The Haircut Rule, The Biggest Risk For The HBD Price | Historical Data On Hive Debt and HBD Price

The native Hive stablecoin HBD has been on a move in 2021 with some significant improvements that lead to better economics. First the @hbdstablizer started operating in February 2021, a full year now, and it has been on the front row in maintaining the HBD peg. The DHF budget also significantly increased in the last year, going from 1M to more than 12M HBD now. This bigger budget allowed for bigger daily payments, ergo more liquidity for HBD on the internal market. Furthermore, with the HardFork in the summer of 2021 a HIVE to HBD conversions was enabled, meaning that HBD <-> HIVE conversions are now possible in both ways. Another great thing is that HBD now has a 12% APR for HBD kept in the savings wallet.

With all this improvements and push for HBD stabilization, adoption and expansions it’s time to take a look at probably the biggest risk for HBD and that is the haircut rule.

What Is The Haircut Rule?

Hive Backed Dollars, as the name suggest are backed by HIVE. What this means is that each HBD can be converted for one dollar worth of HIVE through on chain conversions where HBD is destroyed and HIVE is created. The blockchain guaranties a HBD at one-dollar thorough HIVE. No matter what the price of HBD on the external markets is, when a conversion is made on the blockchain from HBD to HIVE, the returned HIVE will be valued at $1 per HBD. This conversion lasts for 3.5 days and an average price of HIVE is taken for the period.

Since HBD is backed by HIVE, HBD acts as debt of the blockchain.

The debt is calculated in the following manner:

DEBT = HBD in circulation / HIVE Market Cap

HIVE Market cap = HIVE Virtual supply * Feed price

HBD In circulation = Total HBD – DHF Holdings

The haircut happens when the debt of the blockchain is higher than the predetermined limit by the blockchain. At the moment this limit is set at 10%.

When the debt limit is reached the blockchain no longer guaranties a one dollar HBD when HDB is converted to HIVE. The highest the debt the lowest the price for HBD from the blockchain. This mechanism is put in place to prevent a death spiral.

For example, if the debt is at 11%, the HBD price from the blockchain will be at 10/11 = 0.909. If the debt is at 20%, the HBD price from the blockchain will be 10/20 = 0.5.

Another thing that happens when the debt limit is reached is that HBD stops being printed and all the author rewards are paid in HIVE. The transition from HBD to HIVE payouts starts when the debt reaches 9% and between the ranged of 9% to 10% author rewards are paid in Hive Power, HBD and liquid HIVE. After reaching 10% debt only HIVE is paid.

Just for clarity, we have two set of prices for HBD. The first is the usual market price that is determine on crypto exchanges and aggregated by some of the aggregators like Coinmakretcap or Coingecko. The second one, the one we are interest in here is the HBD price that is guarantied by the blockchain through HIVE conversions. Usually, this price is always at $1, but when the Haircut happens this price drops.

Here we will be looking at:

- Virtual HIVE Supply

- Hive price

- Market Cap

- HBD Supply

- Hive Debt

- Debt VS Market cap

- Debt VS HBD price

The period that we will be looking at is from March 2016 till January 2022. I have added the period for the previous version of Hive, called Steem (before March 21, 2020), in order to get a longer data frame.

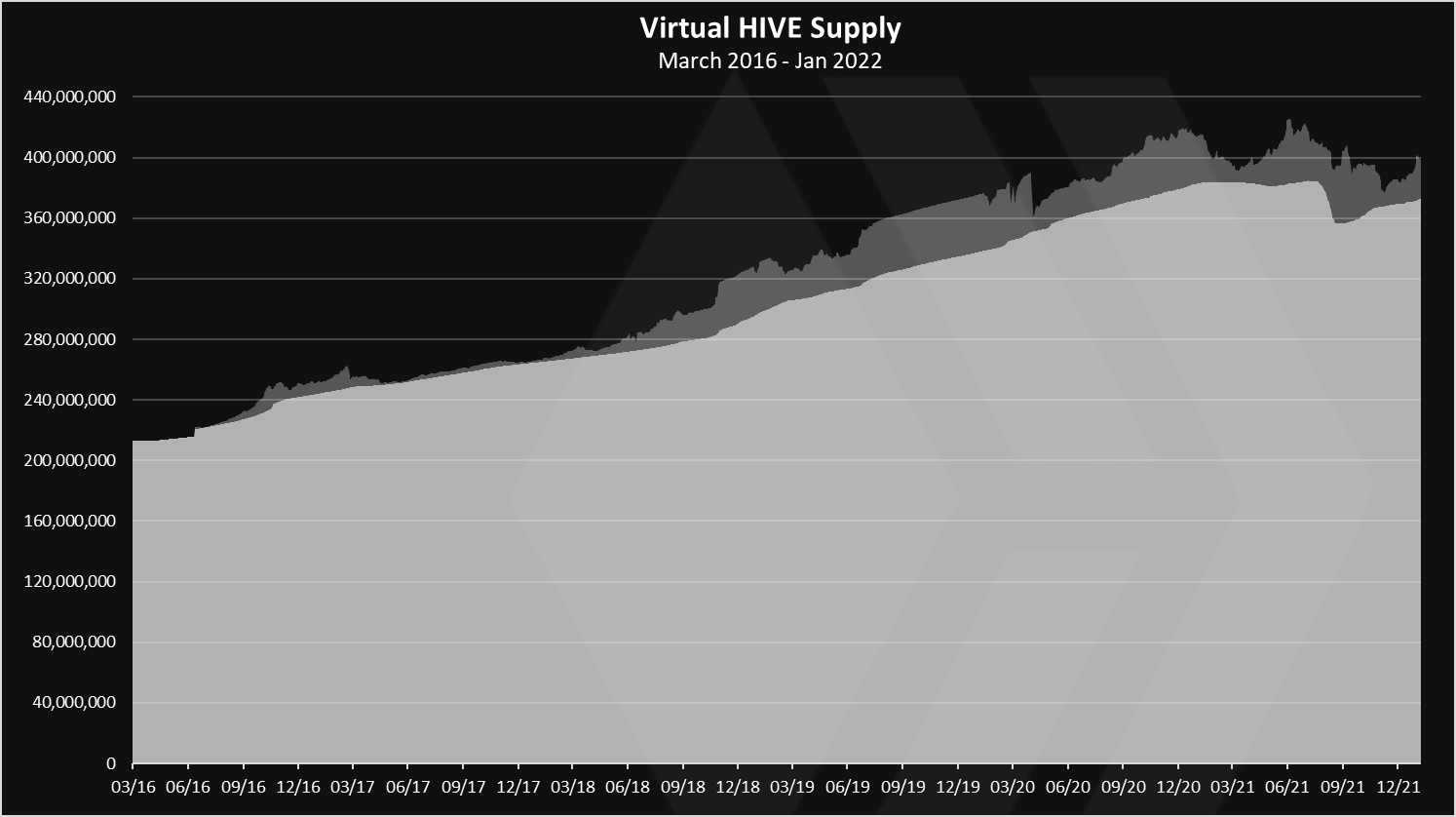

Virtual HIVE Supply

To be able to get the market cap for the purpose for the debt calculation we need the virtual supply. The virtual supply is the sum of the regular tokens plus the HBD converted to HIVE at the current feed price. The aggregators provide data for the market cap, but usually it is not calculated in the manner described above.

Here is the chart.

The light color on the top is the added supply from HBD converted to HIVE. We can see that the supply has grown slowly since the inception. In the last year there has been a drop in the supply.

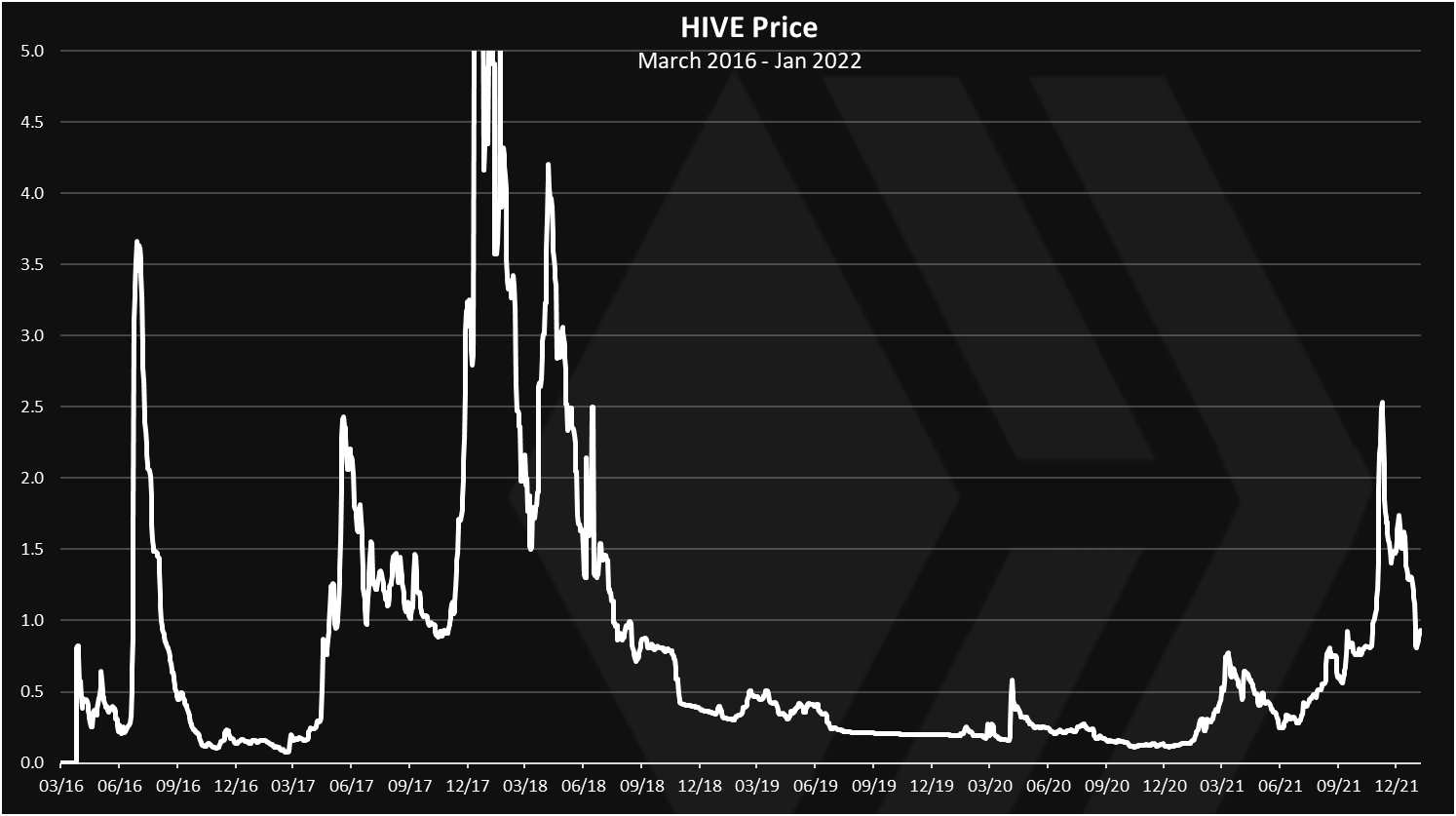

After we get the supply in a form that we need for the purpose of debt calculation, we need the price.

Here is the chart.

Quite the ride for the HIVE price.

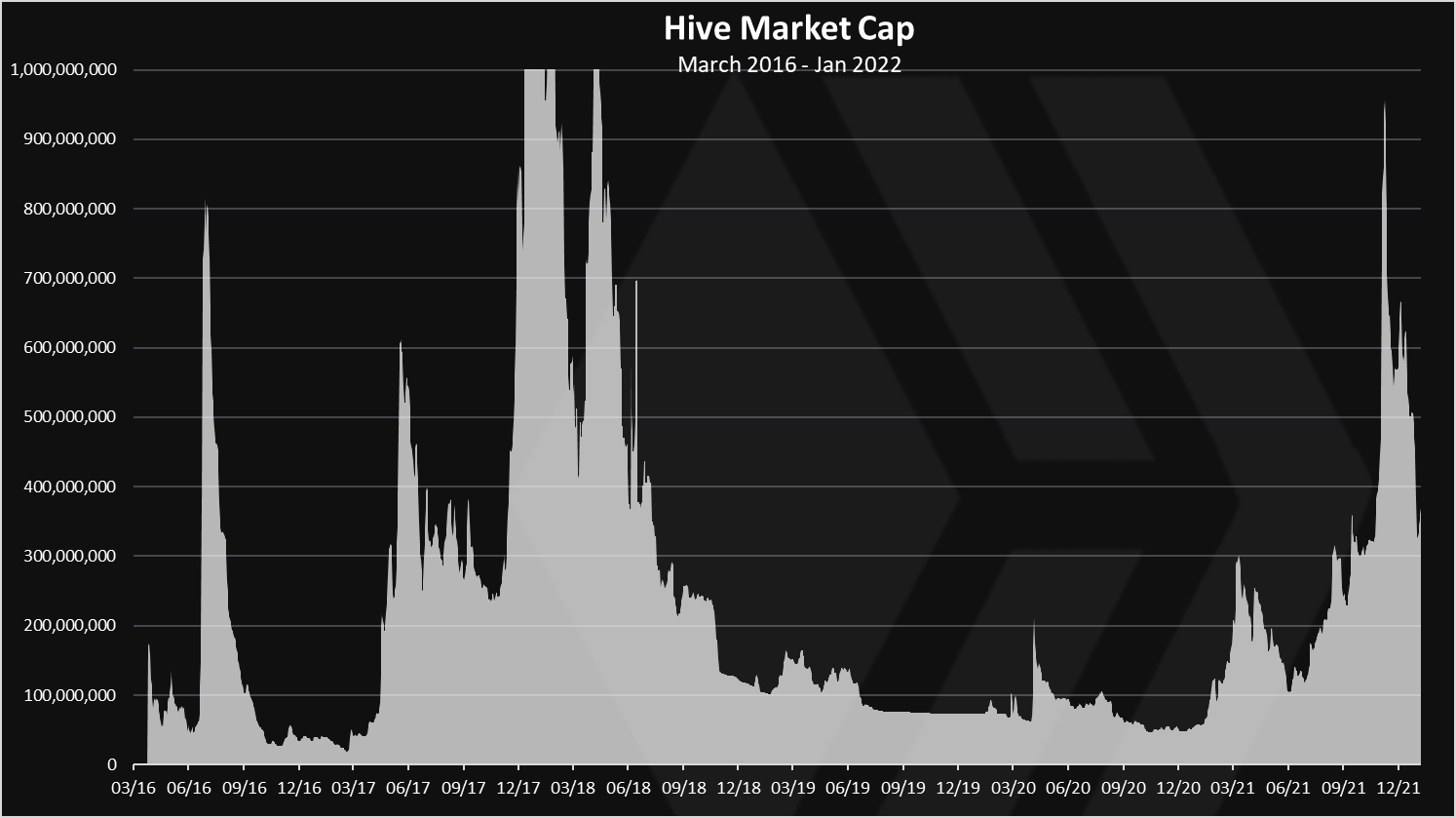

Hive Market Cap

The next step is to calculate the market cap for the purpose of the debt by multiplying the virtual HIVE supply and the price. Here is the chart.

A very similar chart as the price chart.

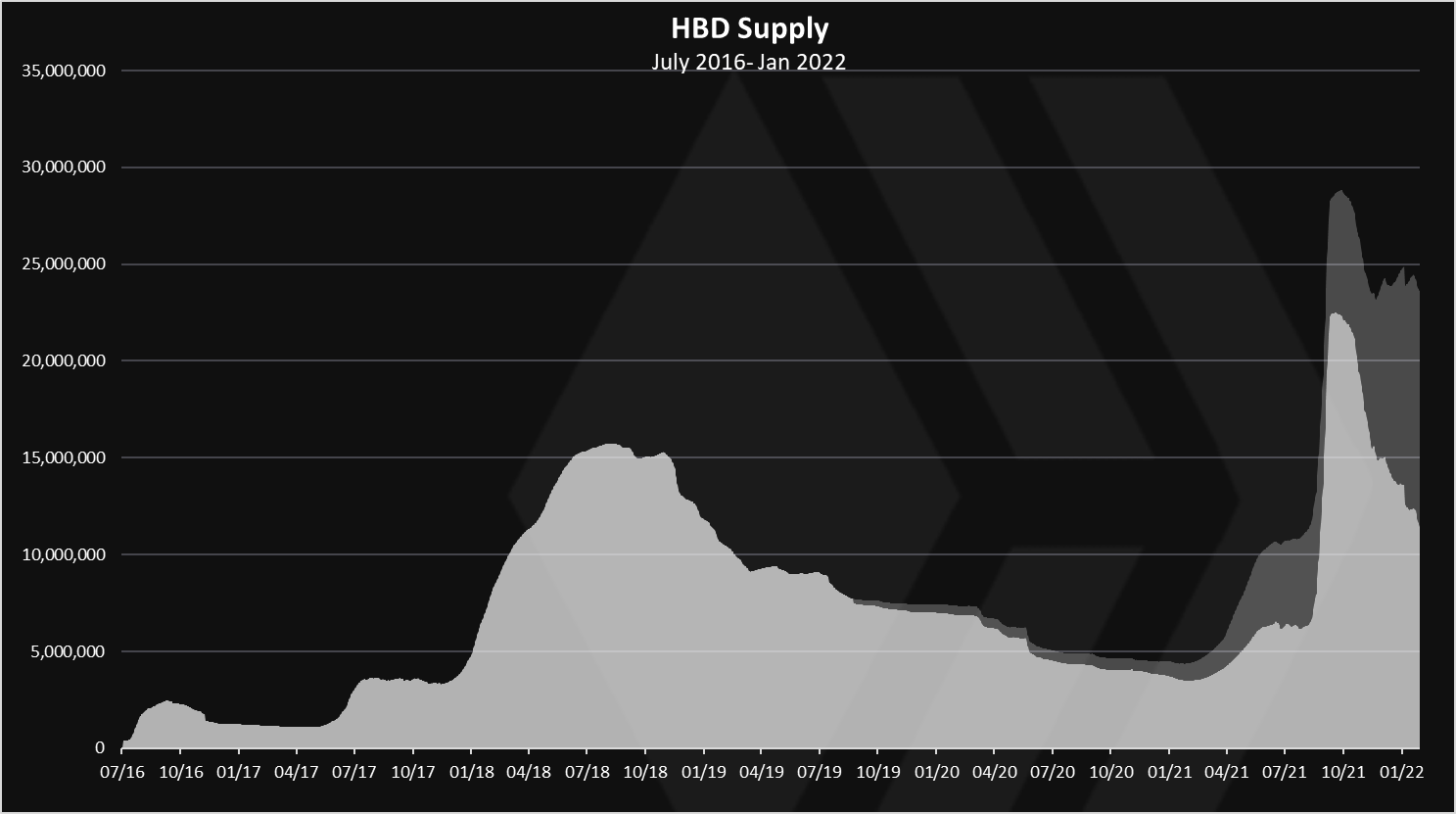

HBD Supply

One more thing for the debt calculation and that is the HBD supply.

The HBD that is taken for the debt calculation doesn’t include the HBD in the DHF. The HBD in the DHF is shown above in the light color.

We can notice the increase in the HBD supply in 2018, when at the peak in August 2018, the supply was around 16M HBD. Then a slow decline in the supply, a conversions to HIVE up until March 2021 when the HBD supply started growing again. A massive increase happened at the end of August 2021 to a new record high of 23M HBD, and a slow decline since then to around 11M HBD now.

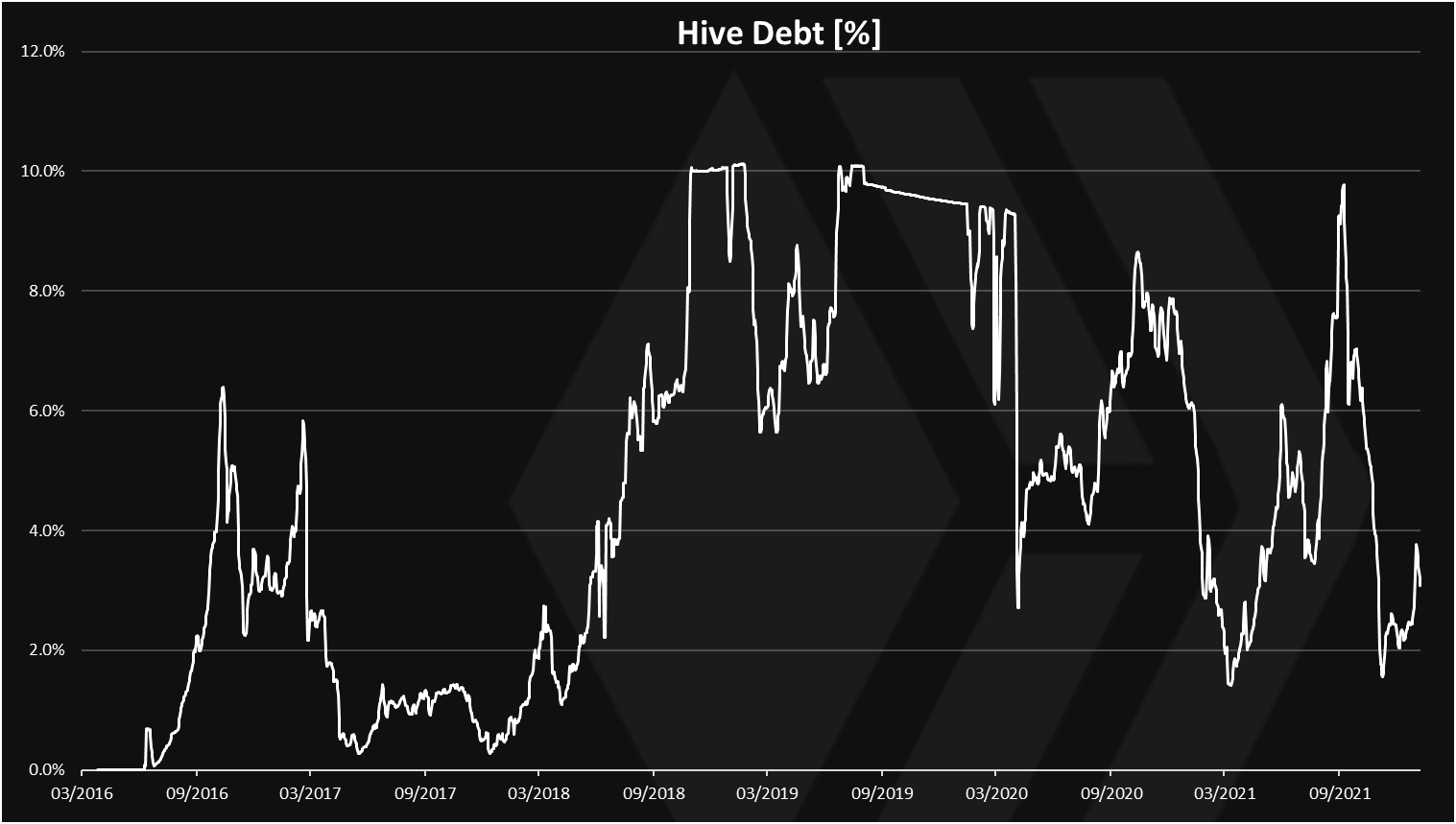

Hive Debt

Finally, the debt calculated as: DEBT = HBD in circulation / HIVE Market Cap.

Here is the chart.

Quite the ride for the Hive debt! In short it has been small but volatile.

In the first two years of operation, 2016 and 2017, the debt was low and never reached the 10% limit. The maximum that it has reached was around 6%.

Then in 2018 the debt reached the limit of 10%, after the massive increase in price at the end of 2017 and the begging of 2018. The increase in debt happened especially in the second half of 2018 when the prices dropped a lot, and there was a lot of HBD (SBD) printed around. This high debt lasted from October 2018 up until March 2020, or around year and a half.

In the last year there was a short period when the debt closed in to the 10% level, but for a very short time.

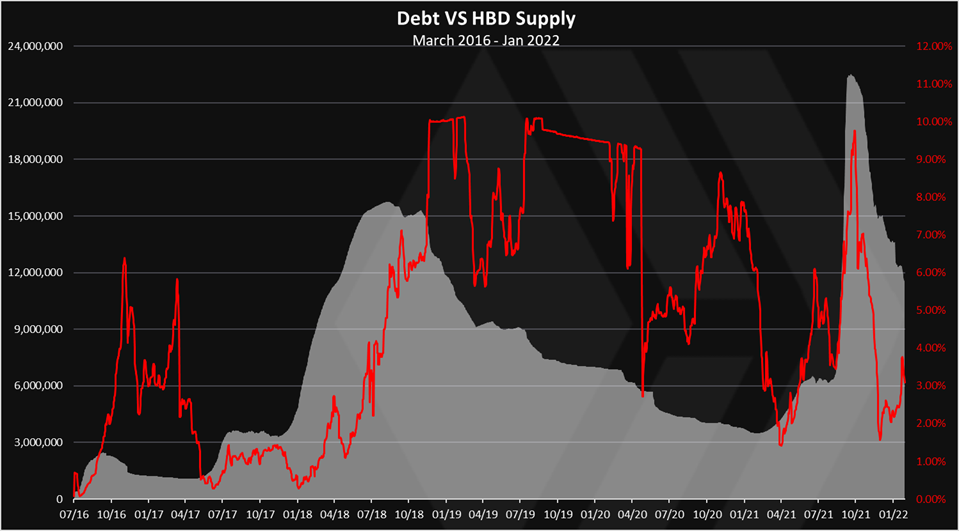

When we plot the debt against the HBD supply we get this.

As we can see, usually the increase in the HBD supply comes first and then the increase in the debt. When the HBD supply increases and a drop in Hive prices happens afterwards, the debt goes up.

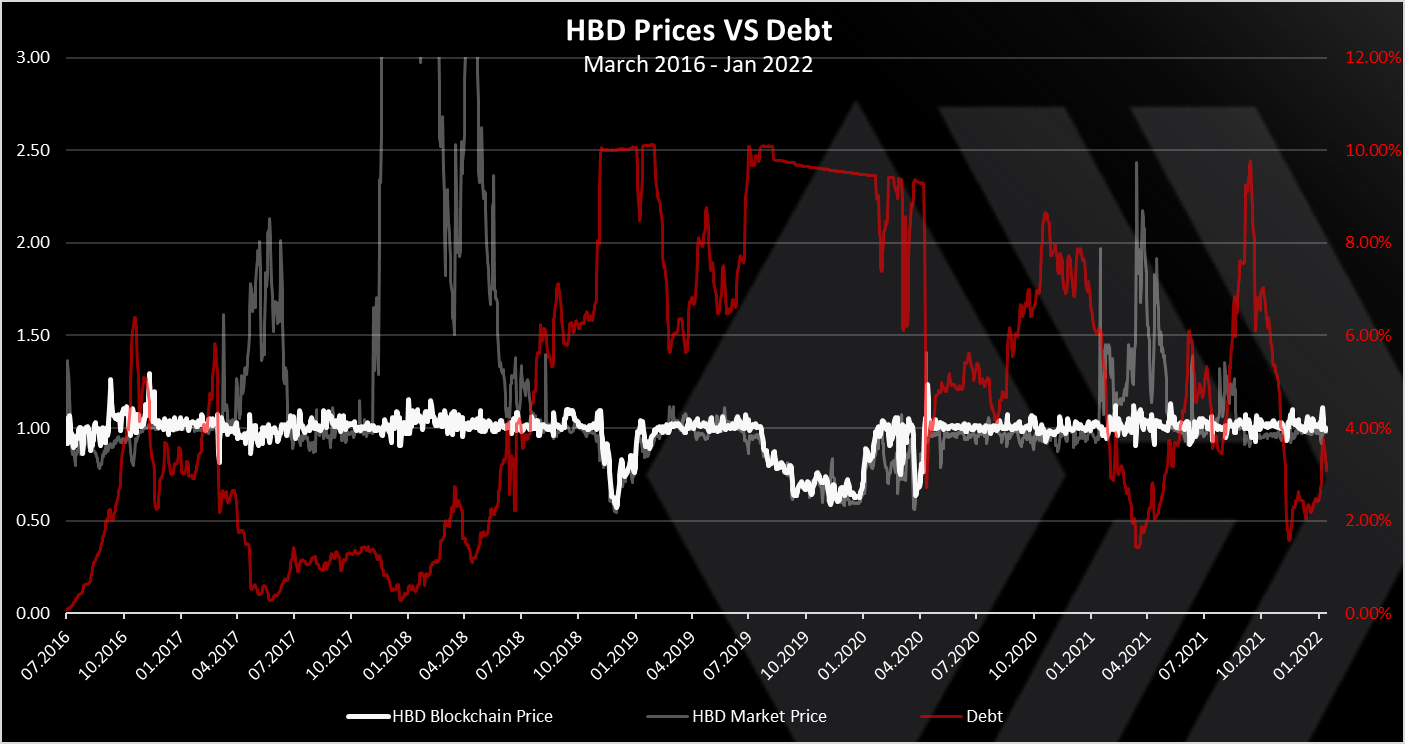

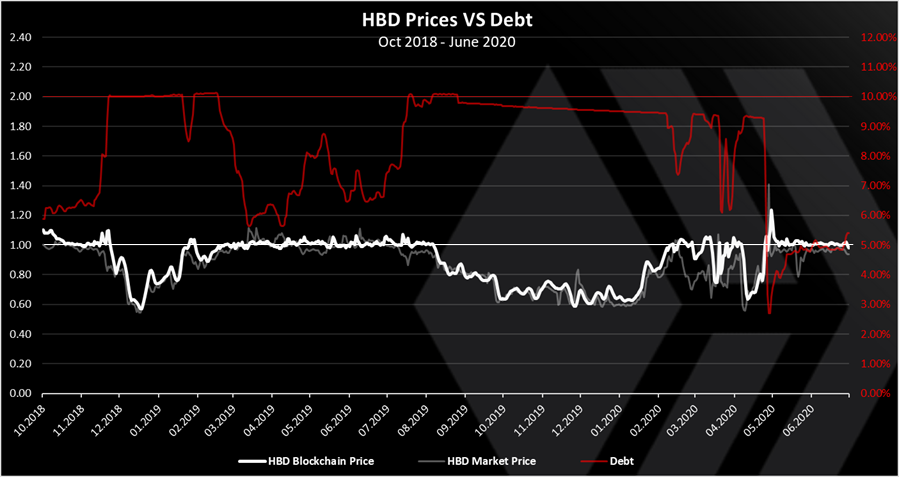

HBD Blockchain Price VS Debt

At the end the important things. The HBD price that the blockchain offers.

When we plot the HBD blockchain price VS the debt we get this.

We have the HBD price guarantied from the blockchain (bold white) and the HBD price on the open market (grey) in the chart. The debt in red is also represented on a different axis.

We can see that the blockchain never gives more then one dollar on the upside, while there has been a period when the price of blockchain HBD was less then $1. On the other side the open market price (grey) has been quite volatile and there has been a period with much higher prices then $1. On the down side the blockchain price and the open market price are closely corelated.

We can see that the HBD price drops has happened in the periods when the debt was on the upper limit.

If we zoom in the period when the HBD price was bellow the peg we get this.

Here we can see a better representation how things went.

For the first time the debt increased by a lot in November 2018, when the price of HBD dropped to around $0.6. The drop of the HBD price has been corelated both on the blockchain and on the external markets. This situation lasted for about four months and in March 2019 the HBD price was back at its peg.

Later in 2019 the debt increased again and the HBD price stared losing its peg again. This time the peg dropped more gradually and reached a low of around $0.6 again in January 2020, when a sharp recovery happened. Another short drop in the HBD price happened in May 2020, that lasted for a week. Since then, HBD has been on the peg, at least from the blockchain perspective, for an almost two years.

Disclaimer: I had some issues collecting and scraping data especially about the HIVE feed price and the HBD price from the blockchain. There is simple no easy way to get this data. Hivesql from @arcange doesn’t record this type of data. Would be great if it happens in the future 😊. Because of this, please take the data like indicative and not a 100% accurate.

I also found some illogical things, like the HBD price from the blockchain at $0.6 under conditions when the debt is just above the 10%. For a HBD price at $0.6 the blockchain debt should be around 16.6%. Probably I’m missing something.

Final thoughts and moving forward

From the presented we can conclude that HBD (former SBD) had dropped below its peg in the past when the debt was high. The drop happened on both, HBD market price and the HBD blockchain price when making conversions. The drops in price was at the lowest at $0.6. The periods when this happened lasted from one week to a max of six months.

In the last two years the HBD price offered by the blockchain didn’t went under the peg. On short intervals there was drops in the market price but those were arbitraged, and the price went back again. Remember if the price of HBD on the open market is lower than $1, its better to use the conversion option and convert HBD to HIVE for a $1.

Debt limit increase

10% is a very small debt level. It means that the collateral is a 1 to 10 ratio. This type of low debt levels are ok for a new projects that haven’t matured and are very experimental. But this blockchain and tech has been around for more then six years now and it has been tested in the period. Some things didn’t worked and were improved, and there is a room for more improvement. If the market cap of HIVE was in the top 50, I would say a 50% debt is perfectly fine. But since we are still in the middle sized projects with a market cap around 0.5B and position somewhere between 150 to 200, a 30% debt is probably a more careful approach.

In the next Hardfork the debt limit will be increased to a range between 20% to 30%. This should give HBD holders more security in the HBD value and should probably increase the overall HBD supply. For example, at the current market cap, a 30% debt will be a HBD supply more then 100M HBD, while at the moment it is around 11M. A 10x opportunity for growth without increasing the market cap of HIVE. The thing is HBD can come only from HIVE and more HBD created will push the price of HIVE.

All the best

@dalz

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

https://twitter.com/Dalz19631657/status/1490739190069350403

https://twitter.com/The_Crypto_Dood/status/1490750508725854212

https://twitter.com/306752051/status/1579828852855279616

The rewards earned on this comment will go directly to the people( @penyaircyber ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for this! I've been building my HBD savings thinking it was a safe bet... but now I see there is risk here too. Guess I will keep at organic building but won't get all crazy and get that second mortgage to buy HBD. !LOLZ

Posted Using LeoFinance Beta

lolztoken.com

It's a little bit funny.

Credit: reddit

@dalz, I sent you an $LOLZ on behalf of @captaincryptic

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (5/10)

I wouldn't take out a second mortgage but I think keeping some HBD with that 12% interest rate is worth a little risk. Even when the peg breaks, sooner or later we always seem to return to $1.

Yes the peg keeps coming back, and with the folowing increase in the debt limit the security will be even higher. Even if it breaks you just need to be comfortable waiting a bit and not be in a rush to get your funds out

Thanks! !LOLZ

Posted Using LeoFinance Beta

lolztoken.com

He had no Monet to buy Degas to make the Van Gogh

Credit: reddit

@dalz, I sent you an $LOLZ on behalf of @captaincryptic

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (7/10)

Awesome... that helps me feel better about it. I have seen it get down into the 90 cent. !PIZZA

Posted Using LeoFinance Beta

Yea, plz no mortgages :)

The risk is the peg doesnt hold. However, as cited, with the HBD stabilizer, it is only temporary. Plus there is more work being done to ensure we keep improving the peg and the use cases for HBD.

I am hoping we see a lock rate of at least 20% for a year at some point. That would help to move Hive further into the fixed income market.

It would allow for the creation of more HBD along with a way to ensure it all doesnt hit the open market as sales orders.

Posted Using LeoFinance Beta

Heck yeah, they give me 20% and I will be getting a second mortgage to buy HBD. Maybe even a third!

Espectacular post here! You are a master

Thanks man .... this one has been especialy chalenging :) Long time in the works

I can imagine

Then, if the haircut is increased in the next HF, the price of Hive will go up automatically?

No :)

It will just make HBD more secure, giving it more room to grow

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

We can't wait for Hive and HBD to get upto 5 dollar. HBD backing Hive makes HBD a stable coin.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@captaincryptic(4/5) tipped @the-bitcoin-dood (x1)

Join us in Discord!

Thanks for sharing this useful and detailed information

So many technical details...makes be better appreciate the work devs put in here for improvements and operations we see everyday

It is great to see more mechanics built around HBD. If with the next HF the debt limit is increased between 20% to 30$, is there any correlation with the APR which is currently standing at 12%. Should we expect this number to be updated in one direction or the other as well?

Posted Using LeoFinance Beta

The debt limit is not conected to the APR. Also the debt limit is a setting that needs a Hardfork.

The APR in the savings can be changed by witnesses at any time wothout the need of a HF.

They do not have any direct correlation. The difference might come from the fact that we will see the witnesses possibly decide to move it up.

Posted Using LeoFinance Beta

Yowser excellent write up!

!1UP

I am feeling good about the Hive price!

An excellent summary of what is taking place. It is great to see advancements in what is happening and how $HBD is becoming a focus for the community. To me, this is a hidden gem.

I hope the haircut is raised to 30%. That is a good level to start the process at. You are right, we are not near 6 years into this and we know the basis that already exists with Hive.

It is less risky than it was even a few years ago.

Posted Using LeoFinance Beta

Thanks task!

The debt limit as I understand will be raised to 30%, with a long transitional period between 20% to 30%. This range is now between 9% and 10% and in that range the blockchain is rewarding all the three coins, HP, liquid HIVE and HBD, with HBD slowly being replaced the closer we are to the upper limit. The blockchain will still gives a $1 HBD in that range.

30% Is happening now for HF26

You have received a 1UP from @revisesociology!

@leo-curator, @ctp-curator, @pob-curator, @vyb-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

This is a masterpiece and needs a well applause. This is actually my first time of hearing and seeing this calculations and the realities of the HBD.

This facts probably means that a time will come (if nothing is done to clear the debt) when the HBD might not have significant values. I need ask this question, is there anything that can be done to either watch the debt level or clear the debt?

I think that once there's enough hive in the blockchain, the debt will not rise above the 10% benchmark.

Thanks for the enlightenment, it's worth publishing.

Posted Using LeoFinance Beta

Tnx!

The debt need to be controlled, otherwise it is a great mechanic for creating a stablecoin.

Debt is reduced either by increasing the HIVE price, or by destroying/converting HBD to HIVE.

In a month or two the debt limit will be 30% so there will be enough safe zone.

This is brilliant !

So, just to make sure I've understood it right.... am I right in thinking that if we as a community want to help, the best thing we can do is;

Posted Using LeoFinance Beta

Not sure why would you think this. For example at the moment HBD is in a perfectly safe zone. The debt is lower then 3%, the debt limit will soon increase to 30%, and there is enough liquidity provided on the internal DEX by the hbdstabilizer.

Banger of a post as always!

Adding my 2c, increasing the HBD debt limit has to happen and I'm happy to hear that its on the cards.

As you put it:

Posted Using LeoFinance Beta

At my first glance at the post title ,seeing the haircut rule I thought it would be something favorable to the hbd since a haircut is meant to enhance good looks , ironically it just trims down the value of the hbd . One can only wish the rule doesn’t occur or last for long whenever the debt of the blockchain is higher than the predetermined limit of the blockchain .

From the one side I absolutely agree that Hive is a more mature project and we can feel more secure about it's future, however there is one more factor to consider. Price of HIVE seems to be heavily correlated with other crypto assets, hence, we cannot rule out another crushing bear market and price ranges we all waited through for a long time.

In this case higher haircut creates potential attack vector. Somebody could potentially buy a lot of HBD and convert these to HIVE for a relatively low cost. It would costs somebody leg and arm to buy HIVE off the market, but HBD with stable price makes this opportunity possible. The higher haircut the easier it gets if I have it right, or don't I?

Thank you for your effort and this post!

Interesting point!

Still not sure where those big amounts of HBD will come from without moving the price of HBD. HBD on the open market is not pegged. Its is pegged only on the blockchain when making conversions.

For example the biggest external HBD liquidity is now on Upbit with around 4M HBD. On bittrex there is around 400k, and there is a few pool on Hive Engine with 50k to 100k HBD in them.

Usually in a bear market there is a tendency to reduce the HBD supply, just look at the chart above, from 16M HBD in July 2018 to 3M in Feb 2020. Meaning if the bear market comes, this 4M HBD on Upbit will be at least less then 2M HBD. Even if some manage to buy all of this for a $1 (theoretically not possible), at a $0.1 per HIVE this will be 20M HIVE if converted.

Now in a case when the debt limit is higher, all the numbers above can go x3, so a 60M HIVE. This is a super extreme and theoretically not possible, because cant buy all the HBD from external markets, without pushing the price of HBD and then HIVE.

I see a small added risk here when combine HBD buying with buying HIVE. HBD just to be a helper in the case. In that case HIVE price goes up, and the rest is history :)

Great report! Nice to see that debt level will be raised in the next HF, HBD is going to evolve.

Posted Using LeoFinance Beta

So it means current debt ratio is less then 9% as we are not getting any Hive .

I did not get if 12% APR has any impact on debt ratio vice versa or it has nothing to do.

Current debt is less then 3%.

The APR ans the debt are not conected.

Well articulated but for a novice like me, understanding every bit of it is a challenge.

But I will try, no matter if it takes even weeks.

Thank you, man! You rock.

It will help create more HBD

Thanks for the very in-depth analysis! I learned a lot in the few minutes that it took me to read the whole thing.

Just a terminology clarification, if you will:

Is it the average or the median? Because I think I heard both and am not really sure which is the correct one.

This is interesting. I remember hearing from Blocktrades on one of the Cryptomaniacs episodes that he thought the 10% limit was a bit too conservative for the time being but I didn't know it was actually going to be raised on the next HF.

Posted Using LeoFinance Beta

For conversions its median ... not sure about the feed :)

Perfect! Thank you!

Posted Using LeoFinance Beta

increasing the debt limit is going to be really great; I plan to convert a substantial part of my Hive holdings to HBD in the future :)

great post!

Thanks for all the insights. Hive lacks in DEFI/Dapps which would bring more utility to both HIVE & Stable coins. We need those smart contract platforms to grow us by folds, that way HBD can also become more useful and grow by market cap.

I'm curious to know how long it took you to make this incredible post! Nice work as usual 👍

I have seen it happen when we were still on the Steem blockchain. But you are indeed correct, the debt ceiling has definite potential to get raised. 25 % could be a great compromise...

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @pele23 for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Any thoughts on creating a long term deposit function like a CD for HBD and offer a higher interest rate for 6 month or 1 year locked deposits?

Posted Using LeoFinance Beta

I think this is a fantastic idea. If they gave an additional incentive like an extra 1-2% APR on a more long term lock period for the HBD savings, we could get additional demand for HBD, which would keep the HBD peg better at exchanges, would cause more HIVE>HBD conversions thus reducing HIVE supply and increasing price, and the increasing amount of locked HBD for long periods would keep a constant need to mint new HBD and keep the demand cycle flowing and compound the positive effects.

I think this is what we are missing here honestly. Haven Protocol also needs something like this for their Mint & Burn system too, perhaps I will look into how to submit a proposal over there.

And BTW, while I am not sure how optimal the exact percentages are, I do think the Haircut Rule is overall a very good policy for the ecosystem.

Thanks for sharing this valuable information.

Really appreciated!

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 30000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

This was a really awesome post; I've so often wondered about the need for the HBD/Hive - but was able to get some clarity from your post. I have only used the conversion tool once, instead opting for the instant on-market trade to turn my HBD to HIVE (in turn, to power up). I will certainly be looking at this more closely in the future; speaking of the future, Projections ahead were also looking good. Thanks for the time to put together such a super post. I gave you an upvote, it's not worth a whole lot, but I did want to recognise the effort.

Thanks so much, Tim.

Posted Using LeoFinance Beta

There are few things to consider for conversions VS market.

If the debt is low, like now then conversions give you $1 worth HBD at the feed price.

The second thing is the price of HIVE in the 3.5 days conversions.