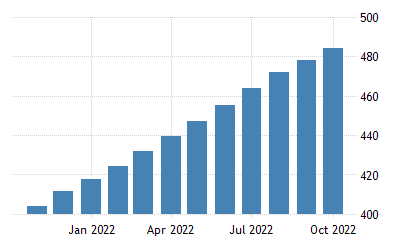

Consumer Price Index Annual Snippet

The past fews weeks, retail traders have been dribbling so much due to some fundamental release which has really raised so much dust in the financial market, thereby making most retail traders make decisions that make them lose some funds.

In a certain telegram group I belong to, one of the forex traders in the group said something last week which incited so much argument. He said that the sudden spike that occured in the financial market was a result of the unemployment rate in the US. He made the statement after the Consumer Price Index (CPI) data release which happened last week Thursday. Though some other person's countered the opinion, he was technically right.

The CPI data release is one of the major news traders look forward to. This data is released every month so that central banks can try stepping up interest rates in order to cool the overheating economy.

Earlier this morning at about 2a.m EST, a report from the Office for National Statistics showed an updated monthly round of Consumer Price Index and Core CPI on a rise in the United Kingdom economy. Though the yearly CPI was forecasted to be at 10.7% spiked to 11.1%, making a high which hasn't been seen in decades. The annual Core CPI also moved a bit beyond expectation of 6.4% to 6.5%. This made the Great Britain Pound rise to 1.19571 per dollar before falling down to 1.17630. Though as at the time of making this post, it was ranging between 1.18190 and 1.17910.

From the retail trader stand point of view, the UK CPI data release twerked the market today. While many retail traders were holding on to their long bias, some were having short bias.

The last CPI and Core CPI data release for the year will be next month. If the inflation rate as forecasted by analysts is higher than expected, then the Central banks will definitely be prompted to raise their respective economy interest rates in order to keep inflation rate in check.

N/b:

Every information contained in this post is solely for educational purposes. Never mistake it for financial advice. Thank you

Posted Using LeoFinance Beta