Data On PancakeSwap | The no.1 DEX On The Binance Smart Chain BSC

PancakeSwap was launched back in September 2020. It has been around for a while now and in the period, it has established itself as one of the top DEX in the industry. It remains the no.1 DEX on BSC, and on a few occasions it has flipped Uniswap on some metrics.

A new addition to the platform were added like farm and pools, staking LP tokens, prediction market, IFOs, NFTs etc. The low fees on BSC, the dynamic tokenomics, ease of use has made this platform attractive to new and old users.

Let’s take a look at some of the data!

Games like Splinterlands, using the Pancake platform for their SPS token is another proof for its usability in the space. The centralization aspect of BSC always will remain as a con, but for what is worth Pancake started without presale, premine etc. All the tokens in circulation were distributed as rewards to the users and liquidity providers on the platform.

Here we will be looking at:

- Total Value Loc TVL

- Trading Volume

- Numbers of users

- Top pairs

- Inflation

- Price

The period that we will be looing at is form December 2020 to April 2022.

PancakeSwap has been around since September 2020, but it started to take of in December 2020. The numbers in the first two months are almost not visible on the chart.

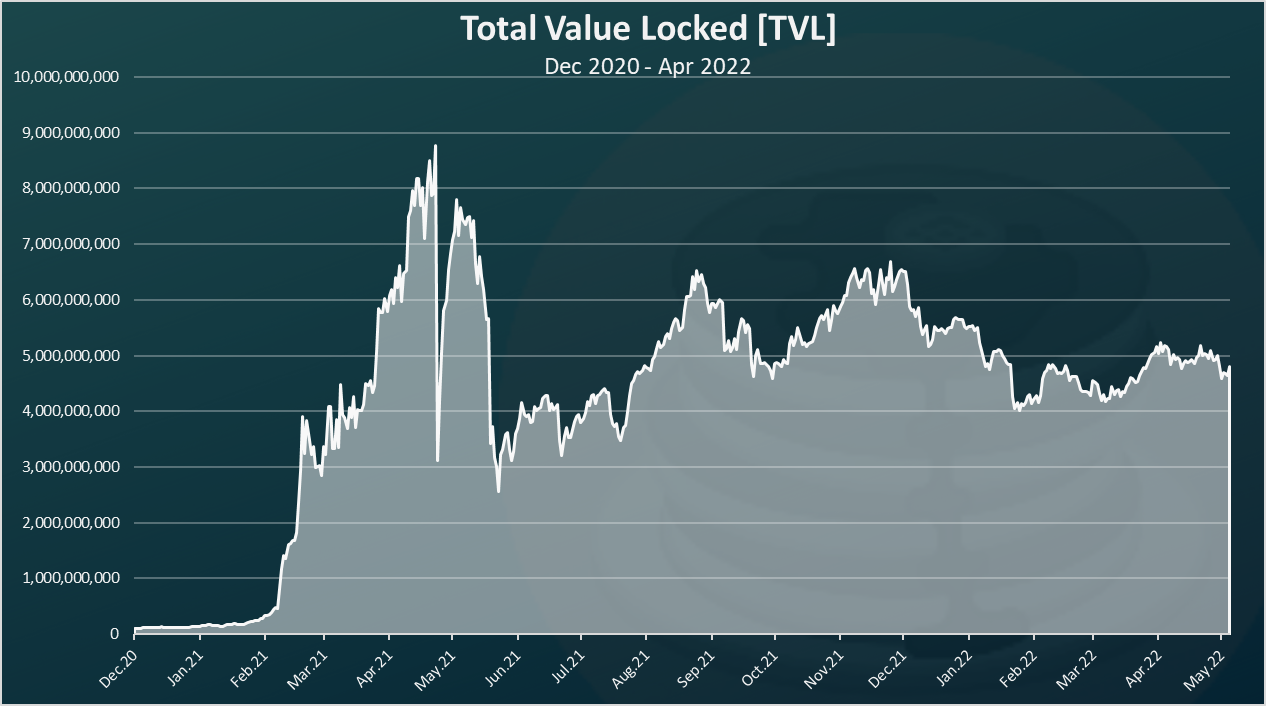

Total Value Lock on Pancake

Here is the chart.

There has been a massive growth in TVL in the start of 2021 up to May 2021. At the top there was almost 9B, a drop in the summer 2021, then a slow increase, and now the TVL is around 5B.

The TVL value follows the overall market in the period with ups and downs. For comparison Uniswap is around 7B at the moment.

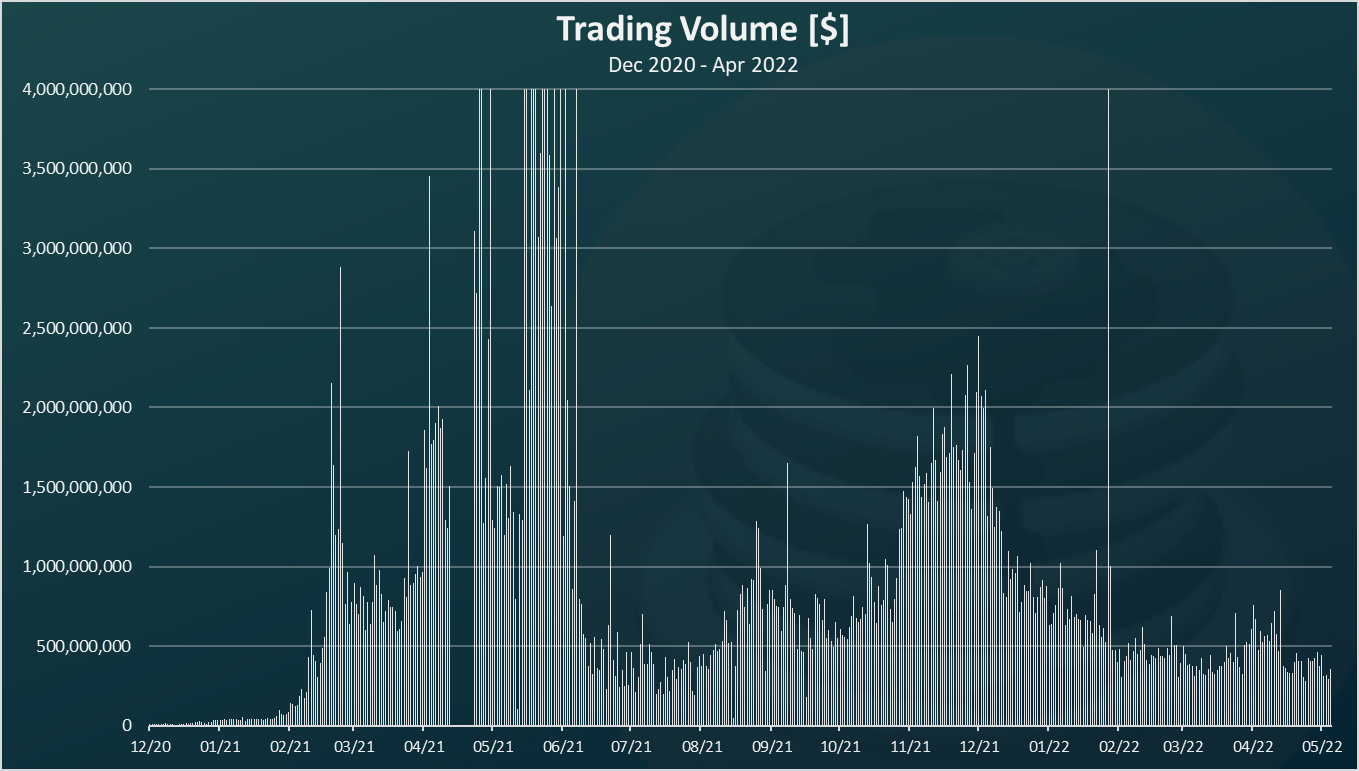

Trading Volume

Here is the chart for the trading volume.

This is quite a volatile chart.

We can see that it follows the TVL overall with a strong growth in the beginning of 2021 and a drop in the summer of 2021. An increase again in November 2021, and in the last period the TVL is around 500M per day.

A note on the trading volume. Unlike the TVL where capital is locked in smart contracts, the trading volume can be played a bit with wash trading. Since the fees are smaller on BSC its cheaper to wash trade there. It also can be happening on Uniswap as well. The main point here is that the trading volume should be taking with some reserves due to possible wash trading. Still more legit than most of the CEXs where the trading is on a central servers and zero fees 😊.

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for the last 24 hours:

- Binance 25B

- OKEx 5B

- Coinbase 3.5B

- FTX 3.5B

- Gate.io 3.2B

- Crypto.com 2.3B

If we plot Pancake here with the 500M, it will be quite down on the list out of the top 10. Uniswap with its 2B daily volume will have the top rank from the DEXs.

Numbers Of Users

I have extracted some data for the historical numbers of users beffore and ploted them in a chart, but these days there is less and less sources at least to my knowadge. I have used the Graphql.bitquery in the past, but now that query seems broken.

The numbers from the dapp aggregators like dappradar are showing around 270k daily users.

This number seems quite constant for Pancake in the last year and even without data on historical users the number seems to be hovering around 300k DAUs for a long period now.

Top Pairs

Here is the table for the top 10 pairs on April 2022.

The BNB-BUSD pair is on the top with 360M in liquidity.

Another BNB pair, the BNB-USDT pair comes on the second place. The stablecoins pair BUSD-USDT is third.

We can notice a lot of the top pair are with BNB. Out of the top 10, six are paired with BNB. This is locking more BNB and putting it to use.

We can se the stables to stables pair in the top as BUSD-USDT, BUSD-USDC and USDT-USDC in the top as well.

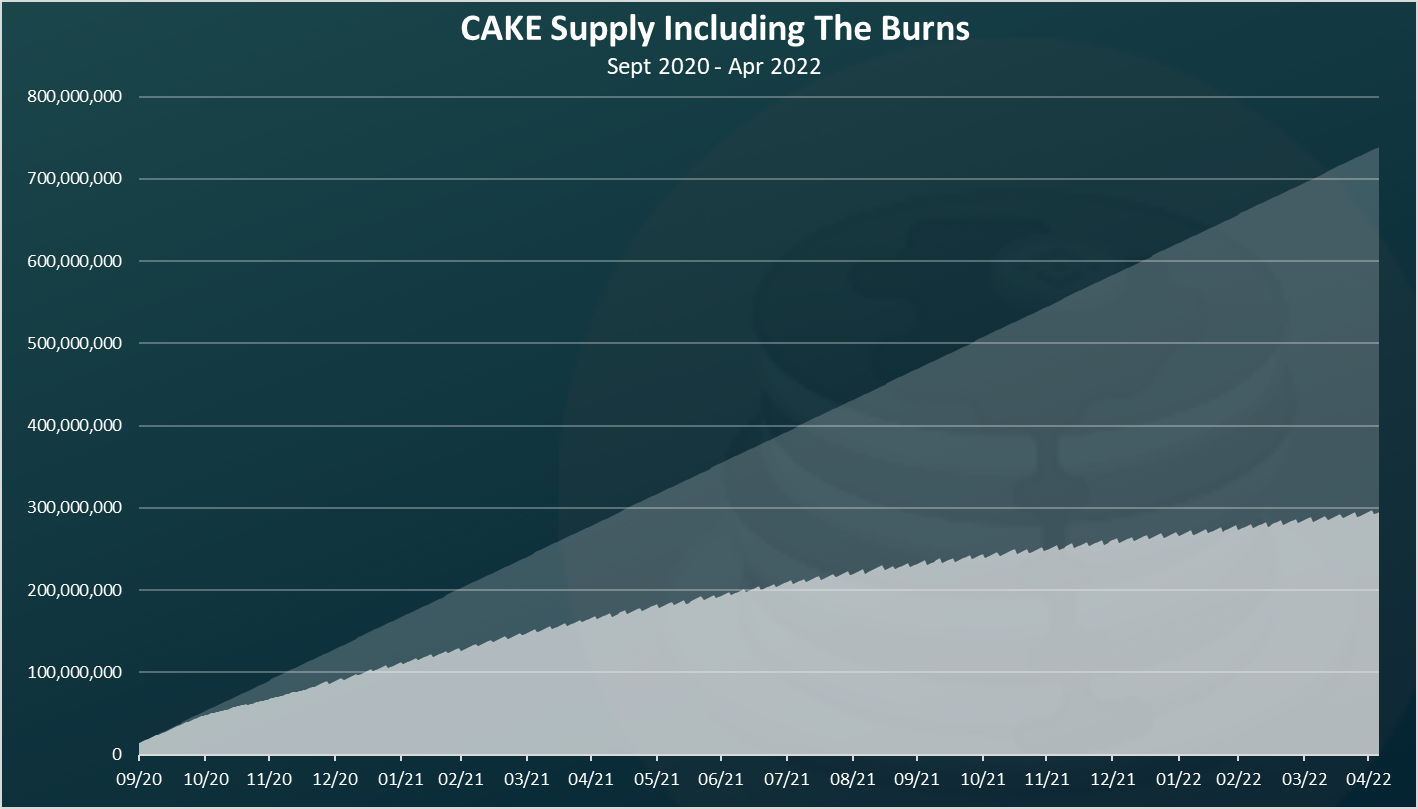

CAKE Supply

Here is the chart for the CAKE supply.

CAKE inflation is a bit wonky with print to burn coins.

Initially CAKE had a 40 tokens per block inflation, then they reduce it to 25 and again to 15 tokens per block. The thing is the reduction in the inflation is not effective but, the difference is printed and then burned. Also, there are burnings from lottery, IFOs, prediction markets, account registrations etc.

At the moment there is around 10M CAKE created per month, or around 120M per year. If we add this to the current supply of 295M, the inflation is somewhere around 40%, and dropping each day. With this after a period of high inflation and high growth, CAKE seems to be meeting some balance point, and soon it will reach 30% inflation that is quite sustainable level for defi crypto. In the past the inflation was at 300% and more.

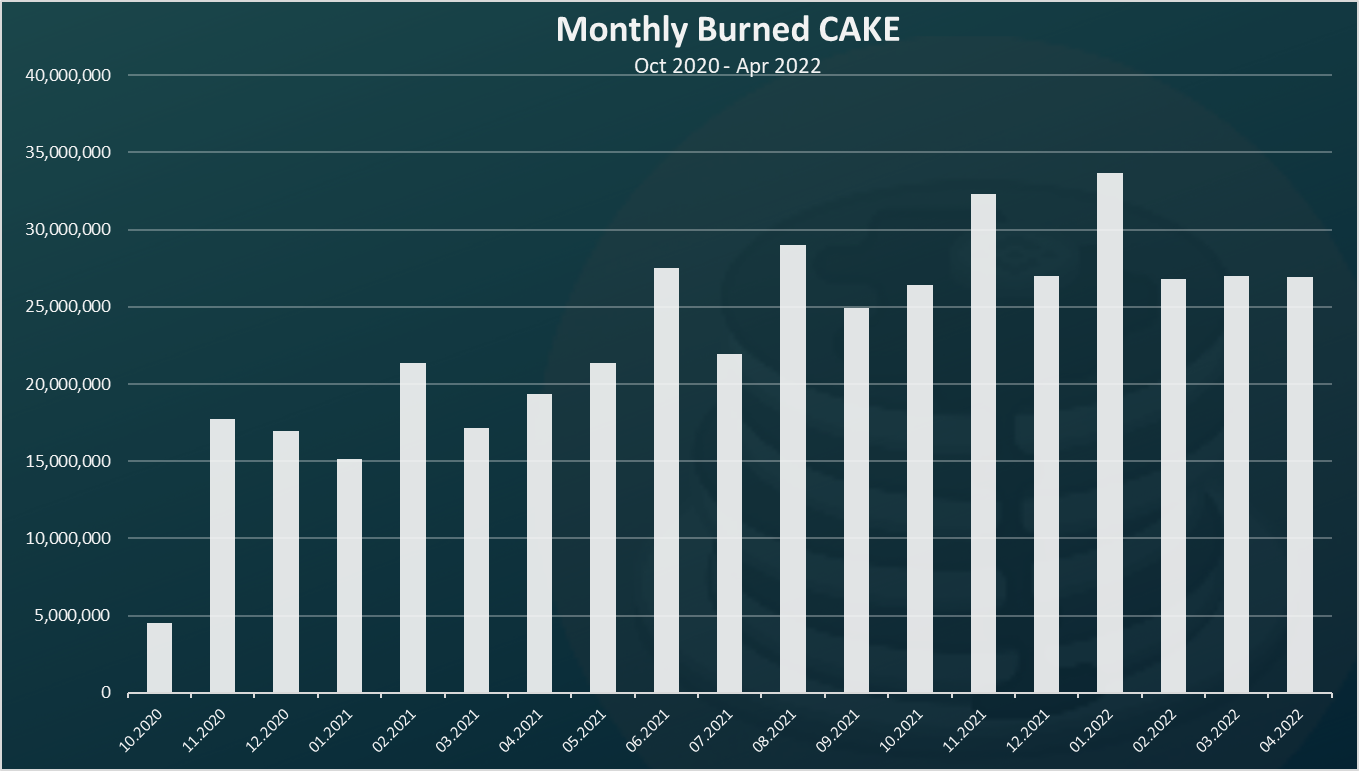

Monthly Burned CAKE

The chart for the burns on a monthly level looks like this.

While CAKE has been introducing new ways to burn tokens, the monthly burned amount seems quite stagnant in the last period. Around 27M CAKE is burned per month, but a lot of this amount comes from tokens that should been released in the first place and it is more of a marketing strategy.

Price

At the end the chart for the price.

CAKE has been trading under a dollar at first. Then the price kept growing to 17$, had a pullback to 10$, and then up again to ATH of 40$ in May 2021, a correction to 15$ in the summer 2021. A growth again in September 2021, and from there on it seems to have a general downtrend to under 10$.

In the last period the price of the token has been around 7$.

At the moment CAKE is ranked at the 47 spot with 2.2 billions in market cap.

Overall, a great start and a great 2021 year for the platform amounting a nice TVL and number of users. In 2022 the numbers are down, but this seems to be in a relation to the general market. Recently Pancake added limit orders and even futures, and these option are great addition to anyone that doesn’t want to use CEX and KYC. Having in mind that Pancake is a part from the greater Binance family, they have some experience in building exchanges.

All the best

@dalz

Posted Using LeoFinance Beta

good analysis. i did a boo boo selling cake for cub when it was a bit high, now I wait to recover them from APY.

Awesome update as always

Good analysis. Thank you. 75% of my investment is in cake because of that passive income. Do you think cake will rise again with that inflation?

Cant tell for sure, but the inflation will go down constantly, the protocol is here to stay, so long term it should be

Thank you very much. I want to keep my cakes for the long term

.

Mostly yes

@dalz mis saludos realmente su articulo esta muy bueno Cake es criptomoneda de muy rápido crecimiento y muy estable tiene una capitalización de Mercado que ronda los 2.000 millones de dolares , y tubo un gran pum, ademas tiene su propio Exchange. llego a rondar los 40 $. buen articulo.

Excellent analysis. I have about 3 cake token, got in pancake swap. I bought then for $12, should have got more when the prices were low. Now its still a good buy opportunity !

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 170000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: