The Battle Of The DEX | Uniswap VS Curve | Data On TVL, Volume, Users, Top Pairs

Uniswap and Curve has been the two major defi apps. Both initially started on Ethereum and then spread to other chains, but with the majority of the liquidity still on ETH.

Let’s compare these two and see how they are doing once they are aligned next to each other.

Here we will be looking at:

- Total value locked

- Trading Volume

- Uniswap V2 VS V3 in trading volume

- Number of users

- Top Pairs

- Marketcap

The period that we will be looking at is 2022 - 2023.

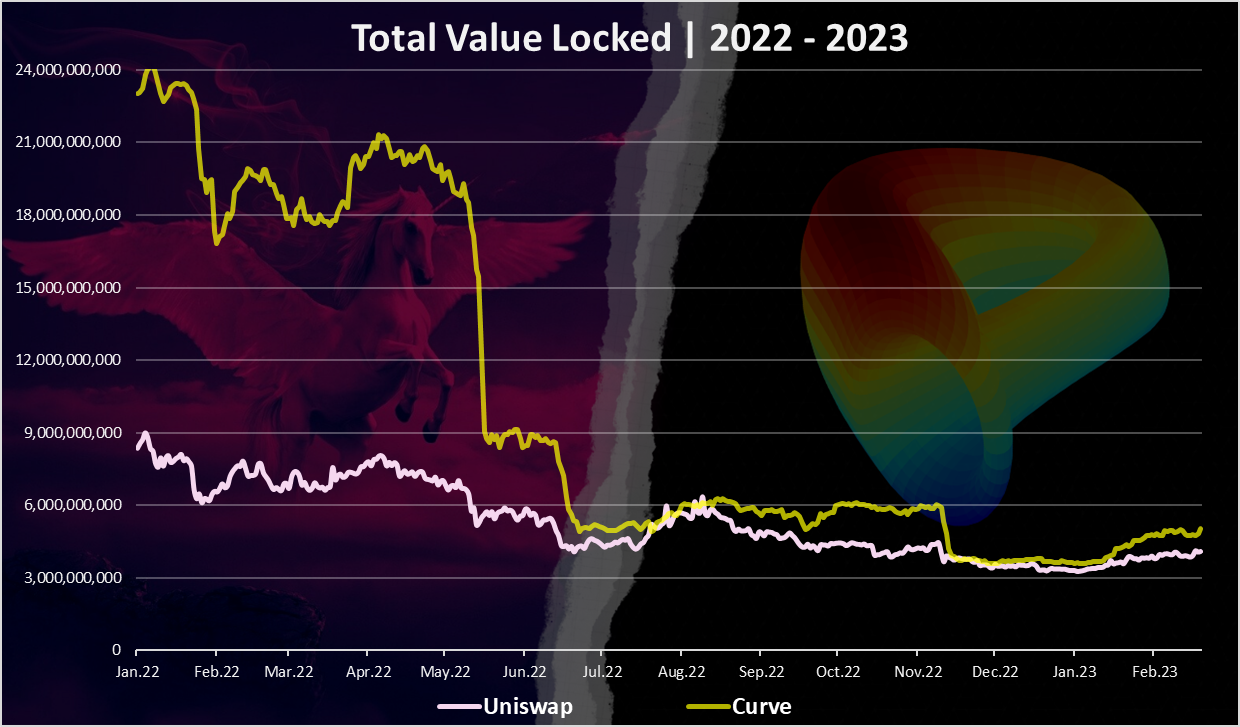

Total Value Locked

Here is the chart.

As we can see Curve was leading here by a lot at the beginning of 2022. At the time Curve had around 24B in TVL, while Uniswap was just around 8B. Three times more TVL on Curve.

But then in May 2022, the collapse of UST happened, and we can see a sharp drop in the TVL on Curve from 18B to 9B just in a period of few days. Obviously, UST hit the stablecoins a lot, and especially the pools on Curve.

From the summer of 2022 these two are quite close in TVL value, with Curve leading with a small margin. In November we can notice another drop in the TVL, and again Curve dropped by more. The TVL on both apps reached lows at 3B.

In the last months there is an increase in the TVL again and we are now at 4B in TVL for Uniswap and 5B for Curve.

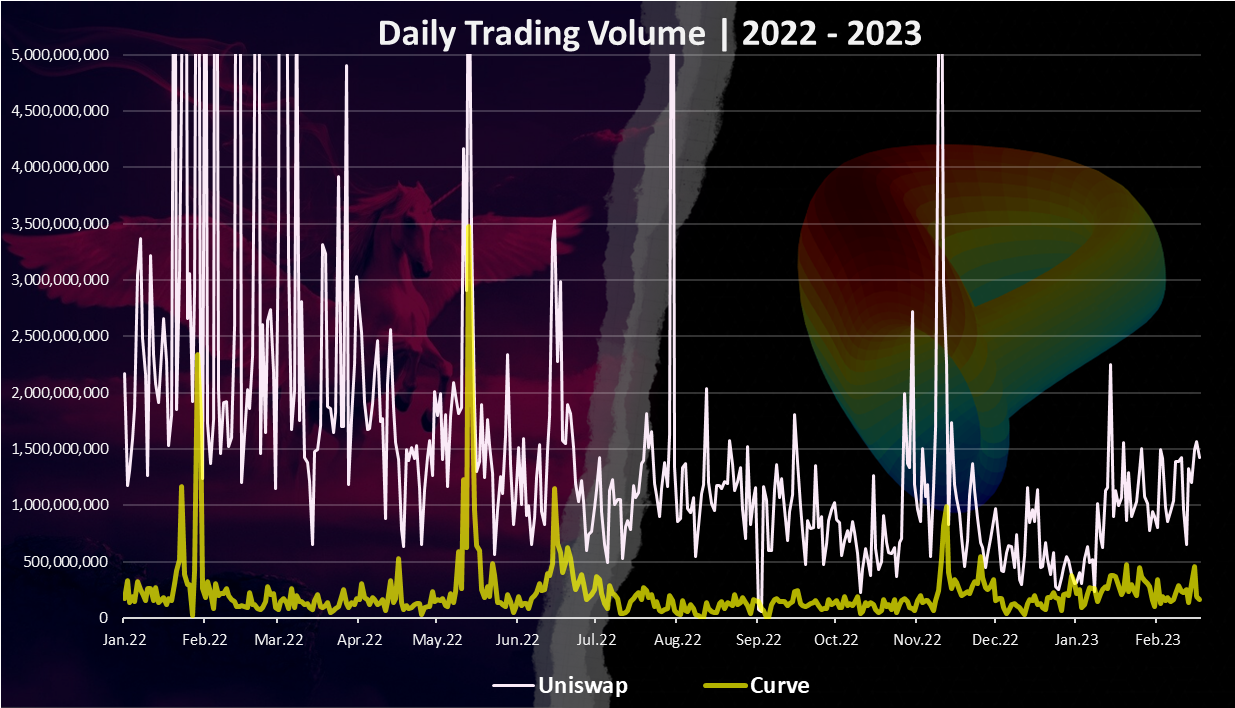

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

We can see a lot of volatility when it comes to the trading volume.

Uniswap is oscillating a lot, while Curve has some volatility when there are major moves in the market.

In the last year Uniswap had trading volume more than 5B on few occasions, while Curve was mostly under 1B for the whole year, just with few spikes.

In the last months the trading volume has increased again, especially on Uniswap, reaching 1.5B. On Curve the trading volume has been around 200M daily.

Uniswap is leading by a lot in terms of trading volume.

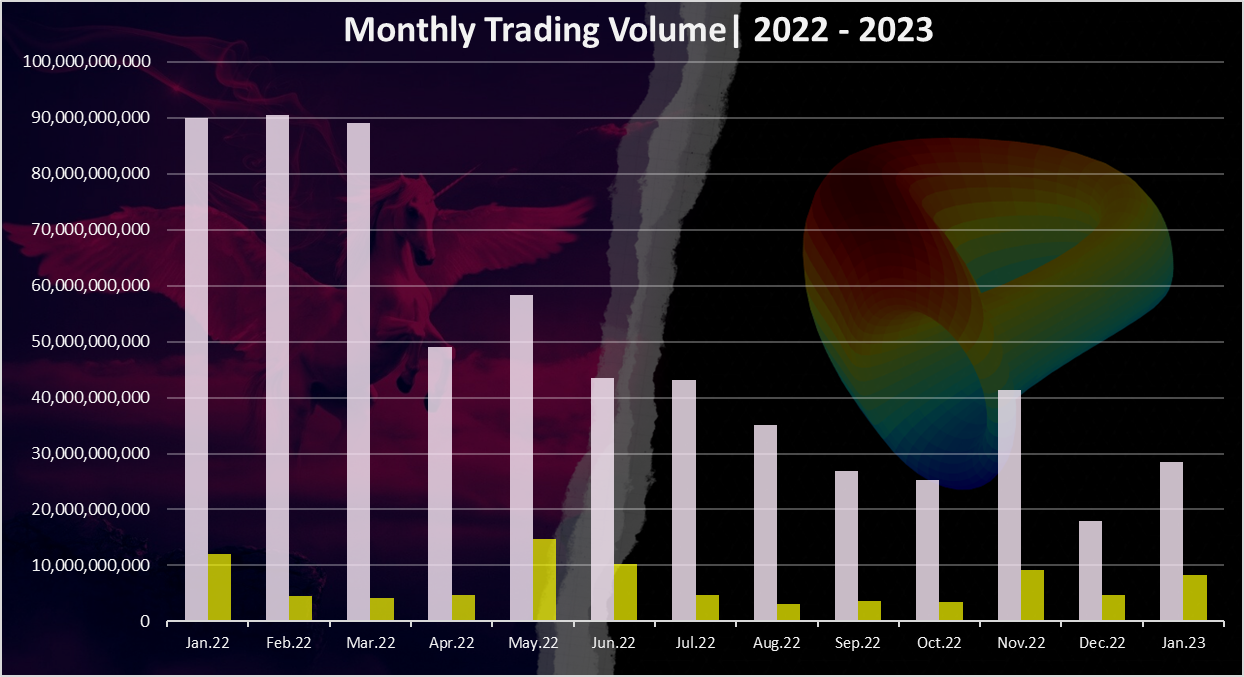

The monthly chart looks like this:

Here again we can see the lead of Uniswap. In the last month, January 2023, there was 28B trading volume on Uniswap, vs 8B on Curve. While the difference is still big, in the last year January 2022, the numbers were 90B to 10B, that is much higher then what we have now, meaning Curve has closed the gap a bit.

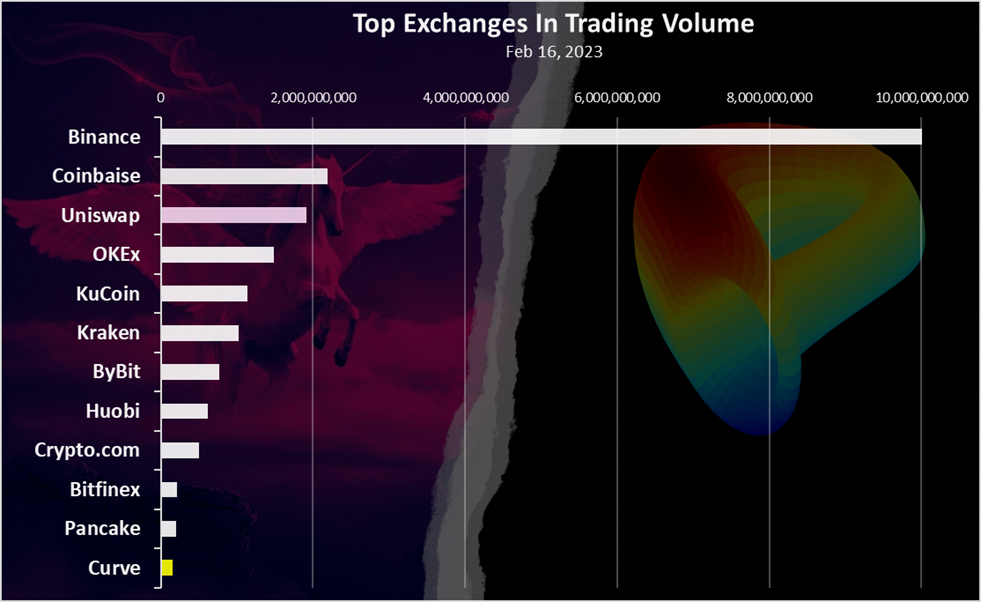

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for 24 hours:

Uniswap ranks on the 3th spot, just behind the two big boys Binance and Coinbase. Curve is down on the ranking, but it is still managing to enter in the top exchanges list.

Obviously Uniswap is a bigger competitor to the big CEX than Curve. Curve is having its niche in the stablecoins arena.

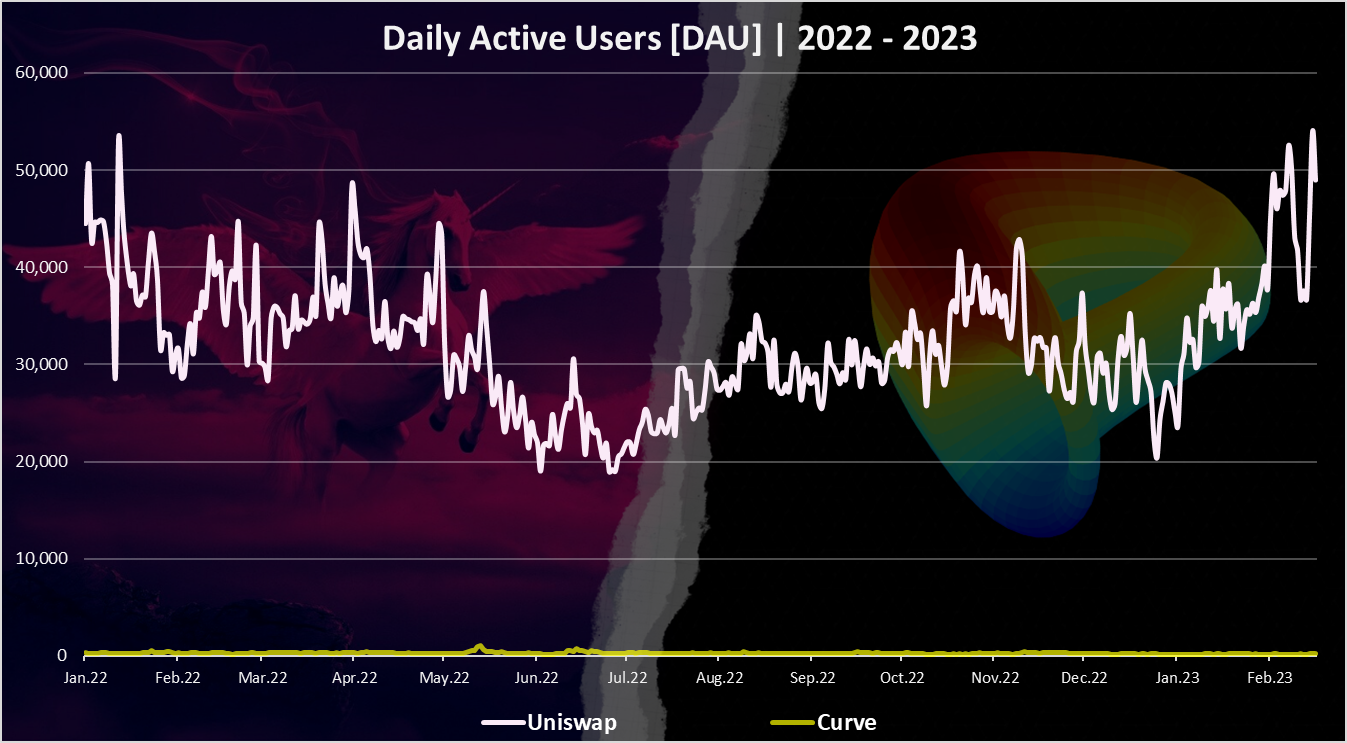

Active Users

How many users Uniswap has? Here is the chart.

In terms of users Uniswap is leading by a lot. Curve is barely visible on the chart, with the yellow line close to the x axis.

Uniswap now has around 50k DAUs, while Curve is in the range of few hundreds. Seems like Curve is more of an industry liquidity provider, not a regular users one.

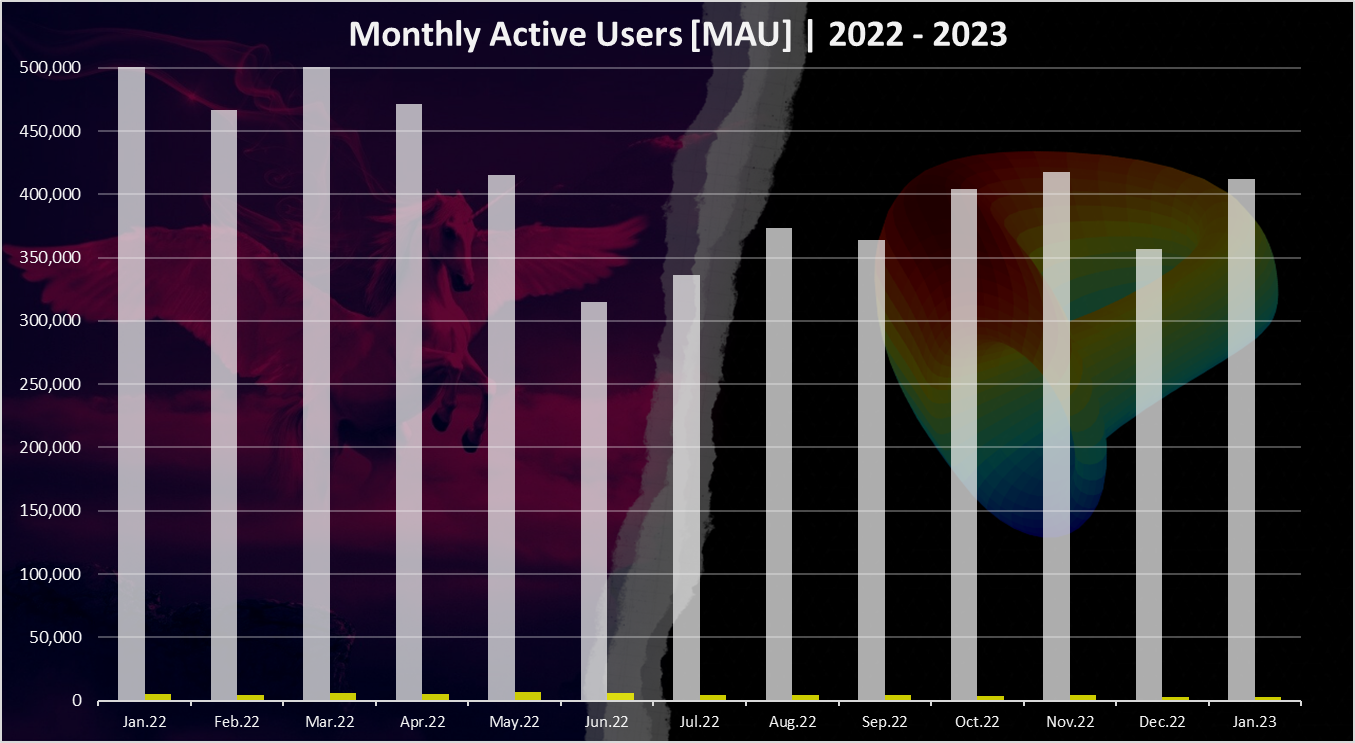

On a monthly basis the chart looks like this:

The month chart tells similar story. A big lead for Uniswap. 400k users in January 2023 for Uniswap and only around 3k for Curve.

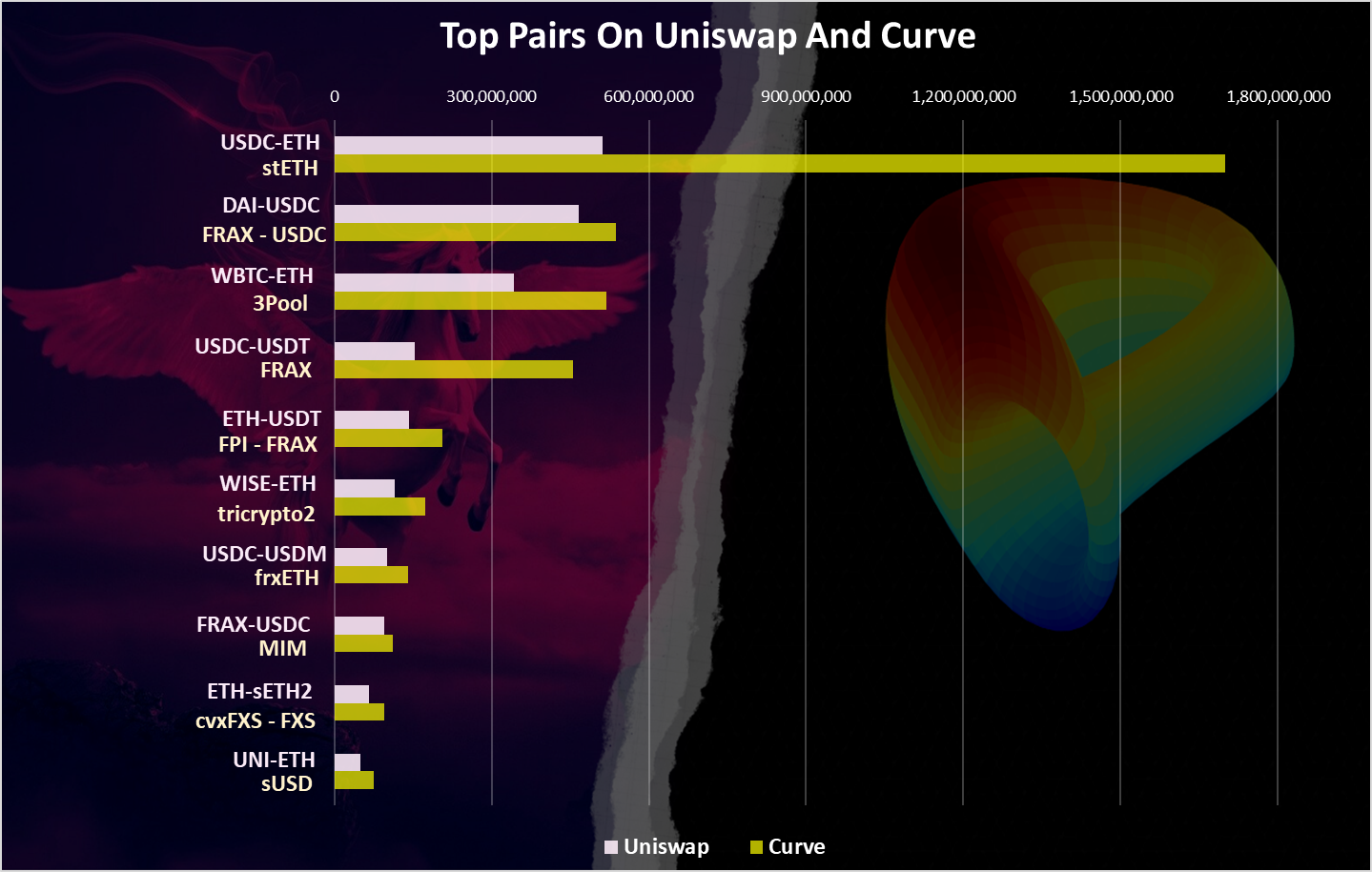

Top Trading Pairs on Uniswap

Here is the chart for the top trading pairs ranked by liquidity.

In terms of top pairs, Curve is leading with its staked ETH, stETH pool. A 1.7B in the ETH-stETH pool on the Curve pool now. Obviously staking ETH is an attractive thing now, and a lot of users and whales are taking advantage of it. On Uniswap the number one pool is the USDC-ETH with 500M.

Interesting the FRAX pool is on the second spot on Curve with 530M, while on Uniswap the DAI-USDC pool.

Overall as we can see from the chart, the Curve pools are bigger than Uniswap, that is understandable because Curve has overall higher TVL than Uniswap.

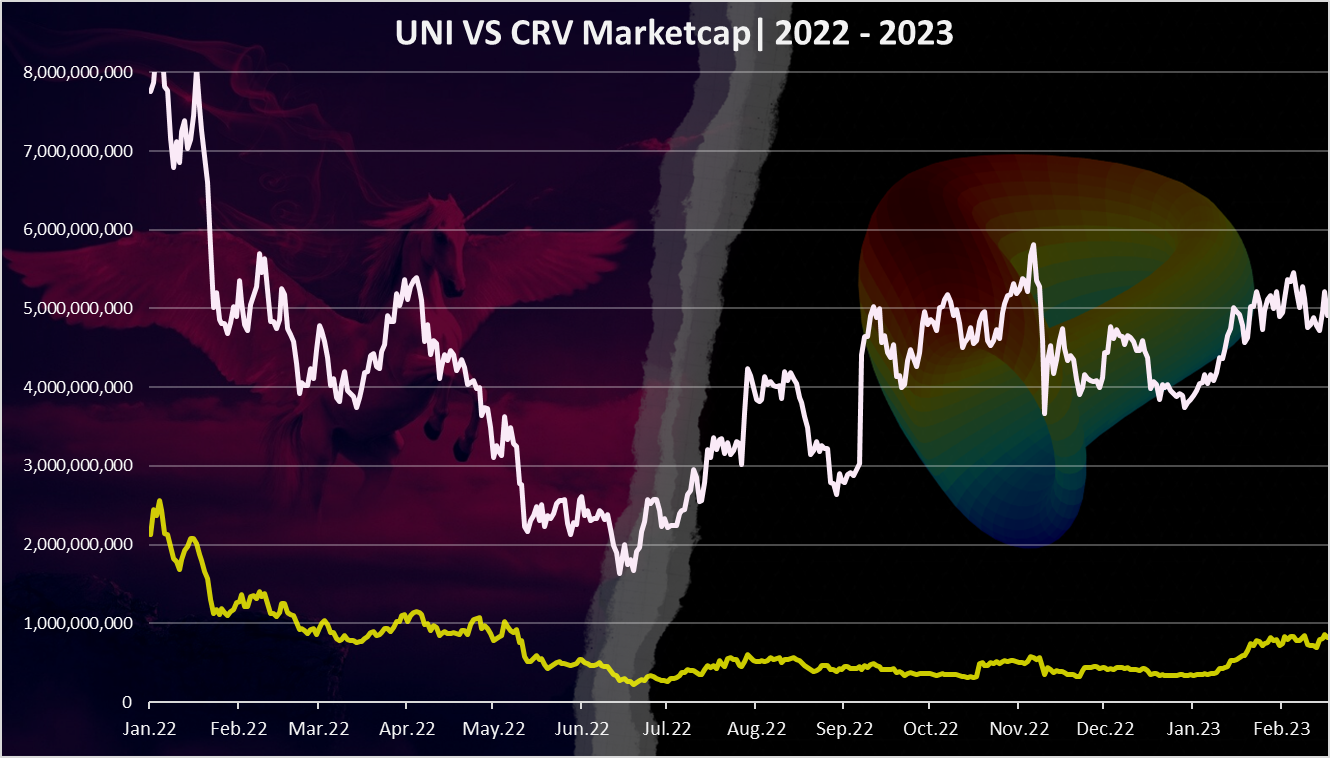

Market cap

When we compare the market cap for these two apps, we get this:

UNI is leading by a lot in the whole period. In the last period UNI is around 5B in market cap, while Curve is almost at 1B. A 5 to 1 ratio.

In summary Uniswap is obviously is leading by most of the metrics, trading volume, users, market cap, but Curve is leading on the TVL side. Stablecoins can attract a lot of capital obviously, but its interesting that staked ETH is also a major pool on Curve now, that has by far the highest TVL. Since stETH is a derivative of ETH, this pool is similar to USD pools, and Curve has provided the highest liquidity for trading these two assets, stETH-ETH.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/1012995341468295168/status/1628747994345402368

The rewards earned on this comment will go directly to the people( @dalz ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Personally, I have never done any transaction on CURVE, but I have used UNISWAP many times. But there are also a lot of transactions on CURVE as well which is not so bad.

Yea as mentioned above, Curve is more like for the industry/company scale users

can't wait for PulseX to blow all these out of the water

What is that?

The premier Dex on Pulsechain when it launches. Uniswap and other dex's will be forked over but there will be many reasons to use PulseX instead.

That is most likely where most of the liquidity will go

There will be an additional incentive token for liquidity providers

But honestly, the biggest thing about PulseX will be the buy and burn function. A portion of the trading fees (which is 0.29% while uniswap is 0.3%) will go in a pool that has a public function to buy then send to a null address, thus, buy and burn.

Pulsechain isn't even out so you haven't missed out on anything. Plenty of time to do research I am not a financial advisor just letting you know you'll run into plenty of FUD so have fun lol

https://leofinance.io/threads/@cryptodonator/re-leothreads-4dtfix

The rewards earned on this comment will go directly to the people ( @cryptodonator ) sharing the post on LeoThreads.

Uniswap is an exchange that I use and for token. Whereas Curve is just for buying !

https://reddit.com/r/CryptoCurrency/comments/11ahf5l/the_battle_of_the_dex_uniswap_vs_curve_data_on/

The rewards earned on this comment will go directly to the people( @acidyo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for making this comparison, I don't know either of the two exchanges well. From your post, if I understand correctly, it seems to me that Uniswap is more used than Curve. I've always heard more about Uniswap than Curve !CTP

Posted Using LeoFinance Beta

Ouch!! Uniswap totally crushed curve and sent them a curved ball at every pitch.

I honestly wanted to see a good enough competition. I see uniswap coming up against coinbase. Earlier this year they were able to handle more ethereum transactions that coinbase.

The SEC will also swallow coinbase and all the other centralised exchanges also.