of liquidity but why are they not publishing audits...

and is it ok to hold USDC when Blackrock has a big stake on Circle...

11

Maybe BUSD is safer, but how should we know, its all uncertain thesedays!!

Charts are mine .... the data used for them is from coin agregators, like coingecko or CMC ... easy available, transparent data

Uncertainty is guarantied :)

You can see all stablecoins what that lost its peg using this site...

Stablecoins

That is a nice one :)

https://twitter.com/Cloudsystem83/status/1562072464032768003

The rewards earned on this comment will go directly to the people( @claudio83 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Amazing analysis and it is good to see the stablecoin market recap

I have shared this post with some of my non-hive friends. It is simple, easy to understand and factual. Your usual excellent quality product on a popular and important topic. Cheers!

Thank you!

after reading this I'm glad I stuck around with USDT. Like I like to say: it's better to be lucky than smart :P

.

This post has been manually curated by @finguru from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Youtube was full of foolish VLogers calling for people to buy into the Luna and UST fiasco. I still wonder if they thought it would bounce back or if it was a marketing offensive by the Terra Foundation trying to turn the tide. But if all the nutjobs out there cry-sing like the sheep in Animal Farm, there's usually a Conductor close.

Nice analysis! You break them out for easy explanation. That being said , I feel for Tether(USDT) more cash injected into the stablecoin space may imply further market growth. If new capital is moving in, then that could mean new dollars are getting invested.

Seasons are there for everything a time to rise and a time to fall. The force of gravity maybe is at work here.

Stable coins aren't left behind though they be backed up by the fiat and other equivalent like Gold, and other prescious and natural resources if with all these backings there's still a huge record of decrease, then top cryptocurrencies would be said to be doing marvelously withstanding the waves.

It has been a challenging moment for both stable and the other side of the coin .

Supper analysis. I hope that other currencies experiences stability.

Muy valiosa esta información...

I always appreciate the update on stuffs like this, thanks for sharing.

I like this analysis, it shows stablecoin still have a future, hence, there is neef to keep holding.

Hey, good little rundown of the major so-called stablecoins. I would like to point out that USDC is now wholly-backed and controlled by BlackRock, who bought in earlier this year, and has taken responsibility for full custody of the USDC asset. USDT has also never been audited by a reputable 3rd party accounting firm that they haven't paid for.

In my view, USDC and USDT aren't free to use whenever the holder desires. USDC, because any wallet address can be frozen by BlackRock at any time for any reason they choose, and USDT, because there is no actual guarantee that it's backed 1:1. Yes, Tether did lose a lot of "market value" in a short period of time, but they also have very deep pockets backing them, the question is, what is actually propping up Tether. They have sold a lot of their previously-owned commercial paper debt, so, what's really behind it?

As for DAI, although it is overcollateralized with cryptocurrency (other than Bitcoin) by 150%, it is over 60% backed by USDC, which is controlled by BlackRock. I would hesitate to ever touch it, for the reasons listed above.

Posted Using LeoFinance Beta

I had doubts about USDT, but this event restored my faith. USDT did what it was supposed to do. My favorite is still HBD. I barely have any HBD with myself. On the other hand I don't even have other stablecoins as a part of my portfolio (unless you are talking about DEC which is trying to be a stablecoin).

!PIZZA

Posted Using LeoFinance Beta