How to buy UST on Cub Finance and Bridge to Terra

Walkthrough for using BSC to buy UST in order to stake on Anchor.

There’s no doubt that by now you’ve come across Terra (LUNA) and the platform’s suite of algorithmic stablecoins.

The fact that Anchor currently offers 20% APY on staked UST is just too good to turn down right now.

But did you know that you can easily use BSC DEXs like Cub Finance to buy UST before bridging it to Terra for staking?

This section of our Terra (LUNA) guide walks you through the steps you need to follow in order to start your Terra yield farming journey.

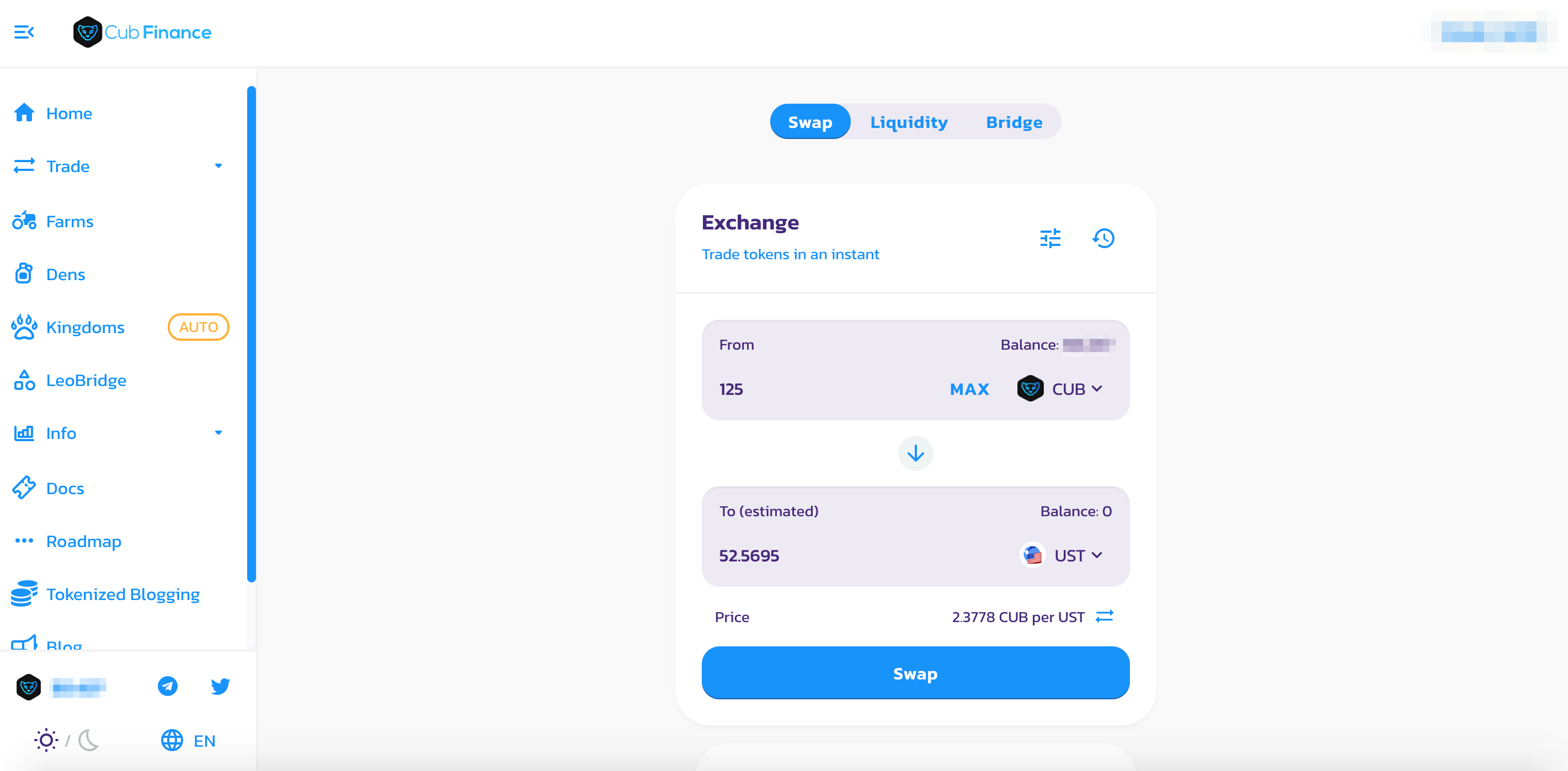

1. Buy UST off Cub Finance

Go to the Cub Finance exchange.

Swap your Cub Finance (CUB) for UST.

The correct UST contract on BSC is: 0x23396cF899Ca06c4472205fC903bDB4de249D6fC

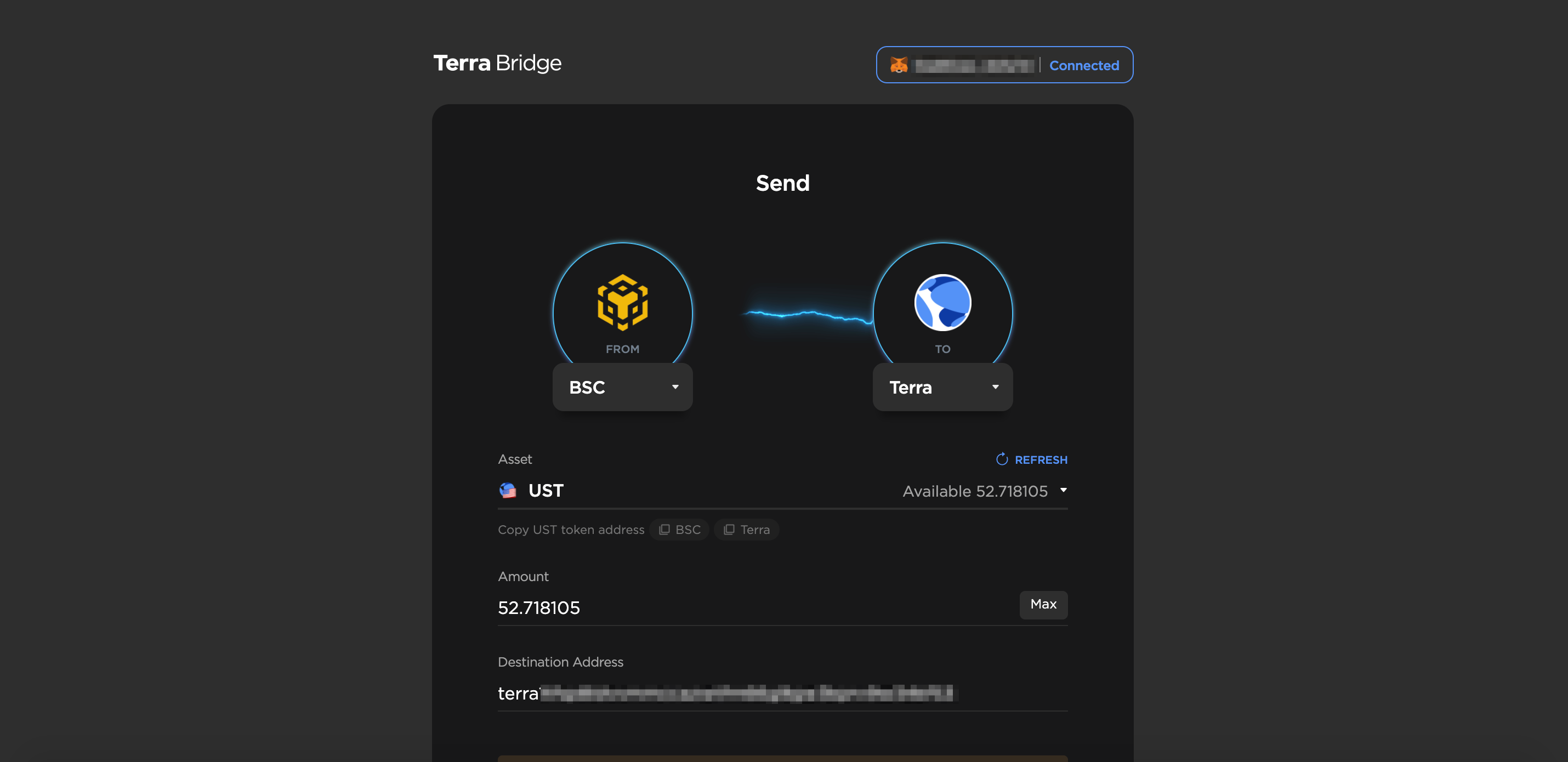

2. Bridge UST to Terra

Open the Terra Bridge.

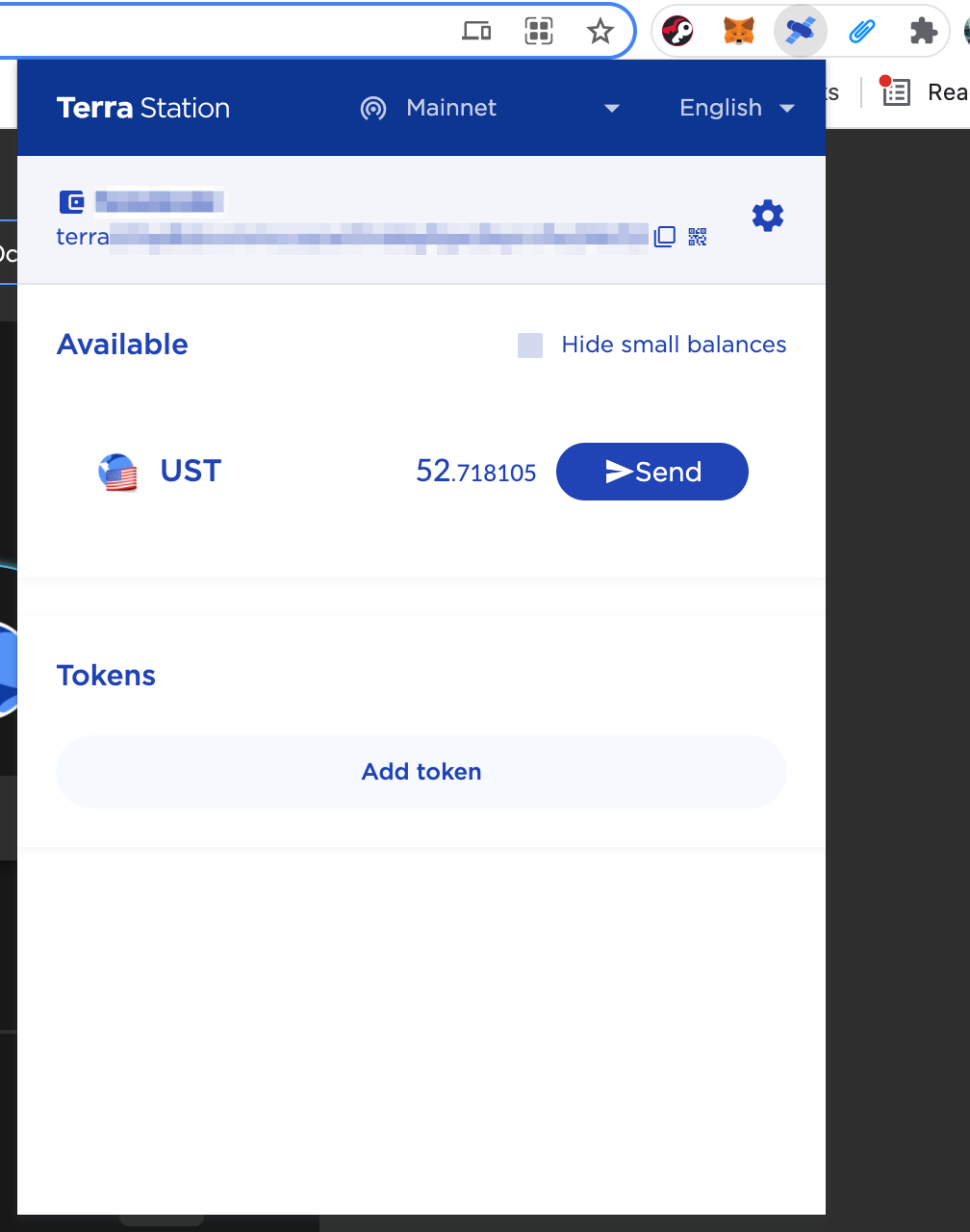

Transfer your BSC based UST that you bought on Cub Finance to your Terra wallet.

The UST will hit your Terra wallet in just a few seconds.

Final thoughts on buying UST on Cub Finance

As this section of our guide to Terra (LUNA) has shown, even those of you stuck in the US can now take advantage of the unique UST stablecoin.

I personally can’t get enough of the project and as US regulations are set to decimate Tether, believe that UST is going to play a huge role in our day to day financial operations.

You can however, take advantage of Anchor’s 20% APY on staked UST right now.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment and share your thoughts on buying UST on Cub Finance and Bridging to Terra within the comments section below? All comments that add something to the discussion will be upvoted.

This Terra (LUNA) blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Nice..

What's the advantage of using cub finance over other swaps in terms of exchange?

Posted Using LeoFinance Beta

Remember that these BSC DEXs all use the same protocol in the back-end.

So using Cub Finance instead of PancakeSwap or the like is simply for convenience.

Especially for those of us here in the LeoFinance community who are more familiar with using the Cub Finance interface to specifically earn and swap CUB tokens.

Posted Using LeoFinance Beta

Thanks a lot Dane. Going to try this out today itself.

My next blog is about Terra's Columbus 5 upgrade that is coming by the end of this month. LUNA is going to the moon.

Posted Using LeoFinance Beta

I see that your Terra Columbus 5 blog is already up.

Great work as always.

Loving your content lately.

Posted Using LeoFinance Beta

I learnt a lot. I didn't knew that it there was terra bridge

That's what our Terra (LUNA) guide is here for :)

Posted Using LeoFinance Beta

How long does it take to unstake on Anchor?

Unstaking your UST on Anchor is instant.

Just hit the withdraw button on the earn page.

Pay the fees and you'll see your money back in your Terra wallet.

Be careful not to confuse this with unstaking LUNA on Terra Wallet, which takes 21 days.

Posted Using LeoFinance Beta

Instant

Awesome guides, I’ve been working on some LUNA-related stuff for the past few months as well. It’s a huge protocol for the space, glad to see your coverage of it!

This will all be even more useful for all of LeoFinance #soon 😉

Posted Using LeoFinance Beta

Fantastic work brother. This is the block chain of tomorrow right here I rekon. Well done and great to see Leo Finance will be there soon.

Now this is an unexpected development for the LeoFinance ecosystem.

VERY keen to hear more about all things LUNA.

Yes yes, all in good time...

Posted Using LeoFinance Beta

Great to see this brought to our attention, I was thinking about how I can get some UST to put them at work. Using CUB Finance to do that, is just much sweeter.

Posted Using LeoFinance Beta

Yep, with the Cub Finance and LeoFinance link, it's really easy for anyone here in our community to get involved in the Terra ecosystem.

UST offers by far the best (and safest) returns on stablecoins anywhere in crypto.

Well...

Bar our very own HBD that is ;)

Posted Using LeoFinance Beta

This is what I was looking for, I personally prefer terra much more than tether, I think that at any moment I can lose everything I have if I keep it in tether.

Posted Using LeoFinance Beta

Yeah, I agree with you that the risks of holding Tether have become too much.

The US government is making it their mission to take Tether down and by the looks of things, they're going to do it.

I can see UST and other untouchable algorithmic stablecoins (like our own HBD) flying under the radar for a little longer.

Before going mainstream in a BIG way.

Posted Using LeoFinance Beta

Wonderful.Well explained.

It have been long I'm looking for how to do this but you have say it all.

Thanks for the information.

Posted Using LeoFinance Beta

Cheers William.

As a Nigerian, the stability of UST could really help you in your daily life.

I would encourage you to continue down the Terra (LUNA) rabbit hole and take advantage of what they're building in the stablecoin space.

Posted Using LeoFinance Beta

Okay.i hope is in LUNA I will get this coin

Posted Using LeoFinance Beta

This worked a charm! Thank you for letting me know. It was great.

Posted Using LeoFinance Beta

It's easy, right? :)

Like I said in that other comment last night, converting to and then staking UST offers those of us earning crypto on LeoFinance a way to cash out.

For all the talk about Hive doing partnerships with other chains blah blah blah, it's LeoFinance that's actually built cross-chain infrastructure Hive can use.

Earn Hive > bridge to DeFi on BSC via bLEO > cash out to untouchable stables on Terra.

How good!

Posted Using LeoFinance Beta

It is really good and now I'll reassees my position. I was originally BUIDL cake and was bringing earnings across to Hive and Leo but the volatility has killed me lately.

I'm wondering if in the long run 20% APY on stables is a better long term investment opportunity. It's pretty much $200 per thousand and I think it auto compounds too.

Nice tip! I haven't been on LUNA yet.

Posted Using LeoFinance Beta

The fact you can buy UST on Cub Finance means that the Terra (LUNA) ecosystem is now completely open to the Hive/LeoFinance community.

As I just said in a comment above:

Earn Hive > bridge to DeFi on BSC via bLEO > cash out to untouchable stables on Terra.

Posted Using LeoFinance Beta

That's a very good guide AND a great advice to move some funds to UST and Terra ecosystem.

I will just add my 2 cents but swapping CUB to UST on BSC is hurting your gains with the slippage (4% for 1000 CUB).

You can exchange CUB for BUSD and the use https://nerve.fi/ to convert from BUSD to UST (usually slippage less than 0.5%.

Have fun !

Posted Using LeoFinance Beta