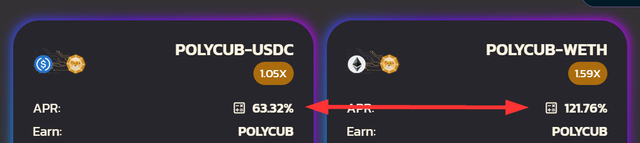

PolyCUB-USDC 63% APR is Good, but PolyCUB-WETH 121% APR is Better - The Amazing Wonders of PolyCUB Bridge

Hello Lions 🦁!

It's a beautiful day to behold and a time to reflect on the current dip affecting the entire cryptoverse and how to utilize the yield optimizing platforms around us in a way that we'll not feel much of the negative impacts of the current dip. It's your friend @faquan saying hello from this part of the world.

Today's post will focus on the numerous opportunities that PolyCUB offers to potential investors and how an individual can earn more rewards from PolyCub amidst it's current market price.

Yesterday I wrote a post entitled: PolyCUB-USDC Pools at 63.06% APR: An Amazing Offer During The Dip Season - Revisiting My PolyCUB Farm, in that post, I told us about the amazing nature of PolyCUB-USDC pools that has about 63% APR and how one can utilize the offer to become financially free.

These are the words of @onealfa in commenting on my post:

63% is good but 121% is better.

Those lines is what prompted me to do more research on multi nature of PolyCUB multi-chain bridge APR.

PolyCUB on its own is a multi-chain bridge that has the ability to project yield optimizing goals, when utilized very well.

Looking at PolyCUB in general, you'll observe that the APRs on the different V2 vaults (pHBD, pHIVE and pSPS) is giving holders a run for their money. For instance, the APR of PSPS-POLYCUB is at 101.11%, while the liquidty pools for pSPS is at $27,270. Imagine investing in PSPS-POLYCUB on this APR acceleration + the amount of PolyCUB and SPS rewards that one will get from a short period of time.Source

With the liquidty pools of pSPS at $27,270 and an APR of 101.11% blockchain gamings can become more attractive and rewards from wrapping and unwrapping pSPS become more exciting.

For pHBD-USDC vault, the liquidty pools is at 325k at the moment, with the projected 5 million liquidity pools in mind, one is expected to cash out big once you move your HBD to the polygon network. The APR for pHBD-USDC vault dropped from it's former 40% to 29.85% due to the drop in current PolyCUB market price at $0.1401.

PolyCUB is also linked to Ethereum through the PolyCUB-WETH pools and this offers the highest APR when compared with any other PolyCUB pools. It offers holders and potential investors a whooping APR of 121%. Just imagine you swapping your PolyCub to the PolyCUB-WETH pools for just a year and see how much you'll cash out from that scheme.

It's time to look inwards to stack PolyCUB and swap to these various multi-chain bridges in order to earn huge rewards that'll take you to that financial freedom you desire.

Thanks!

Posted Using LeoFinance Beta