Fees on BSC as BNB Price Goes Up

Earlier today (I think, because I sometimes have an entire backlog of posts to read which goes back a few days), @acesontop wrote a post about x10 in crypto in this bull market, starting from this point.

While some coins may have in them much more than x10 and for others this will be an unlikely limit, there is another factor to consider when coins moon. Fees also moon. At least on certain blockchains.

I am not going to talk about the obvious case - Ethereum.

Instead, I'd like to take a look at the level of fees on BSC and how they evolved since Cub Finance launched on that blockchain.

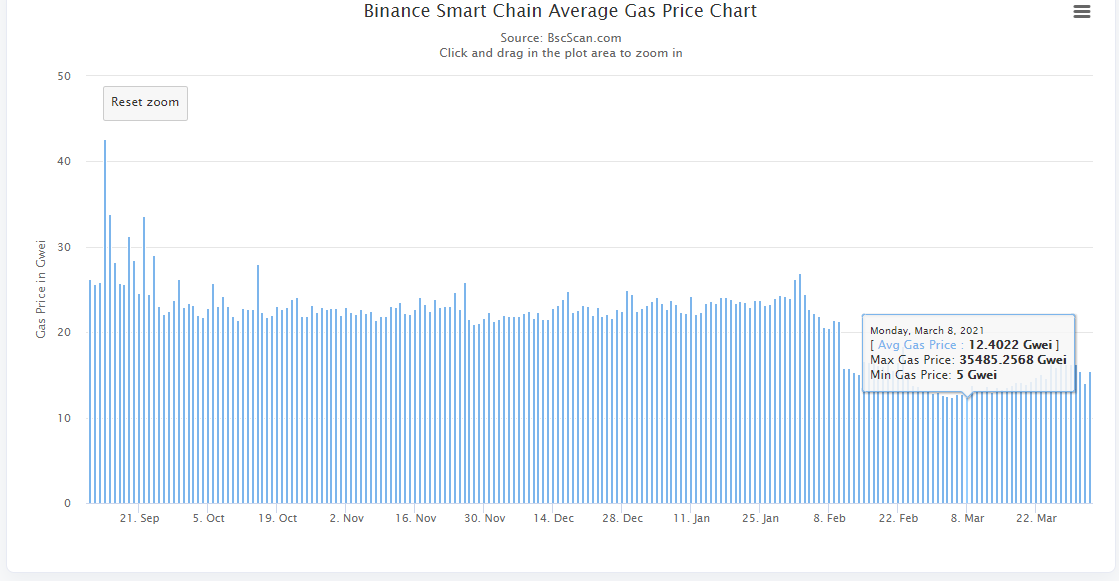

Here's a chart with the minimum, maximum and average daily fees on BSC. If you click on the image, you'll go to BSCScan and see and interact with the original chart.

When Cub Finance was launched on March 8th, the fees were around 12.4 Gwei on average, much lower than in January, for example, when they were over 20 Gwei.

What happened between January and March? Well, BNB pumped about 10x from around 30$. Interestingly though, unlike on Ethereum, where fees lately also pump in Gwei with the price, they were lowered on BSC. Which means they really try to keep these fees low, and the centralized protocol helps them with that.

Not to the same extent, because fees were lowered in Gwei almost x2 on average, while the price went up x10. Which means fees increased x5 in fiat.

Since the launch of Cub, the fees on BSC in Gwei slowly grew, and they are now around 15.5 Gwei on average. That while BNB is attempting to break previous ATH.

If previous pattern repeats, I expect fees to lower in Gwei if BNB pumps, but overall they will be significantly higher in fiat the higher BNB price goes.

Why have I linked this with Cub Finance?

Because we tend to do regular operations which cost fees.

As always, the bigger your assets, the less these fees affect you.

Otherwise you should consider them, especially as BNB price increases.

Currently, while I don't attempt to minimize fees, as that would make me lose on the growth side, I do optimize in a way that I don't pay as many fees as in the recent past, while I am still in all the LPs and dens I want. The best optimization is to not harvest rewards until they are meaningful for your account. And never harvest all rewards, if it's not necessary.

Posted Using LeoFinance Beta

I guess Ethereum is going to become a rich folks blockchain to use after all.

I don't know. They're trying. But it's hard to steer a giant ship like Ethereum once it's set on a certain path.

Posted Using LeoFinance Beta

I still harvested from the DEC/BUSD farm yet because of the fees.

Last week I made the mistake of compounding in the DEN and then discovering that the fees were more than the amount compounded.

I didn't realise this was going to be such an issue for small holdings and I'm not sure how to work out in advance what the cost will be.

Hopefull someone will write a post describing the process soon.

Posted Using LeoFinance Beta

You can't know in advance what the fees are going to be. But you can NOT do an operation if the proposed fee seems too much. You just cancel it on Metamask. This is one way to know what the fee will be and you can make your calculation and see if it's worth it to make the operation or not at that time. Remember, sometimes it's more than one operation, depending on what you are doing.

Posted Using LeoFinance Beta

Easier said than done. Maths is not my strong point. 😁

But thanks for the extra info.

Posted Using LeoFinance Beta