Pooling LEO on Hive DeFi - The SWAP.HIVE:LEO LP

With BXT rewards now on offer, pooling LEO on Hive DeFi via BeeSwap becomes a lucrative option.

For those looking for the highest APR on their LEO, the launch of BXT rewards on the BeeSwap Hive DeFi platform, means there’s an intriguing new option available.

While there have been some minor token rewards allocated to the CENT:LEO LP, the risk of pooling your precious LeoFinance (LEO) against an extremely risky asset like CENT is too much for many.

Let me introduce the SWAP.HIVE:LEO LP.

The SWAP.HIVE:LEO LP

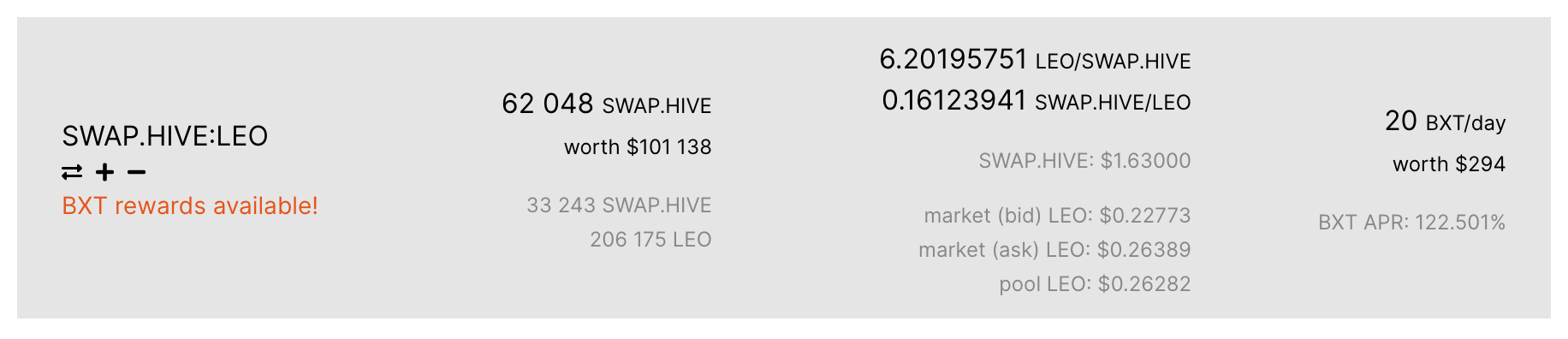

With a current BXT reward APR of 122.251% on the SWAP.HIVE:LEO LP, you not only have the relative safety of pooling against an asset more likely to rise alongside your LEO.

But you also receive an extremely attractive APR in a token with further potential earning potential if you choose to then stake what you receive.

With a BXT APR of 122.251% on this particular pool, its current returns even trump the 85% APR on offer in the Cub Finance BSC bLEO:BNB LP.

In the midst of an overall crypto bull market, the numbers show that LEO investors have been happy to pool their assets alongside BNB due the prospect of both increasing in price together.

Now with the option to be rewarded for pooling your LEO against our very own native HIVE, Hive DeFi now offers a genuine, lower-risk LEO pooling alternative to the Cub Finance pool.

Final thoughts on pooling LEO on Hive DeFi

Your decision on whether to pool your LEO on the BeeSwap Hive Defi platform will ultimately come down to whether you believe the BXT APR will be greater than the losses you could incur if the price of either side of your LP ran away from the other.

At the end of the day however, this is just a part of DeFi that you’re going to have to accept if you want to put yourself in a position to earn.

If you’re extremely risk-averse, there is always the option of stablecoin farming, but of course, the rewards just aren’t the same.

In my opinion, pooling LEO with HIVE offers an intriguing new option because I’m happy no matter what the price of any token does.

Like so many of you here, I’m in accumulation mode and by continuing to add to the pool, it can simply be viewed as dollar cost averaging across each.

The SWAP.HIVE:LEO Hive DeFi LP offers some food for thought at the very least.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment on what you think about pooling LEO on Hive DeFi. All comments that add something to the discussion will be upvoted.

This Hive DeFi blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

https://twitter.com/forexbrokr/status/1469108508960321540

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Some very interesting use cases forming. I like to see the inclusion in Hive in liquidity pools. The fact that LEO is also part of the process is fabulous also.

What an amazing step forward. Pools like these are only going to help lock up more tokens and thin out the amount of supply on the open market.

Posted Using LeoFinance Beta

Having a HIVE sided LP with rewards was something I have been after for a while.

Happy to see that they're finally here and working seamlessly!

Posted Using LeoFinance Beta

That is an interesting pool but just BXT in the pool worries me. After all the high inflation rate will die down eventually since its printing BXT at a higher rate right now. So in that case it looks like Cub Finance might still be the better option a few weeks down the road.

Posted Using LeoFinance Beta

For me, it's all about having on side of the LP denominated in HIVE.

Yes you can get higher rewards pooling bLEO with BNB on Cub Finance.

But that means you have to dump either half of your LEO or your HIVE for BNB in order to pool.

This Hive DeFi option offers an alternative where you can keep both tokens.

The BXT rewards will continue to go down, you're right.

But if the returns are still higher than you can get by staking your HIVE/LEO and curating, then it's going to still be worth it.

Posted Using LeoFinance Beta

What about just selling leo for BXT and stake BXT?

Posted Using LeoFinance Beta

That would make more sense.

I can't see LEO going up against Hive and with BXT you get paid in Hive.

I still find this pool appealing though for some, probably irrational reason.

If nothing else it saves me bothering with transferring the LEO to BSC!

Posted Using LeoFinance Beta

All it would take is a handful of whales hunting for web3 themed airdrops and LEO could easily outperform HIVE.

It's not like it hasn't done it before either.

Don't sleep on LEO.

Posted Using LeoFinance Beta

Fair point, there is a lot of money kicking about in the Cryptosphere after all!

Posted Using LeoFinance Beta

That's certainly another avenue to take.

But I don't want to be just straight up trading LEO for BXT.

Ultimately, it's both LEO and HIVE which I want to stack.

At least by using the SWAP.HiVE:LEO LP, If one side goes up harder, I will just be dollar cost averaging.

While the BXT rewards are on offer, it seems like a no brainer to at least have a portion of my HIVE and LEO in this pool.

Posted Using LeoFinance Beta

Interesting, I'd overlooked this, I might have a small punt.

Posted Using LeoFinance Beta

If it's both LEO and HIVE that you're after, it seems like a no brainer to at least have a small position within this LP.

Some say impermanent loss, some say dollar cost averaging between positions.

If you're stacking both tokens, then view it like the latter and be happy either way.

Posted Using LeoFinance Beta

I did have a few hundred liquid LEO kicking about so added to the pool, it's a nice place to keep it - I usually wait until I've got 1000 then exit that to Cub.

Posted Using LeoFinance Beta

Interesting, I'll have to take a serious look at this!

Posted Using LeoFinance Beta

Looking forward to hearing more of your thoughts when you get a chance.

Posted Using LeoFinance Beta

It's surprising how the Hive-engine dieselpools are thriving. Glad that I read about the dieselpools and their operations with simple words from your blog weeks ago. The growing APYs over 100% is really amazing there.

LEO into many pools would mean a lot to the LEO supply and pricing.

Posted Using LeoFinance Beta