bHBD, Yellen vs Fidelity, USDD, Osmosis & Optimism, Investment Decisions -> 211th 🦁 LEO Curation

@HODLCommunity presents to you the 211th LeoFinance Curation Post

We feel very excited as we think we will address one of the most important issues on the leofinance.io platform: Curation.

We truly hope, big stakeholders will support this initiative in order to spread rewards to some amazing writers.

Our goal is to support content creators and generate qualitative interactions between LeoFinance users.

We will set a 5% beneficiary for every author selected in this curation report.

So Lions 🐯, let's roll !

bHBD coming to Cubfinance | Binance Smart Chain (BSC) by @hironakamura

Since the launch of PolyCub platform and it’s token, it has definitely been able to take users attention off Cub token and Cub finance. The platform which avail users with different opportunities when you talk about staking and defi farming, the introduction of pHBD- USDC actually facilitated it’s growth and gradual adoption in the decentralized finance ecosystem.

This is will be beneficial to pHBD-USDC, PolyCub and soon to be launched bHBD because of the arbitrage opportunities it’s going to provide once this is achieved. The fantastic thing about the bHBD is that the development stage is fully completed and we are just waiting for it to be launched. Bringing more HBD to Cub is a very innovative idea which will see to the bullish in price of cub token.

The pHBD - USDC stablecoin pool is by far my favorite De-Fi product in the entire crypto ecosystem. Thanks to the HBD pool, we are getting a decent APR for the pool share and the rewards can be staked on xPolyCUB once again. So far the pool made me quite happy.

With bHBD on CUB, we will have an arbitrage opportunity as the author mentioned. So, the stable HBD + Arbitrage option is going to bring more value to the stablecoin of the Hive ecosystem.

Waiting for bHBD to conquer BSC once again 😎

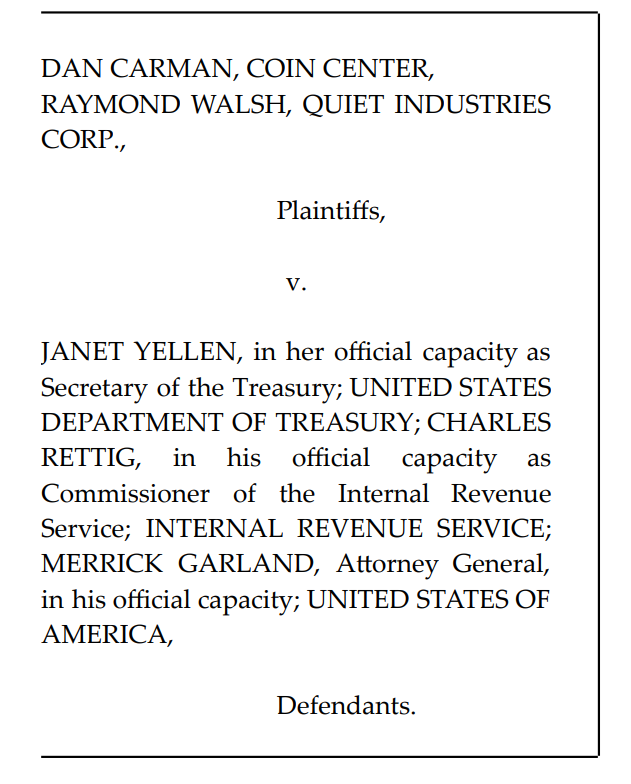

U.S. Treasury Sued Over Alleged Financial Spying / Yellen Voices Opinion on Crypto and 401(k) - Dual News Brief by @kevinnag58

D.C. based blockchain advocacy group, Coin Center, is suing the U.S. Treasury Department for allegedly providing an unconstitutional provision within the infamous 'infrastructure bill' requiring that "digital asset transactions worth more than $10,000 be reported to the Internal Revenue Service" [Wright, T. President Biden signs infrastructure bill into law, mandating broker reporting requirements. (Accessed June 11, 2022)].

In response to a question concerning the announcement by Fidelity Investments to add a cryptocurrency option to 401(k) retirement plans, Yellen said: "It’s not something that I would recommend to most people who are saving for their retirement. To me it’s very risky investment" [Attlee, D. Yellen doubts crypto’s place in 401(k), says Congress could regulate. (Accessed June 11, 2022)]. And regarding Congressional action, she added: "I’m not saying I recommend it, but that to my mind would be a reasonable thing" [Condon. Supra].

Fidelity vs Yellen...

Fidelity is pushing hard to embrace crypto ecosystem while Yellen is performing exactly opposit actions to prevent crypto reaching out many people in the midst of global inflation.

What Yellen tries to achieve is unlikely to be accopmplished as people can easily see that the existing financial system is shaking because of the problems that have been postponed so far.

Fingers are crossed for Crypto 401k ! (sounds crazy, though ^^)

USDD - US Dollar Disaster Waiting To Happen by @chekohler

In the space of a month USDD A unbacked stablecoin, I guess I shouldn't say unbacked, I mean backing something with hopes and dreams and an army of retards is still backing right? Anyway, this make-believe USD has gone from 0 market cap 2 months ago to over 700 million and is fast moving into the billion.

Forgive me but I don't understand why a "decentralized" stablecoin requires a centralized DAO fund with third party assets to act as a buffer in case the algo breaks, lol, the amount of mental gymnastics to call this decentralized is beyond me.

Justin in on the stage again.

It has always been shady for Justin to launch something in crypto ecosystem. He built several projects which are copied from other blockchains and He advertised them as "better" options for the counterparties.

This time he is playing with fire intentionally!

We all know what happened when UST crashed and made cryptoecosystem suffer from the failure of a couple of people. Next target of some manipulators may be USDD as it is not hard to realize that whatever Justin claims is made up by him.

Inside Two Recent Exploits This Week; Osmosis and Optimism by @xabi

The Osmosis LP exploit was the result of a bug in the liquidity pool that allowed liquidity providers withdraw 150% of the LP tokens from the LP against their deposit. Some people did it intentionally and some did unintentionally. The loss that was worth $5 million forced Osmosis devs to halt the network, In order to stop the bleeding. It was latter discovered a total four accounts were responsible for stealing 95% of the stolen amount.

Optimism exploit was kind of a dramatic one. It started with Optimism sending 20 million of their DAO's OP token to business partner Wintermute. But as it turns out receiving address was not configured to receive the L2 OP tokens, leaving the 20 million OP tokens floating and inaccessible. While both Optimism and Wintermute were in process of figuring out how to recover the stranded tokens, an anonymous hacker stepped in, sweeping away all the tokens.

In crypto, everything is possible

I did not have much information about the case happened in Osmosis and the things that I learned made me shocked. Spotting the issue in the liquidity pools due to bug, people manipulated the system and ruined the unity of the platform. To be honest, it made me consider twice before investing into a new De-Fi platform.

Optimism, on the other hand, is a failure by the team! I keep blaming them because they accelerated the process of token launch and they could not make it properly. Also, they could have chosen another MM company after such a devastating mistake. Honestly, I lost my hope over Optimism L2.

Applying Discretion In Your Financial Investment by @samminator

It is not enough for an investment to look good, you still have to understudy it to know if it will be right for you or not. You will agree with me that even though an investment may not be bad for others, it does not mean you should jump into it. The truth is that some investments that some people fail at are not always caused by something scammy, but some can be caused by lack of knowledge.

Another thing to look out for that should point towards "red flags" in a business opportunity is if the terms of investment are unrealistic or unsustainable. Imagine someone promising you an ROI of 1000% in 3 weeks for example, how does he hope to sustain that kind of outrageous returns? Or someone giving you fake promises that you can easily decipher, so do not sweep it under the carpet as "it does not matter".

Crypto is full of opportunities but also threats for those who are not competent in crypto knowledge. If you are served abnormal return of investment on a platform, either you are scammed the moment you send your fund or you are entering a ponzi scheme that will end up making some people lose their savings.

For 5 years, I've lost huge amount of money due to false promises of projects and scams that could not be spotted on time! Yet, after a long time, I found the way to assess crypto projects before investing into them.

Always better to analyze the projects, teams, tokenomics and products of the start ups / tokens. The roadmaps may look delusive but full of hopium ^^

This post is created by @idiosyncratic1 to curate quality content on LeoFinance.

Hive on!

Delegate to @hodlcommunity

If you would like to delegate some HP to our community and support us; we give you back 90% of the curation rewards on a daily basis ! APR > 12% !

You can also delegate LEO Power to serve for the Leofinance Community.

By following our HIVE trail here

How to reach us | Links

Discord Server | https://discord.gg/VdZxZwn

Posted Using LeoFinance Beta

You got one 100000+ cent token backed 100% upvote from @dailygiveaways (your page for daily free giveaways) !LUV

@hodlcommunity, @dailygiveaways(8/10) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily