The One Thing In Crypto That Keeps Going Up! | The Stablecoins Market Cap

The debate around stablecoins keeps on going with some recent talks coming from US regulators that might have some positive tones about them. The main stablecoins that are being used in crypto usually are the ones with pegged value to the USD. If those assets are backed by a 100% USD kept in a bank, as they grow so does the demand for USD, making the dollar even stronger.

Now the question is are these companies that are issuing tokens that claim to be backed by 100% USD, actually have that USD in banks. This is something that might be a central point of regulators in the future and the process of issuing crypto tokens backed by dollars.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- Terra-UST

There is a few more out there like TrueUSD [TUSD], PAX, Huobi USD [HUSD], etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from Jan 2020 till Feb 2022. In this period most of the stablecoins market cap was generated.

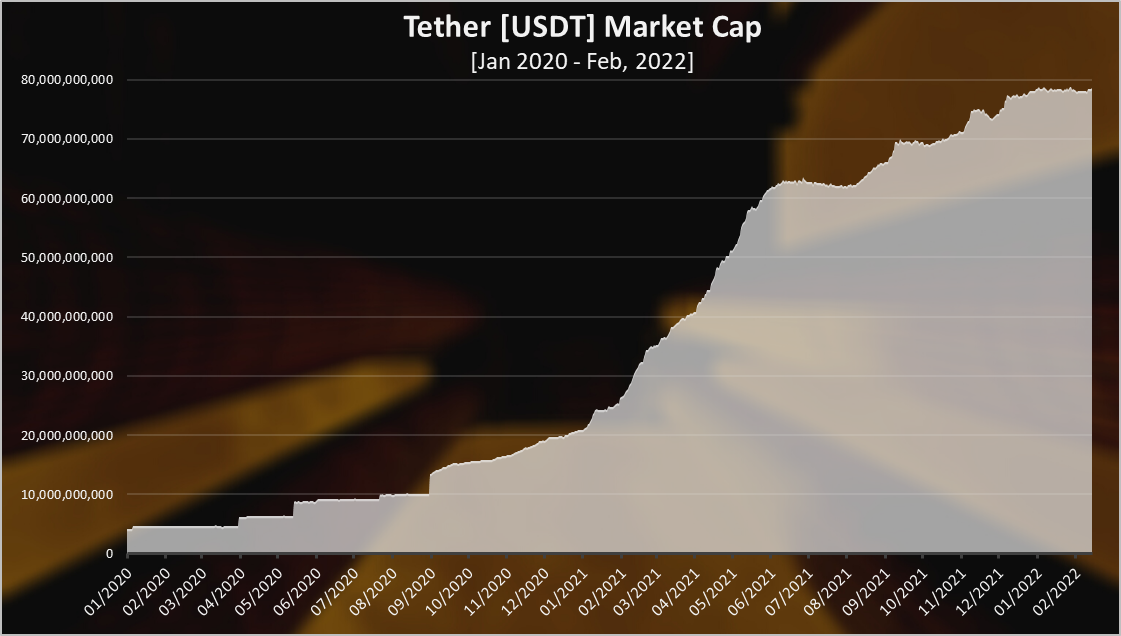

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

Here is the historical market cap for Tether

Tether has seen a massive growth in 2021, starting from a 20B market cap and now at 78B! But in 2022 we can see slowdown in the growth with the market cap staying stagnant at the 78B. Furthermore, most of the growth happened in the first half of 2021, while in the second half the growth has been smaller.

Overall, a slowdown in the growth for the Tether market cap in the last months.

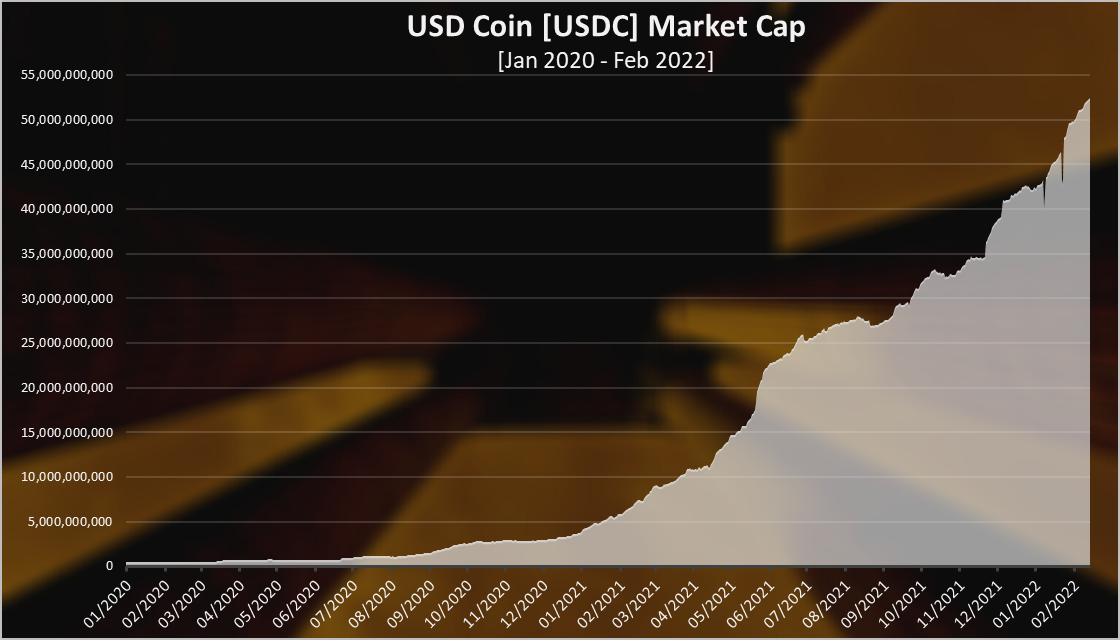

USD Coin [USDC]

USDC is a common project between Coinbase and Circle. Its supply should be more legit.

Here is the chart.

USDC has seen a massive growth in 2021 as well, but unlike Tether that has seen slow down in the growth, USDC just keeps on growing. At this pace there is a chance that USDC will flip USDT in 2022. The stablecoins flippening!

At the begging of 2021, the market cap of USDC was around 4B and now it is around 52B. More then 10X in just above a year. USDC the 10X coin 😊.

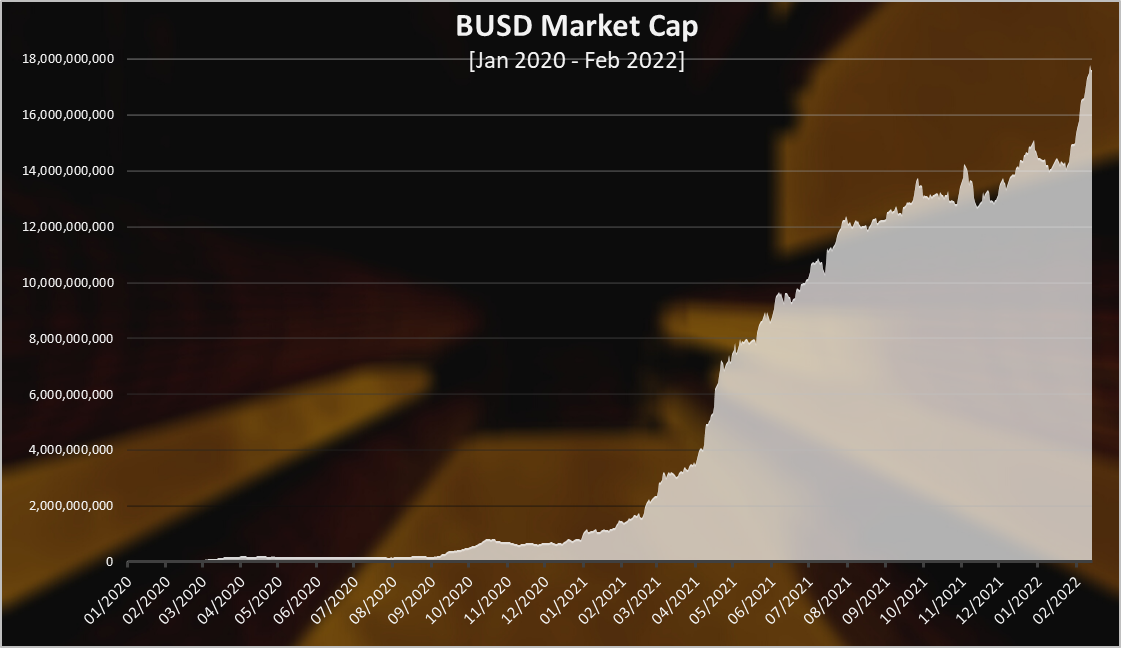

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

BUSD has been growing very fast in the first half of 2021, then a slower trend in the second half and a big spike in the last month. BUSD gained almost all of its market cap in 2021 and now it is standing at 17B.

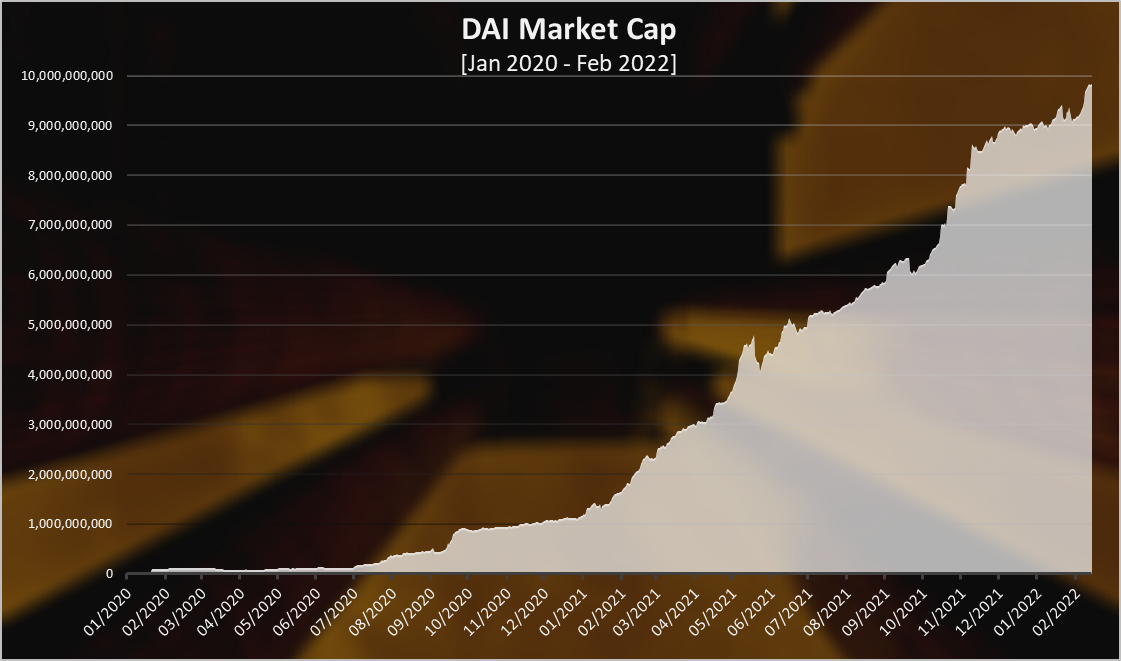

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI started later than USDT or USDC. The current version of DAI (multilateral) stared in January 2020. From what we know there was a previous version of DAI, a single collateral one, that started at the end of 2017.

DAI has seen a continues growth during the whole 2021, with some down trend at the end of the year.

Unlike the previous dollar collateralized stable coins. DAI started 2021 with around 1B and now is at 10B in market cap.

Unlike the USDT, USDC, BUSD, all DAI is generated in a decentralized manner with collateral locked in a smart contract. The average ratio of the collateral is somewhere 3:1. So for 1B DAI there is an approximate 3B collateral. No fractional reserve policy here 😊.

The holders of the governance token Maker, are deciding on the cap of the DAI issued.

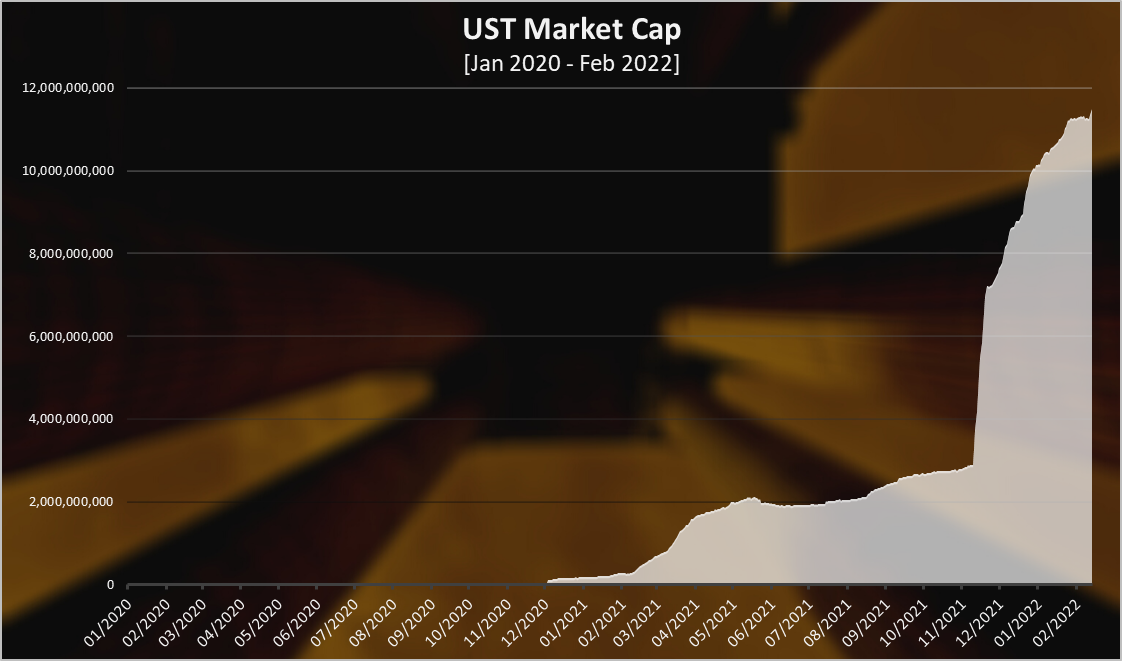

TerraUSD (UST)

The Terra stablecoin UST has seen some interesting development in the last year. It is another crypto backed stablecoin, the closest competitor to DAI. Unlike DAI it works in a different manner, without collateral, but with UST convertible to LUNA, the main token of the platform. Similar to HIVE and HBD. This method for stablecoins in theory is much more capital efficient then the overcollateralization that DAI uses.

2021 was year in which UST established itself as a reliable stablecoin. It is the new boy in the stablecoins arena. The year started with a few hundred in market cap and now it is more than 11 billion.

There was a massive spike in the UST supply in November 2021, as some of the LUNA treasury was converted to UST.

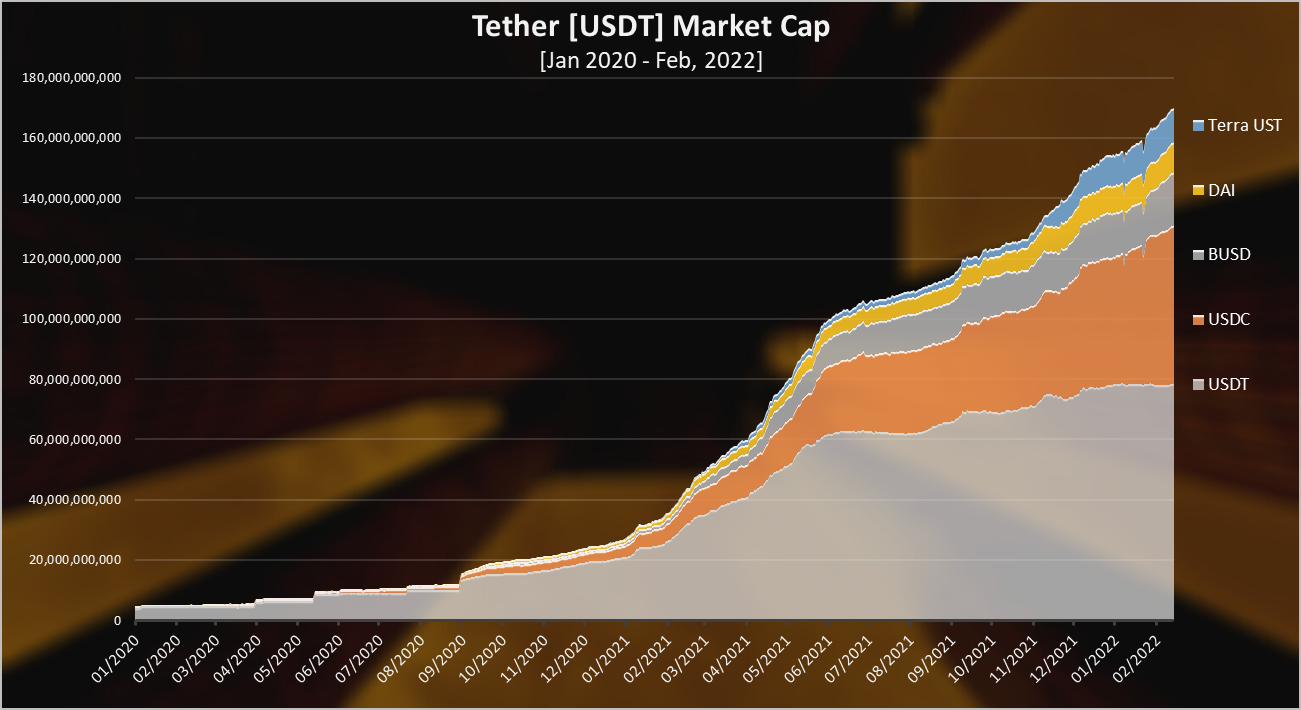

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

The chat above includes the stablecoins from the previous list. There are some others, but these consist 99% of the market cap.

The overall market cap for stablecoins has gowned from 27 billions at the begging of 2021 to 170 billions at the moment. More than 140 billion added in a just above one year. Some nice demand for USD there 😊.

We can see how USDC is growing faster then USDT and it is now take a big share of the stablecoins arena. The other three have grown a lot as well, especially UST.

No wonder stablecoins are no.1 on the regulatory list. The issuance of a stablecoin can cause a lot of regulatory problems, especially if it is not 100% backed. Also, in the long run corporation can overdue it, if left unchecked.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top, but USDC is closing in now. A 78B to 52B in market cap, or 67% of Tether market cap. A year ago, this percent was around 20%. BUSD is on the third position.

UST has flipped DAI now and is leading in the decentralized stablecoin arena.

The stablecoins growth remains with USDC pushing for the biggest share of it in the last months. The fiat backed centralized options remain in the lead with USDT, USDC and BUSD on the top. The decentralized stablecoins DAI and UST are in the top five and UST is now in front of DAI.

Just for context the market cap of HBD at the moment is around 24 million, out of which 13M in the DHF. If we compare this to the billions for the top stablecoins, we can see the potential. UST works amazingly similar to HBD.

What stablecoin are you using?

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1493606269160148997

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

.

#meto :)

Need a lot more expansion. Wish we have Hive Bonds to help attract money.

Posted Using LeoFinance Beta

The fact that stablecoin supplies never seem to go down is one of several reasons why I am skeptical of the leading bunch.

There are tiny bumps on the way down, but it is mostly up.

Looks like USDC will overtake USDT soon

There is so many stable coins now. I bought usdt for liquidity but it was busd I needed. So I had to go to pancake swap and exchange it using metamask. The problem is that we don't really know if these stables are guaranteed by crptos or not !

USDT and BUSD are both fiat backed with dollar in the bank. BUSD is more transparent about its dollar holdings.

I mainly use tether and, obviously HBD... I hope one day HBD will be discovered by the masses

12% FTW :)

Many youth in Africa are actually holding stable coin to beat inflations in their currencies.. crypto is saving alot of people

Posted Using LeoFinance Beta

This is interesting to hear

That makes a lot of sense. Many in the West, especially the US, bash the USD. They do not realize how stable that is compared to a lot of the currencies out there.

Posted Using LeoFinance Beta

thanks for sharing the important thing about crypto

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

HBD wen?

There is also a new player in two $USDV from Vader Protocol.

Posted Using LeoFinance Beta

USD market Cap has been going up since November last year. We believe is the stable coin like USD that's making BTC, BNB and others not to bull.

Posted Using LeoFinance Beta

We need to be doing everything in our power to increase the liquidity of HBD in order to allow our stablecoin to go to the next level.

The untapped potential here is insane.

Posted Using LeoFinance Beta

Have to increase the payouts on there to get more HBD out onto the market. The haircut rule is being increased. Of course, that is not relevant if the price of $HIVE goes on a run.

Posted Using LeoFinance Beta

This proposal from @ecoinstant is one of the best ways you can help with increasing HBD liquidity at the moment. I would also like to see HIVE on THORchain as an added expansion. We don't have enough easy ways for investors to acquire more HIVE (at least compared to many of the competition).

!PIZZA

You can put liquidity into the trading pairs on exchanges that trade HBD with a stablecoin base. Ionomy, does this. There are few CExes that do include HBD though.

Ionomy does this.

You're welcome to put limit orders on the HBD/BUSD trading pair on Ionomy.

I have used UST and more often USDC.

Lately understanding HBD gives me a good head start with stable coins wit lH power to bring liquidity to cryptocurrency

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.We are seeing the stablecoin market growing and that is drawing more attention. We are now seeing a bill being presented that stablecoins will have to be backed by FDIC. This means those providers are going to have to get that.

It seems like another reason to focus upon HBD.

Posted Using LeoFinance Beta

What is FDIC?

Federal Deposit Insurance Corp.

It is what is required on all bank deposits. This means stablecoins within the US will have to purchase this on all the tokens they issue to ensure they secured; if the bill becomes law of course.

Posted Using LeoFinance Beta

greetings

very interesting post, the stable currencies that I use the most are USDT for trading in the exchanges and BUSD in the BSC network.

from your opinion what do you think would happen if it is proven that the usdt is not backed 1x1 with usd ?

I have used most of the stabelcoins. At the moment, I am saving on USDT and UST and a small bag of experimental HBD.

I think it is a clear indication of people putting savings in another location rather than banks. It is a risky form of savings but we're a few years into stables now and they appear to be working.

With the incoming possibilities of Interest rate hikes and inflation people are shying away from traditional investment in a stock or a Crypto asset and waiting for it to reduce in value due to inflation and than buy in.

Posted Using LeoFinance Beta

I firmly believe there is a bubble here. 😁

Haha ... no we are just getting started ;)

Terra UST growth is really impressive. In a few more years, it might overthrow some of the centralized stable coins in market cap size.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@vimukthi(4/5) tipped @forexbrokr (x1)

Join us in Discord!

I'm using DAI as long-term collateral in DeFi. It earns a small yield. But, it reduces volatility to reduce the danger of liquidation. I use USDT and USDC as shuttles to conduct business. At the moment, LUNA is available on Cronos. But, UST is not available on Cronos.

Oh, and I am starting to accumulate HBD in my Hive accounts for the long term. I'm not actively putting in savings. It's mostly earnings from HIVE leases that are being converted to HBD.

Posted Using LeoFinance Beta