If you are not investing you are losing your money.

Hello everyone...

Inflation is a global phenomenon that is being felt more and more all over the world right now. And this phenomenon seems to have been accelerated by the pandemic and the Russian war against Ukraine. In the pandemic by crippling the economy which caused the U.S. government to print bills like there was no tomorrow, hundreds of billions in just over two years which is even more than in the entire history of the nation. This caused the value of the dollar to begin to decline worldwide.

And with the advent of the war between Ukraine and Russia it seems that the value of the dollar may go to 0 very soon, as many countries worldwide are beginning to leave the hegemony of the dollar by the various events, for example the sanctions on Russia as the ban on oil imports, the departure of Russia from the Swift interbank system among other sanctions, have made Russia look for other ways to trade without the need to use the dollar, and countries allied with Russia may also follow in their footsteps. Which would leave the dollar increasingly out of the game and where accelerated printing would impact much more strongly on the global devaluation of the dollar.

To understand how your money devalues, let's imagine that the devaluation is negative compound interest. Compound interest is that which earns you interest on your investments and that interest is reinvested to generate more wealth in the future. But with a negative compound interest this process is serious, on the contrary, since every year your money loses value and in the future it will be worthless.

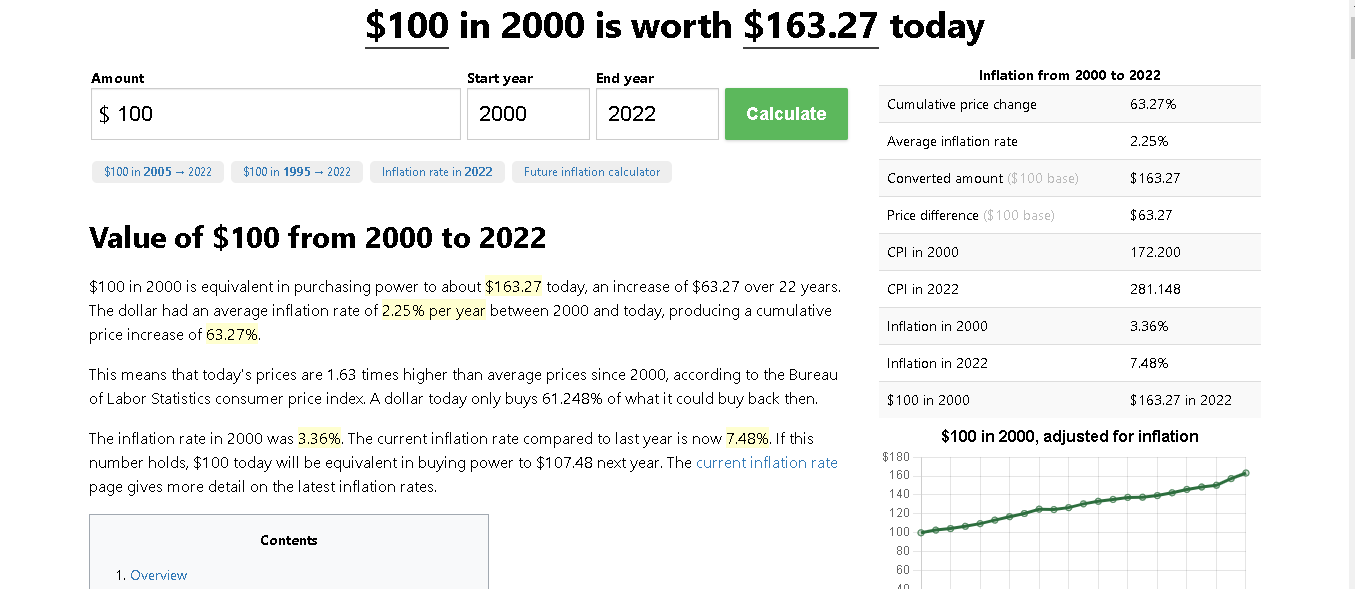

At the moment the negative compound interest rate of the dollar is around 4% per year, which means that if you keep $100 in the bank now, in one year it will be worth $96, and as more years go by it will be worth less. The CPI inflation calculator gives us an idea of how much money has devalued over the years. For example, since 2000 $100 has devalued by more than 60%.

Now, keeping your money in the bank is not the best option if you want to hedge against inflation. That is why you are presented with a wide range of options to invest your money for the long term to preserve the value and increase it as well. We have the physical investments such as real estate, metals, diamonds, bonds, or those that are intangible such as stocks, the stock market or cryptocurrencies.

But of all these, cryptocurrencies are the best option for you in the long term. And although it is true that they are volatile and that you have to invest carefully, it is also true that they produce much better returns than investing in other options. Since cryptocurrencies are playing a greater role as stores of value.

For example, let's look at bitcoin, a pillar currency and extremely interesting. Since it is the best currency to invest in due to its peculiar characteristics such as limited issuance, decentralization and increase in value.

Limited issuance: Since bitcoin was created, it was thought with the idea of limited issuance, to avoid inflation and loss of value. It was thought that only 21 million bitcoins would be created and so far approximately 19 million bitcoins have been mined, leaving 2 million bitcoins remaining for a few years. Now the bitcoin is also slowly passing the life time of some coins, and so far it has accumulated a lot of value.

Decentralization: A wonderful thing about bitcoin is that it is not controlled by anyone, no bank, government or commercial entity. This makes it perfect because it can not have massive falls due to someone's mismanagement, the price is dictated only by market supply and demand.

Increase in value: Since bitcoin was created in 2009 it has not stopped growing. For example, if you had invested $100 in bitcoin in 2014 you would have bought 0.18 BTC which would now be worth $6990 despite the market decline. On the other hand, if you had put your money in the bank or under your mattress that $100 would have lost 18% of its value.

So remember that if you are not investing your money correctly you could be losing 4% or more per year, we have seen with a simple example the great opportunity that cryptocurrencies have and so much so that the government of the country owner and issuer of the dollar commanded to create a crypto dollar, because they know that if they do not evolve they will die because things are changing and Fiat currencies will be out of the picture.

Posted Using LeoFinance Beta

In Iran inflation is more than 40% per year! 2.25 % per year is like a joke for us! in 20 years ago price of everything grows more than 20X in my country.

Now imagine this inflation in the "supposedly" most powerful currency in the world, this would directly affect all countries. With inflations of 80% or more.

currently, Every single Dollar worth 260.000 Rial :)))))) 😅🤣

This is more or less the value of the Argentine peso to the dollar at this time. But 3 years ago in Venezuela the value of the bolivar to the dollar was 500 million bolivars to the dollar.

Iran is a big and full of wealth country. we have oil, we have farmery, we have carpet! Iranian pistachios and saffron are famous in the world! we built Cars very sooner that south koreans Hyundai and Kia

But alas, alas for dirty politics

We was most powerful country back to when the great SHAH was rulled here.

But the world order didn't want iran be powerful.