Is The US Dollar Too Big To Fail?

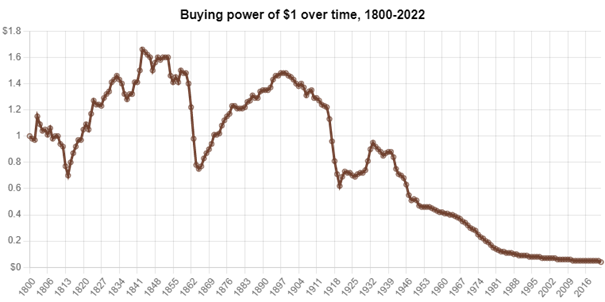

It looks like the purchasing power of our money is melting month by month. There is a famous saying that the safest assumption an investor can make today is that the currency they are trading with is going to zero at some point. In this article I want to talk about the value of the dollar and in what scenario it could be going to zero.

Fiat Currencies Are Doomed

Trough out history, there are plenty of examples that fiat currencies are doomed to fail. One of the most recent examples is the Zimbabwe Dollar. One of the most common reasons for this is hyperinflation. The national debt is getting higher, imports as well as exports are decreasing along with the national GDP. At one point the nation can not pay their national debt which leads to printing more money. This obviously leads to inflation which turns worse and worse. Other very prominent examples are Germany in 1923 when they had to pay back the Allies after World War I, Venezuela in 2018 or Chile in 1981. The main think is that Fiat currencies seem to be doomed to go to zero at some point and it happens all the time.

The Dollar

To be honest the following graph shows that the dollar is losing its value throughout time immensely. What is more interesting is that since 1913 the value seems to be decreasing even more. What happened in 1913? In this year the Federal Reserve was created. It is basically a Central Bank for the United States that is in control of the money supply. What’s more interesting is that in the beginning the dollar was pegged to gold which made it very difficult for the banks to create new money. But since this gold standard was thrown away the dollar started to lose even more value as more and more dollars have been printed.

The main difference between the US dollar and other currencies is that the dollar is a reserve currency. While normal currencies get to live around 30 years, reserve currencies tend to have a much longer life line. Currently, the strongest reserve currencies are the British Pound and the US Dollar.

Can The Dollar Actually Fail?

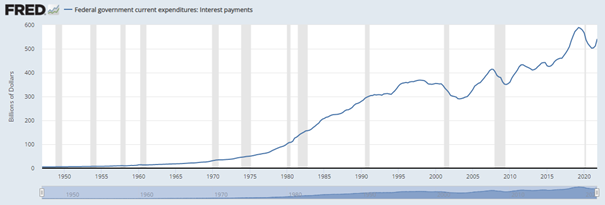

So let’s ask the question: Can the US Dollar actually fail? The short answer it is possible, but the more complex answer would be that it is not going to happen any time soon. Nevertheless, I want to look at one scenario how this actually could happen. Let’s assume the US defaults on its debt and is not able to pay it back. How would we come into this situation? If the FED would raise the interest rates to high this is a real scenario because increasing interest rates would also increase the amount of money the US government is owing. Currently the national debt in the US is something about 30 trillion dollars.. In fact, over the past decades the interest rate payments alone went up consistently. This would mean that if the FED would increase the interest rates too much, it would actually damage the society as there would be less money left for programs like healthcare, education or infrastructure because all of the money would be used to pay off the debt interest.

If the situation gets so out of hand that US can not pay back the debt anymore, the Dollar would lose the status as an reserve currency. But this scenario is VERY unlikely. This is because only the dollar can be used to buy oil. As long as there will be a connection between a resource that the world needs and the dollar, the world will always need the dollar and hence the dollar will stay a reserve currency.

Conclusion

With that being said, the dollar would get into big trouble if the world suddenly won’t need any oil anymore. For example, due to renewable energies. The other scenario is that oil is getting bought by another currency. For example, something like Bitcoin. Like I said, I doubt that these scenarios could happen anytime soon but I would like to know your thoughts on this topic: Is the US Dollar too big to fail?

Published by ga38jem on

LeoFinance

On 20th February 2022

Posted Using LeoFinance Beta

https://twitter.com/ga38jem/status/1495511710148534280

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The more dollars that the Federal Reserve pumps into the system, the more likely it is to fail.

The Federal Reserve creates dollars through a complex lending structure which piles debts upon debts. The US Debt is now over 30 trillion and the interest on the debt is rapidly compounding.

The reserve currency status gave the dollar clout in the past. The status might backfire. If world banks reduced the dollars they were holding on, then we could see an epic bank run.

The American Congress holds the purse strings of the country. They seem to be spending with the idea that the dollar can't fail. That attitude is a primary reason that it might.

Posted Using LeoFinance Beta