Redirecting DeFi Yields to Liquid Staking - $ATOM - $stATOM...

Hey All,

Liquid Staking has got my attention for quite some time now. And I have been leveraging the liquidity staking on the Stride Platform which is a home to liquid staking and is also known as - aka The Liquid Staking Zone. In this post I am going to share how I am taking my DeFi yields to enter a pool which is linked to liquid staking asset.

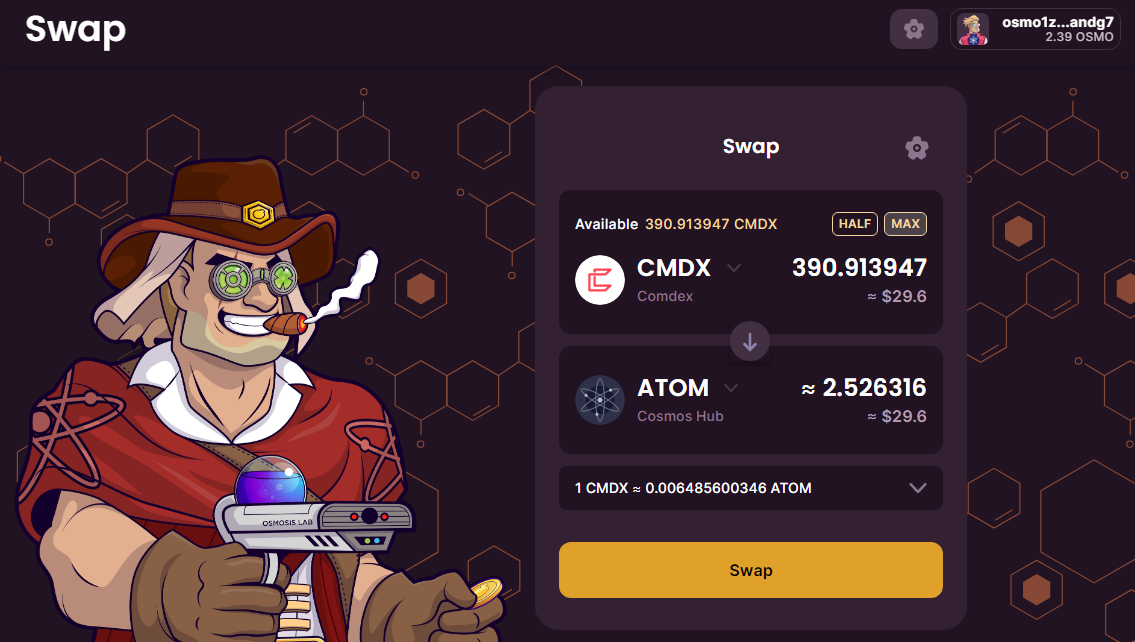

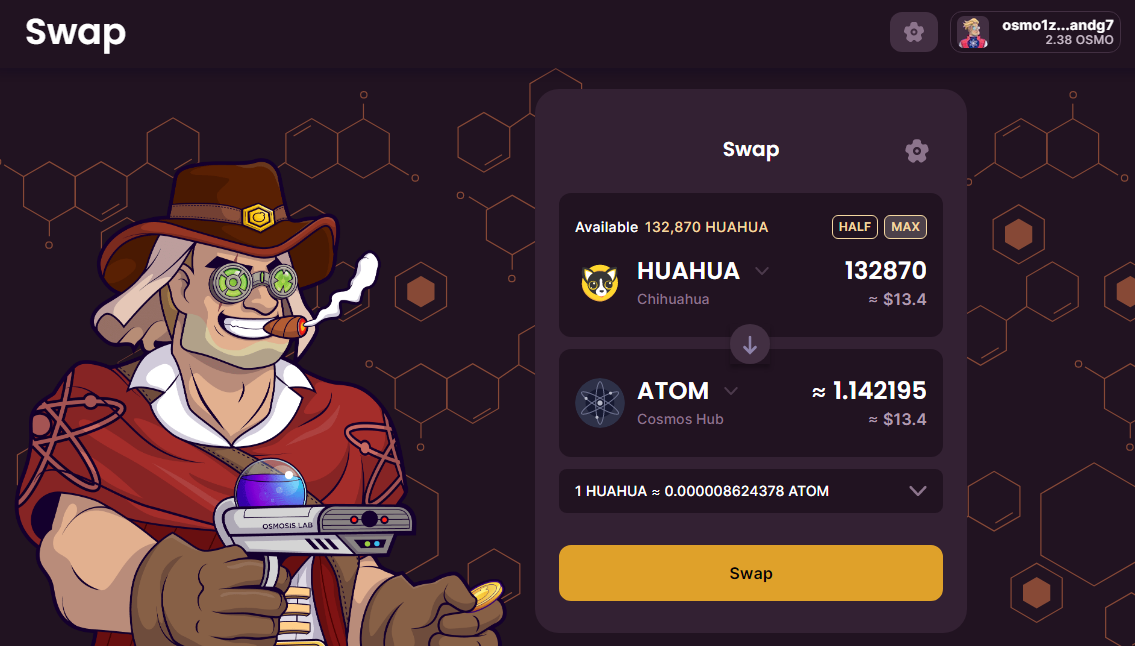

Sold $HUAHUA tokens for $ATOM

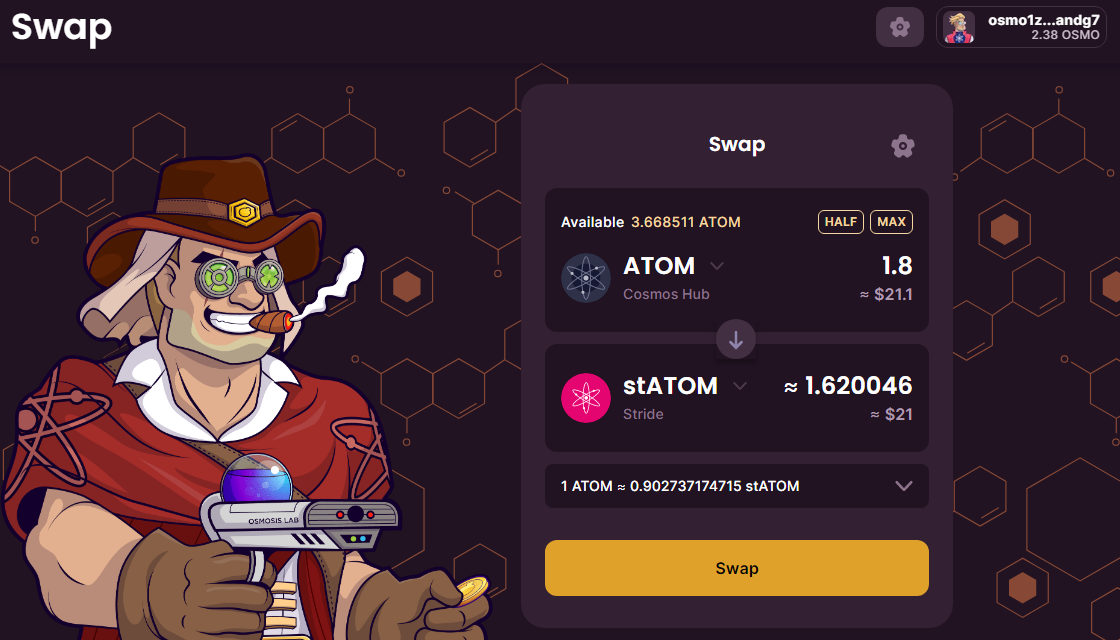

I sold around 130K+ $HUAHUA for $ATOM. All these $HUAHUA tokens that I sold were received as part of staking. At the same time, I sold $CMDX for $ATOM and overall with all these selling and swaps, I was able to collect close to 3.5+ $ATOM. This is all the Defi yields that I am going to redirect to liquid staking assets. Now I had two options either take this $ATOM and stake it to a normal Defi Pool or convert some of these $ATOM to liquid staking assets like $stATOM and then enter a Defi Pool associated to these liquid staking assets.

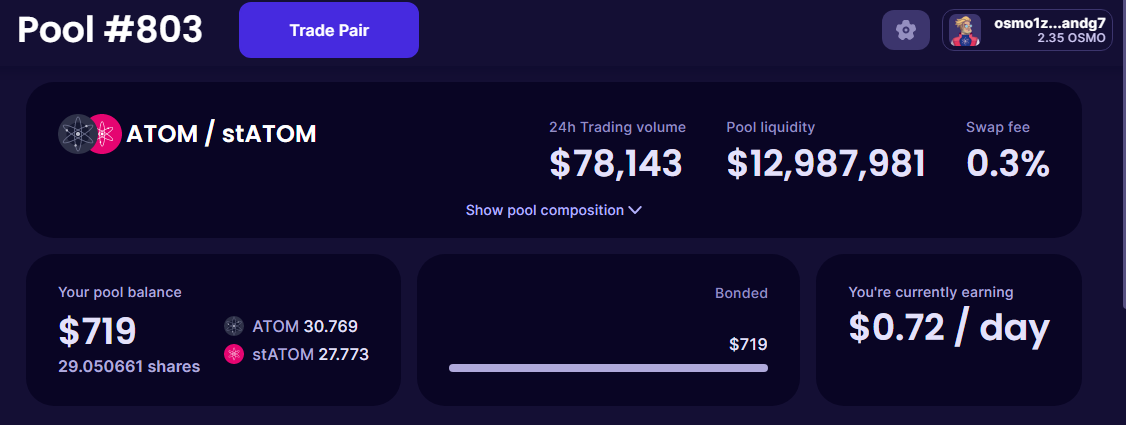

I choose the second option for which I swapped some of my $ATOM for $stATOM and further increased my holding for the pool #803 on Osmosis App for $680+ to $720+

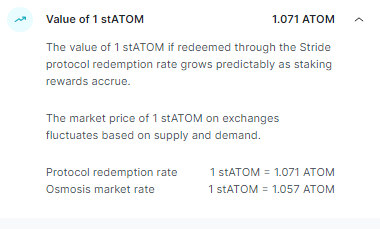

The value of 1 stATOM if redeemed through the Stride protocol redemption rate grows predictably as staking rewards accrue.

Protocol redemption rate 1 stATOM = 1.109 ATOM

Osmosis market rate 1 stATOM = 1.108 ATOM

Redirecting funds to $stATOM increases the value of $ATOM over time. As you can see exchanging 1 $stATOM will get you more $ATOM.. When I started leveraging Liquidity staking at that point we had the following exchange rates::

Protocol redemption rate 1 stATOM = 1.071 ATOM

Osmosis market rate 1 stATOM = 1.057 ATOM

Hence the reason to build assets associated to liquid staking. $ATOM being native token of Cosmos, a decentralized network providing open-source tools that can be used to create other interoperable blockchains. The vision of Cosmos is to become the “internet for blockchains" and allowing blockchains to freely share data and tokens across multiple blockchains that are in the Cosmos ecosystem. I can happily say that this is one of my favorite coin and for that reason I want to keep building my assets around it and one the method adopted is redirecting my Defi yields to Liquid staking $ATOM and then entering the Liquidity Pool #803 $ATOM - $stATOM on Osmosis App

#strd #rewards #stake #statom #defi #staking #atom

Redirecting DeFi Yields to Liquidity Staking...

Best Regards

Image Credits:: stride.zone, app.osmosis.zone, coingecko

Posted Using LeoFinance Beta

https://twitter.com/1244245420026376192/status/1638911428102066177

The rewards earned on this comment will go directly to the people( @gungunkrishu ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations, @gungunkrishu Your Post Got 70.7% Boost.

@gungunkrishu Burnt 25 UPME & We Followed That Lead.

Contact Us : CORE / VAULT Token Discord Channel

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.