Lawsuit against Binance and other exchanges.

Hello everyone...

Today is a black Monday for the crypto market, as bitcoin broke the $30K floor and is on its way to a new one, many expect it to be around $18K, but many times it is surprising how the price is heading, in fact this might be a vital support point as many big investors mentioned that they would enter the market if the bitcoin price falls below $24K. So we could expect a strong rally.

In any case, the most important thing here is not the bitcoin price, but rather what we are seeing in the crypto sphere, for example Celcius, a cryptocurrency lending company that managed more than $12 billion in assets, has stopped withdrawals due to the large drop in prices arguing that it did not have liquidity, which has flooded the market with fear and has caused the market to plummet even more. If you want to know more about what is going on with Celcius you can visit this publication from @whatsup BREAKING: DeFi lending giant Celsius halts withdrawals.

Now what I want to comment is another great news that we found in the crypto twitter, and is that a lawsuit is being prepared to Binance U.S and other exchanges such as gemini, coinbase or krakenfx for defrauding investors with the sale of LUNA and UST.

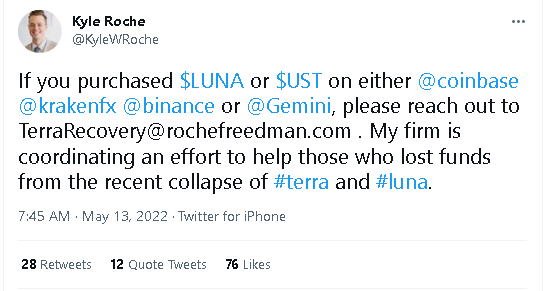

A group of investors filed a class action lawsuit in the Northern District of California, The lawsuit was filed by the law firms Roche Freedman and Dontzin Nagy & Fleissig, you can read the pdf document here:

Binance US Luna Class Action

The lawsuit against Binance is because it sold unregistered securities in the form of LUNA and UST to investors and tricked them into buying them, i.e. this company knowingly promoted a flawed project. Not only did the exchange support and promote the value token, but its parent company also listed the second version of LUNA 2.0 after the failure of the first one. And he also accused the exchange of false advertising, pointing to its claims that UST was backed by fiat, which was redacted after the collapse.

And the founder of the law firm handling the lawsuit, Kyle Roche, urged people who had lost money by buying moon on the major US exchanges to contact him by email. So this lawsuit may be the beginning of other lawsuits against other exchanges in the United States.

But honestly, while I think this is a great idea that may give some people hope that something can be accomplished. I really don't think this lawsuit will get anywhere, as these billion dollar companies would crush any plaintiff with their lawyers.

Besides, binance can easily wash their hands of it since during the collapse they de-activated the trade and when they re-activated it they placed a big ad warning those who wanted to invest to be very careful with the high volatility of the asset. And as this trade you must operate at your own risk, as Binance nor any other company buying and selling cryptocurrencies is responsible for anyone's losses. And finally if it achieves something, it would be beneficial for the people of the United States, since the demand goes to Binance U.S.

But what do you think, do you think this lawsuit will achieve something? Comment your answer, thank you very much for reading.

Posted Using LeoFinance Beta

You are right that these cases will not be easy to solve in courts. But it's great that they are trying.

I hope this will help them recover the funds of as many people as possible!!!

Posted Using LeoFinance Beta

I sent an email, but since I'm from Venezuela I don't expect much haha.

Posted Using LeoFinance Beta

I don’t see the lawsuit doing much really.

Posted Using LeoFinance Beta

Well, let's say it's 50% 50%.

Posted Using LeoFinance Beta

So far most of the law suits we have seen have resulted in very little outcome, usually a very payable fine. The end result is that the exchange or project in question no longer has to fear future penalties.

Posted Using LeoFinance Beta

Absolutely true.

In addition, all the money lost by the affected parties, if any, they will recover a maximum of 20%.

Posted Using LeoFinance Beta

How many unregistered securities Binance and other exchanges are selling. Is there any registered security that sell by Binance and other exchanges.

Well, these records when they come to light are not totally accurate and that is where the error lies. Because it is not understandable that out of nowhere binance had billions of LUNC if the network was paused.

Posted Using LeoFinance Beta

Thanks I see now.

No one knows for sure what will happen, but big companies usually end up winning cases like this. Atleast they're trying.

Posted Using LeoFinance Beta

Hopefully it will take an unexpected turn and lead to forceful justice, but as you say that probably won't happen.

Posted Using LeoFinance Beta

There's no harm in trying 😁.

Posted Using LeoFinance Beta