What Is The Right HBD APR Policy?

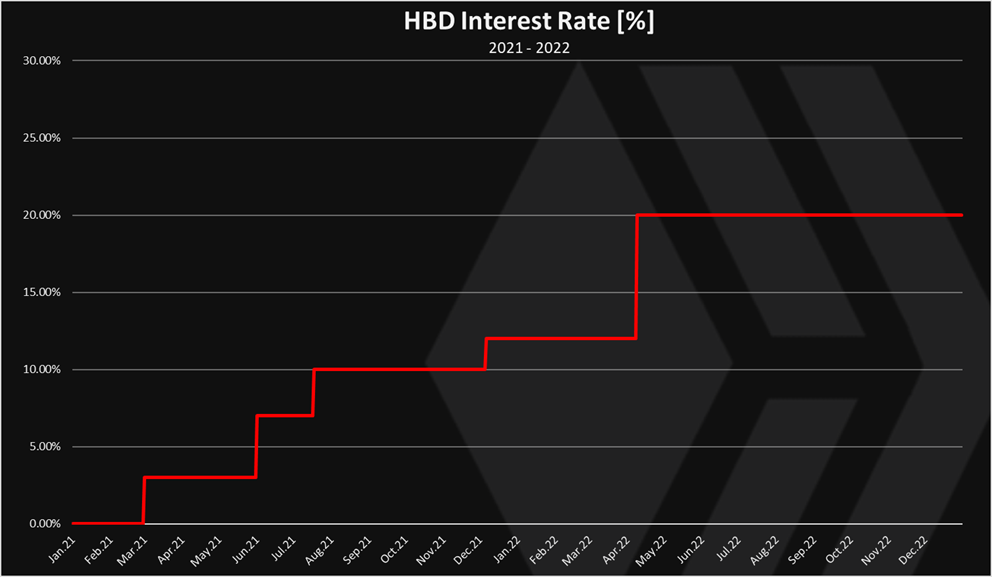

The APR for the HBD in savings at the moment is 20%. It is set by the witnesses and in the last two years it has been increased and improved upon.

The way HBD interest is set is by a consensus mechanism by the witnesses. It doesn't require a Hardfork, meaning it can be flexible.

Since the interest rate for HBD was increased we are seeing more use cases and apps leveraging it and building around it. Thing is if this change at some point in the future and all the work and products builds around it will face challenges going forward. This doesn’t gives a lot of certainty about it.

As mentioned, changing the interest rate is witness decision, but having some general rules around it, or some principals that each individual witness will say he/she will follow will give users and projects a lot more stability to build upon and use it.

Having a stablecoin, even with flexible stability as HBD is, and the option to control the interest rate for it, is a massive thing. That is what the FED main job is and how they control the entire economy worth trillions of dollars.

Having some discussion and ideas where we are going with HBD, what will be our principles for the interest rate is valuable and not to be undermined.

What are the options for the HBD interest rate?

When we think about it there are two main options:

- Fixed interest rate

- Variable interest rate

We can say that in the last year HBD had variable interest rate with the APR going up.

Here is the chart.

As we can see the HBD interest rate was changed five times in the last two years.

- Mar 2021 - 3%

- Jun 2021 - 7%

- Jul 2021 - 10%

- Dec 2021 - 12%

- Apr 2022 – 20%

The last adjustment is the longest living for now.

So here we are at the 20% and the question is how we should continue forwards?

There are concerns in the community that the 20% interest rate is not sustainable, because it comes from inflation, and it is additional inflation on top of the current one for HIVE. I have looked into the data what is the additional inflation from the HBD interest, realized and projected, and the main conclusion from there is that for 2022 it will be around 0.5% on top of the current 7%.

Yes, but what will happen in a few years when this compounds?

Having a long term overlook on thing is always a good thing. Let’s see some data. At the moment there is around 8.5M HBD in circulation, out of which 4.4M are in the savings. At the current interest rate of 20% this will generate 880k HBD per year. In theory in five years’ time this can double, having around 9M HBD in the savings, grown only from the interest. This 9M will generate 1.7M HBD additional yearly inflation. At the current HIVE price (that is quite low) a conservative scenario, this will be additional inflation of 1% per year. If the HIVE price doubles, we are back at 0.5%.

There can’t be a significant increase in the savings without expanding the HBD supply. By significant I mean X5 or X10 the current supply. For the HBD supply to expand for X10, the HIVE price needs to go up. But let’s say the HBD supply expands slowly without a large impact on the HIVE price. With this slow rate of expansion, it can probably double, maybe triple in the next five years. This will add an additional 0.5% to 1%, on top of the 1% with the interest included. Meaning a total of 2% additional HIVE inflation per year. Let’s push this even further to be safe to a projected 3% additional yearly inflation in a five years’ time.

At the same time the HIVE inflation is going down by design at 0.5% per year, or in five years the HIVE inflation will drop for a total of 2.5%.

From the conservative scenario above we can see that the inflation from HBD is sort of balanced out from the projected contraction of the inflation. On the optimistic side we will have an expansion in the HBD supply followed by appreciation in the HIVE price, that will result in a large market cap for HIVE and low additional inflation, less than 0.5%, or even a deflation in the HIVE supply.

I must put a disclaimer on the napkin math above, even though it should be a pessimistic scenario with no appreciation in the HIVE price, some other factors that are not taken into consideration might distort this.

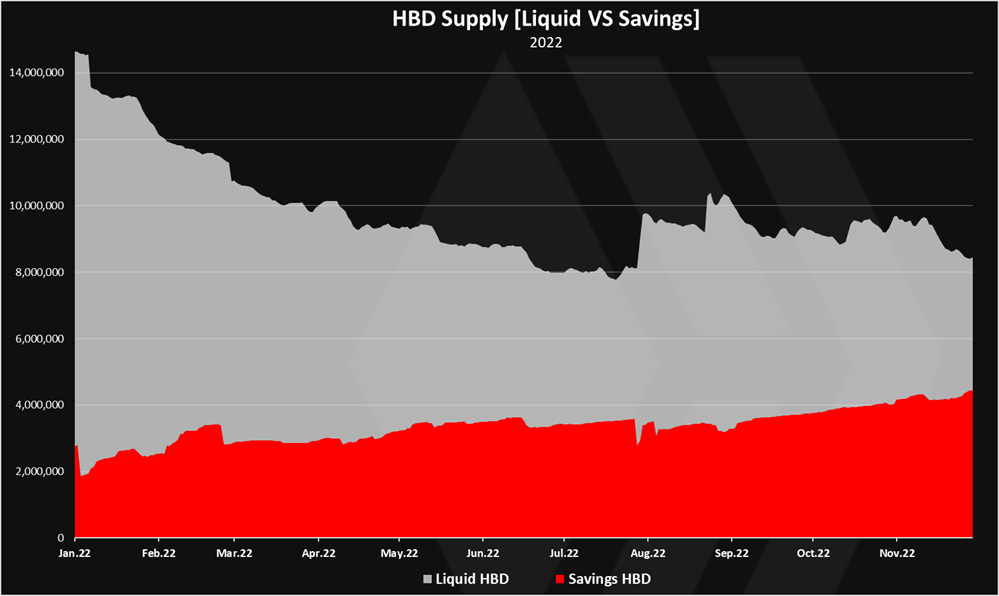

If we take a look at the HBD supply in 2022 we get this.

The amount in the savings has been constantly going up, while the overall supply has been going down!

At the beginning of the year there was 14M HBD and now we are 8.5M. The savings has grown from 2M to 4.4M.

How can it be the overall supply to go down and the savings up? It is because the HBD supply outside the savings has mainly been subject to price speculation especially on Upbit. In this year the supply there has been going down while in the savings up. Tokens are transferred from speculators to holders.

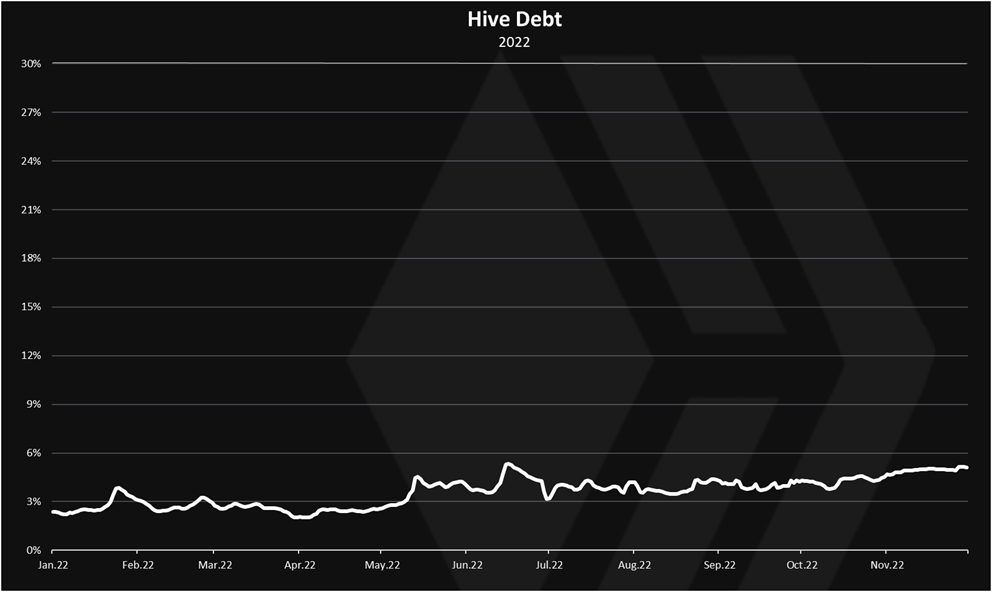

One of the main things driving the HBD supply is the HIVE price and the debt ratio! Not to forget about the Haircut rule, HBD will not be valued at one dollar if the Hive Debt increases above the debt limit. It used to be 10%, and now we are at 30%. This means that the blockchains allows maximum HBD to be printed to 30% of the Hive market cap.

As the price of HIVE goes down, if the HBD supply stays the same, the debt goes up. But in most cases the HBD supply decreases as we have seen from above, allowing a healthy debt ratio to be maintained.

The top limit of the chart is 30%, representing the debt limit itself. This to have a visual representation where we are in terms of the debt limit and the haircut rule.

As we can see the debt has increased in 2022, from 2% to 5% where we are now. This has happened while contracting the HBD supply from 14M to 8.5M. If the HBD supply remained the same, now we would have been at around 10% debt. The current 5% debt is still far from the 30% limit that is now allowed. If BTC drops further, we will most likely see further reduction in the HBD supply and the HIVE support price for HBD that is now 5.9 cents. At the beginning of the year this support price was at 20 cents.

The main conclusion from the above is that the HBD supply is mostly driven by the HIVE price and the debt ratio, not the interest rate

This might change in the future, but for 2022 this is the case.

Having in mind the above let’s dig into the pro and cons of the fixed and variable HBD interest rates.

Fixed Interest Rate

The pros of the fixed interest rate will be the obvious predictability and expectations from users and projects. Everyone can plan and build around it, without fearing that witnesses might come up with arbitrary decision to change it overnight. It also provides a long-term incentive and demand for HBD as it is a yield bearing semistablecoin 😊.

The cons of fixed rate is that it removes the flexibility and the option to try to increase or decrease the demand for HBD. Meaning there is no possibility to try to steer things in a preferred direction if something unexpected happens.

Variable Interest Rate

The pro and cons for the variable interest rate will be the opposite from the fixed. The variable interest rate introduces uncertainty for users and projects. Everyone who is building around HBD cannot plan accordingly. The pros are that it gives a flexibility space to try and adjust the interest rate and the demand for HBD and trough HBD the demand for HIVE.

If we were to implement variable interest rate policy, what would be some of the principles around it? Depending on the market conditions, high or low HIVE price, we would change the interest rate for HBD.

What would be the right thing to do with the interest rate, in a bull or a bear market?

Does a high interest rate for HBD supports the price of HIVE? This is up to debate, but we can say that if an assets has yield there is a higher chance for users to want to hold that asset, while if there is no yield there is a lower chance for users to want to hold that asset. Especially if it is a stablecoin like asset, that has no expectations to appreciate in the future. On the cons side if there is to much of the token users might start cashing out and selling. It is a balance!

With the reasoning above, we can conclude that if a variable interest rate for HBD is implemented, it should be done in a way that the interest rate is decreased during the bull market and is increased during the bear markets.

Decreasing the interest rate for HBD in a bear market condition like we are now, for sure will cause users to sell HBD, that will trigger HBD to HIVE conversions putting more pressure on HIVE when its price is already depressed. We want to increase the demand for HBD and by that increase the demand for HIVE. When prices are up there is no need for incentives.

Final Thoughts

The above is just ideas up for discussion. All inputs are welcomed. Making predictions is extremely hard, and here I have touched on some predictions, that might turnout wrong.

I’m not sure what the right answer for the HBD interest rate policy is, but one thing is sure, it is a powerful and important instrument to have, and having principles how we go about it and how decisions are made, will paint a picture for a more serious community, than just arbitrary decisions based on individual feelings or market conditions.

At the end this is all experimental. We don’t know all the answers ahead of time. Practice is needed. One possible scenario for the HBD interest rate would be to give it a fixed rate for the next five years, that will give stability for the community and incentivize growth, and revisit after that. Then depending on where we are in the market, what have we learnt, we can try to change the HBD interest rate, remove incentives during bull market and introduce them during a bear market. Things is, its hard to say when we are in a bull or a bear and there should be some additional principles for this.

Another major thing to add is that the main controller for HBD supply still remains the debt ratio and the haircut rule. If there is a treat for the HBD price to drop users don’t care much about the interest rate. This is the ultimate safeguard for the system.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/1012995341468295168/status/1597969952736436225

The rewards earned on this comment will go directly to the people( @dalz ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The problem with this article in terms of inflation is the same thing we always see.

Here is a discussion about the right rate of inflation yet there is no mention of growth of the economy or the ecosystem. People seem to think that money operates in a vacuum. Yes we can look at the rate inflation but in what context?

I have heard the arguments that the 20% is unsustainable and laugh at it. How can it be unsustainable if the growth of Hive economy is 40%? Considering where we are starting at, this is not a large number.

Here is the case in point: what kind of economy does anyone think is going to be powered by $8.5 million? Does anyone think this is a legitimate level of money to facilitate commerce, investment, funding, and collateralization?

10x that number and it still will result in a small economy.

Posted Using LeoFinance Beta

8.5M really is next to nothing in that context. I guess the general view is that HBD becomes a risk for Hive if its supply increases too fast. But as you said, it makes sense for Hive to also continue to grow in the near future which would mitigate that risk considerably

I for sure I'm not saying that 20% is not sustainable, and that is not the point of the post. Altough I have put some numbers in, to suggest that we are good to go at least for the next five years :)

The main point here is that I wanted to open discussion about how we set the interest rate.... what if from tomorow witnesses decide they put 5% interest rate, becouse they feel that is right at the moment? What if they put 30% .... can we have some priciples upfront? Can we say it is 20% forever?

I didnt mean to imply that you were saying it is unsustainable. Actually the article does the exact opposite of that, it concludes the inflation rate is not jumping much due to it.

They can change anytime, that is true. At the moment, there seems to be little incentive to alter it up or down since there is not much threat. Overall, the HBD market is rather slow developing so par for the course could be the present mantra.

Posted Using LeoFinance Beta

Thank you :)

Looks the same to me, and probably the interest rate will stay there for a while. Will like to here some thinking from the T20 ... smooth gave his opinion in a comment here, that is from a high perspective but reasonable what we want to achieve here. We just need to polish some details out .... probably will do it as we go.

Yeah, crank it up and let it sink into a crypto-defi system. Agreed. But if FUD takes over, you might have an interesting scenario at a 10x scenario.

I think currently it pretty good; of course there is uncertainty whether the top wtinesses will change the interest, but it seems fairly stable with little incentive or risk to reduce it soon. The longer it stays at these high levels, the more chance we also get for positive exposure in the crypto community that HBD exists

dalz I guess you are the right guy to answer this :)

What are the differences for HBD peg, pressure in stabilizer and hive for, let's say.. if I sell 10k HBD in the internal market vs I buy 10k HBD in the internal market?

There is any difference or it doesn't matter? There are differences (not for me, for tokenomics) if I sell HBD directly on IM vs 3,5 days?

If you sell or buy large amounts of HBD on the internal market you will basicly have bigger slipadge/fee ... its bad for you, good for users making arbitradges or the stabilizer and the dhf. Its an open market trade on an asset with low liquidity

If you do the 3.t days conversions, you skip the market and make an otc deal with the chain so to speak. Thing is your peice is the 3.5 days average whatever that would be.

So, in non 3.5d conversions it doesn't matter to stabilizer and the dhf if it's HBD sell or or buy, right?

Yes

👍 thanks for explaining!

The main difference is that if you use conversion, you burn those tokens in favor of creating the opposite one.

Burn it means less supply which is good, or not?

It usually is :)

@dalz,

Good afternoon here in my world. I am not a financial "anything" really! I have said that time, and time again 😜. When it comes to explanations and posting mind you. My take is that...

We have HBD. Now... we can save them... great! Then the savings alone (I remember when I was young... always being told, "Put your money in a high-interest account".) I know it gets folks' attention. Then interest of 20 % APR? Well, sign me up!! Right? For me just looking from the outside in. I see people appreciating the high interest that helps them grow their accounts. This will allow them to make a more significant/positive impact on the blockchain. That's why all of us are here... right? Now... with this mindset, I can see the importance of maintaining a transparent HBD APR Policy. Maybe some Witnesses could sound off... but the actual reason I came to visit. Was to commend you on the background choice for your main graphic...

Seems we both appreciate Cairns and the history of what they represent. Hope you have a good Wednesday, my friend.

!LUV

@dalz, @wesphilbin(3/10) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

HiveWiki

HiveBuzz.me NFT for Peace

Witnesses having full control over HBD interest rate, changing it on a whim, is not a problem. Note that witnesses control a lot more sensitive things, security and viability of whole chain rests on their ability to properly understand, select and manage changes. It is their duty to consider impact of their decisions on different [classes of] actors on the chain and it is our duty as voters to keep them in check and vote for someone else if we disagree with their decision.

I only have a problem with HBD in how ridiculously (from technical and usability standpoint) its interest payments are implemented. It should just replicate the VESTS model (effectively if not explicitly introducing VHBD as an asset held in savings balance) - much cheaper to hold (we would only need

balance, all theseconds,seconds last updateandlast interest paymentvariables could be dropped) and also we'd no longer need to "stir the balance" once a month to get the interest. I wanted to change it long ago, but my lone voice is apparently not enough :o)The claiming of the interest is a bit wonky I agree. But still not that much ofa pain, as most users just go woth jt. I would like it to be more than once per month, thats for sure.

Certainly some food for thought. If the hive price goes up, it may make sense to reduce it, but I think we need to grow the hive ecosystem and adoption more. Once people realise it's the best crypto out there, hopefully it will grow.

People are stick with hive not because of hbd interest but because the project is good. Why can’t the interest be reduce to avoid all this explanation. 10% is still very good

Posted Using LeoFinance Beta

The best policy makes HBD reasonably attractive to hold but not so attractive that its supply grows at an unsustainable rate. This depends a lot on competitive factors, both USD interest rates and other DeFi rates, but also adjusted for risk and liquidity. Right now we are probably about right given that funds are neither flooding in nor fleeing. The reason we're much higher than USD or other DeFi rates despite being largely in balance are the risk and liquidity factors that weigh against Hive as a smaller platform.

Thanks for the feedback!

Totaly agreed with this. Also on the liquidtiy side, its still the no.1 problem for HBD, although its improved a lot recently.

Just today someone was asking me how to get 100k HBD and it is not an easy task.

What is your opinion on leaving a fixed rate for a few years, and then revisit?

Not in favor of that idea.

This is really teaching. Thank you for sharing

!1UP The current APR is, indeed, really high; but it's also a great opportunity for the blockchain to attract larger players looking for a profitable stablecoin to park their money.

You have received a 1UP from @underlock!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

I gifted $PIZZA slices here:

@curation-cartel(8/20) tipped @dalz (x1)

Send $PIZZA tips in Discord via tip.cc!

It's really hard to project anything right now because the savings number is way too small. 4.4M is very tiny compared to the market cap of Hive so a 0.5% inflation annually shouldn't be worrisome for now IMO.

A lot could change in 365 days so I think the max projection we could potentially use for a "safety mechanism" is one year. I think Task has a correct view of the situation and even though it sounds like too much, 20% is like a tiny dividend Hive pays to those that invest in it.

Many projects will build HBD sinks, something I first saw with the upcoming game Ragnarok. If the savings amount stays the same and sinks start kicking in we may need to increase the APR even more due to the burns generated by the Hive economy.

But, all of that aside, I do agree that we need a formula for calculating APR at least. If 200% per year is fair then so be it. It will attract outsiders and slowly keep coming down. I would rather see a market-driven dynamic APR than what we have now but I'm also not an expert.

In summary, we still seem to be playing it safe here on Hive so at least there is no sense of urgency to solve this one.

Posted Using LeoFinance Beta

Better safe then sorry they say :)

HBD is slowly improving as so does the liquidity, that is the main issue atm.

It'll be smart to not overthink this. Tron is the best example of not giving a damn about Tokens, while keeping LPs, DEXs and Sideshows running to stay as a top coin forever.

Crank it up, or tune it down. The System will protect itself because it's good.