Everything You Need To Know About The HBD Haircut Rule And The Latest Updates| The Biggest Risk For The HBD Price

Unlike every other stablecoin that promises to keep its peg to the dollar at all times, but then fails to do that, HBD is embracing the volatility and is designed to lose its peg in a controlled manner.

All of the top stablecoins have lost their peg at some point. USDT/Tether has lost its peg most recently in May/June 2022, when it traded around 95 cents for a short period of the day, and previously has broken its peg in 2017.

USDC has lost its peg weeks ago and dropped to 87 cents. DAI did the same, and has lost its peg previously as well, in March 2020, when the Covid market crash happened. BUSD, that is relatively new has also has troubles and dropped a bit, although not that much. Not to mention now dead UST.

The point from the above is that all the top stablecoins had troubles at some point in the last years. HBD is not promising to keep its peg at all times at all costs, but has in place a protective mechanism, that is set to lose its peg by design. This is what we refer to as the Haircut rule.

What Is The Haircut Rule?

Hive Backed Dollars, as the name suggest are dollars backed by HIVE. What this means is that each HBD can be converted for one dollar worth of HIVE through on chain conversions, where HBD is destroyed, and HIVE is created. The blockchain guaranties a HBD at one dollar thorough HIVE. No matter what the price of HBD on the external markets is, when a conversion is made on the blockchain from HBD to HIVE, the amount of returned HIVE will be valued at $1 per HBD. This conversion lasts for 3.5 days, and a median price for HIVE is taken in the period.

Because HBD is backed by HIVE, HBD acts as debt of the blockchain.

The debt is calculated in the following manner:

DEBT = HBD in circulation / HIVE Market Cap

HIVE Market cap = HIVE Virtual supply * Feed price

HBD In circulation = Total HBD – DHF Holdings

The haircut happens when the debt of the blockchain is higher than the predetermined limit by the blockchain. At the moment this limit is set at 30%.

When the debt limit is reached the blockchain no longer guaranties a one dollar HBD. The highest the debt the lowest the price for HBD from the blockchain.

HBD Printing Limits

Prior to the last Hardfork in October 2022 the HBD print limits were set to 9% and 10% debt level. Most of the Hivers were aware about the 10% limit, when HBD is no longer valued at $1.

After the Hardfork these debt limits were moved to 20% and 30%.

But what exactly happens at these debt levels?

The major thing is that HBD will deppeg and lose the pair to the dollar. But there are a few other details to be aware of.

First let’s take a look at all the ways HBD is printed:

- Author rewards

- Conversions

- Interest

- DHF payouts

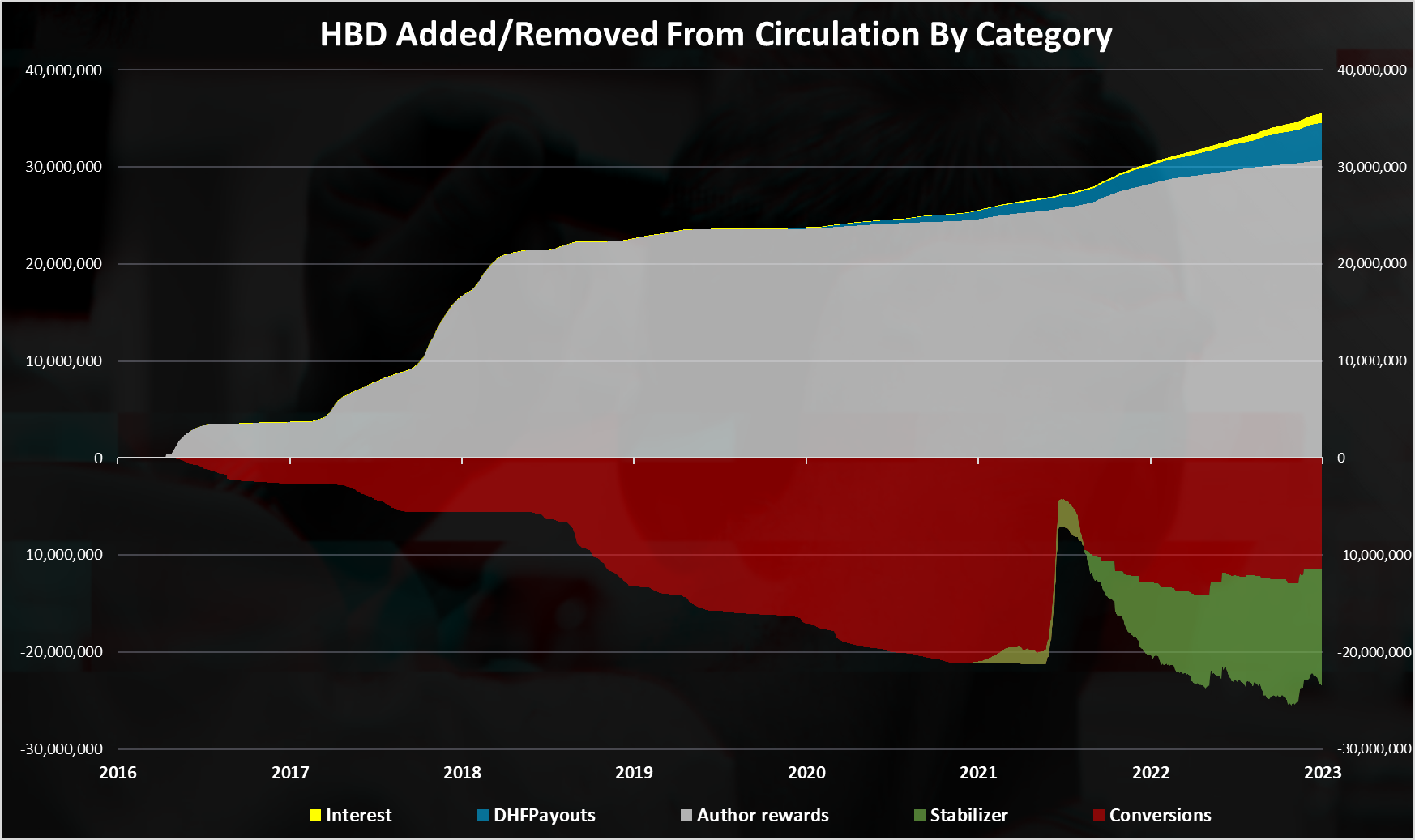

HBD Added/Removed From Circulation By Category

Here is the chart.

As we can see, in the past HBD was added in circulation only trough authors rewards and removed with conversions. Also, those conversions were only one way, HBD can only be removed and not added with conversions.

From 2021 we can see more dynamic on HBD side. First the stabilizer started working in 2021 and at first it started adding HBD in circulation because of inflated HBD prices. Later, in August 2021 there was much more HBD added in circulation when HIVE to HBD conversions were enabled.

Since then, both, conversions from regular users, and the @hbdstabilizer has mostly been removing HBD from circulation, although in the last months there was some opposite movements.

The current summary for the HBD supply looks like this.

| Category | HBD |

|---|---|

| Author rewards | 30,682,876 |

| DHFPayouts | 3,872,006 |

| Interest | 998,384 |

| Other | -291,877 |

| Conversions | -11,459,117 |

| Stabilizer | -11,955,249 |

| Total | 11,847,023 |

Things that are starting to take effect at 20% debt limit

First and most important HBD is still valued at one dollar at this limit and users can convert HBD to HIVE for a dollar worth of HIVE. But what is happening to the HBD printing?

Author rewards

At 20% the HBD author rewards stop being printed and all the rewards are paid in HIVE only. This is changed from the previous setup, where there was a slow transition in the payouts from HIVE to HBD. In the range of 9% to 10%, authors received liquid HIVE and HBD, depending how high the debt was. Now there is no transition zone and when the 20% is reached, authors stop receiving HBD as payouts. A sharp cut off. No new HBD printed from authors rewards.

Conversions

HBD can be created from conversions as well, converting HIVE to HBD. When the debt reaches 20% these conversions are disabled and are no longer effective. Meaning no more HBD can be created from conversions.

Here I want to add a note on the @hbdstabilizer. Not sure how will the stabilizer operate in conditions when the debt is high. I would guess that it will temporarily stop operating, because there is no point in providing liquidity when the peg is broken by design.

HBD Interest

What about the interest that is paid for HBD held in savings? The interest is not affected at 20% debt, and it is continued to be paid out. Although the interest rate is set by the witnesses, and they can decide at some point to adjust it. So, it is not hard coded but still flexible.

DHF Payouts

Another source for HBD are the payouts to proposals. The 20% debt limit has no effect on the payouts, but similar to the HBD interest rate, the DHF payouts are controlled by the stakeholders, and they can vote to remove funding to proposals.

As we can see from the above, at 20% the HBD printing is starting to get reduced, limiting the amount of HBD that is entering circulation. The HBD in circulation is still valued at one dollar. This is like a warning sigh to the blockchain that things are starting to get serious. Although notice that there is still a lot of room between 20% and 30%. Its not like the 9% and 10% as it was previously, meaning there is more room for maneuvering from the stakeholders.

Things that are starting to take effect at 30% debt limit

At 30% debt HBD is set to lose its peg and it is no longer valued at one dollar!

This is the upper limit for HBD printing and when it is reached, HBD will lose its peg, meaning all the HBD to HIVE conversions will no longer be valued at one dollar worth of HIVE.

Author rewards are all paid in HIVE, HIVE to HBD conversions are disabled, while HBD interest and the DHF payouts are left up to the witnesses and stakeholders to decide about.

What price will the blockchain value HBD after the 30% debt limit is reached?

This depends how high the debt is. If the debt is higher, the HBD price will be lower.

Example table:

| Debt level | HBD On Chain Price |

|---|---|

| < 30% | 1.00 |

| 40% | 0.75 |

| 50% | 0.60 |

| 60% | 0.50 |

As we can see from the table, for a debt level between 30% and 40%, the HBD on chain price will be in the range of 0.75 to 1.00. For a debt level higher than 50%, the HBD on chain price is closing on the 50 cents mark.

What usually happens when the debt increases and HBD is close to the haircut limit, or above it, more HBD is starting to be converted to HIVE, as users exit it, and the HBD supply drops.

As the HBD supply drops so does the debt level. In this way, the debt limit provides a balancing for the system as it forces users to exit HBD and reduce its supply. At the end it all depends on the price of HIVE.

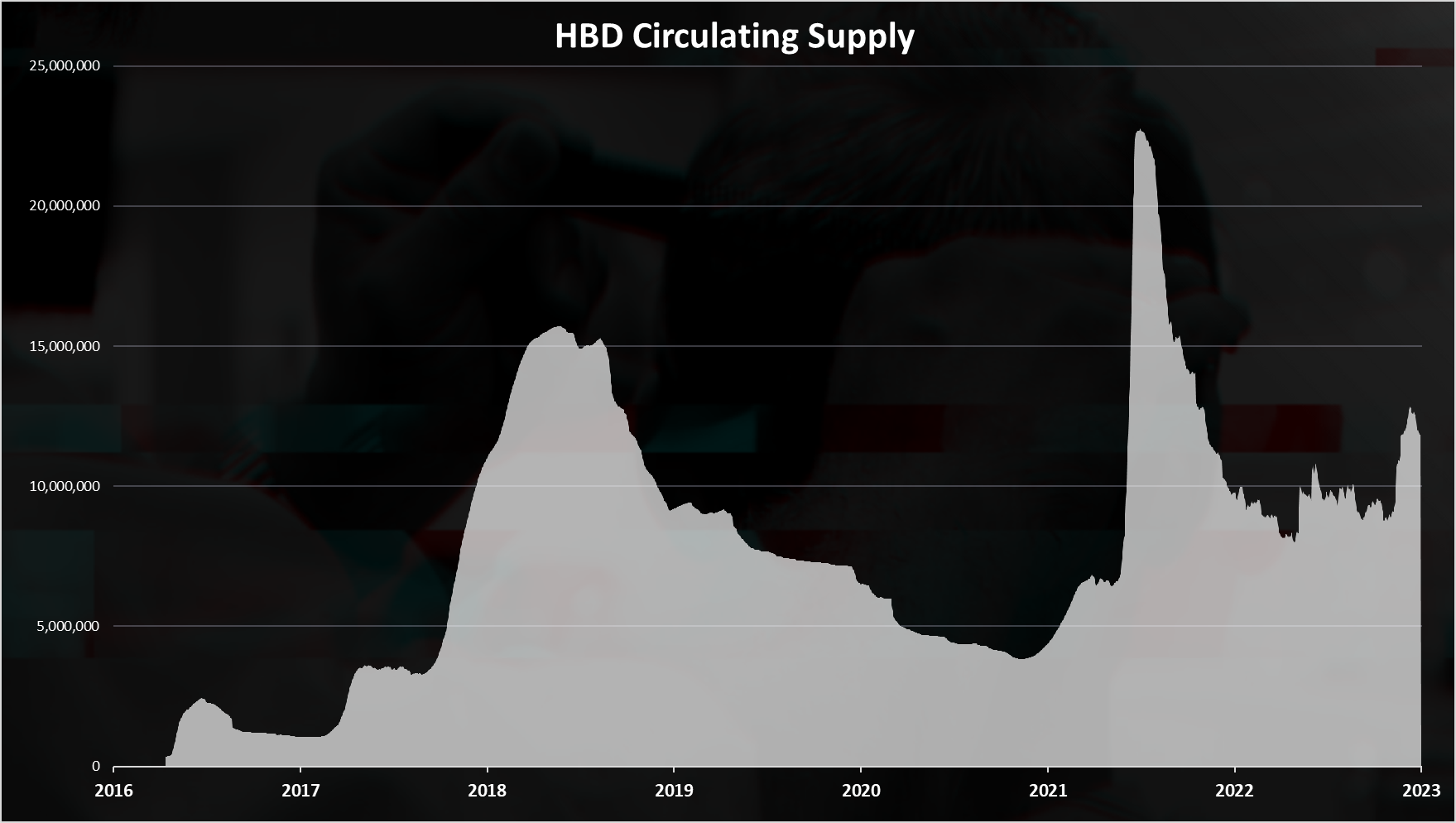

HBD Circulating Supply

When we sum the positve and negative numbers from the previous chart the HBD supply looks like this.

Note that this supply doesn’t include the HBD in the DHF. This is the HBD supply that is used when calculating the debt.

We are now around 11M HBD in circulation. For the most of the 2022, the HBD supply was contracting, while we have seen a small expansion in 2023. It is still far from the ATH back in 2021, when there was 23M HBD in circulation.

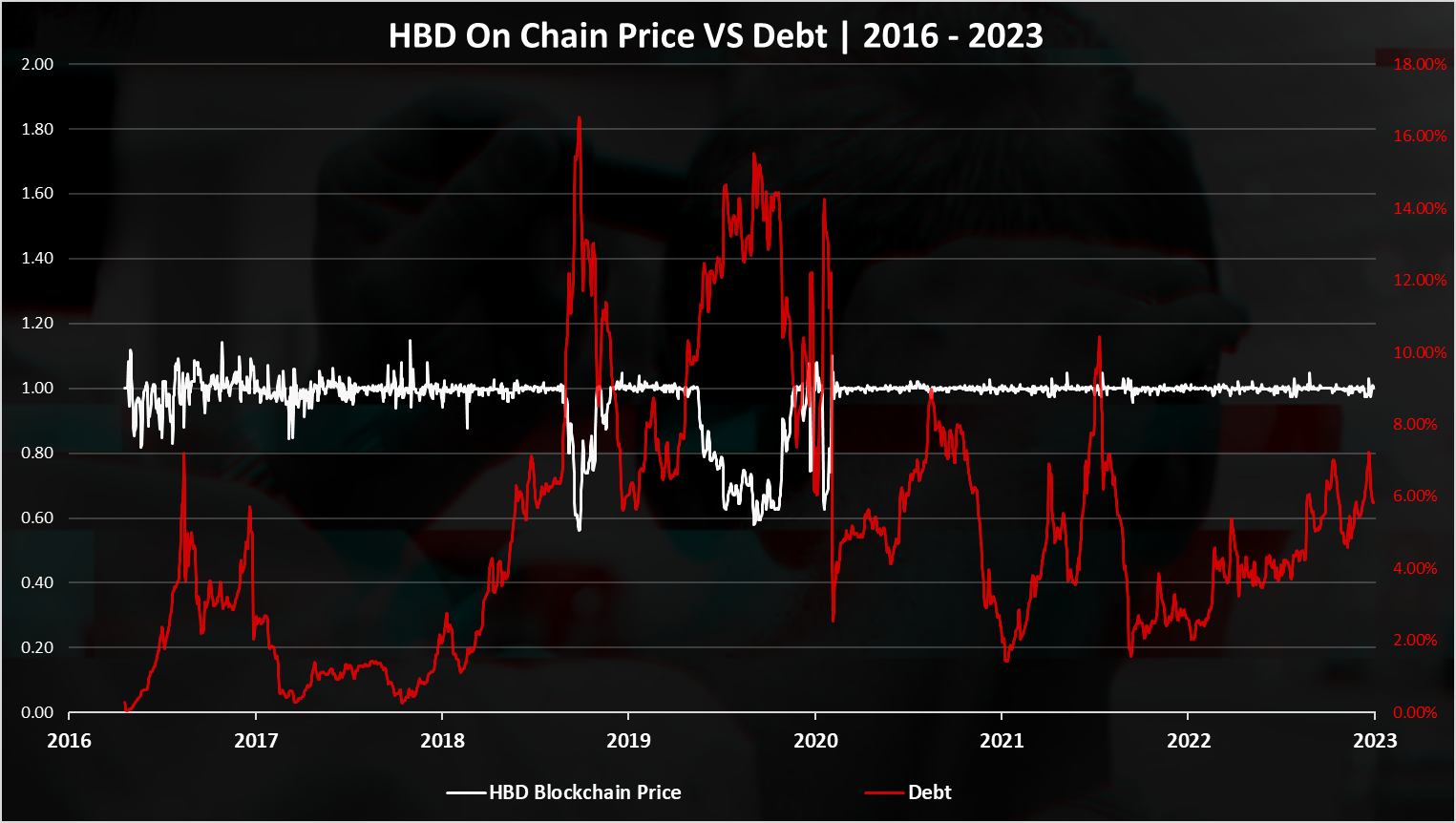

Hive Debt

The chart for the debt looks like this.

The red line represents the debt limits, and as we can see they have been increased on two occasions. The last one is a more drastic move from 10% to 30%. This has provided more room for the HBD supply and we are now far from the debt ceiling. The current debt is around 6%, while the limit is 30%.

We can see that there was debt limit was reached in 2018 for a short period of time when it comes to 17% and especially in 2019 when it reached 15% for a period of couple of months.

HBD On Chain Price VS Debt

The chart looks like this.

Note that this is not the HBD market price, but the on chain price, that the blockchain gives when HBD to HIVE conversions are made.

We can see the drop in HBD on chain price, as debt limits were broken. First back in December 2018 with a sharp drop and sharp recovery in a month period. Then again in the second half od 2019. As the debt level reached 16% in these periods, the HBD on chain price dropped to 60 cents.

As market conditions improved, the debt dropped and the HBD price recovered.

Since the Hive fork, back in March 2020, till today, a full three years, HBD has not lost its peg.

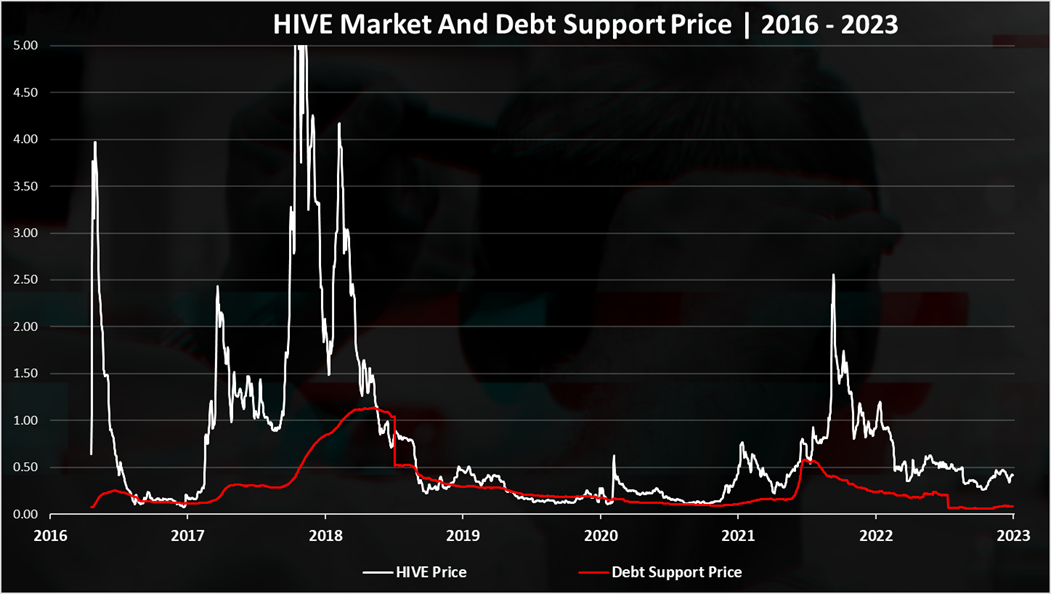

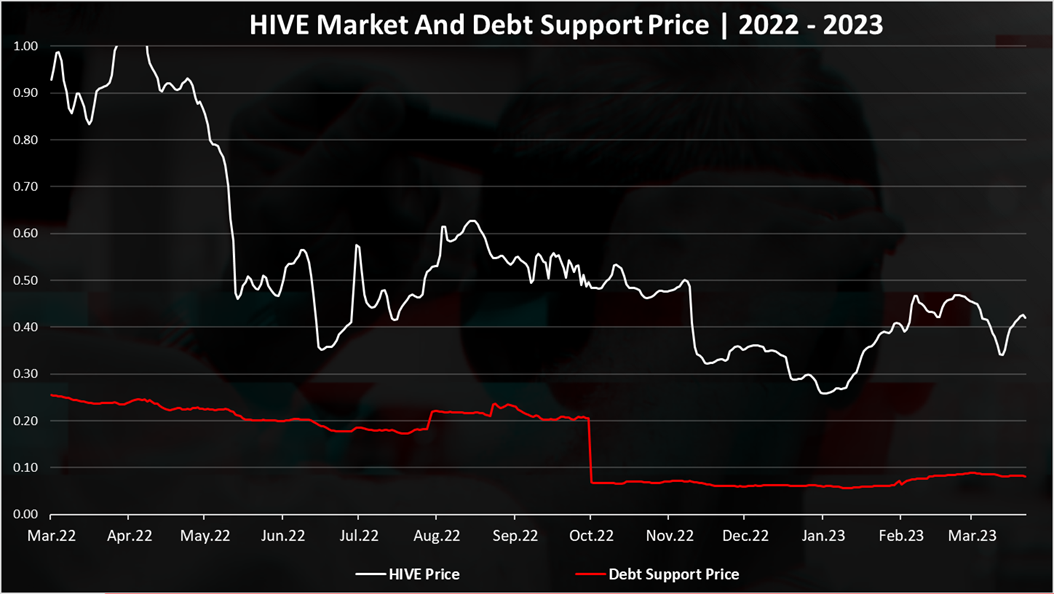

HIVE Market And Debt Support Price

A bit more easier way to check the HBD health is to look at the HIVE price that supports the current HBD market cap. This is the price to which HIVE can drop and there wont be a haircut in the HBD peg, for the current HBD supply.

Here we can notice the sharp drop in the price back in 2018, when the HIVE price dropped below the support levels.

As the HIVE price drops, HBD is started to being converted to HIVE and removed from circulation, reducing the HBD supply and pushing the support price lower.

We can note a bit of unusual situation in 2021, when the red line had a spike. This is due to the increase in the supply of HBD. The HIVE to HBD conversions were enabled at this point, and when the HBD prices increased, users were making arbitrage and creating HBD.

Overall from the above we can notice, while the HIVE market price has dropped bellow the debt support level, it has never dropped significantly bellow that. Whenever this happens, HBD is getting destroyed and the support levels drops as well.

When we zoom in 2022 – 2023 we get this:

We can notice the drop in the support price in October 2022, from 20 cents down to 7 cents. This is because of the increase in the debt limit from 10% to 30%. Since then, we are hovering in the range of 6 to 8 cents, support price for the HBD in circulation, while the HIVE market price has been in the range of 30 to 50 cents.

Summary

The main changes for the Haircut rule is the increase in the debt limit from 10% to 30%. The other change is that there is now a lot more room in the transition period so to speak, from 20% to 30%, unlike the previous 9% to 10%.

When the debt limit reaches 20%, HBD is still valued at $1, but the HBD issuing is limited, no HBD author rewards and no HIVE to HBD conversions. This limits the HBD supply as a first step in preventing HBD deppeg. If this is not enough, then at 30% HBD will deppeg in a controlled manner.

In the past, HBD, formerly SBD has lost its peg on two occasions, but also has recovered from there.

At the moment HBD is in a healthy spot, with a debt level of 6% far from the 30% limit. The support price is also much lower than the market price, a 8 cents vs the 40 cents market price. Thing is if HIVE market price drops, so will the HBD supply and this will further push the support price lower, as we have seen it happened in the past.

Since the Hive fork, a three years ago HBD has not entered in deppeging event, but quite the contrary it had a market pumps on the upside. This doesn’t means it wont happen again, but at least we know that there is a mechanics in place to prevent death spiral and LUNA, UST scenario. Apart from the debt limit and the HBD deppeg by design, the price oracle for the conversions, that is 3.5 days long is another safety mechanism as it prevents instant and violent price actions to have a significant effect on the conversions.

All the best

@dalz

Posted Using LeoFinance Beta

Thanks for this great info. When we look at HBD in terms of debt, it sounds very much like fiat we are talking about. Is there any similarities?

No, its not at all the same.

HIVE is acting as a collateral and backup for HBD, with clear rules and mechanics in place, all transparent and on chain for everyone to see.... while in the fiat world, the currencies are issued without any collateral (use to be gold), debt is actually money, and there are a ton of hidden things.

We can debate how good of collateral HIVE is, but that is becoming a very wide debate for what gives things values etc ...

Fiat is totally uncollateralized. HBD is a collateral currency, just one where the collateral is extracted through the dilution of stake. It is functionally more similar to an equity-convertible bond than either fiat or commodity currency.

Posted Using LeoFinance Beta

Thanks, that makes sense.

https://twitter.com/1012995341468295168/status/1639245081961005058

https://twitter.com/18214974/status/1639248099389349888

https://twitter.com/1456718443789447170/status/1639251022806745088

https://twitter.com/1331330355513745413/status/1639264115301466114

https://twitter.com/739093769434238977/status/1639269439970394116

https://twitter.com/716646750602309632/status/1639280614066081792

https://twitter.com/1366686073250865153/status/1639293220382294016

https://twitter.com/1472693700933345286/status/1639371482760462342

https://twitter.com/27706436/status/1639529514135965698

https://twitter.com/1527185679549345792/status/1639629343302230016

https://twitter.com/1415155663131402240/status/1639991468449497089

The rewards earned on this comment will go directly to the people( @dalz, @joanstewart, @allentaylor, @taskmaster4450le, @manuphotos, @ferod23, @elyelma, @kalibudz23, @seckorama, @documentinghive, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Is there a source where we can easily view the current debt ratio in real time, or a weekly snapshot?

This gives live info:

https://hive.ausbit.dev/hbd

This will be really helpful.. thanks for the info

Thank you.

For a daily snapshot, you can check my stats (section 2 - supply)

Cheers :)

Your posts are always very informative, thank you much for giving very deep knowledge about HBD and I am pretty sure that most of us including me didn't know anything about that before reading this post.

Thanks for the in-depth review on workings on Hive's financials, always easier to understand when utilizing graphs.

@tipu curate

Upvoted 👌 (Mana: 2/52) Liquid rewards.

Thanks!

👍 concise and clear, thanks!

Thank you very much for sharing your valuable information with us. Because of you, many things have become clear and we have learned many new information.

A very nice informative post and you have nicely highlighted the overall situation of HBD, thank you.

I really enjoyed this information. thank you very much😘😘😘

This might very well be the first time someone explaining HBD and the haircut rule and how it all works in good detail that makes sense.

Thank you ser ;)

Do you know the difference between HIVE/HBD and LUNA/UST?

Yes, it is in this post :)

I don't know the mechanism of UST/LUNA (I don't have any investment in LUNA. So lucky I am)

I just think if LUNA/UST can swipe 15b market cap so 150m of HIVE can also be swiped.

What if the users exit HIVE because of the low HIVE price and debt level increases again, then HBD loses its pegged again, users keep exiting HBD and then exiting HIVE ... Does it look like a death spiral?

No because, the HBD supply will drop, but also the HBD price will drop as haircut kicks in, and it cannot put a lot of new HIVE in supply. That is the role of the haircut rule.

There is a cap how much HIVE can be created from HBD, even at low HIVE prices.

Plus this will not play out fast, as the UST/LUNA did, because of the 3.5 days price feed.

This is battletested and has happened in the past, as you can see from the post.

Okay. It's too complicated for me but as long as it's not bad then it's good. 😆

Wow... Insightful as always... so beautifully explained with those graphics as well...

But if the current dept is at 6%, HBD, why is the ceiling was it incresed to 20%?

is it because that was necessary... 30% HBD, means it gives more room for increase of HBd supply because price fall made it necessary... but at the same time efforts are made to decrease the supply of HBD is it, so that ceiling limit is not reached?...

Bt if current dept is at 6% why stop HBD rewards when there is room, quite a bit of room?

This is beautiful mechanics ad fasinating... i need to re-read it again to visualize things becase I am not getting it crisply why its marked danger zone now, and efforts made to reduce supply of HBD, when ceiling has increased...

I did a real haircut for myself today(:... but there are other types of haircuts, cost cutting measures of companies, and now HBD haircut...

But we can still convert Hive to HBD now...3.5 day period or that's prevented...

Brilliant and very must read article, for any Hive user for sure!!

Thanks dear for this piece...!! ... I always love your insightful posts, they are fun for me!!

Until now, i haven't been able to undestand HBD mechanism to stay on the peg. Thank you so much for the explanation, it has make my day. Keep making this awesome content!

Posted Using LeoFinance Beta

What an amazing and educative post about HBD. This post give me more insight regarding HBD and thanks so much for sharing this wonderful post.

With this it's very clear that investing on HBD regardless of Market situation is definitely safe

Posted Using LeoFinance Beta

🚀🚀🚀

Good stuff bro! bring more

Its a great confidence booster when you analyse in details. I now have $26 in HBD savings !

Quality posts as always @dalz

Happy weekend! 😉

That is an outstanding explanation of a complex system. Thank you!

Posted Using LeoFinance Beta

Thank you - for the first time, an explanation I actually understand (yeah, I'm a thicko like that....)

So if I understand right, in order to avoid the haircut kicking in, the little bit I can do is to make sure I power up around 3 times more HIVE than I buy HBD, and to buy more HIVE when the price is low in order to help push the price up.

This is wonderful info. Thanks a lot. I'm definitely gonna put a Million in $HBD savings in the bull market.

And I hope it pumps also😂. $1.6 will do🙂

Posted Using LeoFinance Beta

This is a very informative post.

According to what I've read, the price of HIVE will fall in the future due to less demand and more supply.

Isn't it?

No :)

You realy cant tell what the future will be ... its equaly possibe to have more demand and less supply as it happened in February

This is very awesome presentation. Actually this is my first experience it hearing HBD Haircut

Great analysis and explications on the HBD haircut rule and the scenarios in which HBD can depeg.

Posted Using LeoFinance Beta

fantastic charts!

@tipu curate

I have finally decided to start saving those HBD... Or at least half of it every other day.. The other half would be going towards buying Hive and then ill try and trade with it. I know this isn't what you spoke of but still😂 it's all profit on profit

I understand that the fluctuations in HBD's value may cause concerns, but it's important to remember that HBD is designed to be volatile in a controlled manner, and its haircut rule is in place to protect the stability of the Hive blockchain. It's impressive that HBD has taken a unique approach to stablecoins and embraced the volatility of the crypto market. Your post provides valuable insights for the Hive community and anyone interested in HBD. Keep up the good work and continue sharing your knowledge and experience. Remember, every challenge is an opportunity to learn and grow, and I believe you are doing an excellent job of navigating the complex world of cryptocurrencies.

https://leofinance.io/threads/@leogrowth/re-leogrowth-jzmk9mjk

https://leofinance.io/threads/@seckorama/re-leothreads-kqjnbxsy

The rewards earned on this comment will go directly to the people ( leogrowth, seckorama ) sharing the post on LeoThreads,LikeTu,dBuzz.

There are several major inaccuracies in your post:

This is not what we refer to when we talk about the "haircut rule"!

The haircut rule is the fact that when the debt ratio is higher than predefined thresholds, the blockchain will slow down or even stop printing new HBDs for some of its HBD creation mechanisms.

Again, this is not correct. The debt limit has no direct influence on the price, but only on the printing of new HBD. The price is driven by market forces, not by the blockchain. The HBD might lose its peg, which is very likely, but it might not.

There are 5 mechanisms involved in the creation of HBD:

This is not correct. If the debt ratio reaches 20%, the blockchain will start to slow down HBD printing as defined in the blockchain code (database.cpp / line 5370). Authors will be paid with both HBD and HIVE. It's when the debt ratio reached 30% that the payouts will be HIVE only. If this were not the case, there would be no point in having two thresholds.

This is not correct!

The haircut rule has no influence on the payment of DHF proposals for the simple reason that it is not at that time that new HBDs are printed.

It is the provisioning of the DHF which is the source of creation of these new HBDs. Even when no proposal would be supported by the community, meaning no proposal payouts, the blockchain would continue to create new HBDs and add them to the overall budget. There is no way stakeholders can influence this dynamically.

It should also be noted that the DHF payouts are not part of the HBD supply. They are just HBD transfers from @hive.fund to the proposal recipients.

I invite you, as well as the readers of this post, to read the post I wrote about the debt ratio.

I have read your comment, will come back with more detailed response, some of the things you are mentioning are correct, some are not...See comment above

Hehe, a great debate in perspective...

Thanks for your feedback!

Here is my commentary.

This is mostly wording, not sure is there is a definition about what exactly is the haircut rule. For the regular user the important thing is that HBD is no longer one dollar, and this is what I have been referring here.

Referring to the overall process, stop printing HBD and then lose the peg is a good point.

I have pointed out in a several places and it the cited sentence that we are talking about the on chain HBD price, not the market price. The price that the blockchain values HBD when converting to HIVE. The market price can be totally different, in fact this is now the case for SBD, where the debt limit is reached but the speculators keeps the prices above one dollar. But I have made a clear distinction between these two type of prices.

For this part I think its important to distinguish the total HBD supply and the available (?) HBD supply. What I mean by this, is will we include, or exclude the HBD in the DHF. For the debt calculations the HBD in the DHF is excluded, and because of this I have taken a look at the available HBD. If we look how HBD enters circulation as available HBD, then its the points I have mentioned, while if we look how HBD enters the overall circulation then it is the points you have mentioned. But for the debt calculation the HBD supply that counts is the available HBD.

This was one of the surprises for me, but its true. There in lower and upper soft limit. The upper soft limit is now taken down to the lower soft limit, but the hard limit remains. In short the point I have made is valid, there is no transition period in which authors receive, both HBD and liquid HIVE as rewards, but it sharply switch to liquid HIVE only. I have consulted @andablackwidow for this and he has pointed out this is the case.

Here again we come to the point in the two different types of HBD supply. Total and available. The available supply is what counts for the debt (excluding the HBD in the DHF), and when DHF payouts are made, that increases the available supply and the debt levels.

Words are important, especially when it comes to definition.

The "haircut rule" exists because it is implemented in the code (and the code is the law).

As we are in the computer science scope, the definition of "rule" here is the scientific rule of inference: "a term in logic for a function which takes premises and returns a conclusion", i.e. "if this then that" in layman's language.

In the case of the haircut rule, the "this" is "the debt ratio has exceeded a threshold" and the "that" is "HBD printing rate change". This is what is defined in the code and it makes no reference to the HBD price.

Everything else is a side effect of the application of the rule but is not the rule. So referring to "HBD is no longer one dollar" is not referring to the rule but one of its potential effects.

The price at which the blockchain converts HBD to HIVE is proposed by the witnesses, which in turn is based on their observation of the price of HBD on the external market. We can therefore deduce that the price of HBD is defined by the market and not by the blockchain itself. So I have trouble conceiving an "on-chain HBD price". But I wouldn't dwell on this subject because in this topic it is indeed more a question of semantics.

That doesn't change the fact direct influence of the haircut rule is on the printing of HBD, not on its price.

In this part of your answer, you are going off-topic. Your paragraph concerns "let's take a look at all the ways HBD is printed". The fact is that one was incorrect and one was missing, even if we agree that the DHF Budget does not enter into account in the calculation of the debt ratio.

You get the point here.

I missed the fact that the "soft-low" and "soft-high" thresholds were set with the same value since HF26 (config.hpp/ L301 for those who want to check the code). Previously the "soft-high" threshold was the same as the "hard" threshold. There is therefore effectively a sudden stop in the printing of HBDs as soon as the debt ratio exceeds the "soft-low" threshold.

The title of your section is "But what is happening to the HBD printing?" and you later refer to "DHF payouts" as "Another source for HBD", which is incorrect.

Even if we agree that the DHF payouts have an influence on the "available" HDD supply and the debt ratio, although I can understand your reasoning, I think that you are mixing several concepts here, which only adds confusion.

I have on purpose focused on the availble hbd supply here and cut off the other things, as hbd in the dhf and how hbd is added there for simplicity on what is already a bit of complicated topic, to make it more understandsble to the general public.

Going into the three types of debt limits, low soft, high soft, hard limit ... adds complexity ... also about the prices, when the hard limit is reached its the price of hive on the internal market that increases, not the hbd, but again more complex.... overall we can agrree there are a lot of details here, and I tried my best to make it easier to understand to the general public.... although I can understand the points from someone who is more into the topic and has deeper understanding how things works.

Thanks again for the feedback!

This is liquid gold @dalz. Thanks for the detailed explanation.

Posted Using LeoFinance Beta

Witnesses are just like the law makers in our countries lol

I still love the age conversation in hive .

#LeoFinance

I never knew HBD was designed to depeg. That actually seems like a great time to buy a stack of it, and put it in savings!

This post has been manually curated by the VYB curation project

Excellent info and just helps keep me as a Hive maximalist. !ALIVE

Posted Using LeoFinance Beta

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @hankanon. (1/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Thanks much, @dalz, one could not explain better and still, it seems I'm hermetic to understanding these notions, it's a shame, I tried and tried, and was explained again and again, but can't get to understand all this.

Test

@misshugo read through this, it might give a better understanding.