Hive Backed Dollar (HBD) outlasts another stablecoin

Direct from the desk of Dane Williams.

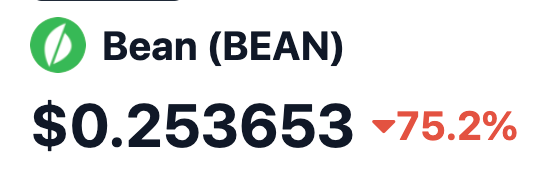

Ethereum's BEAN stablecoin is the latest to collapse, dropping 86% from its $1 peg.

Hot on the heels of Solana’s Cashio stablecoin going to zero, Ethereum based Beanstalk Stablecoin Protocol was yesterday night drained of $182 million.

This attack ultimately meant that the protocol’s associated BEAN stablecoin collapsed, causing a drop of 86% from its $1 peg.

Not sure why it has any value now that this has happened, but it seems people were willing to scoop up this garbage for pennies on the dollar.

Eww.

So I’m going to ask the same question that I keep asking.

Do you know which stablecoin didn’t go to zero?

Hive Backed Dollars (HBD), an actual layer-1 algorithmic stablecoin that is housed on a truly decentralised blockchain.

Yep, HBD didn’t go to zero.

Funny that.

What happened to Beanstalk’s BEAN stablecoin?

The Ethereum based stablecoin project called Beanstalk was yesterday flash loan attacked.

A flash loan attack is when an attacker borrows funds from somewhere that doesn't require collateral.

Then manipulates the price of another crypto asset on one exchange and allows them to quickly resell it on another one.

This causes excess slippage which drives the value of whichever token they’re exploiting deep down toward zero.

Before the attacker then buys back the token at a deflate to buy back the token at a deflated price.

What we saw here was the attacker taking out a flash loan on the lending platform Aave.

This then enabled him to amass a large amount of Beanstalk’s native governance token, STALK.

With those tokens, they were able to manipulate governance via their newly acquired voting power and thus pass a malicious governance proposal that drained all of the protocol’s funds into their own Ethereum wallet.

Beanstalk was exploited for $182 million in the attack, with the hacker himself making away with at least $80 million.

Talk about being in the wrong line of work as a Web3 blogger…

To top it off, the “team” behind the latest failed stablecoin project had this to say:

“Beanstalk did not use a flash loan resistant measure to determine the % of Stalk that had voted in favor of the BIP. This was the fault that allowed the hacker to exploit Beanstalk.”

The team you trusted with your money just forgot to include a flash loan resistant measure in the code.

Hive Backed Dollars (HBD) is the best algorithmic stablecoin

This latest saga is yet another lesson that the words “trust” and “stablecoins” should never be found in the same sentence.

Algorithmic stablecoins should never rely on trusting someone and the only way to mitigate stablecoin risk is to use trustless algorithmic stablecoins like HBD.

HBD is a safer, superior algorithmic stablecoin due to its layer-1 status on the Hive blockchain.

With regulations, attacks, hacks and just plain laziness from teams behind stablecoin projects, attention will eventually shift to HBD.

Even if it is simply achieved through attrition.

Best of probabilities to you.

Posted Using LeoFinance Beta

This is absolutely crazy. I mean, how the hell do they not think that this could actually not be a possibility? Flash attacks are difficult, but not impossible, talking about being stable, it's a mirage.

Posted Using LeoFinance Beta

Just criminal negligence by the team.

While investors knew the risks, I can't help but feel for the regular people who just bought it like any other stablecoin and got royally screwed.

Sucks :(

Posted Using LeoFinance Beta

https://twitter.com/forexbrokr/status/1515932283483885568

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I dunno... I just don't get how the creators of these things can be oblivious to the fact that every conceivable exploit is going to be attempted against them. And then some. You shouldn't even be allowed to release anything till a team of world class professional hackers have banged on the door in a test environment for 60 days!

=^..^=

Posted Using LeoFinance Beta

LMAO seriously mate. I am in approval of this!!!

Posted Using LeoFinance Beta

Exactly right.

Well, I'm certainly no developer...

...but isn't the situation you've described here just good, responsible development?

Especially if your users are trusting tens of millions of dollars of their hard earned money with your code?

Crazy, haha.

Posted Using LeoFinance Beta

I am going to say most dont care. They simply proceed forward without taking the safety precautions.

That is what is great about Hive, there are developers who are always thinking about security. We might delay our growth in some ways but it is for naught if things are hacked.

Posted Using LeoFinance Beta

I agree 100%

One of the great things about Cubfinance and Polycub is that they are examined by CertiK for vulnerabilities and certified as being free of common exploits.

It's crazy to see how many platforms are not considering safety. It makes me wonder if this was an inside job and whether or not this was ever reported to the team.

Posted Using LeoFinance Beta

The ultimate rug pull...

Too bad we'll never actually find out.

Posted Using LeoFinance Beta

Seems to be a common exploit of EVM.

Posted Using LeoFinance Beta

Sounds like the best way to rag pool your community and blame it on an overnight and not having it point directly at you

Posted Using LeoFinance Beta

The similarities between this and a DeFi rug pull by project founders are striking, aren't they...

So dodgy.

Posted Using LeoFinance Beta

People in crypto need to do their homework and if you want to invest you should be able to read the code yourself before you can honestly decide if it's worth your trust. These happenings are bad for crypto in general. But the good thing is that, like you say, eventually the attention will shift to HBD!

Posted Using LeoFinance Beta

Short term, the community funded Hive is always going to struggle with exposure and accessibility when compared to Ethereum based projects like Bean.

But over the long term, Hive's superior solutions such as HBDm surely can't be ignored forever.

Posted Using LeoFinance Beta

It's safe to say that HBD is the stablecoin of stablecoins. :))

HBD can withstand the test of time.

Posted Using LeoFinance Beta

HBD - The stablecoin of stablecoins...

...when it is holding its peg ;)

Haha but seriously, we certainly have a long way to go ourselves.

But we're certainly on the right track here on Hive.

Posted Using LeoFinance Beta

😂😂 Won't criticize the peg too much because it has been holding pretty well nowadays. But yeah, it seems to off a little every now and then.

Maybe in a year or two but I am hopeful that we will get there.

Posted Using LeoFinance Beta

We are progressing. There is a difference in that we dont take major steps back. We dont advance as rapidly but that helps us to avoid the pitfalls.

Posted Using LeoFinance Beta

I would agree with you.

We are working on it. Each day, we get further ahead.

Posted Using LeoFinance Beta

Wow, there are some things they missed even I wouldn't miss lol!

Posted Using LeoFinance Beta

The lack of due diligence by the team is almost criminally negligent.

I just feel sorry for the regular people that didn't think between which stablecoins to park their funds in and lost money they no doubt couldn't afford to lose :(

Posted Using LeoFinance Beta

We don't have flash loans but even if we did there are so many ways this attack would not work on Hive. For example, DHF only pays out a maximum of 1% per day, and only 1/24 of that in a single payment. The most you could pull out with malicious voting is about 0.04%. But you can't even do that because you have to power up to vote, and it takes 12 weeks to power back down (making it impossible to repay a flash loan). And even then you don't even get to vote for 30 days after powering up.

It's amazing how these well-funded projects manage to get so much wrong compared to a no-external-funding community project (Hive).

Cheers for stopping by and sharing your insights, Smooth! :)

The comparison amazes me too.

It just shows how much of a difference exposure and accessibility makes to a project.

Short term, the community funded Hive is always going to struggle in this regard when compared to Ethereum based projects like Bean.

But over the long term, Hive's superior solutions can't be ignored forever.

...right? ;)

Posted Using LeoFinance Beta

Great to know how the security features of Hive make so much impossible.

EVM sure does have a lot of holes it seems. The flash loan idea never made sense to me in terms of the having it in the protocol. Too much risk without much of a payoff.

Posted Using LeoFinance Beta

Hi @smooth

Please explain the features of the HBD stabilizer in terms of any protections they would provide against the collapse of Terraluna stablecoin UST.

Thank you

I'm thinking on a post about Terra and HBD. I don't know when it will be done.

Great, we can all benefit from your knowledge.

Posted Using LeoFinance Beta

!BEER

Posted Using LeoFinance Beta

Nothing I !LUV more than an ice cold beer on a warm day.

Cheers!

Posted Using LeoFinance Beta

@forexbrokr(1/1) gave you LUV. wallet | market | tools | discord | community | <><

wallet | market | tools | discord | community | <><

View or trade

BEER.Hey @forexbrokr, here is a little bit of

BEERfrom @fiberfrau for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Yeah, I've just read about that and it seems that stablecoins are not infallible and they have their own risks associated. Hopefully, HBD has better tokenomics with the Hive balancing and with Bitcoin backing which now is laid within a proposal. As we are not huge enough yet, the hackers probably didn't pay attention to Hive, but if success occurs hopefully the code will counter any attacks.

Posted Using LeoFinance Beta

HBD is in a much better position due to its home on layer 1 of the truly decentralised Hive blockchain.

As for the HBD's potential BTC insurance proposal you brought up, I actually shared by thoughts on it the other day.

Just gotta remember that this is a different type of insurance.

It isn't to repay investors if Hive gets flash loan attacked (something that smoooth has explained as being impossible in a comment above), but only to be used in the worst case scenario of a death spiral.

Posted Using LeoFinance Beta

"another one bites the dust"

And another one gone and another one gone,

Another one bites the dust!

Posted Using LeoFinance Beta

These flash loans created many problems on EVM blockchains.

Posted Using LeoFinance Beta

Yet EVM blockchains remain super popular with the punters!

Posted Using LeoFinance Beta

I saw last night BEAN took a hit a a rather large one. It just floors me how these places keep getting hacked for so much while some of the older school ones seem to have no issues?

Posted Using LeoFinance Beta

Haha, some others in the comments are suggesting it looks like an elaborate rug pull from the team!

I'm not sure about that, but I do maintain that in the short term, the community funded Hive is always going to struggle with exposure and accessibility when compared to Ethereum based projects like Bean.

But over the long term, Hive's superior solutions such as HBD surely can't be ignored forever.

Posted Using LeoFinance Beta

EVM have some exploits it seems. Hopefully teams are learning to plug them.

I also wonder if the fact that not many are familiar with Solidity is feeding into this.

Posted Using LeoFinance Beta

Glad I only have HBD. I am just not a risk-taker with all these different cryptos. Thanks for the information.

Posted Using LeoFinance Beta

Not to mention that the whole point of stablecoins is that they're not meant to be a risk at all!

Posted Using LeoFinance Beta

Cant go wrong with that. It is one of the safest bets out there.

Posted Using LeoFinance Beta

When I read that a development team does not take appropriate measures to ensure the stability of a currency that they promise to be stable, I greatly admire the great work they do on HBD. I hope that investors can better see our stable coin since it is armored in these aspects. Good times are sure to come for Hive

Posted Using LeoFinance Beta

Yep, the devs and our current top 20 witnesses are doing a fantastic job.

With that in mind, make sure you keep your witness votes up to date and support those you trust to deliver!

Posted Using LeoFinance Beta

I can't imagine such language as forget, wow they were careless and now they have nothing more to give out. everyone in there lost their money just because someone forgot.

This makes me remember a word I use to say to others, "I don't stray far away from home HIVE"

Posted Using LeoFinance Beta

I can't believe that they actually released that statement.

It's like they're laughing in the face of regular folk who lost money by trusting their code.

Disgusting.

Posted Using LeoFinance Beta

I am not buying the forgot line.

Posted Using LeoFinance Beta

Anyone who saw the name Bean and put money in it thinking it was going to hold any kind of value kinda deserves it.

Posted Using LeoFinance Beta

Kinda... definitely haha.

Posted Using LeoFinance Beta

Well, you know that's what I'm thinking but I try to be cognizant of how others might take it.

Posted Using LeoFinance Beta

LOL.

That is one way to judge a project.

Of course, who would invest in something called Google?

Posted Using LeoFinance Beta

Fair point. I guess Google at least sounds weird enough to work. But... Bean? Nah lol

Posted Using LeoFinance Beta

Kind of like KODAK.

Posted Using LeoFinance Beta

Wow this is crazy, maybe it would be better to be a flash loan hacker, but I have a bit of morals still in me...

BTW I came from listnerds

!PIZZA

Posted Using LeoFinance Beta

It's absolutely horrendous when you consider the personal, human stories of the people who lost money.

I just couldn't do it to them either.

Thanks for stopping by :)

Posted Using LeoFinance Beta

It seems like an easy profession since it is what tends to be exploited regularly.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@solymi(4/5) tipped @forexbrokr (x1)

Learn more at https://hive.pizza.

Can we be sure the developers weren't in on it?

Posted Using LeoFinance Beta

It would be the ultimate clean rug pull, wouldn't it...

Too bad we'll never actually find out.

Posted Using LeoFinance Beta

We can never be sure who is in on stuff like that.

Posted Using LeoFinance Beta

The safety of HBD cannot be overstated.

Base layer coin, individual controls his/her keys, decentralized blockchain....

The more we see of this, the more I like us operating on a nice tight base layer.

Posted Using LeoFinance Beta