Binance Coin (BNB) back in the spotlight

As Binance doubles down on BSC via a new $1B development fund, Binance Coin (BNB) returns to the spotlight.

I’m a couple of days late on this one, so you’ve no doubt already seen the news that puts Binance Smart Chain (and BNB as a result) back in the spotlight.

Any time you put a B next to a number, you’re going to garner yourself some attention.

And rightly so!

With our very own Cub Finance DeFi platform based on BSC, a lot of us here on LeoFinance have some sort of vested interest in seeing Binance Coin (BNB) do well.

So while I’ll let you go and research the development fund news yourself, I’ll instead focus on what it’s done to the BNB price and what that ultimately means for those in the bLEO:BNB LP on Cub.

Binance Coin Price

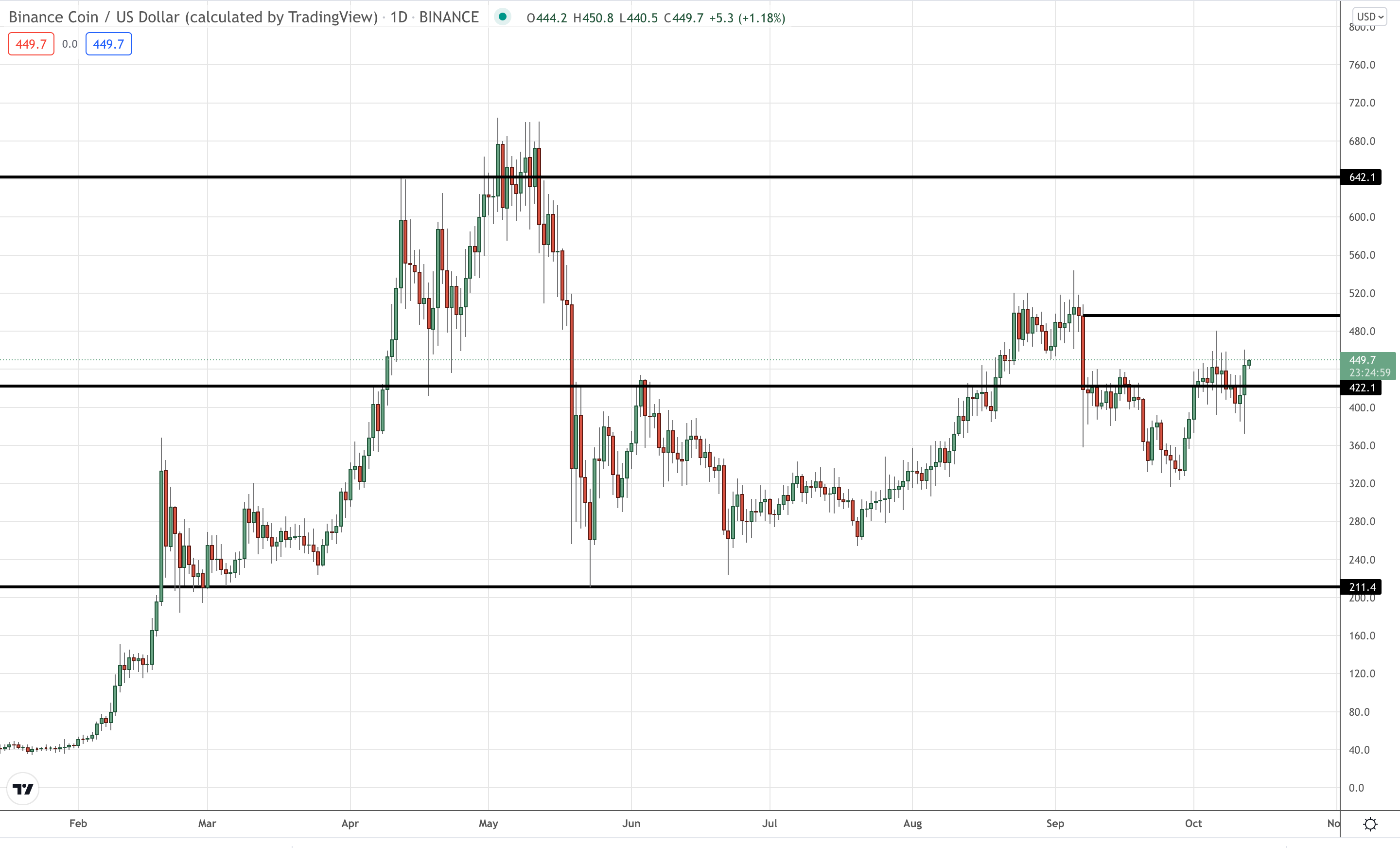

With Binance Coin back in the spotlight, price of course received a nice little booster that sent it back to swing high resistance.

Take a look at the TradingView chart below with a few key, support/resistance levels drawn on.

As a mature, highly liquid network utility coin, we’re less likely to see those 300% rip your faces off type moves like on SHItcoinB.

But if you’re in BNB at this stage, you’ve most likely put it to work in one of the many BSC-based liquidity pools on offer.

A concept that’s highly topical for us here on LeoFinance.

(Before we move on, does anyone’s investment strategy involve simply buying and holding BNB? No staking at all?)

The bLEO:BNB LP on Cub Finance

As I briefly mentioned above, a lot of us here on LeoFinance have some sort of vested interest in seeing BNB do well.

For now, BNB is the only other side available to pooling bLEO on Cub Finance and the 80%ish returns are certainly attractive.

But as we know, pooling your assets within LPs, opens us up to the (often misinterpreted) concept of impermanent loss.

I’ve personally been watching my BNB side continue to be sold for bLEO as the relative value of the two moves further apart.

If you also check how much is my Cub Finance LP worth semi-regularly, you too will also have seen the effect that a rising BNB has caused.

As a LEO bull, I’m not all that unhappy with how things have played out as I see an eventual return to equilibrium playing out, but the effect is certainly worth noting.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment and share your thoughts on Binance Coin (BNB)’s return to the spotlight, within the comments section below? All comments that add something to the discussion will be upvoted.

This Binance Coin (BNB) blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

It has definitely started to pick up and I think it will eventually break $1000 I think all the recent changes is forcing the company to alter its game plan with some great developments occuring.

I don't own any BNB as I went across to Terra but this is definitely a great project which will continue to stick around for quite some time.

I'm reluctantly in BNB because it's currently the only pooling option for bLEO.

As long as Binance controls all the validators, anything BSC isn't truly DeFi and is therefore going to face problems in the end.

My plan is to take advantage of these sorts of announcements and milk BNB for all its worth before the impending centralised implosion.

Posted Using LeoFinance Beta

I wonder if the extra funding can offset all the regulation hits across the world. It wasn't that long ago when Binance was being investigated and called out for being one of the biggest exchanges.

As for the BNB/bLEO pool, I tend to prefer this pool. What is your guess at the equilibrium price? I can't really figure out what it will be.

Posted Using LeoFinance Beta

Binance Inc is always going to face regulatory issues no matter where they go.

But at this stage, they're probably too big and in too many different jurisdictions to ever truly go under.

Regulators have to learn to work with them whether they like it or not.

But as they control all of the BSC validators, the network is centralised.

There are positives to this like Binance Inc being able to inject this sort of cash into BSC based projects.

But also huge negatives because at any time it only takes 1 person to pull the plug and everything goes up in smoke.

My plan is to take advantage of these sorts of announcements and milk BNB for all its worth before the impending centralised implosion.

Anything I say here is just pulling a random number out of my arse, but I definitely can see bLEO outperforming BNB in the medium to long term.

LEO is essentially HIVE's cross-chain link and as more versions such as Polygon etc come online, we're going to benefit from the success of all chains, not just ETH and BSC.

Posted Using LeoFinance Beta