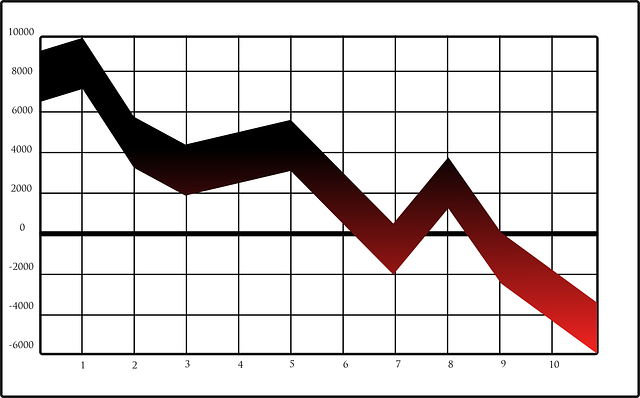

Encouraging investing in a bearish market

If you’ve been paying attention to the market lately, you may have noticed that everything is down, and fear abounds.

Source

You might also notice that even with a positive market, fewer people are investing. It turns out that some people don’t invest in stocks citing fear as their reasoning.

This is not reason enough to complain about the state of the economy and label them as uneducated. Rather, it's an opportunity to find innovative ways to encourage them whether it be through financial education or allowing them to experiment and gamble with their money for greater success in the future.

Long-term traders and Diversification

Traders who are still bullish for the long term should use this opportunity to think about diversifying their portfolios.

We all know that investing in the stock market, especially in a bearish market, is a risky move. However, traders should take advantage of this opportunity and focus on diversifying their portfolios. The market is currently in a bearish state, but there is a window of opportunity for traders who are still bullish for the long term. Traders who are still bullish should use this opportunity to think about diversifying their portfolios.

Buy stocks in a company with potential

One of the best ways to explore your analytical skills is to buy stock in a company you want to learn more about or that you think has great potential. Basically, there are three approaches for generating your investment portfolio:

Index funds:

The first approach to investment is using an index fund.

Index funds are those that track a specific market index such as the S&P 500, Dow Jones Industrial Average, and NASDAQ.

Investors in these funds buy the same basket of stocks that the publicly-traded companies use so they don't have to worry about what companies to invest in.

This makes it easy for anyone starting off with investing more time focused on other things (job, school) because you don't have to do the research of what companies to buy.

Therefore, invest in hundreds of publicly-traded companies and weigh their holdings according to the amounts of money invested in them

Market Timing funds

The second approach is market timing funds. These are funds that invest only in stocks that have a high potential for returns or low-risk probabilities such as "the hot stock" or those in a volatile sector.

These types of funds are best for investors who know what they're looking for and have time to perform the necessary research and due diligence on which stocks to invest in.

So you invest in stocks with the highest potential returns or those exhibiting the lowest risk probabilities

Different Sector funds

The third approach is investing your money in different sectors each month, weighing your portfolio in those sectors to assure that you're investing your money in the best possible places. By following this method, you Invest your money all over monthly and weigh the investor's capital once per year.

One Sector Funds

The fourth approach is investing your money in a particular industry. This approach is meant for investors who know what they're looking for and have time to perform the necessary research and due diligence on which companies are best to invest in.

A sharp drop in prices is an opportunity

People invest in the stock market when they believe the price of a given share of stock will rise over time. This is called an "Income" investment because people buy certain companies' stocks to generate income as the company pays out dividends. A "Growth" investment is when people invest in a company's stock expecting that it will grow over time, thus generating a capital gain.

In periods of uncertainty that characterize bearish market trends, likely, most investors will not be too keen on long-term investments.

Thus, the exorbitant return rate offered by companies often encourages such investors to act.

However, sharp drops in prices can provide opportunities for growth investors. If someone gets into a position near rock bottom, their risk goes down dramatically because those who want to get out now have to pay you if they want to capture whatever trickle profits may be left on top of their losses—and no one was ever out at trend-line support that didn't pay up such winners go on increasing volume day after day as long as prices are holding.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thank you

At these moments, I don't dare to trade too much as the price could go in either way easily... But, on the other side, this is the perfect time to DCA-ing into the token that you believe in... I have no doubts about the big ones like BTC or ETH, and HIVE, for example, so I do try to accumulate them for a long term... ;)

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

And that's a worthy approach. The market is likely to take a different turn so DCA to the rescue. Thanks for sharing your thoughts.